Shaky Bonds make HD Supply and Tremor Video stock market actions cautious. Futures rise on strong jobs, consumer numbers. Stock Futures Rise Ahead of Data, Fed Speakers

Shaky Bonds make HD Supply and Tremor Video stock market actions cautious. Futures rise on strong jobs, consumer numbers. Stock Futures Rise Ahead of Data, Fed Speakers

By CountingPips.com

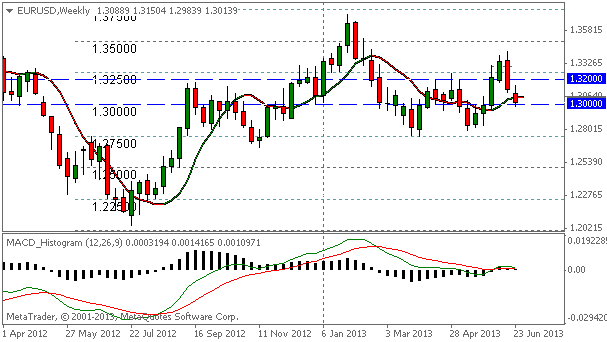

The European common currency fell for a second straight day against the US dollar and touched the lowest exchange rate since the beginning of June. The EUR/USD declined to trade briefly below the 1.3000 major support level in Wednesday’s trading before pulling back to trade slightly over 1.3000. This is the lowest level for the EUR/USD since June 3rd when the currency pair was on its way heading higher and away from the 1.3000 level.

The US Federal Reserve meeting last week took most of the air out of this currency pair as the Fed outlined the possible pullback of its quantitative easing program which has boosted US dollar sentiment. The EUR/USD had gained for four consecutive weeks before last week’s decline and now the EUR/USD pair is at a major crossroads at the 1.3000 level.

Notable Levels to Watch:

The most important key level to watch is the current 1.3000 price and whether prices can stay above or fall below this level. In 2013 so far, we have seen consolidation around this level many times followed by a breakout above with prices accelerating into the 1.3200 resistance area or a breakout below and prices accelerating to the 1.2850 — 1.2800 support area. Will we follow that same type of path again(?), we can only wait and see.

In the short-term, if we can stay above the 1.3000 then bullish momentum will likely see a run into 1.3050 — 1.3075 resistance followed by more resistance at 1.3100 and eventual heavy resistance at 1.3200.

Further downward movement should see support at the 1.2950 area before the 1.2850 key support comes into play. If this pair breaks below 1.2800, we will likely challenge the lowest levels of the year near 1.2750 that were reached in early April.

Traders ‘take a breather,’ buying stocks and bonds. HBO’s Richard Plepler: James Gandolfini Had ‘Compassion for the Underdog’. Same-Sex Couples: Celebrate, Then Call a CPA

The top prospects for the 2013 NBA Draft gathered in New York Wednesday with great anticipation. The 67th annual NBA Draft will take place Thursday at the Barclays Center in Brooklyn. (June 26)

The Fed Gets a New Reason to Keep Stimulating. Fed’s Fisher is comfortable with rise in U.S. yields. Financial Crises May Call for Easier Monetary Policies: Fed’s Dudley

IEA: Global renewable energy growing fast. Mike Tyson and Spike Lee Team Up for HBO Special. NY court upholds ex-billionaire’s conviction

Supreme Court has cleared the way for same-sex unions in California, but has avoided a sweeping ruling on gay marriage. (June 26)

Britain’s Osborne plans three billion sterling boost for affordable housing. Julianna Margulies Headed To Court. Ex-Manager Says She Skipped Out On Paying $400K Commission Fees.. Wall St. Advances in Rebound Off Recent Weakness

Democratic U.S. Rep. Edward Markey and Republican businessman Gabriel Gomez both expressed confidence in the messages they delivered to voters during their campaigns to succeed John Kerry in the U.S. Senate. (June 25)

Wall St. Advances in Rebound Off Recent Weakness. Stocks rise on higher home prices, durable goods. Stock futures point to bounce after selloff