By CountingPips

The US dollar had mixed results last week against the other major currencies in the foreign exchange trading markets. The greenback continued its ascent against the commodity currencies (Australian dollar, New Zealand dollar, Canadian dollar) while falling against the European currencies (euro, British pound sterling, Swiss franc) and also declining against the Japanese yen for a second straight week.

This week’s fundamental calendar is full of important economic events with a major focus on Friday’s US nonfarm payrolls report while there is also three interest rate decisions (Australia, euro zone, United Kingdom) for the markets to digest. See the currency pair commentary & major economic highlights below.

Major Currency Pair Commentary:

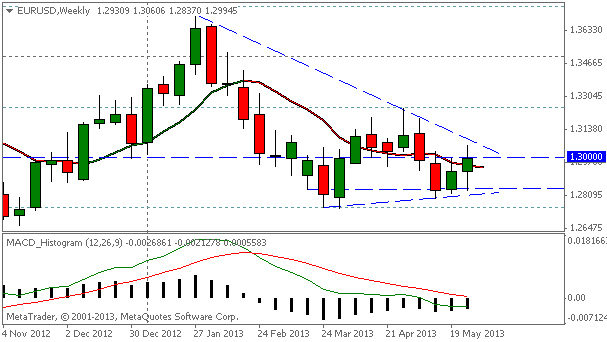

EUR/USD — The euro made gains against the dollar last week but failed in its bid to surpass the major 1.30 level. This week will be all about overcoming this major level and whether this pair can build some upward momentum. Levels to watch this week are the previously mentioned 1.30 major and on the downside, the 1.2900 and also the 1.2850 level for weekly support.

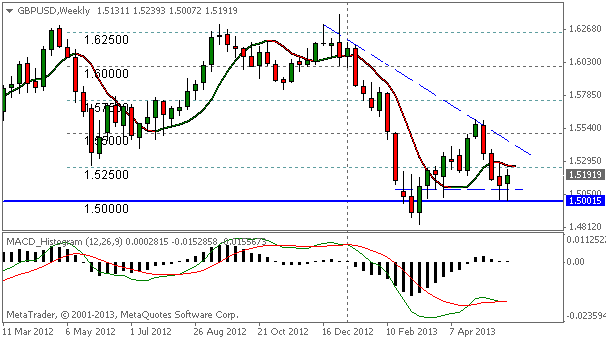

GBP/USD — The pound sterling fought back last week from three straight weekly declines to gain against the US dollar as the pair bounced off the major psychological 1.50 level. Levels to watch this week are at 1.5250 level which has provided previous support and resistance. A close above this level would indicate bullish momentum going forward. On the downside, support comes in around the 1.5100 — 1.5090 area and then the major 1.50 support level which has provided price bounces for the past two weeks.

USD/JPY — The dollar has fallen against the Japanese yen for two straight weeks and looks to test the major support and resistance area of 100.00. This is a major test for this currency pair and will likely determine the short-term direction as well as whether the 100 level will act as future support or future resistance. A close below 100 could bring a correction to the 97.50 target area.

USD/CHF — The Swiss franc has gained against the dollar for two straight weeks as this currency pair has run into selling resistance above the 0.9750 area. This currency pair trades currently near the 0.9550 level which had acted as previous support and resistance. Levels to watch for this week are 0.9550 and 0.9500 while a close below 0.9500 could open up further decline to the 0.9250 area. Upside momentum will likely see resistance at the 0.9650 level and into the 0.9700 — 0.9750 area.

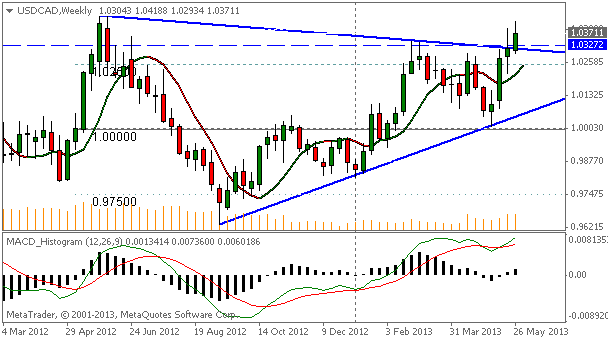

USD/CAD — US dollar has now risen against the Canadian dollar for four consecutive weeks and has broken out of the wedge pattern to the upside. Look for support around the 1.0300 — 1.0330 area with the 1.0250 level supporting below. Further upside momentum could bring into play the 1.0500 level which hasn’t been touched since November of 2011. Before that major level look for resistance into the 1.0400 area.

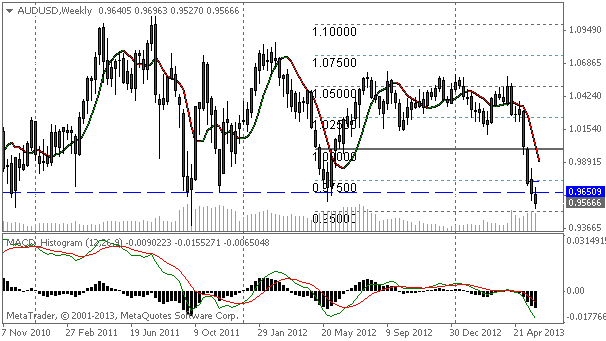

AUD/USD — The Aussie continues on its downfall against the dollar and has fallen for four straight weeks. Further decline will see the 0.9500 major level come into play with previous support (October 2011) sitting below the 0.9400 level around 0.9385. Upside momentum will likely see the 0.9650 resistance and into the 0.9700 — 0.9750 area.

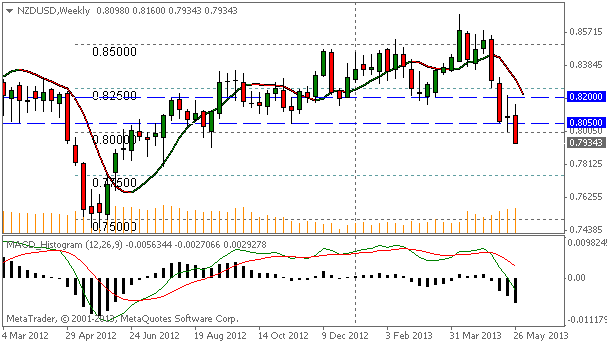

NZDUSD — The New Zealand dollar resumed its sharp downtrend against the dollar last week and fell below the major psychological level of 0.8000. Previous support has been seen around the 0.7900 level a few times in the fall of 2012 while further decline will likely see support at the 0.7850 level. Upward momentum will likely see resistance at the major 0.80 level and at the previous support and resistance level of 0.8050.

This Week’s Economic Calendar highlights:

Monday, June 3

United States — ISM manufacturing

China — PMI

Australia — retail sales

Tuesday, June 4

Australia — interest rate decision

Australia — current-account

United States — US trade balance

Wednesday, June 5

Australia — GDP report

euro zone — GDP report

United States — ISM nonmanufacturing

Thursday, June 6

UK — Bank of England — interest rate decision

euro zone — European central bank — interest rate decision

Friday, June 7

United Kingdom — trade balance

Germany — trade balance

United States — nonfarm payrolls report

United States — unemployment rate

Canada — employment change and unemployment rate

See our full economic calendar for more events.

Written by Zac Storella, CountingPips Forex Blog & Currency Pair Technical Analysis