By Sean Hyman

Lately, I’ve been asked a lot about where I see the U.S. dollar going in 2009. So let address this for a moment.

Specifically, I think the dollar will gain against the Japanese yen (USD/JPY pair will rise) throughout 2009.

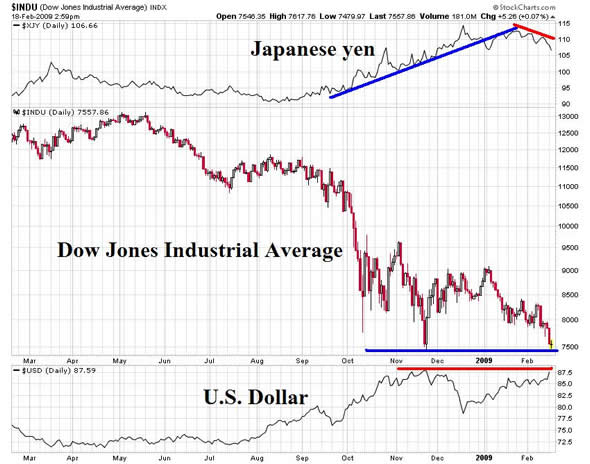

While formerly, the yen and dollar rose as the Dow crashed, you will notice that the yen is backing off quite a bit even as the Dow sits on its lows as of this writing. Yet the dollar still rises as the Dow falls.

See the chart below.

Yen rally plays out but the dollar strengthens even still!

Therefore, I think for the dollar/yen pair, the bias will be in the favor of the dollar and against the yen overall throughout 2009 no matter what the stock market does from here.

HOWEVER, when it comes to how the dollar does against most other currencies such as the Euro, Australian dollar, etc. it will very much hinge on how stocks hold up.

If the Dow breaks to fresh lows and holds below them, then it is likely that the dollar will continue its strength against these foreign currencies BUT if the Dow and other U.S. indices halt their slide and head higher overall from here, then I think risk aversion dies down and that will hurt the U.S. dollar and cause foreign currencies to rise up against it once again.

So right now, I’m bullish on the USD/JPY pair and even bullish on gold. However, stocks are on the fence right now. They can’t stay there forever. So we’ll have a break one way or the other, sooner rather than later.

Once we get a decisive breakout, then we have our new found direction on the dollar. Therefore, my focus will remain on being long (buying) the USD/JPY pair until stocks get off the fence and make a distinctive move to either side. Once this happens, then the trend will be in place for the dollar for the remainder of the year minimally.

About the Author

This post was provided by Sean Hyman, Head Instructor at mywealth.com. See his blog at http://www.mywealth.com/blog.