Article By RoboForex.com

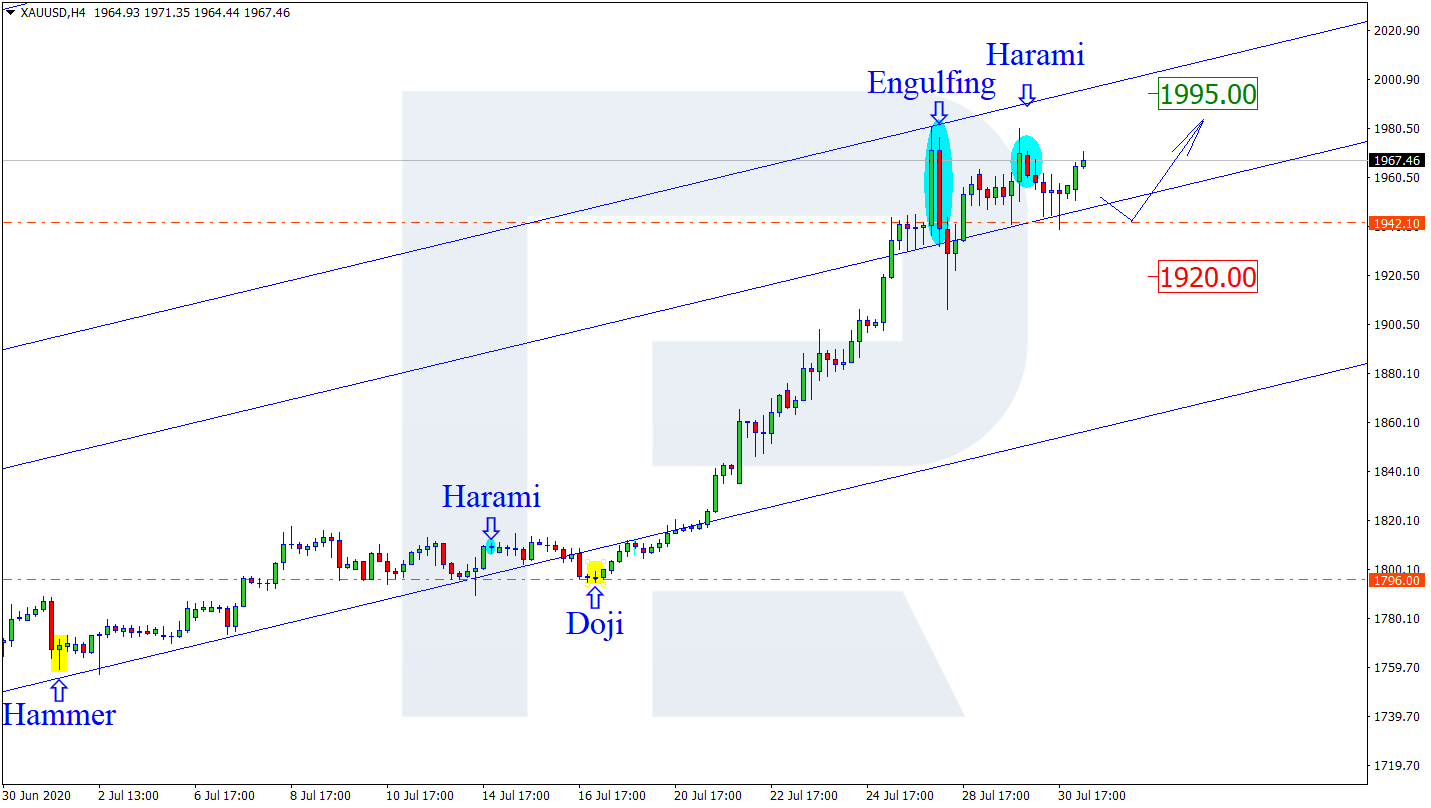

XAUUSD, “Gold vs US Dollar”

As we can see in the H4 chart, the uptrend continues. After finishing a Harami pattern not far from the resistance level and reversing, XAUUSD has returned to the level. Later, the price is expected to continue trading upwards. In this case, the upside target may be at 1995.00. At the same time, an alternative scenario implies that the pair may correct towards 1920.00 after updating the highs.

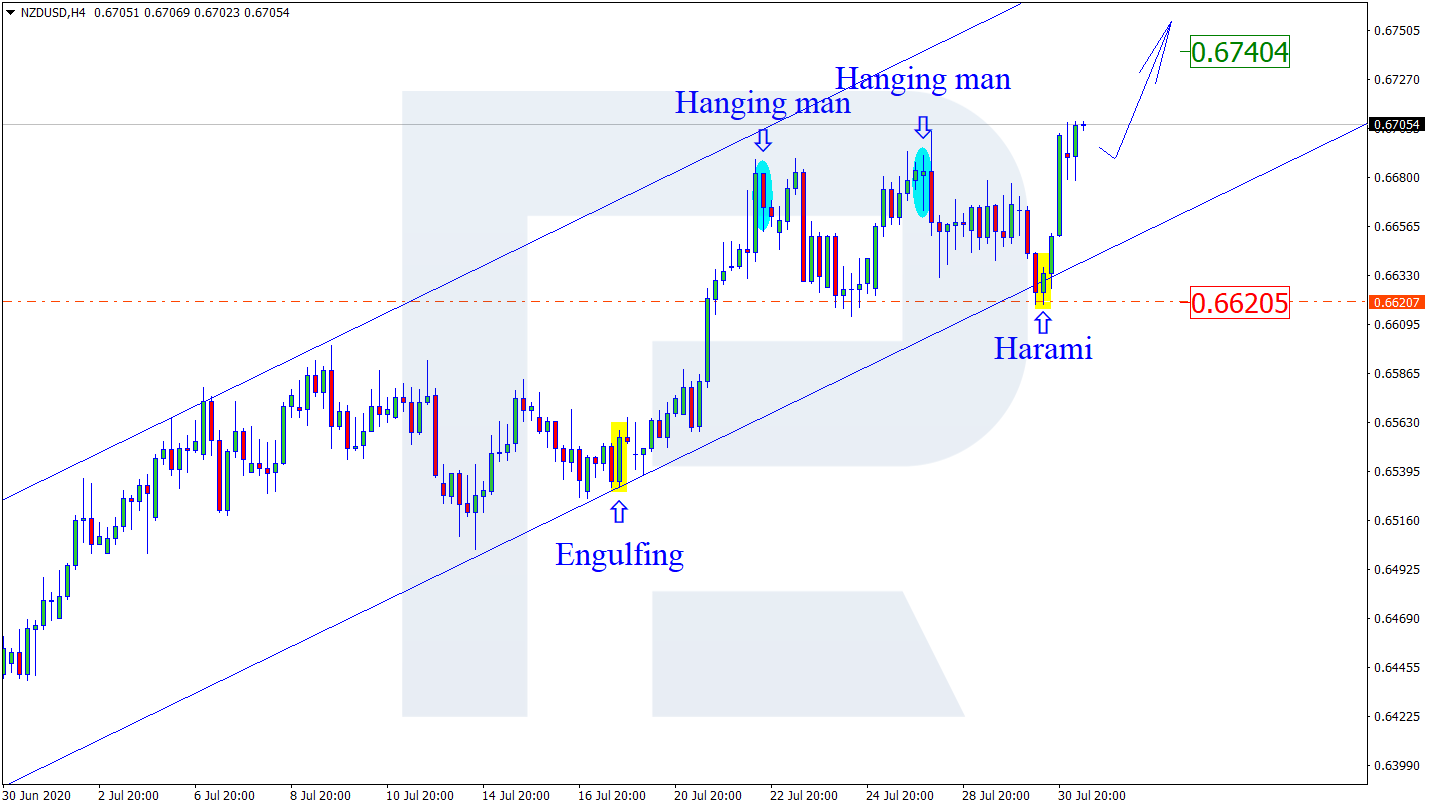

NZDUSD, “New Zealand vs. US Dollar”

As we can see in the H4 chart, the ascending tendency continues. After forming a Harami pattern close to the support level, NZDUSD has started reversing. At the moment, the price is expected to correct a little bit from the resistance area and then resume growing to reach 0.6740. Still, there is another scenario, which suggests that the instrument may correct towards the support level at 0.6620.

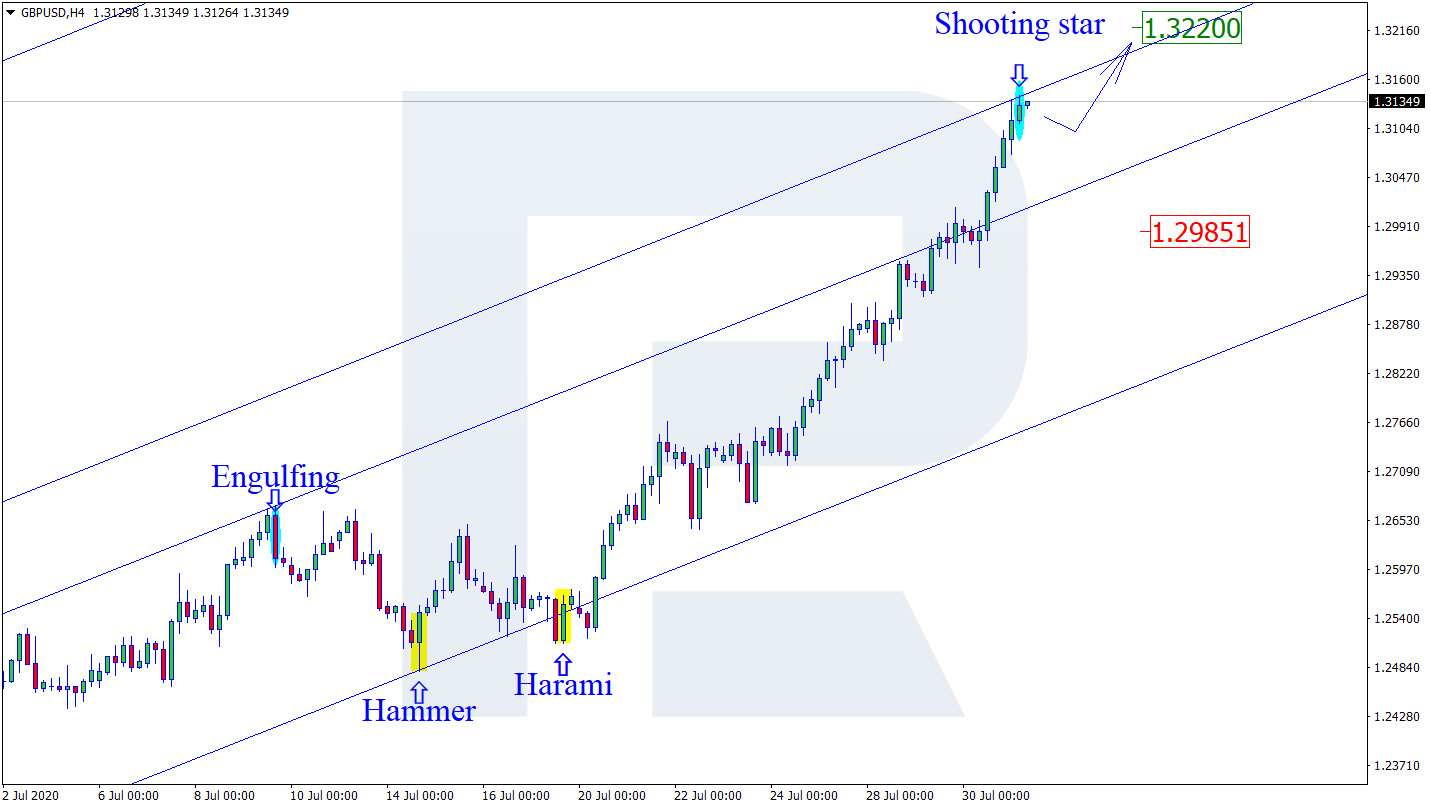

GBPUSD, “Great Britain Pound vs US Dollar”

Free Reports:

Get Our Free Metatrader 4 Indicators - Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get Our Free Metatrader 4 Indicators - Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

As we can see in the H4 chart, the pair is still forming the ascending tendency. After forming a Shooting Star pattern close to the resistance level, GBPUSD has started reversing. At the moment, the price is expected to correct a little bit and resume growing. In this case, the upside target is at 1.3220. However, there might be another scenario, according to which the price may reverse and start a more significant pullback towards 1.2985.

Article By RoboForex.com

Attention!

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex LP bears no responsibility for trading results based on trading recommendations described in these analytical reviews.