Article By RoboForex.com

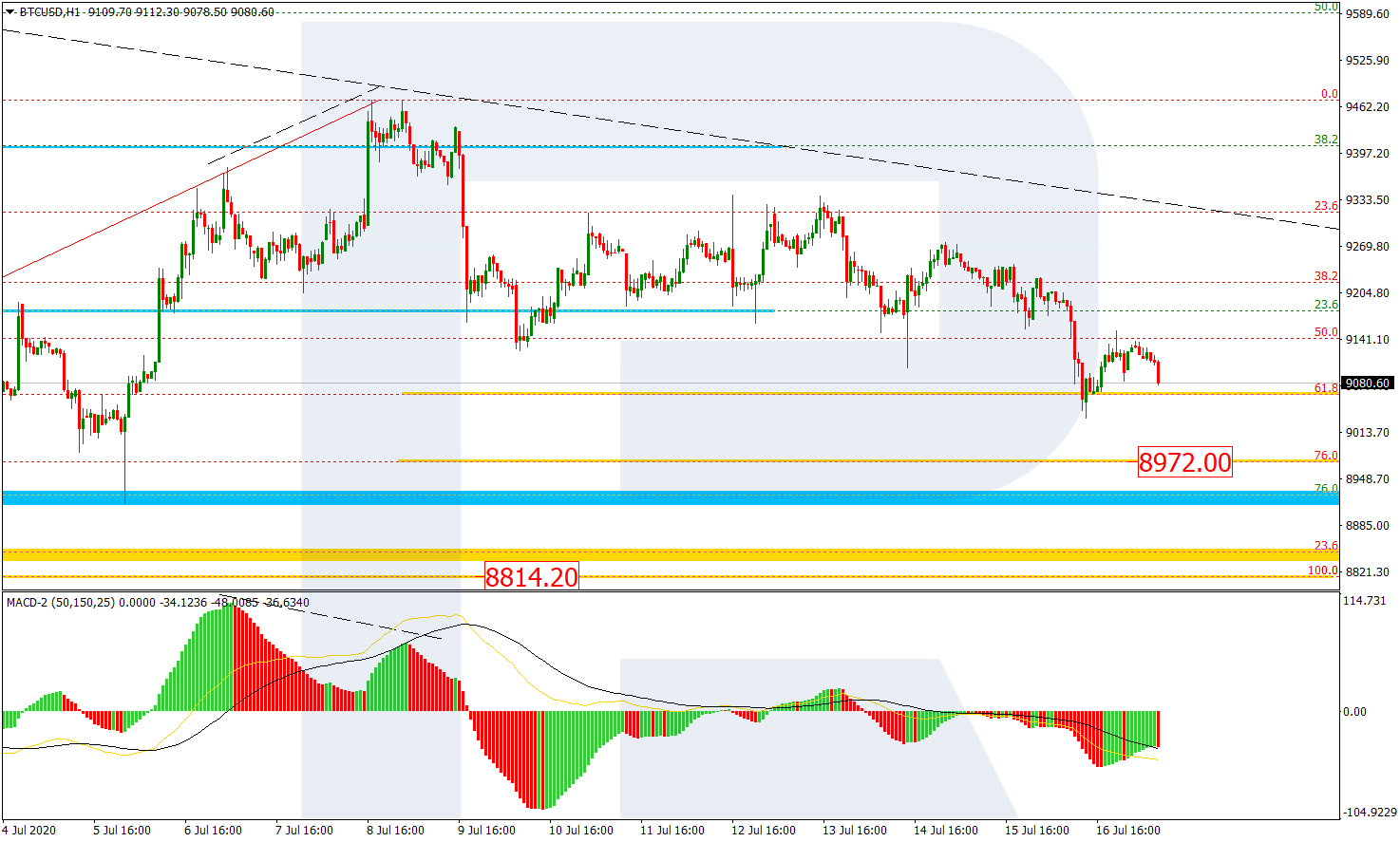

BTCUSD, “Bitcoin vs US Dollar”

The daily chart has been showing the same technical picture as the week before. Bitcoin is falling to re-test 23.6% fibo after failing to reach the high at 10368.40. In the nearest future, the asset is expected to resume falling towards 38.2%, 50.0%, and 61.8% fibo at 7907.00, 7150.00, and 6390.00 respectively.

As we can see in the H1 chart, the divergence made the pair stop growing at the mid-term 38.2% fibo and start a new downtrend, which has already reached 61.8% fibo and may continue towards 76.0% fibo at 8927.10 and then the low at 8814.20.

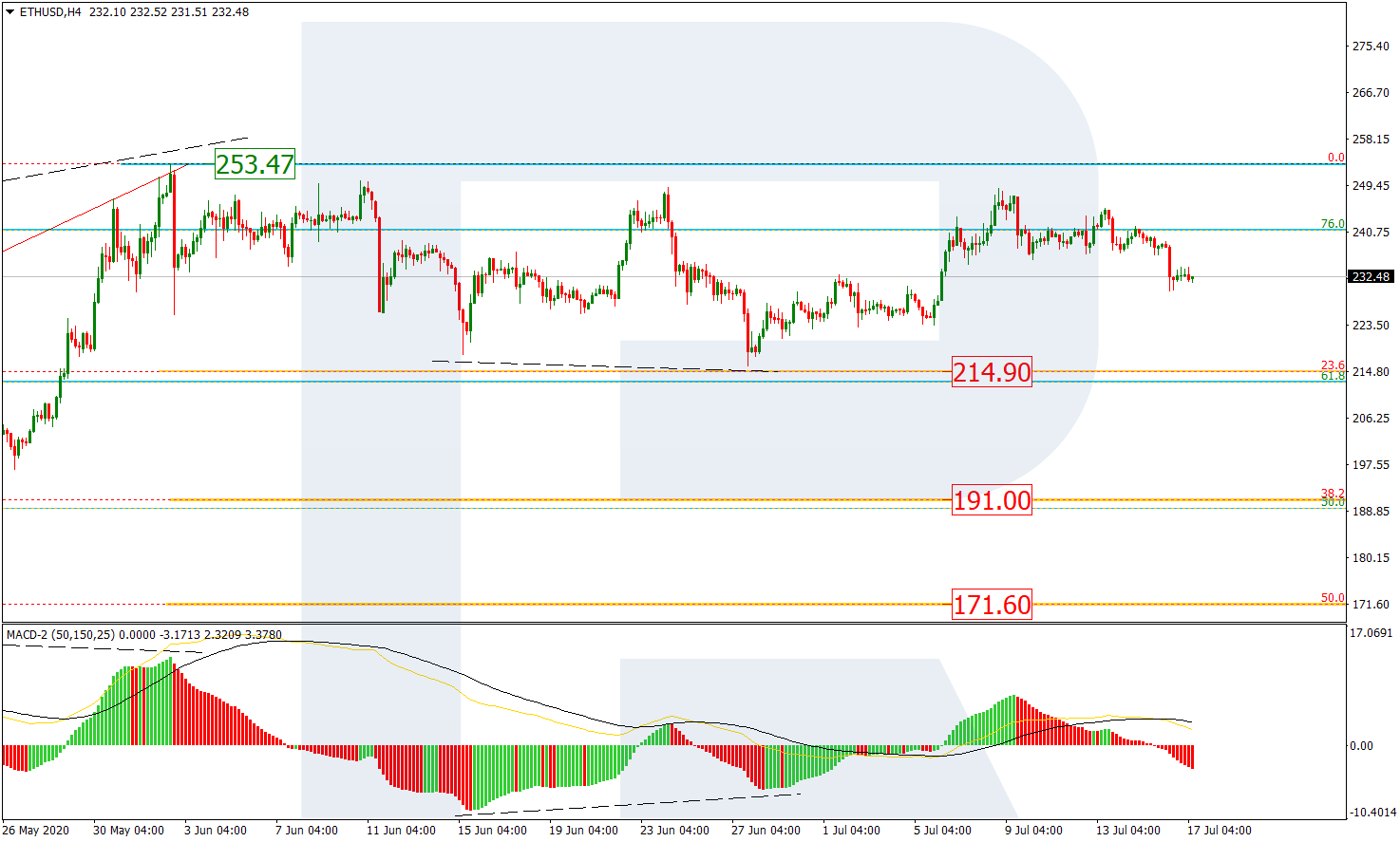

ETHUSD, “Ethereum vs. US Dollar”

As we can see in the H4 chart, Ethereum is forming the mid-term correction between 23.6% fibo and the high at 214.90 and 253.47 respectively. The most probable scenario implies that the price may break 23.6% fibo and continue trading downwards to reach 38.2% and 50.0% fibo at 191.00 and 171.60 respectively.

Free Reports:

Get Our Free Metatrader 4 Indicators - Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get Our Free Metatrader 4 Indicators - Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

In the H1 chart, the divergence on MACD made the pair start a new descending wave, which has already reached 50.0% fibo. Later, the market may continue falling towards 61.8% and 76.0% fibo at 228.50 and 223.80 respectively and then the low at 215.90. The resistance is the high at 248.89.

Article By RoboForex.com

Attention!

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex LP bears no responsibility for trading results based on trading recommendations described in these analytical reviews.