By Orbex

Crude Inventories Plummet

The latest report from the Energy Information Administration this week offered some hope for crude bulls.

The EIA reported the largest weekly crude draw of the year in the week ending July 24th. US crude inventories fell by a further 10.6 million barrels, taking the total position to 526 million barrels.

This drop was vastly different from the 357k barrel increase the market was looking for. One of the key drivers behind the decline was the weakness in US crude imports. These fell by 1 million barrels per day to 1.9 million barrels per day.

News of this latest increase has helped offset concerns over the health of the recovery in the US given the fresh outbreak of COVID-19 there.

As many as 40 states in the US have reported a fresh, upward trend in COVID-19 infections. This has led to more than 10 states reversing the recent reopening measures and returning to varying states of lockdown.

Free Reports:

Get Our Free Metatrader 4 Indicators - Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get Our Free Metatrader 4 Indicators - Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Gasoline & Distillate Stores Rise

Disappointingly, despite the sharp decline in headline crude inventories, US gasoline stores came in higher by 564k barrels over the week.

This was in stark contrast to the 733k barrel drop forecast and finds crude/gasoline stores out of sync once again. Last week, headline crude inventories were higher while gasoline stocks were lower.

Distillate stockpiles were also higher last week. The category, which includes diesel and heating oil, rose by 503k barrels over the week. This was in stark contrast to the 267k barrel drop forecast.

Elsewhere, the report showed that refinery utilization rates were higher by 1.6% over the week, taking total levels back up to 79.5% of total capacity. This marked their highest level since March. Refinery crude runs were also seen higher by 389k barrels per day last week.

COVID Risks Resurfacing

In all, the data is broadly positive for crude prices. However, given the context of renewed COVID-19 concerns in the US, the rise in gasoline stocks has been particularly disappointing.

With the US summer typically seen as the highest demand period for US fuel, the lack of follow-through on recent demand suggests that the US recovery is not taking place at the spend first anticipated.

Given that the risk of broader, nationwide lockdowns is becoming more prevalent, the outlook for US oil demand is looking increasingly compromised.

Crude Oil Consolidation Continues

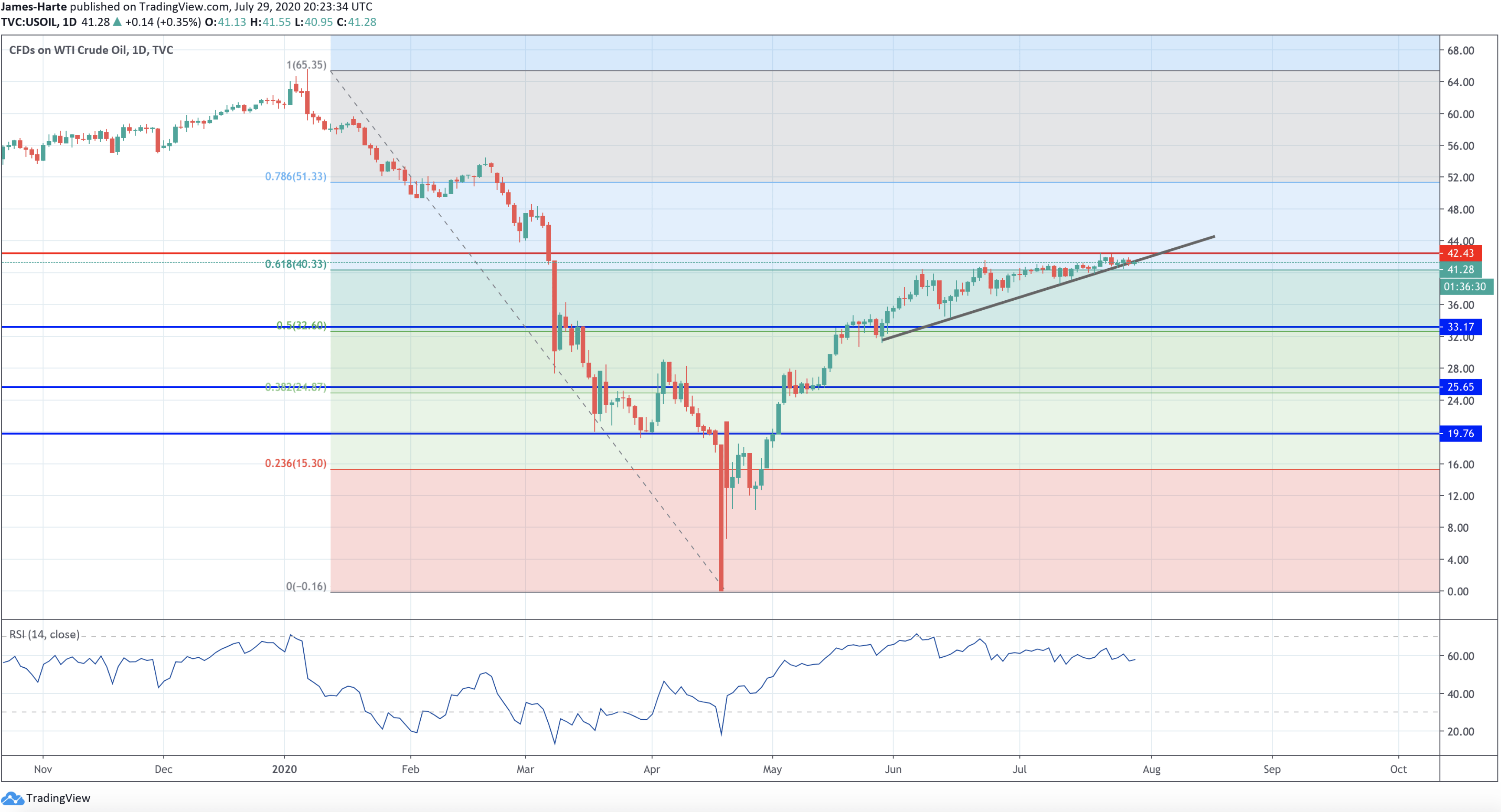

Crude oil prices continue to hold just beneath the 42.43 level, underpinned by the rising local trend line. While the trend line holds in place, focus remains on further upside with bulls looking for an eventual break of the 42.43 level.

However, if selling kicks in here and price moves below the trend line, focus will turn to the 33.17 level support next.

By Orbex