By Orbex

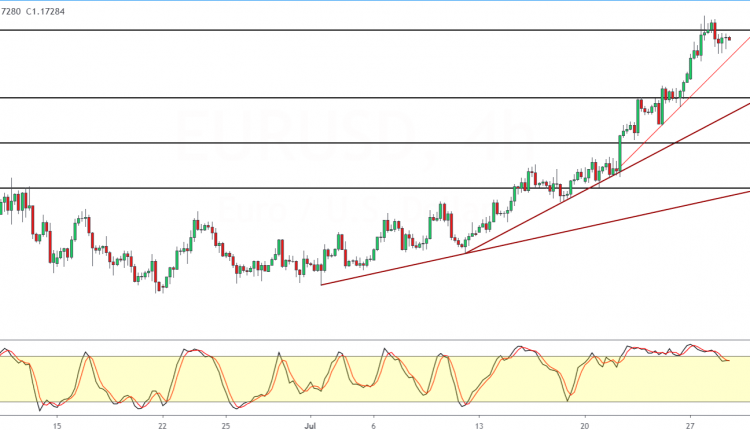

Has EURUSD Found Resistance At 1.1750?

The common currency is trading a tad weaker but not before prices attempted to breakout above the 1.1750 level.

Price action closed with a strong bearish engulfing near this level suggesting that resistance is likely forming here. But a breakdown of the steeper trend line will confirm if the downside will be validated.

For the moment, the bullish momentum is still in play meaning that price action can still rebound to the upside.

A daily close above 1.1750 will confirm the potential for a move higher.

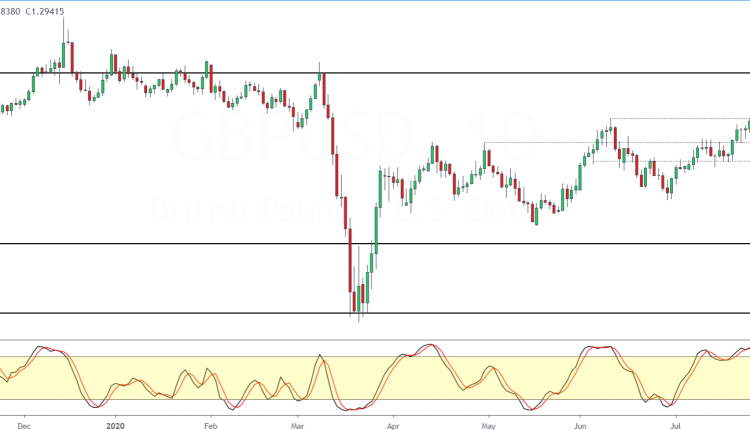

GBPUSD Edges Higher Towards 1.3000

The British pound sterling continues with this bullish streak. Price action is now close to the 1.3000 handle which could potentially open the way to 1.3122 next.

Free Reports:

Get Our Free Metatrader 4 Indicators - Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get Our Free Metatrader 4 Indicators - Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

To the downside, support is found at 1.2813 which could stall the currency pair from further declines. But ahead of the Fed meeting, the pound sterling could see some volatility.

Only a strong close below 1.2813 could signal a move even lower. The next lower support is at 1.2643 level.

For the moment, we expect the cable to potentially settle above the 1.3000 handle in the near term.

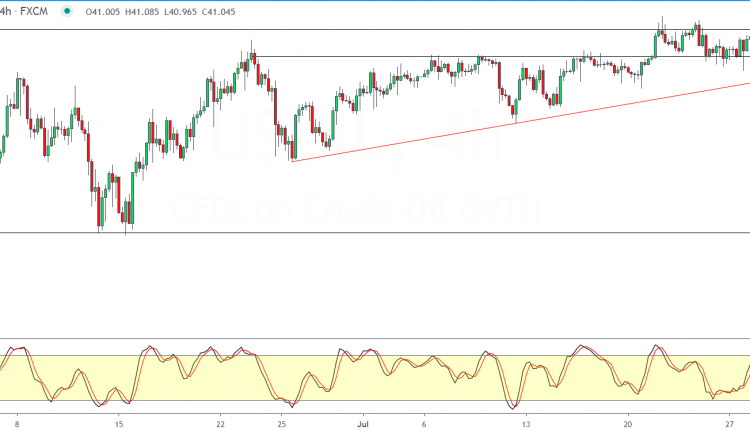

WTI Crude Oil Prices Testing 41.00

The consolidation in the oil markets continue. Price action is testing the lower end of the range at 41.00.

This marks the second test of this level which has held up so far. To the upside, the range high near 42.00 remains strong to breach at this point.

However, given the short term bias in oil, there is scope for price action to breakdown lower. A close below 41.00 could confirm a decline toward the 38 – 40 level next.

The minor trend line could also act as support in the short term to prevent the commodity from further declines.

Gold Prices Pullback From All-Time Highs

The precious metal rose to highs of 1975 before retreating. Price action is still bullish although the pace of gains is relatively muted compared to the past few days.

For the moment, support is at the 1931 level. If prices break down below this area, we could expect a larger correction to take place.

However, given that gold is now a buy on dips, we could see a rebound higher.

Volatility will, however, pick up heading into today’s FOMC meeting. This will potentially set the short term range in place for the precious metal.

By Orbex