By Orbex

Johnson Vows No Austerity

UK PM Boris Johnson unveiled plans over the weekend to help support the economy in the ongoing post-lockdown recovery.

Further easing of the lockdown restrictions is due to be announced over the coming days. Ahead of the July 4th date for the next review of conditions, the PM reassured the UK that it will “not go back to the austerity of 10 years ago”.

Infrastructure Spending to Increase

Speaking with UK journalists over the weekend, Johnson said:

“We’re going to make sure that we have plans to help people whose old jobs are not there anymore to get the opportunities they need.”

Johnsons went on to say that his government will be “doubling down on leveling up” its infrastructure spending in a bid to “build our way back to health”.

Pubs & Restaurants to Return July 4th

Johnson’s comments come at a crucial time as the nation, and the market, watches with bated breath as the UK lockdown eases further.

Free Reports:

Get Our Free Metatrader 4 Indicators - Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get Our Free Metatrader 4 Indicators - Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

There have been fresh fears over the potential for a second outbreak of the virus. These concerns have come about due to the gradual reopening taking place across parts of the economy.

With pubs and restaurants opening next weekend, there are fears that the mild uptick in recent new infections will lead to a reintroduction of lockdown measures.

Leicester Facing Lockdown?

Reports over the weekend suggest that the government is considering reintroducing the city of Leicester to lockdown, on a localized basis.

This comes following a fresh outbreak in infections there, with 600 new cases reported over the last two weeks.

Fears of a second wave are intensifying mainly due to scenes of illegal raves and street parties taking places across the UK over the last week. In addition, the ongoing Black Lives Matter protests which have taken place across the UK are also raising concerns of increased infections.

BOE Warns Over Uncertainty

Such concerns will no doubt be troubling the Bank of England.

This is especially true given the record fall seen in GDP in April, which tanked 20.4% over the month.

The BOE has warned over a great deal of uncertainty in its outlook. And, despite projections of a gradual recovery from this point in line with the lifting of lockdown measures, governor Bailey has warned of the downside risks linked to the potential for a second wave of the virus.

The big question would be how the government chooses to respond to such circumstances. Will it simply reinstates a nationwide lockdown? Or will it perhaps look to use localized lockdowns instead, which might help cushion the blow and allow more of the economy to remain open?

This will depend greatly on how a second wave of the virus plays out and whether a spike is seen nationwide, or just in certain regions or cities.

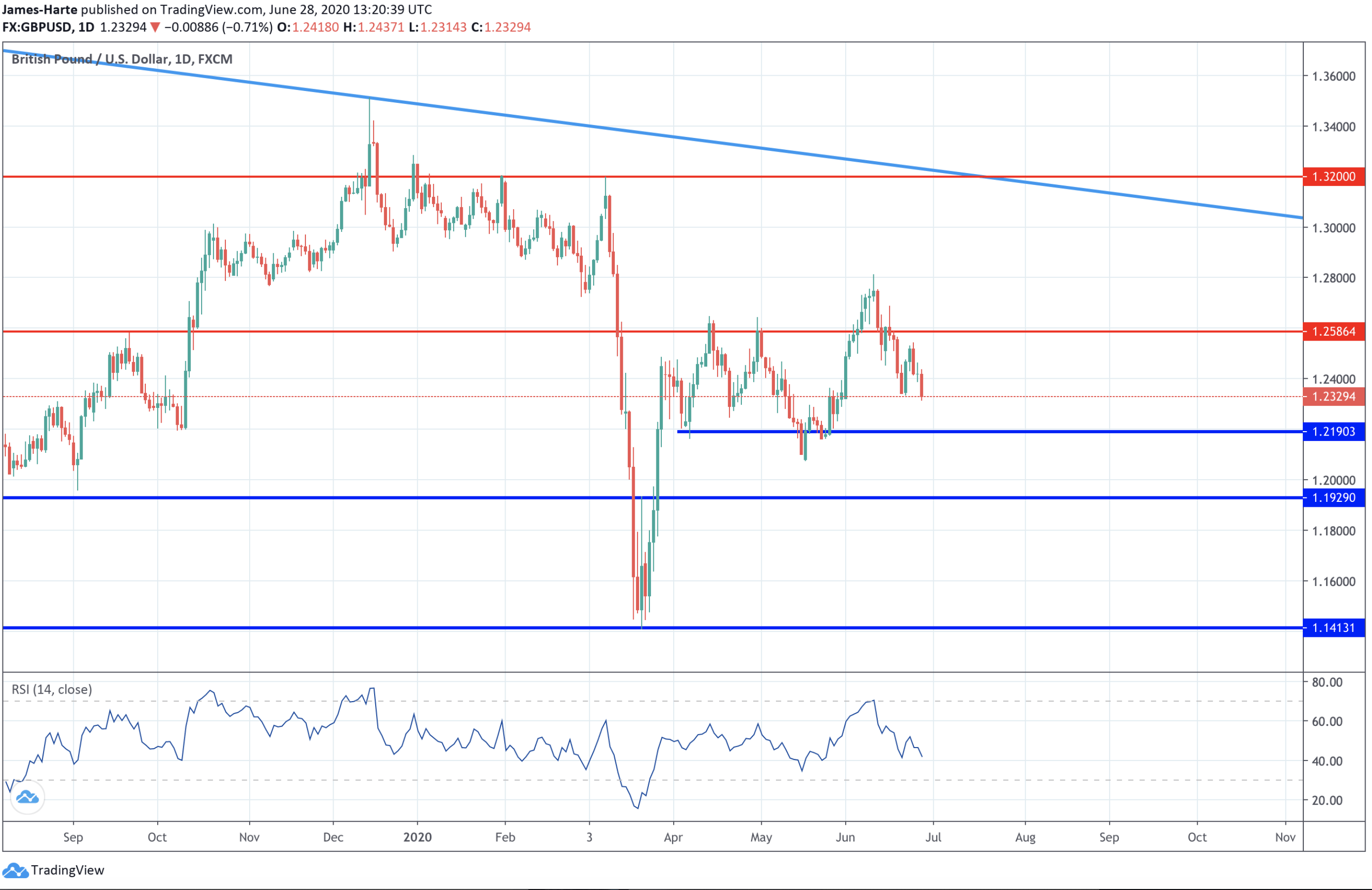

GBPUSD Reversal Picking Up Pace

Price action in GBPUSD over recent months has proved frustrating with the 1.2190 – 1.2586 range seeing false breaks in both directions. Following the recent failure above the 1.2586 level, which has seen price reversing back below the level now, focus is turning to the 1.2190 level once again. If price sees a proper break of this level, the 1.1929 level support will then become the next downside zone to watch.

By Orbex