Peter Epstein of Epstein Research explains why he is watching this explorer.

By The Gold Report – Source: Peter Epstein for Streetwise Reports 05/15/2020

Given the widespread COVID-19 induced downturn, I struggled with the outlook for copper. I feared that like stock markets in March, the copper price might collapse. That didn’t happen. Either due to producer discipline or governments halting operations, a fair amount of world supply has been curtailed indefinitely.

It may turn out that COVID-19 has as big an impact on supply as it does on demand. Copper is trading at US$2.35/lb, ~14% below its average price in 2019. So, not the end of the world.

I came to terms with Dr. Copper by learning that massive, multi-year, global stimulus packages are in the works. In total, probably US$10 or US$20 trillion over the next few years. Much of it will go to copper-intensive infrastructure projects. Furthermore, growing end market demand from the electrification of transportation remains in place.

But enough about copper, today’s gold price is a BIGGER story, currently at US$1,740/oz, 25% above its average price in 2019. New discoveries that contain meaningful gold values will be handsomely rewarded.

Free Reports:

Get Our Free Metatrader 4 Indicators - Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get Our Free Metatrader 4 Indicators - Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

In particular, discoveries in globally significant jurisdictions, made by world-class teams, on projects with tremendous blue-sky potential could generate substantial share price gains. With this in mind, I circle back to a small copper & gold story that has all the ingredients for an exciting discovery.

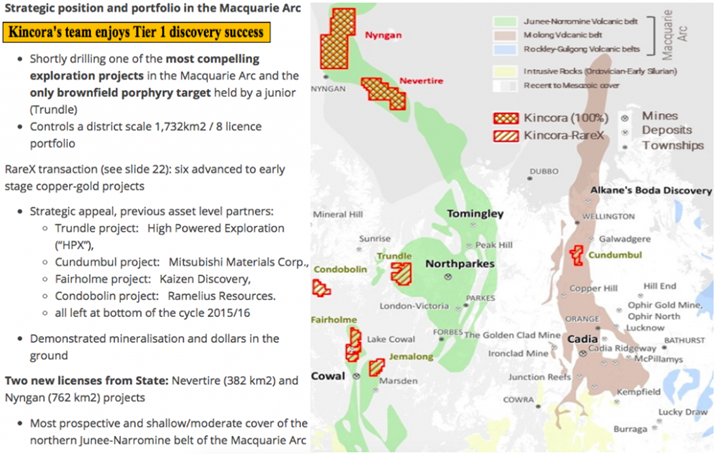

Could Kincora Copper Ltd. (KCC:TSX.V) be the comeback resource junior of the year? After a disappointing drill program in Mongolia, management switched gears, jumping on a compelling opportunity in Australia, just before new discoveries were made all around them. The company is currently drilling its Trundle project in New South Wales (NSW).

It’s worth noting that Trundle is the only brownfield project in the area controlled by a listed junior. Kincora’s enterprise value {market cap (C$12 million) + debt (zero) cash (C$3 million) = C$9 million/US$6.4 million.

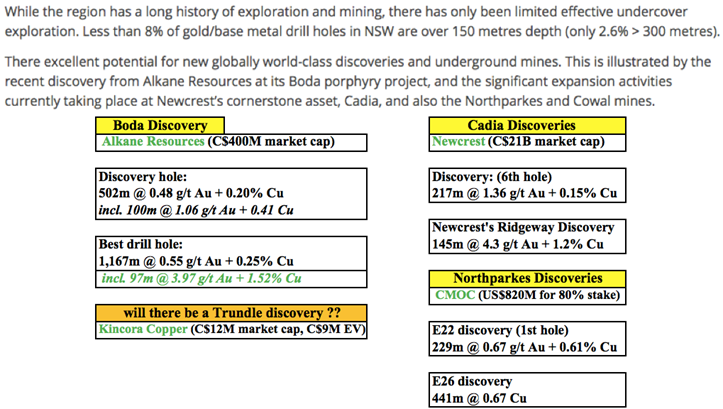

Trundle is in an exploration hotspotthe Macquarie Arc (MA) of the Lachlan Fold Belt (LFB). The MA hosts major porphyry deposits, including Newcrest Mining’s company-maker, underpinning it becoming Australia’s largest gold miner, Cadia {913k ounces gold (2019) at AISC of US$ 132/oz net of credits}; Evolution Mining’s flagship Cowal project {251.5k ounces gold (2019) at AISC of ~US$ 675/oz}; China Molybdenum’s (CMOC) copper-gold Northparkes {~240k Au Eq ounces/year}; and Alkane Resources’ Boda {discovery hole: 502 m at 0.48 g/t Au + 0.2% Cu}.

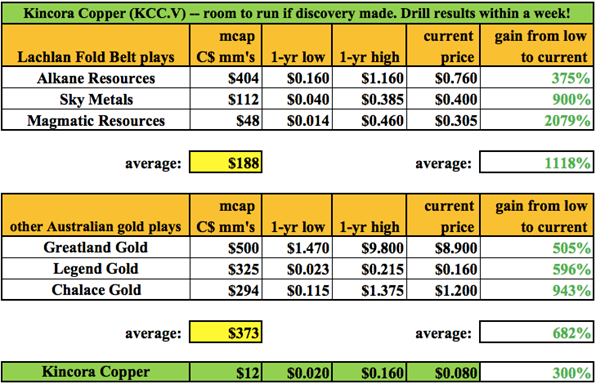

Kincora controls a district-scale 1,732 sq km land position in a few key belts within the MA. Management’s first press release on its Australian activities was on November 21st. Since then, gold is up ~24% to over AUD$ 2,700/oz.a record price. There’s also been significant drill program successes by peer LFB juniors {most notably, Alkane Resources, but also Sky Metals and Magmatic Resources}.

Alkane reported a blockbuster intercept at its Boda project; 96.8m @ 4 g/t Au + 1.52% Cu (~5.4 g/t Au Eq) from 768-meter depth. It also has a 3035k ounce/year producing gold mine and a market cap of ~C$400million. Alkane has the financial ability to aggressively drill out the Boda deposit. A follow-up second phase drill program leading to a maiden resource would be great news for Alkane and neighboring peers including Kincora Copper.

Sky Metals, with a market cap of ~$110 million, has two tin-tungsten-silver projects and two gold projects in the LFB. Its gold discovery really got the share price moving. Sky has some good intercepts, but nothing like Alkane’s.

Magmatic Resources has a market cap of ~$50 million. It has land holdings in the LFB totaling 1,054 sq km vs. 1,732 sq km controlled by Kincora, and is a “nearlogy” exploration play to Alkane’s Boda, as Kincora is to CMOC’s Northparkes. Due in part to Alkane’s success, Magmatic had one of the largest percentage gains of any gold junior on the planet. From 2c to 46c over six months, and recently back to 31c.

Sky Metals and Magmatic Resources, with an average market cap of ~$75 million, are reasonable comps to Kincora’s $12 million pre-discovery valuation. All three are pre-maiden resource or confirmation of an economic discovery hole. Other exploration success stories in Australia, such as Greatland Gold, Legend Mining and Chalice Gold, also demonstrate the power of new discoveries. There’s plenty of run room if management hits pay dirt. A drilling update is expected within a week or so.

There are fewer than two dozen gold/copper (or copper/gold) juniors that have flagship projects in NSW. All but three are Australian-listed. Kincora Copper (TSX-V: KCC) is a good way for North American investors to gain exposure to the LFB.

Kincora has ~$3 million in cash, strong drill targets, (derived from robust prior exploration efforts, plus new studies) and a tremendous management/technical team plus advisors. In addition to the tireless efforts since 2012 of Kincora’s CEO Sam Spring {full bio here}, three additional world-class team members are actively involved, Independent Director & Chairman of the Technical Committee John Holliday, Senior VP Exploration Peter Leaman and Chairman Cameron McRae.

John Holliday has >30 years’ experience in exploration, mostly with BHP and Newcrest Mining, including as chief geoscientist and general manager. He has been working with Kincora since 2015. John has a successful track record in global gold-copper exploration, discovery and evaluation. He was a principal discoverer of the Tier-1 Cadia gold-copper porphyry and Marsden copper-gold porphyry in the LFB, and a geological advisor on the acquisition of many significant projects. {full bio here}

Peter Leaman has >40 years’ experience in exploration, mostly with BHP and PanAust Ltd., where he was regional exploration manager for SE Asia. He’s a hands on, target-orientated leader responsible for project generation and managing exploration programs, resulting in notable discoveries including the Tier 1 Reko Diq porphyry Cu/Au deposit, Crater Mountain epithermal Au/Ag and the Mt. Bini (Kodu) porphyry Cu/Au deposits in Papua New Guinea, among others. {full bio here}

Cameron McRae is a very seasoned mining executive. He had a 28-year career with Rio Tinto and in Mongolia was president of Oyu Tolgoi and Rio Tinto’s country director. McRae led the construction and start-up of the US$6 billin Oyu Tolgoi copper mine and was responsible for safety, strategy, operations and growth initiatives. He has led successful greenfield and brownfield projects, has deep commercial/M&A experience and has sat on numerous exploration and technical committees. {full bio here}

Truly a tremendous team with direct experience, in the right place, at the right time, especially for a company with such a modest enterprise value. As of April 22nd, phase 1 drilling at Trundle has commenced. This phase includes a six hole/~3,800-meter (~630 meters/hole) program, testing three large mineralized zones at greater depths.

The company expects this program to be “high impact, value-add drilling,” as Trundle has “excellent potential for new high-grade porphyry & skarn copper-gold discoveries.”

Regarding the drill program, John Holliday and Peter Leaman commented,

“Modern systematic exploration at Trundle has utilized industry leading IP surveys, including HPX’s proprietary Typhoon system, and magnetic modeling which has been insufficiently followed up by drilling. Existing significant drill intersections support vectoring to very compelling targets at existing mineralized systems within a brownfield environment to Northparkes, Australia’s second largest porphyry mine where five deposits are defined.”

Trundle is 30 km west of CMOC’s Northparkes copper-gold project, Australia’s second largest porphyry mine (behind Newcrest’s Cadia, also in the Macquarie Arc). CMOC acquired an 80% interest in Northparkes in 2013 for US$820 million and has since expanded production and extended the mine life.

Historically an important agricultural hub, substantially increased mining activity in the region has led to favorable infrastructure improvements (power, roads, rail, etc.. This will likely continue as iron ore giant Fortescue Metals ($34 billion market cap) has secured property, including parcels adjacent to Kincora’s southern border of Trundle. Newmont, Gold Fields and Freeport-McMoRan are also exploring in the LFB.

The Trundle project hosts extensive evidence of porphyry and skarn-style copper-gold mineralization across 12.5 km strike length and shares some geological features with Northparkes and Cadia. Results of surface geological mapping, geochemistry, magnetic, gravity and IP coverage, coupled with structural and basement rock interpretations, have been promising.

Past drilling totaled 2,208 holes for 61,146 meters. Only limited modern exploration and very little deep drilling into basement rocks has been done. Importantly, over 92% of historical drilling has been to <50 meters in depth. Just 11 holes have been >300m (~0.5% of total holes drilled). Where the first hole is being drilled, the average drill hole depth is only 28 meters.

Shallow intercepts not followed up on include: [60m @ 0.54g/t Au from 1m], [56m @ 0.88g/t Au + 0.35% Cu from 34m, incl. 2m @ 20g/t Au + 7% Cu & 81g/t Ag from 64m depth], [39m @ 0.55 g/t Au + 0.14% Cu from surface], [35m @ 0.55 g/t Au + 0.25% Cu from 12m], [51m @ 0.58 g/t Au + 0.14% Cu from 33m], [58m @ 0.44 g/t Au + 0.17% Cu from 22m, including 4m @ 1.19g/t Au + 0.41% Cu from 28m]. Note: at spot Au prices, the avgerage grade of 0.6 g/t = nearly $50/tonne, which is good for these shallow depths. Additional high-grade hits, like the 2m @ 20g/t Au (with 7% Cu) would gain a lot of attention in the currently hot gold market.

Deeper core drilling has commenced at the Trundle Park zone on the southern end of the property. Management sees real potential for higher-grade porphyry and skarn copper-gold discoveries. Prior activities intersected, “high-grade localized zones, within a large lower-grade magnetite skarn, similar in style to the Big Cadia skarn, and peripheral to the Cadia porphyry copper-gold deposits.”

Kincora is drilling three fences to test known mineralized porphyry targets analogous to the five identified deposits at Northparkes. Existing intercepts support vectoring to compelling drill targets at the existing systems. No drilling has taken place at the project since 2015, while the Mordialloc target hasn’t seen drilling since 2008.

No drilling has yet tested below the zones, where geophysics and re-logging of historical data has indicated proximity to a porphyry source. Despite a lot of smoke, the potential source has yet to be found.

CEO Spring sums things up,

“With previous drill results, existing untested geophysical surveying and being in a brownfield environment, there’s a strong argument that we have comparable, if not a bit more, smoke at Trundle than Alkane had before its breakthrough drill results at Boda. Boda is the best greenfield discovery in the belt in over 20 years and, before the pull back in the market because of COVID-19, was the catalyst for approximately A$400 million being added to Alkane’s market cap in this rising gold price environment“.

While there are no guarantees when it comes to high-impact exploration of Tier 1 assets, Kincora Copper (TSX-V: KCC) has the foundation for success and a cheap valuation, providing investors an interesting risk-adjusted return opportunity.

Peter Epstein is the founder of Epstein Research. His background is in company and financial analysis. He holds an MBA degree in financial analysis from New York University’s Stern School of Business.

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Disclosures:

The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about Kincora Copper, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is not to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market making activities. [ER] is not directly employed by any company, group, organization, party or person. The shares of Kincora Copper are highly speculative, not suitable for all investors. Readers understand and agree that investments in small cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making any investment decisions.

At the time this article was posted, Kincora Copper was an advertiser on [ER] and Peter Epstein owned shares in the Company.

Readers understand and agree that they must conduct their own due diligence above and beyond reading this article. While the author believes he’s diligent in screening out companies that, for any reasons whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector or investment topic.

Streetwise Reports Disclosure:

1) Peter Epstein’s disclosures are listed above.

2) The following companies mentioned in the article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Newmont Goldcorp, a company mentioned in this article.

Graphics provided by the author.

( Companies Mentioned: KCC:TSX.V,

)