By Dmitriy Gurkovskiy, Chief Analyst at RoboForex

On Monday, March 23rd, Brent is trading at 26.23 USD per barrel. After a quick rebound, market players resumed selling: demand for energy commodities remains low, thus putting pressure on prices.

The COVID-19 pandemic continues spreading worldwide and makes global governments enforce quarantine restrictions. The restrictions, in their turn, have a very significant influence on consumer activity. As a result, the global demand for energy commodities is decreasing as well.

The closer April the 1st is, when oil-producing countries-members of OPEC+ will no longer be bound by any agreements, the more nervous oil prices will be. There are reasons to believe that the market will be flooded with cheap oil and it might not only cause the chaos in prices but fix them on a very low level for a long period of time.

So far, the entire fundamental background is extremely negative for the oil.

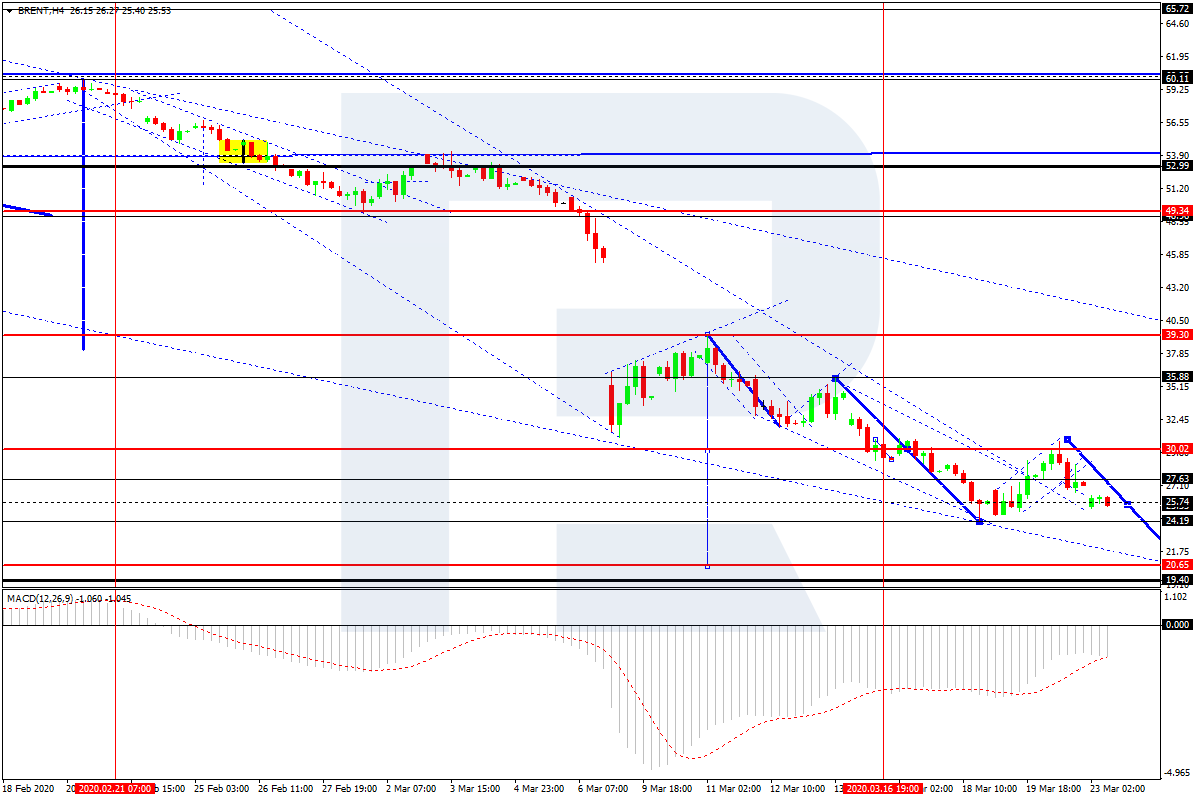

In the H4 chart, Brent is moving downwards. After breaking 26.00 to the downside, Brent may continue falling to reach 20.65. Later, the market may start a new growth with the first target at 30.03. From the technical point of view, this scenario is confirmed by MACD Oscillator: its signal line is moving below 0 and may enter the histogram area soon, thus indicating a further decline in the price chart.

Free Reports:

Get Our Free Metatrader 4 Indicators - Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get Our Free Metatrader 4 Indicators - Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

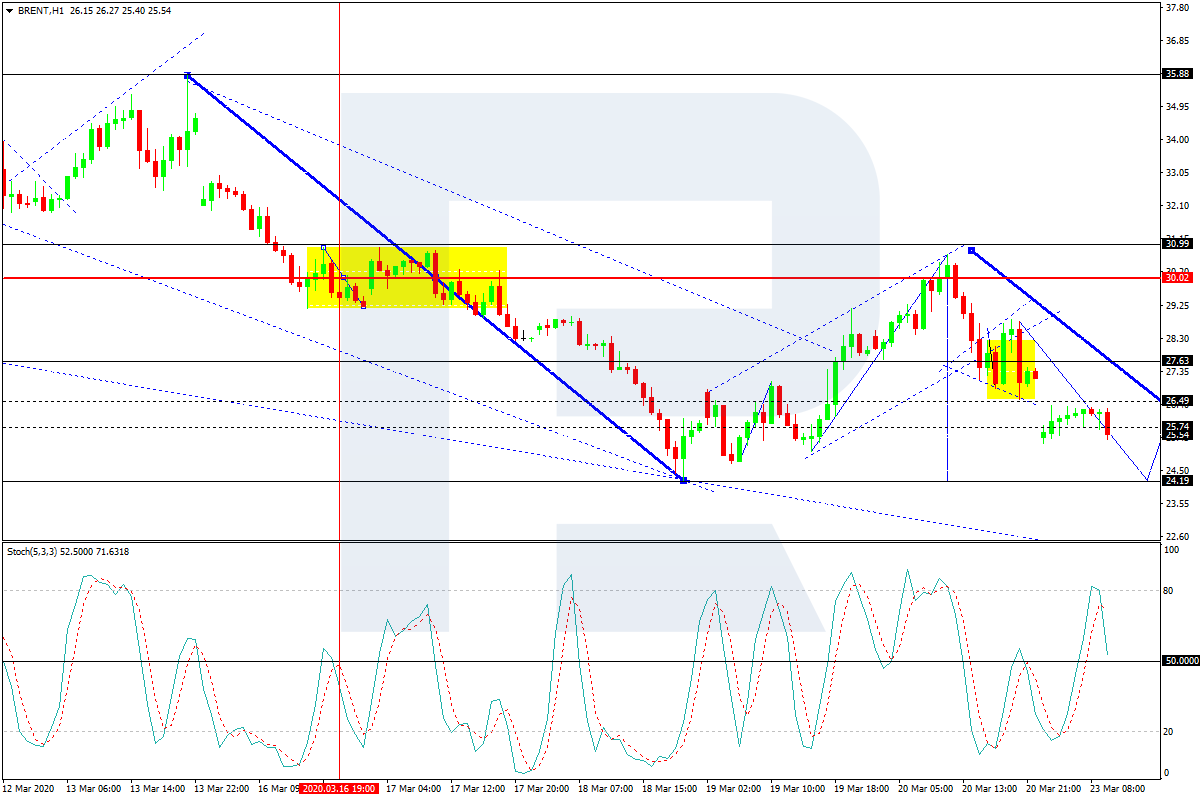

As we can see in the H1 chart, after finishing the descending impulse towards 27.63 and forming a new consolidation range around this level, Brent has broken it to the downside and may continue falling to reach 24.20. After that, the price may correct to return and test 27.63 from below. Later, the price may start a new decline with the short-term target at 23.50. From the technical point of view, this scenario is confirmed by Stochastic Oscillator: its signal line has rebounded from 80 to the downside and continues a steady decline towards 50. After breaking 50, the next target to reach is 20.

Disclaimer

Any predictions contained herein are based on the authors’ particular opinion. This analysis shall not be treated as trading advice. RoboForex shall not be held liable for the results of the trades arising from relying upon trading recommendations and reviews contained herein.