By Orbex

US Unemployment Surging

The latest data out of the US last week showed a dramatic surge in unemployment claims. Claims shot higher to 281k from the prior week’s 211k. The figure was well above the 220k figure forecast and paints an alarming picture of the state of the US economy amidst the ongoing coronavirus outbreak.

To put this figure in context, last week’s increase in jobless claims was the largest weekly spike in unemployment since late 2017. With many major cities in the US now on lockdown, these figures are likely to continue increasing over the coming weeks.

This will put further pressure on both the Fed and the government to support the economy.

Fed to Increase Liquidity For Banks & Corporates

Over the weekend, the Fed announced that it will offer a further $1 trillion in overnight loans to banks through to the end of March. This will be in addition to the $1 trillion 14-day loans they offer on a weekly basis.

This is the latest in a series of uniquely aggressive moves from the Fed which has been taking swift action to help backstop the economy during the severe disruption caused by the coronavirus outbreak.

Free Reports:

Get Our Free Metatrader 4 Indicators - Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get Our Free Metatrader 4 Indicators - Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Fed Cuts Rates & Announces QE Package

In response to the outbreak, the Fed has now cut interest rates from 1.75% to 0.25%. It also announced a massive $700 billion in fresh stimulus. The Fed announced that it will purchases at least that amount in Treasuries and mortgage-backed securities in an effort to maintain liquidity in the economy.

The Fed also announced that it will use emergency powers to create a Commercial Paper Funding Facility in partnership with the Treasury to allow it to buy bonds issued by corporates.

The Treasury has announced that it will be offering $10 billion in credit protection for the CPFF via its Exchange Stabilisation Fund. This mechanism was last used in response to the 2008 Global Financial Crisis. And, again, this draws eery similarities between conditions now and then.

Emergency Coronavirus Bill

The US government is also acting to help buffer the economy. Congress is finalizing a bill that will free up an extra $4 trillion in liquidity for the Federal Reserve to use.

The emergency COVID-19 relief package will also include a one-time $3000 payment for families impacted by the virus outbreak.

With around 25% of the country impacted by work closures and or lockdowns, the need for swift economic relief has ballooned in recent days. Both the Fed and the US government are now scrambling to address the situation in an effective manner.

Technical Perspective

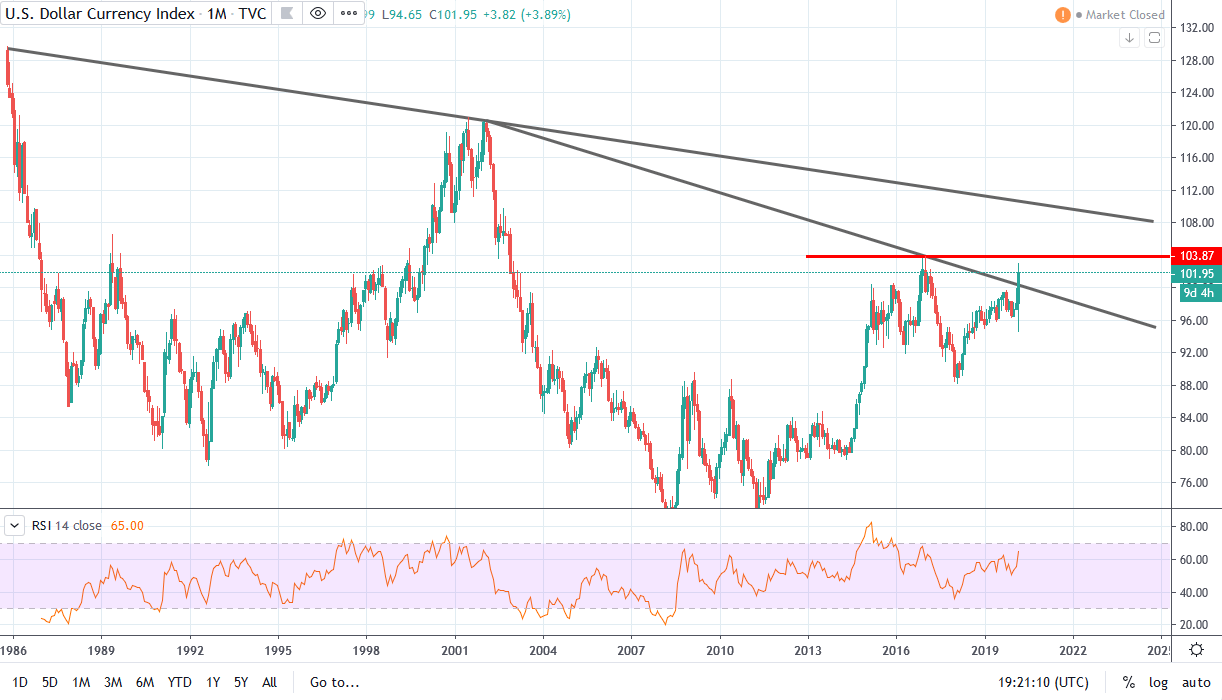

The heavy increase in USD safe-haven buying has seen the USD index surging above the bearish trend line from 2001 highs. Price is now very close to testing the 2016 highs at 103.87. A break of this level will be firmly bullish, putting focus on a test of the long term bearish trend line from 1986 highs next.

By Orbex