Article By RoboForex.com

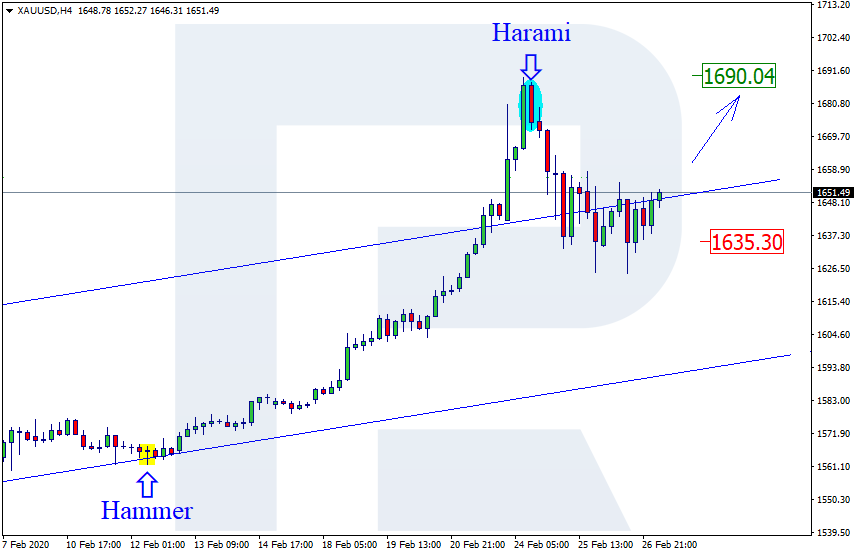

XAUUSD, “Gold vs US Dollar”

As we can see in the H4 chart, the ascending tendency continues. After breaking the channel’ upside border and completing a Harami reversal pattern, XAUUSD has reversed; right now, it is still moving upwards. In this case, the upside target is at 1690.04. However, one shouldn’t ignore another scenario, according to which the instrument may return towards 1636.30.

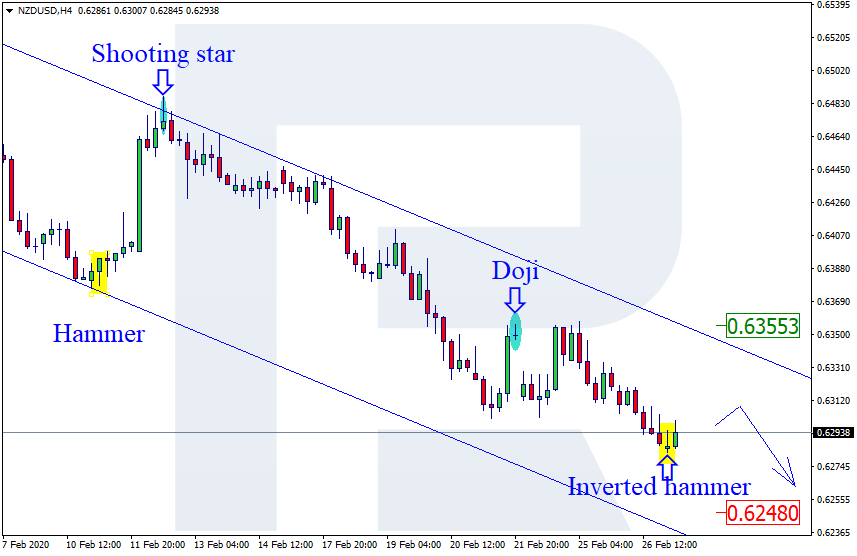

NZDUSD, “New Zealand vs. US Dollar”

As we can see in the H4 chart, the descending channel continues. After completing an Inverted Hammer reversal pattern close to the support level, NZDUSD is reversing. We may assume that later the price may reverse, correct towards the channel’s upside border, and then resume falling. In this case, the downside target may be at 0.6248. At the same time, one shouldn’t exclude an opposite scenario, according to which the instrument may grow to return to 0.6355.

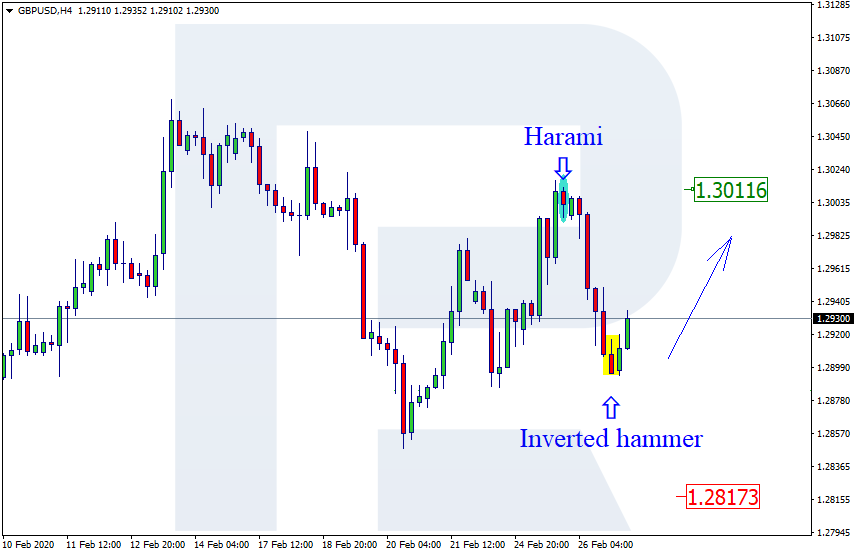

GBPUSD, “Great Britain Pound vs US Dollar”

Free Reports:

Get Our Free Metatrader 4 Indicators - Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get Our Free Metatrader 4 Indicators - Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

As we can see in the H4 chart, GBPUSD has formed several reversal patterns close to the support level, such as Inverted Hammer. Possibly, the pair may reverse and return to 1.3011. Later, the market may continue growing towards the next resistance level. However, there is another scenario, which implies that the instrument may fall to reach 1.2817.

Article By RoboForex.com

Attention!

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex LP bears no responsibility for trading results based on trading recommendations described in these analytical reviews.