By Orbex

Retail sales figures for the United States, covering the month of December will be coming up today.

The data released by the Commerce Department will show how much Americans spent at retail stores over the holiday month.

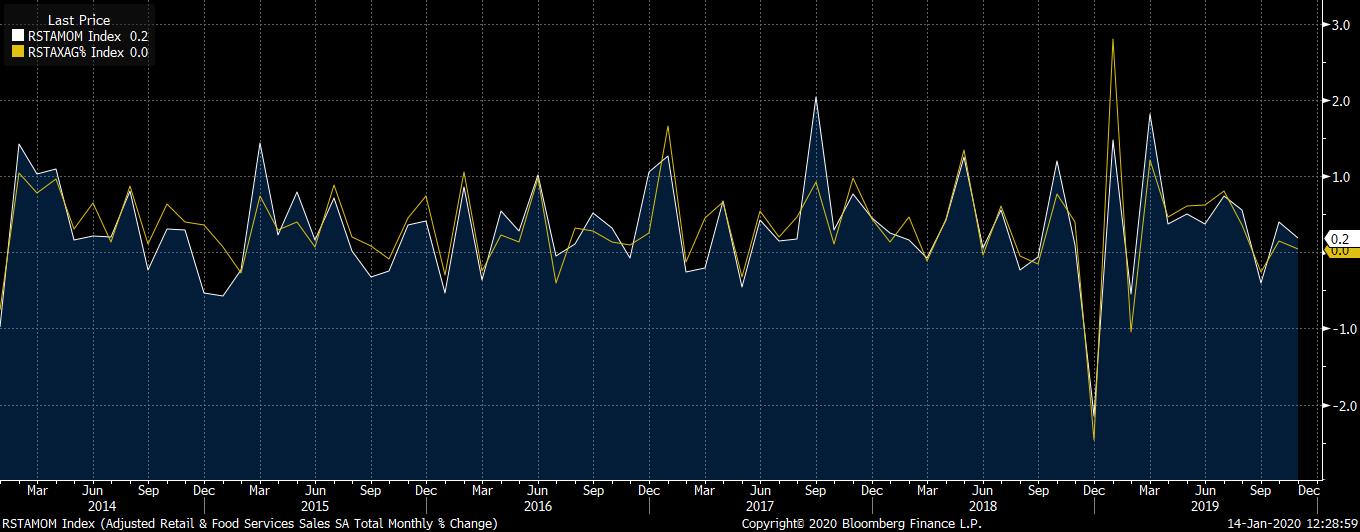

In November, retail sales were weaker than forecasts, surprising to the downside. The declines came amid a pullback in discretionary spending. On a monthly basis, retail sales rose just 0.2% on the month compared to a 0.5% forecast. For December, expectations are once again to the upside.

Economists forecast that core retail sales will rise 0.5% on the month, while headline retail sales will rise 0.3% for the period.

However, it will be interesting to watch for any revisions to November’s data. In October, retail sales were revised higher to show a 0.4% increase rather than the 0.3% increase which was initially reported.

Free Reports:

Get Our Free Metatrader 4 Indicators - Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get Our Free Metatrader 4 Indicators - Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

If the retail sales data comes on top of the expectations, it will be most likely due to an increase in core sales that excludes automobiles and gasoline performing better than estimates.

While the retail sales figures will not give a direct assessment of the pace of growth in the US economy, it will at the very least point to the overall sentiment among consumers. This is because growth in the United States is driven largely by consumer demand.

So far, Fed officials remain hopeful that this demand will continue to drive growth in the US over the coming quarters. The US economy is on a weaker trend, falling from a 3% average growth rate to just close to 2%.

Thus, investors will be keen to see the data on consumer spending during the month.

Weaker Auto Sales & Wages Could Point to Slower Increase

Automobile sales are one of the important components that play a big role in the retail sales report. In December, data indicates that auto sales fell to 16.7 million units compared to 17.1 million units in November.

This translates to a 2.3% decline on a month over month basis in automobile sales. But offsetting this will be the gasoline prices. Although gasoline prices have increased, it still remains stable in the longer-term horizon.

The weaker pace of wage growth is also another factor to consider.

According to the recent payrolls report for December, wage growth rose just 2.9% on the year ending December 2019. This was a pullback from the time when wages rose above the 3% threshold.

Thus, the lower earnings could see consumers cutting back on spending.

In terms of consumer optimism, we can see that according to various surveys, optimism among consumers remains high. Although the conference board’s consumer confidence index was weaker on a month to month basis, it is still at historically high levels.

Combining the above with the fact that spending usually increases during December, we could see a broad match on the expectations. But the drag from lower auto sales will be clearly felt.

Thus, there is scope for core retail sales, which exclude gasoline and automobile sales, to outperform the headline retail sales expectations.

Following today’s report, investors will further be able to assess the impact it will have on the fourth-quarter GDP. Thus, the market reaction could be a bit more than anticipated.

At the time of writing, the average expectations are about a 2.1% growth rate for the fourth quarter of the year. But this will certainly change depending on the actual figures from retail sales.

By Orbex