By Orbex

Gold

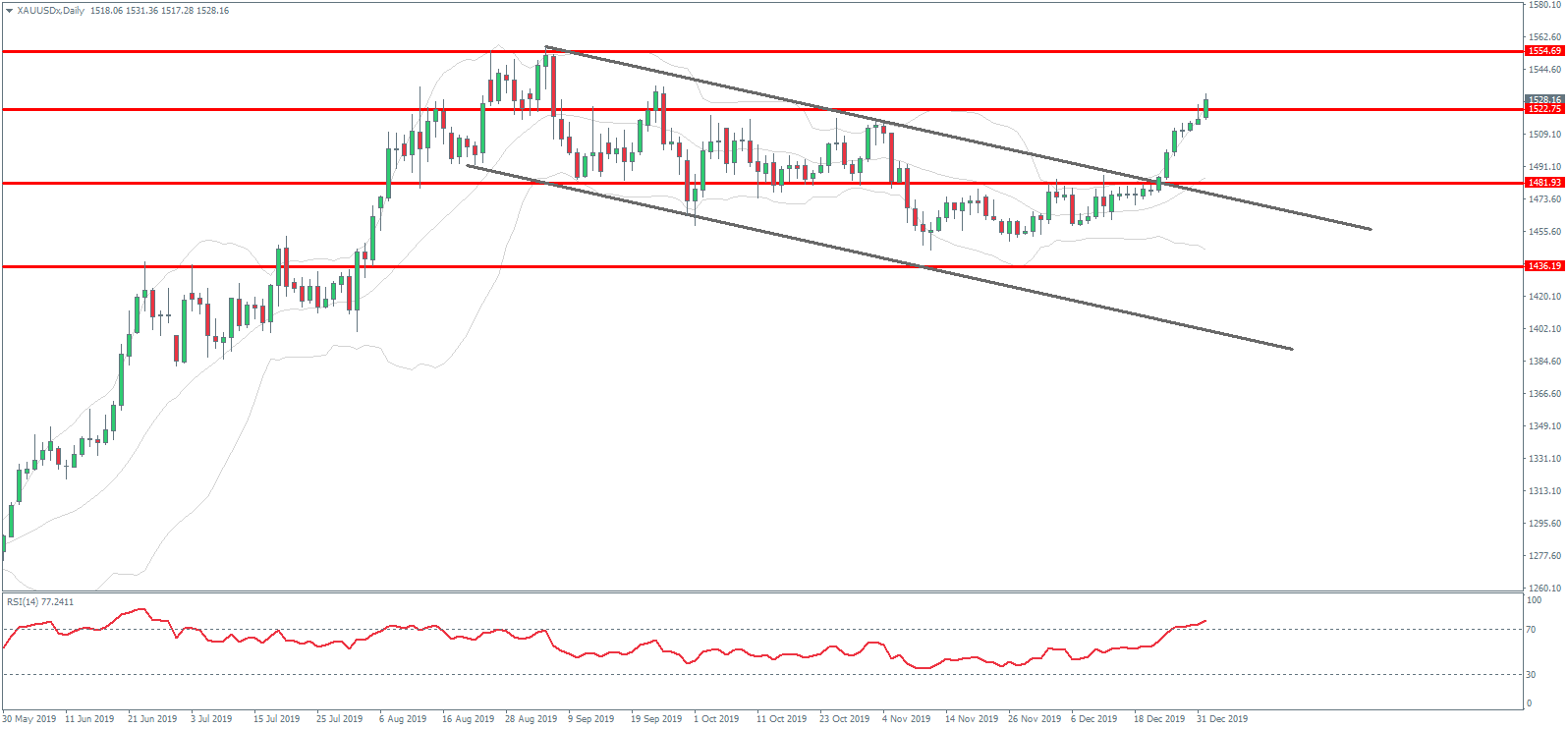

The yellow metal has had a strong start to the first week of 2020. Prices broke out above the 1522.75 level for the first time since September 2019.

The move came on the back of a slide lower in both USD and US equities in response to fears of military conflict between the US and Iran. Tensions rose due to the US accusing Iran of being behind the attack on the US embassy in Iraq. These fears are driving safe-haven inflows into gold currently.

Away from these geopolitical risks, the key driver for metals in the short term remains the trade negotiations between the US and China. Trump declared this week that the two leaders will officially sign the phase-one trade deal on January 15th. He added that the two leaders would soon meet up in Beijing to progress talks onto the next round of negotiations aimed at delivering a second phase of the deal.

The FOMC meeting minutes due later today will be closely watched by metals traders.

At its last meeting, the Fed kept rates on hold. However, it noted that it would be monitoring incoming data. The takeaway here is that there is room for further easing from the Fed if data starts to trend lower again.

Free Reports:

Get Our Free Metatrader 4 Indicators - Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get Our Free Metatrader 4 Indicators - Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

If the meetings reveal a greater level of concern among Fed members, this will likely weigh on USD, keeping gold prices supported.

Technical Perspective

The rally in gold prices this week has seen price breaking out above the 1522.75 level. This level is a key long term pivot in gold. Following the breakout from the bull flag structure, the outlook is now firmly bullish for gold. And we expect a challenge of the 1554.69 level next.

Silver

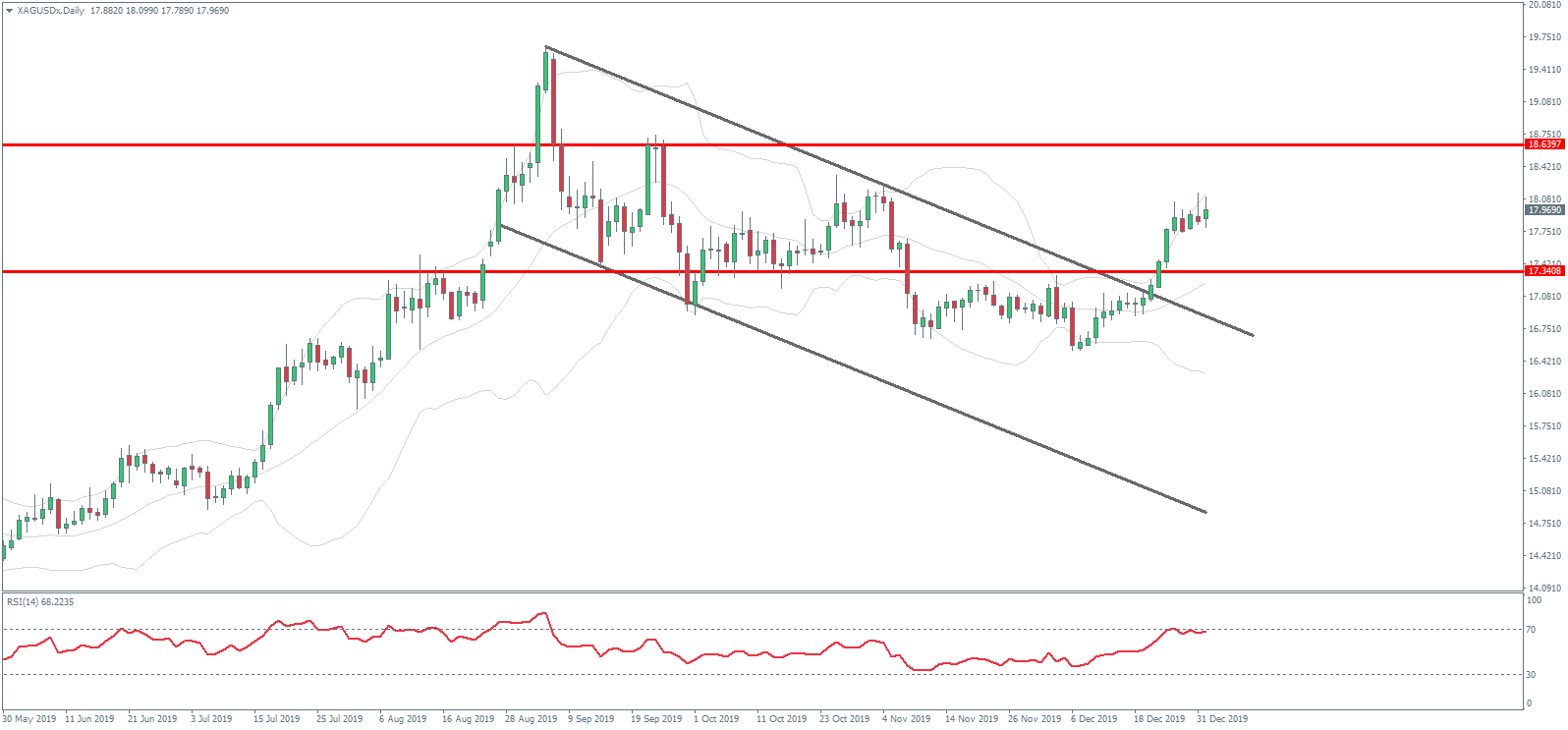

Silver prices enjoyed a strong start to the year also, tracking the moves in gold to trade higher over the week.

Silver has benefitted from weakness in USD recently. News of the trade deal has also supported the metal, offering some light at the end of the tunnel for global manufacturing.

Factory activity around the globe has trended sharply lower over the last year due to the trade war. So, businesses are now hopeful for a pick up as the trade war starts to wind down.

Technical Perspective

The continued rally in silver prices is seeing price head back up towards the 18.6397 level. As with gold, the breakout of the bull flag structure keeps focus firmly on further upside from here. Any retracement lower should find support at a test of the 17.3408 level.

By Orbex