By Lukman Otunuga, Research Analyst, ForexTime

The British Pound slipped below $1.30 for the first time this year as expectations mounted over the Bank of England (BoE) cutting interest rates in January.

Disappointing GDP data from the UK on Monday coupled with cautious comments from BoE’s policymaker Gertjan Vlieghe over the weekend have raised the probability of a rate cut to 47% in January. Should economic data continue to disappoint this month, the central bank may end up cutting interest rates for the first time since August 2016.

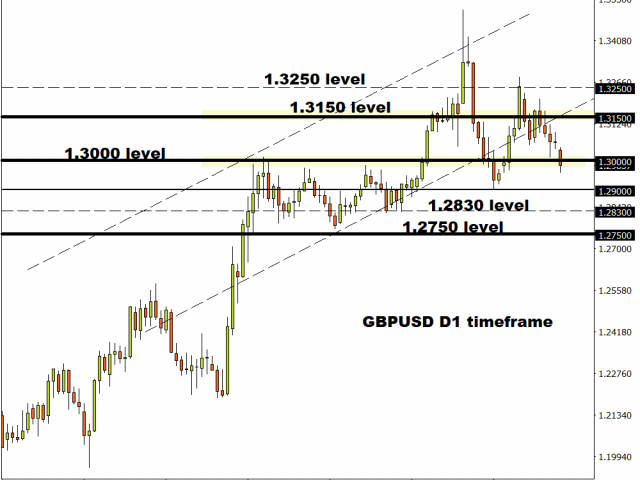

Focusing on the technical picture, the GBPUSD is under pressure on the daily charts with prices trading below $1.30 as of writing. A solid daily close below this level should encourage a decline towards $1.29 and $1.2830, respectively.

Should $1.30 prove to be reliable support, priceS could rebound back towards $1.3150.

Gold waits for “phase one” deal

Gold entered the new trading week a calmer note following the explosive movements witnessed over the few days.

With fears over geopolitical tensions receding, the precious metal is in search of a fresh directional catalyst. All eyes will be on the “phase one” trade deal on Wednesday which should boost global sentiment, ultimately hitting safe-haven assets. While Gold may weaken once the United States and China sign the phase one trade deal, the precious metal may rebound if the details of the deal disappoint market expectations.

Technical traders will continue to closely observe how price behave around the $1555 level. A daily close below this point should signal a decline towards $1535. However, a move above $1555 may open the doors towards $1570.

Yen shrivels on trade optimism

The Japanese Yen has weakened against almost every single G10 currency today excluding the British Pound.

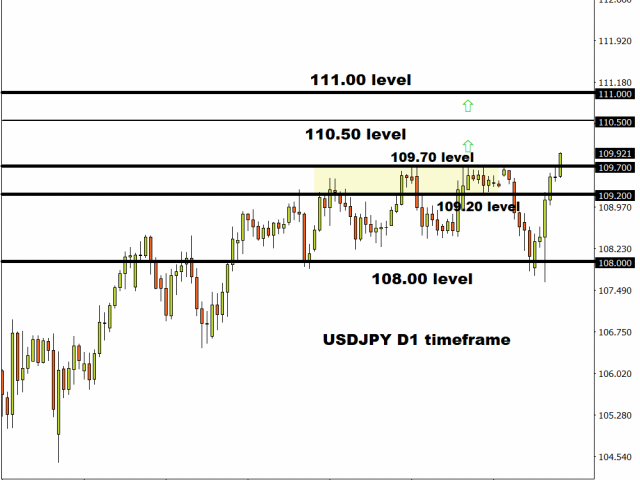

A sense of optimism over the United States and China signing the “phase one” deal is reducing appetite for safe-haven assets like gold and the Japanese Yen. This sentiment is being reflected in the USDJPY which has punched above 109.70 today. Yen weaken is likely to encourage an incline higher towards 110.50.

Disclaimer: The content in this article comprises personal opinions and should not be construed as containing personal and/or other investment advice and/or an offer of and/or solicitation for any transactions in financial instruments and/or a guarantee and/or prediction of future performance. ForexTime (FXTM), its affiliates, agents, directors, officers or employees do not guarantee the accuracy, validity, timeliness or completeness, of any information or data made available and assume no liability as to any loss arising from any investment based on the same.

Article by ForexTime

Article by ForexTime

ForexTime Ltd (FXTM) is an award winning international online forex broker regulated by CySEC 185/12 www.forextime.com