By Orbex

Gold

Its been a rather muted week for the yellow metal. Following moves in both directions, gold is trading roughly flat on the week as of writing.

In the absence of any key US data, there has been limited movement in the USD, which is typically a big source of direction for gold prices. However, on the back of a slew of better data last week, the greenback has been broadly supported over the week, capping upside moves in gold.

The signing of the US/China trade deal has also taken some of the upward pressure out of gold. With the US and China now legally agreed on the terms of the phase-one trade deal, the market is confident that talks will soon progress onto the second phase of the deal, boosting expectations that the trade war will soon be brought to a proper end. This improved level of optimism around negotiations has again weakened safe-haven demand for gold.

However, the metal has found some support this week on lingering risk factors.

The outbreak of coronavirus in China, which has spread through parts of Asia and also reached the US, has fuelled some risk-off trading which has seen demand for hold. There is also some uncertainty around the ongoing Trump impeachment trial.

Free Reports:

Get Our Free Metatrader 4 Indicators - Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get Our Free Metatrader 4 Indicators - Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

While the Republican-controlled Senate is unlikely to convict the President, the damage to his reputation and public-perception could negatively impact his chances for re-election later this year.

Technical Perspective

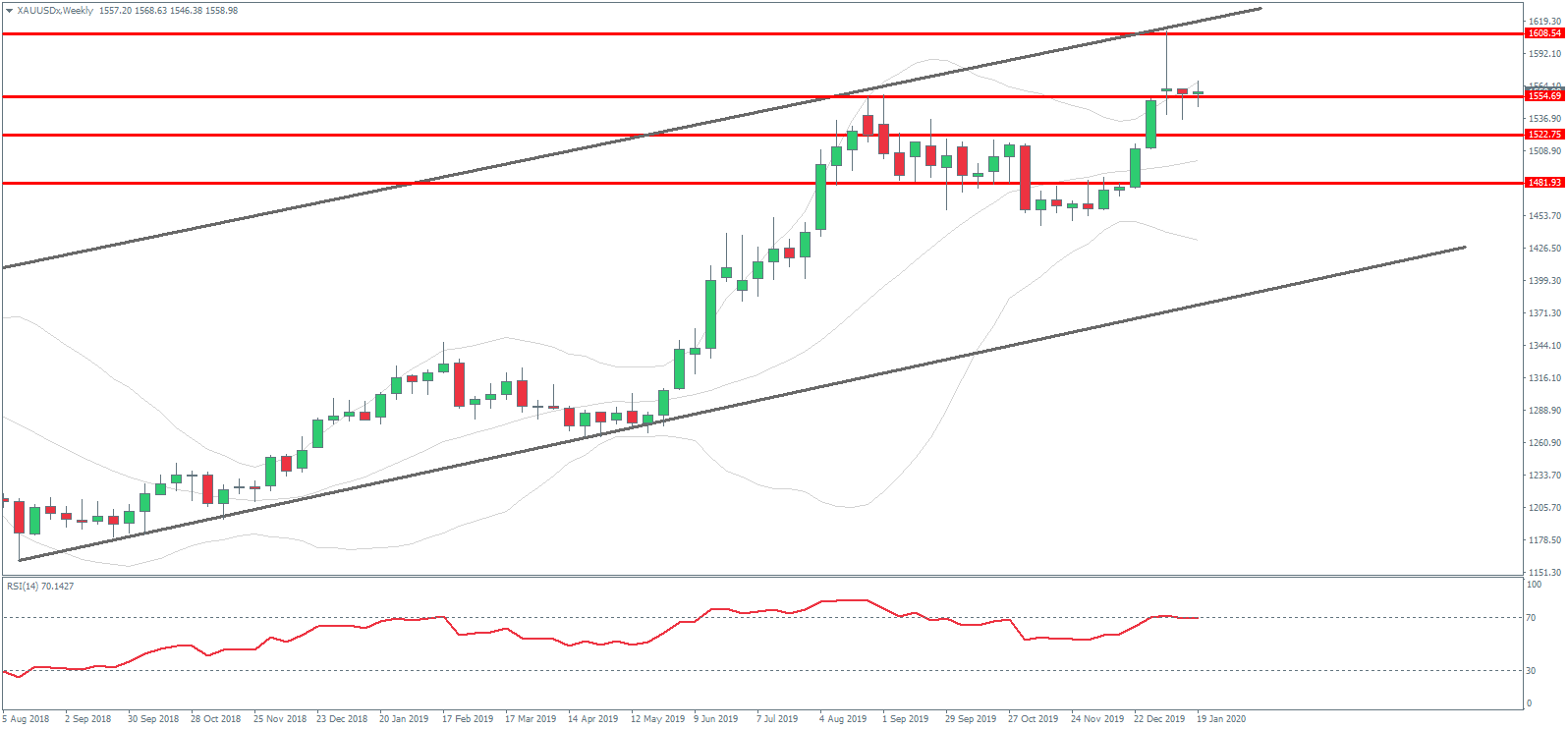

Gold prices continue to consolidate just above the broken 2019 highs around the 1554.69 level. The recent rejection from the 1608.54 level has failed to follow through.

While price holds above the 1554.69 level, a further push higher within the bullish channel looks likely. To the downside, a break of the 2019 lows would bring the 1522.75 level back into focus.

Silver

Silver prices have been a little worse off than gold this week.

Price is trading broadly lower over the week’s session. For the most part, the moves have tracked those of gold, though it seems volatility has been a little higher in silver this week, taking price lower.

As with gold, the main drivers continued to be expectations for the path of the US dollar, largely linked to incoming data and Fed signals, as well as risk-flows around the US/China trade talks.

Despite the positive steps being made in that space, the second round of talks presents far more risk of difficulty given the more complex nature of the issues to be addressed. As such, risk assets still face downside risks in the near term if talks are seen struggling.

Technical Perspective

Silver prices continue to range between the 17.3408 – 18.6397 level, caught between the two bearish trend lines. While price is still holding above the 17.3408 level, a further test of the 18.6397 level is still viable. To the downside, a break of 17.3408 would pave the way for a test of the 16.52 level next.

By Orbex