By Orbex

Equity markets rose to post new highs on Friday. The Dow Jones index briefly broke the 29,000-mark before pulling back. Despite this, all major equity indices closed positive on the week.

The payrolls report for December was soft. The unemployment rate came in at 3.5%, matching expectations.

However, there were just 145,000 jobs added during the month. Wage growth was also soft, rising 2.9% on the year.

Regional Industrial Production Picks up in Eurozone

Industrial production figures from France and Italy showed signs of life. French industrial production grew 0.3% on the month, while Italy’s production was up 0.1%.

The gains come on the back of Germany’s industrial production rising as well. This could potentially signal that business activity remains resilient to sluggish growth and demand.

Free Reports:

Get Our Free Metatrader 4 Indicators - Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get Our Free Metatrader 4 Indicators - Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

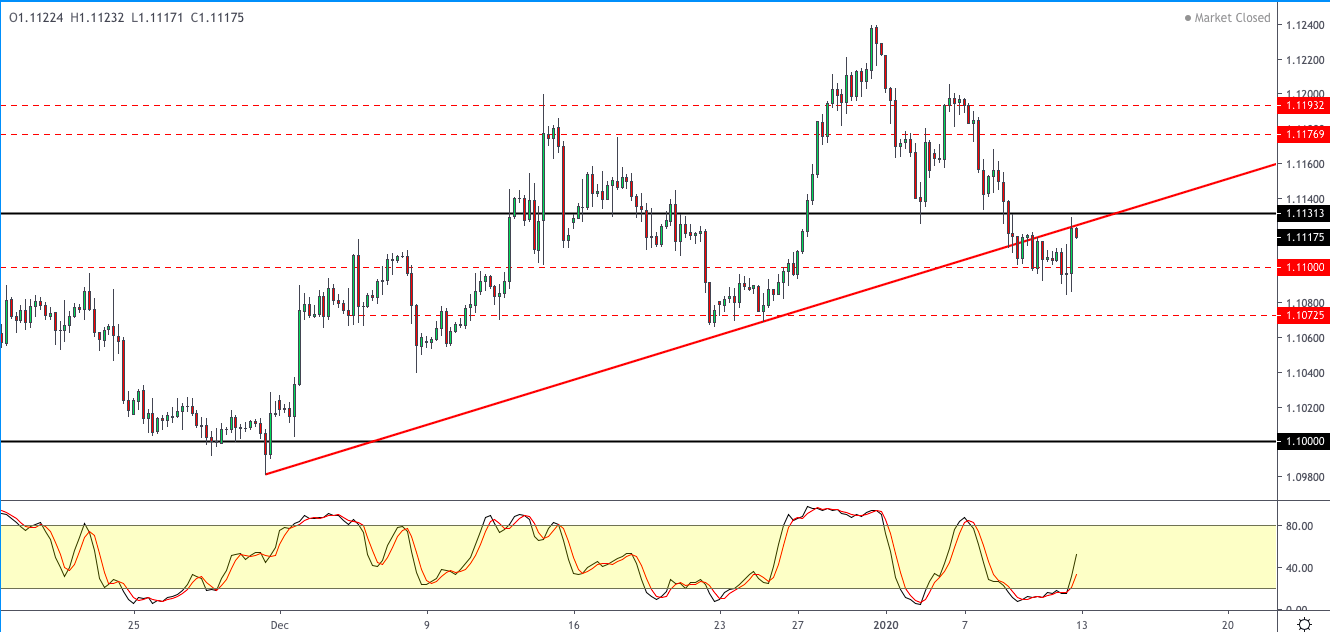

EURUSD Closes Flat After a Decline

The currency pair closed flat on Friday following a patch of declines from earlier in the week. While price managed to rebound late into Friday’s close, the euro remains below the resistance level of 1.1131. If resistance is formed here, then we expect a further move to the downside. Watch the support level of 1.1100. A break down below this level will indicate a move to 1.1072.

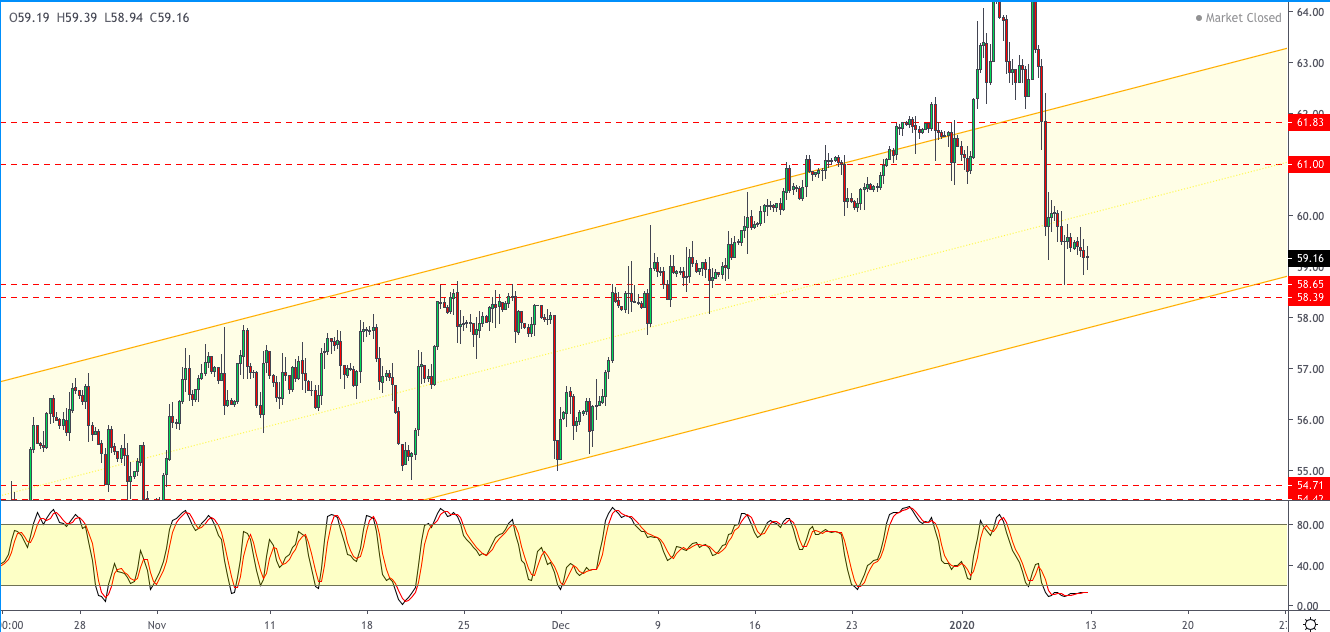

Crude Prices Give Back Gains

Oil prices continued to retreat right after rising to highs above the 65.00 handle. The reversal in prices came as investors saw a lower threat of tensions between Washington and Tehran. Crude oil prices ended up closing the week on a strongly bearish note as a result.

Can Crude Oil Hold on to Support?

Price action is approaching the support area of the 58.70 – 58.40 region. This remains a crucial test for the commodity. If price action is able to rebound off this level we could expect some upside movement. However, oil prices will remain range-bound with the upper resistance level of 61.00 coming into play. To the downside, a breakdown below the support could extend declines to the 55.00 support.

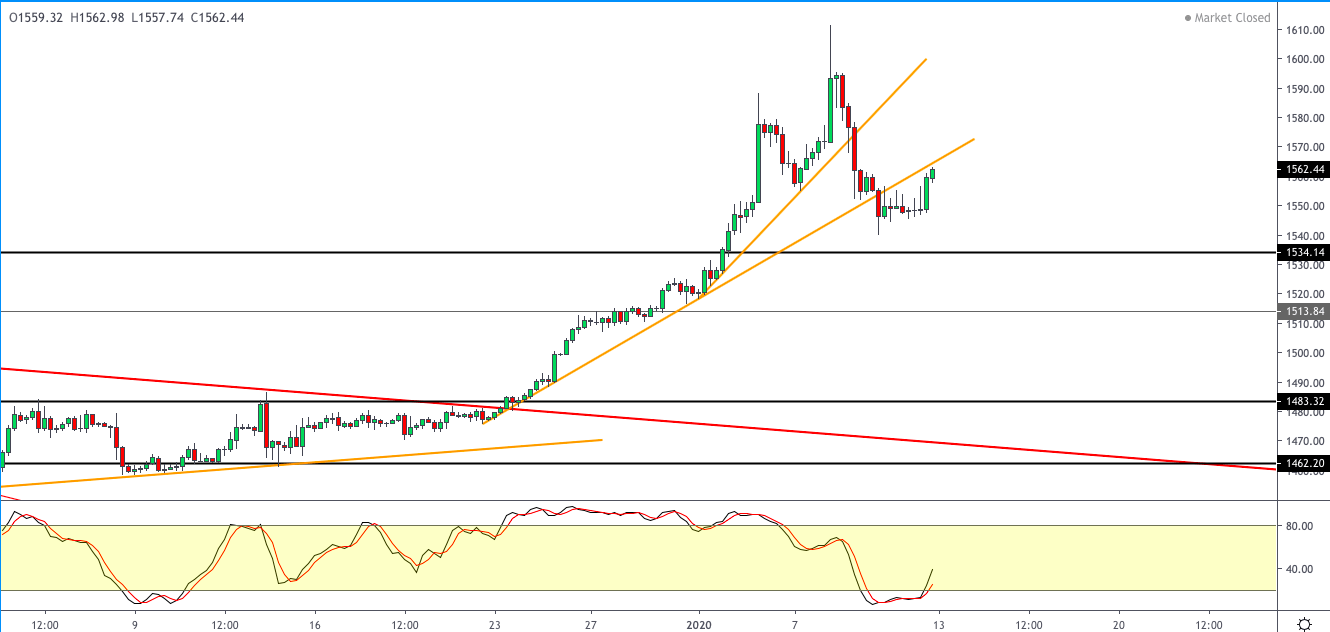

Gold Prices Recover on Weak Jobs Report

Despite the rally from the equity markets, gold prices managed to hold on to the gains. After falling for two consecutive days, gold reversed direction into Friday’s close. However, Friday’s close is still far off from the intra-week highs made earlier. Overall, gold prices remain somewhat volatile and possibly biased to the upside.

XAUUSD Testing the Trend Line

XAUUSD is seen re-testing the trend line from below. If this stalls the current gains, we anticipate a move to the downside. The lower support at 1534 will come into the picture upon a break down from the lows near 1547. As long as the major support level of 1534 holds, gold still has room to the upside. But a close below this support will see 1513 support as the next likely target.

By Orbex