By Orbex

The monthly nonfarm payrolls report will be coming out today from the US Labor Department.

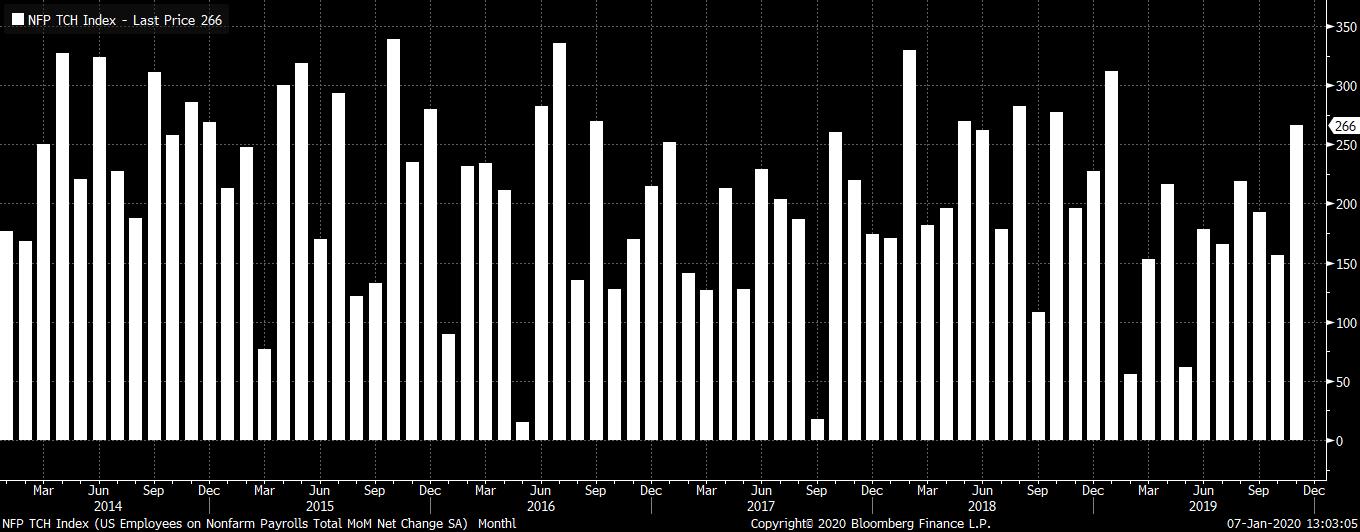

This will be the first payrolls report for this year, but the data covers the month of December. Overall, the expectations for December NFP are somewhat conservative.

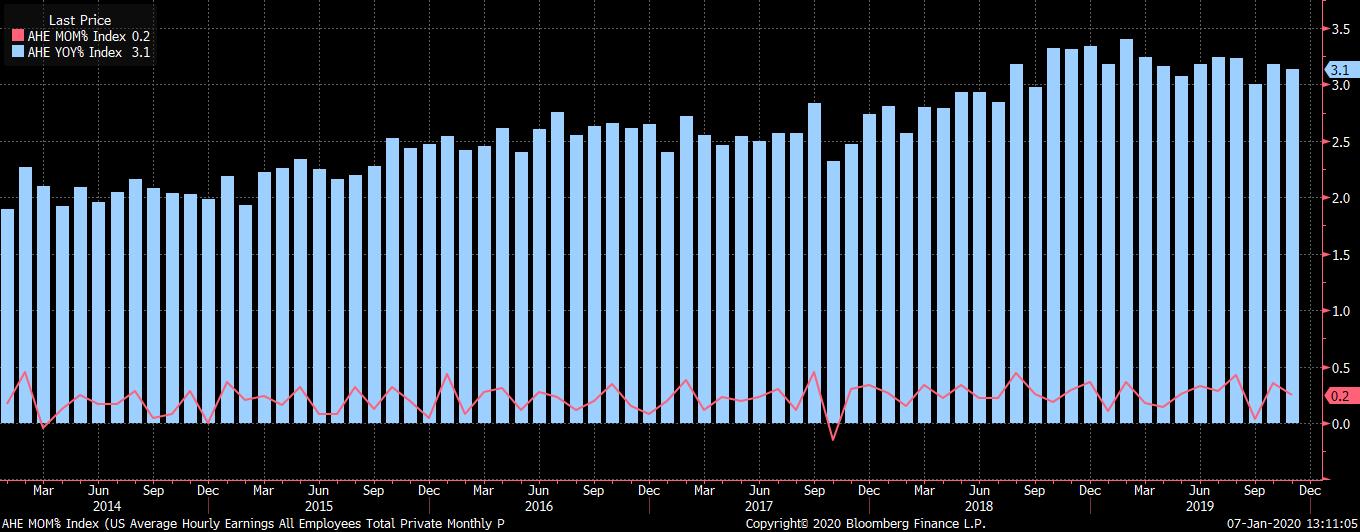

Economists are forecasting that unemployment will be steady at 3.5%. The payrolls estimates are towards the 150k region, while there is some optimism that wages will rise 0.3%, marking a slightly higher pace of increase during the month.

The recent ISM manufacturing activity, however, casts a dark shadow on the payroll estimates. The underlying data in the manufacturing sector is pointing to months before any recovery could take place.

This could potentially mean that the average payrolls may take a hit.

Free Reports:

Get Our Free Metatrader 4 Indicators - Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get Our Free Metatrader 4 Indicators - Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

The November payrolls saw a big boost, largely thanks to the General Motors strike. This enabled employment in the motor vehicle sector to rise 41,300. Indirectly, this also helped the overall manufacturing sector jobs to rise 54,000 as well.

US Change in Nonfarm payrolls, November 2019

Besides the payroll figures, focus will also stay on wage growth. US wage growth has been steady near 3.0% – 3.1% on average. For the moment, with inflation staying sluggish, wages continue to outstrip inflation.

However, given the risk that inflation could rise, wages will need to pick up steam.

One interesting factor to look into will be the diffusion index. The diffusion index measures the percentage of manufacturing industries contributing to the overall job figures.

The data has been hinting towards a core improvement in the manufacturing sector. A similar trend could potentially point to the slump in the manufacturing sector turning the corner.

But this means that investors will have to wait at least for three months to see this taking shape.

Mixed Manufacturing & Services Sector Activity

The latest data covering the business activity in the services and manufacturing sector paints a mixed picture.

While the manufacturing sector continues to remain in a slump, the services sector, on the other hand, rebounded during the month. However, employment in both the services and manufacturing sector fell slightly from the month before.

Given the weakness in the employment sub-sector, the expectations for a weaker headline print stay consistent. The data also indicates that the US economy remains in the late stages of economic growth.

Often during this period, one gets to see lower payroll figures. Therefore, focus will shift to the unemployment rate and wage growth. With the forecasts showing that the unemployment rate will be steady at 3.5%, wages will remain the big-ticket item to watch out for.

Early indications show that inflation could rise in the coming months, largely on account of higher fuel prices. Thus, amid this backdrop, a sluggish wage report will be disappointing for investors.

Fed officials are, however, likely to remain on the sidelines, giving room for monetary policy to take its course until March. The big question is whether the Fed will hold rates steady in March.

As a result, the December NFP will be of importance. Any consistent signs of weakness in the labor market could trigger officials to take preventive measures, by cutting interest rates.

In the short term, today’s impact from the NFP will be seen across all asset classes including equities and forex.

By Orbex