By Orbex

The penultimate payrolls report for the year 2019 is due to come out later today.

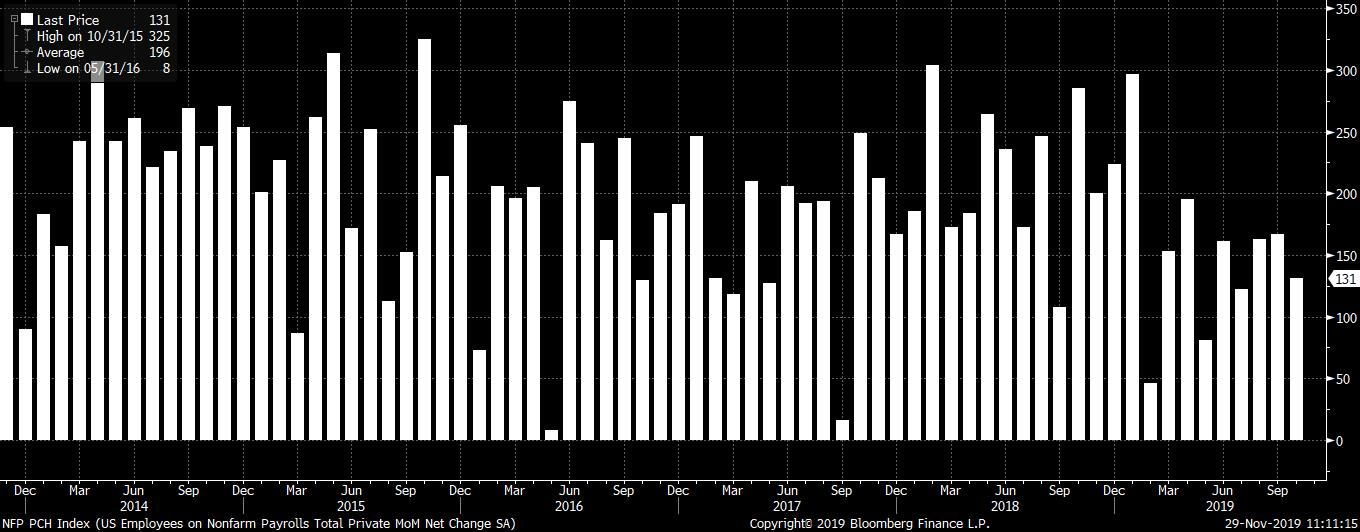

The report will be closely watched with economists forecasting that payrolls will rise 183,000 for the month of November. Elsewhere, the unemployment rate is tipped to hold steady at 3.6%. No changes are expected to wage growth which is forecast to rise 3% on the year.

The payrolls report will be key as investors assess the health of the US economy for the fourth quarter. While there was a slowdown in the previous quarter, the Fed rate cuts could see a reversal.

The data for October surprised to the upside. Economists view a similar trend taking place in November as well. This comes after the impact of the strike at General Motors ended.

If the economic data comes in line with the estimates, the nonfarm payrolls for November would be the highest since August this year.

Free Reports:

Get Our Free Metatrader 4 Indicators - Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get Our Free Metatrader 4 Indicators - Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

From a policy perspective, the November jobs report is likely to give officials enough breathing space. The central bank earlier indicated that it would prefer to wait for the impact of the three rate cuts delivered this year.

Following the higher revised GDP in the second quarter, and the likelihood that payrolls will rise in November, the Fed could be looking into not making any changes to monetary policy when it meets this December.

In October, the payrolls report managed to overcome the strike at GM. The data exceeded the expectations of a 75,000 increase to register 128,000 jobs for the month. However, we expect revisions to bring this figure more in line with reality.

The manufacturing sector which has also been weaker over the past months could start to show a slower pace of job hiring. This was evident from the October report.

Will the Slower Economy Weigh on Jobs?

Investors will be mainly looking for evidence that the slowing economy will have an impact on US jobs. So far, the jobs market has managed to buck the trend. But recent declines in both the manufacturing and services sectors could show otherwise.

The current estimates still prove to be hawkish. This means that if the data comes close to the estimates, then the Fed will have time for its monetary policy changes. Still, many economists believe that a slowdown in jobs is due over the next few months.

The markets are slowly giving rise to expectations that the Federal Reserve will cut rates at the March FOMC meeting next year.

This, of course, depends on how the economic data fares over the period.

The US economy has been holding on to the 2% average growth rate in the previous quarter. We could see similar results in the fourth quarter of the year as well.

Businesses are largely concerned about the uncertainty of the US and China trade wars. Secondly, the economic expansion has been stretching for a while. Therefore, it is not surprising to expect a slowdown in the economic boom cycle.

This will, of course, depend on how the labor market will respond. So far, there is a clear trend of a slowdown in the number of jobs being added. But the unemployment rate remains quite low.

Meanwhile, wage growth is also showing signs of stagnation. On average, the yearly wage growth is around 3%. But this comes as the inflation data remains sluggish, giving more spending power for consumers.

By Orbex