December 2nd – By CountingPips.com – Receive our weekly COT Reports by Email

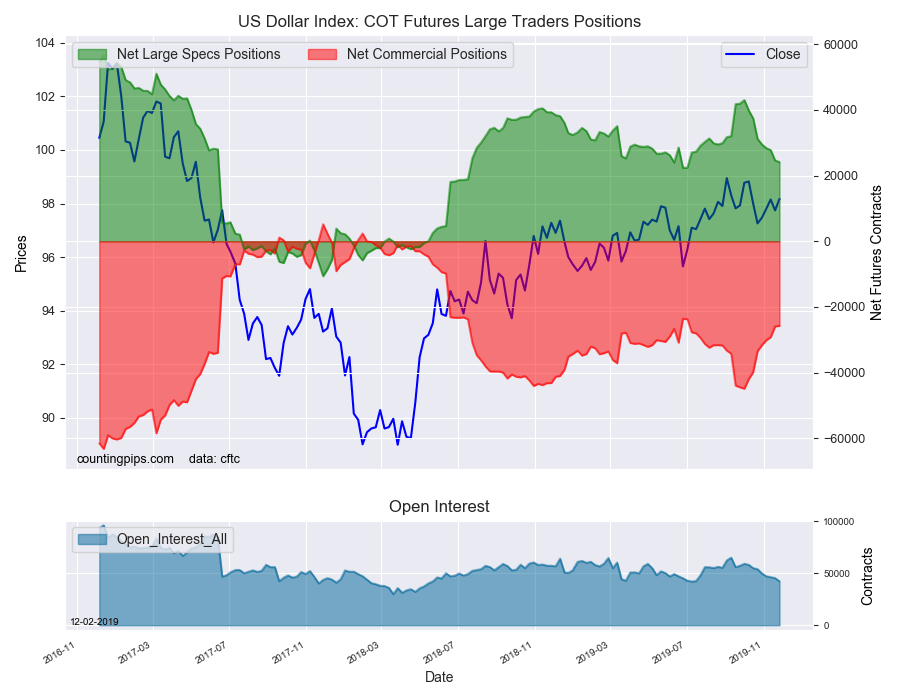

US Dollar Index Speculator Positions

Large currency speculators continued to decrease their bullish net positions in the US Dollar Index futures markets last week, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Monday (delayed due to Thanksgiving holiday).

The non-commercial futures contracts of US Dollar Index futures, traded by large speculators and hedge funds, totaled a net position of 24,138 contracts in the data reported through Tuesday November 26th. This was a weekly decline of -487 contracts from the previous week which had a total of 24,625 net contracts.

The week’s net position was the result of the gross bullish position (longs) tumbling by -2,276 contracts (to a weekly total of 29,233 contracts) compared to the gross bearish position (shorts) which saw a fall by -1,789 contracts on the week (to a total of 5,095 contracts).

US Dollar Index speculators have now cut back on their bullish positions for an eighth consecutive week and by a total of -18,890 contracts over that time-frame.The current spec bullish level is now at the lowest level in the past twenty-one weeks, dating back to early July.

Individual Currencies Data this week:

In the overall major currency contracts data, the major currencies that saw improving speculator positions last week were just the euro (1,087 weekly change in contracts) and the Australian dollar (1,885 contracts).

Free Reports:

Get Our Free Metatrader 4 Indicators - Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get Our Free Metatrader 4 Indicators - Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

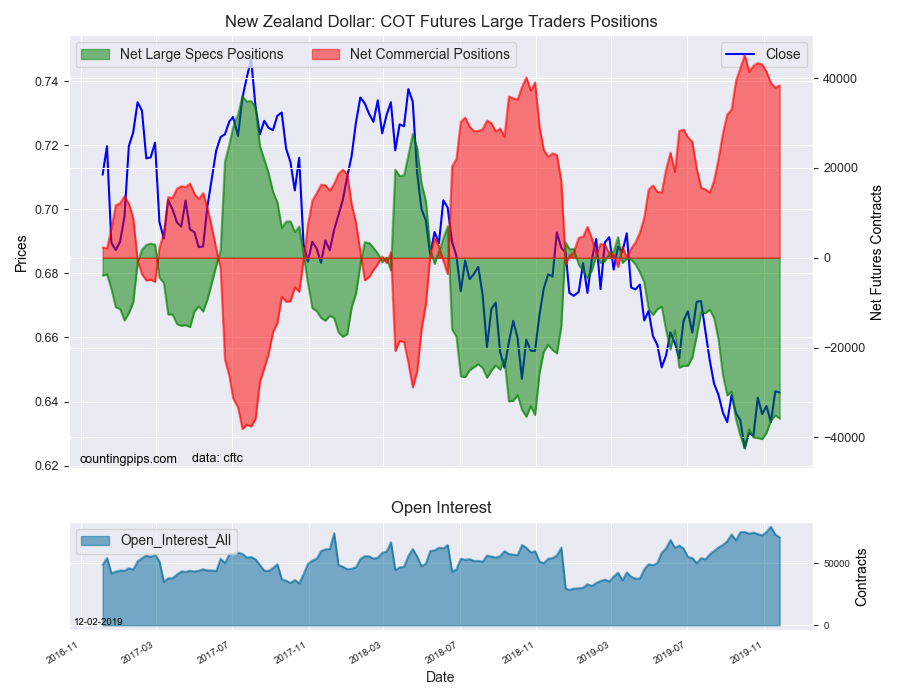

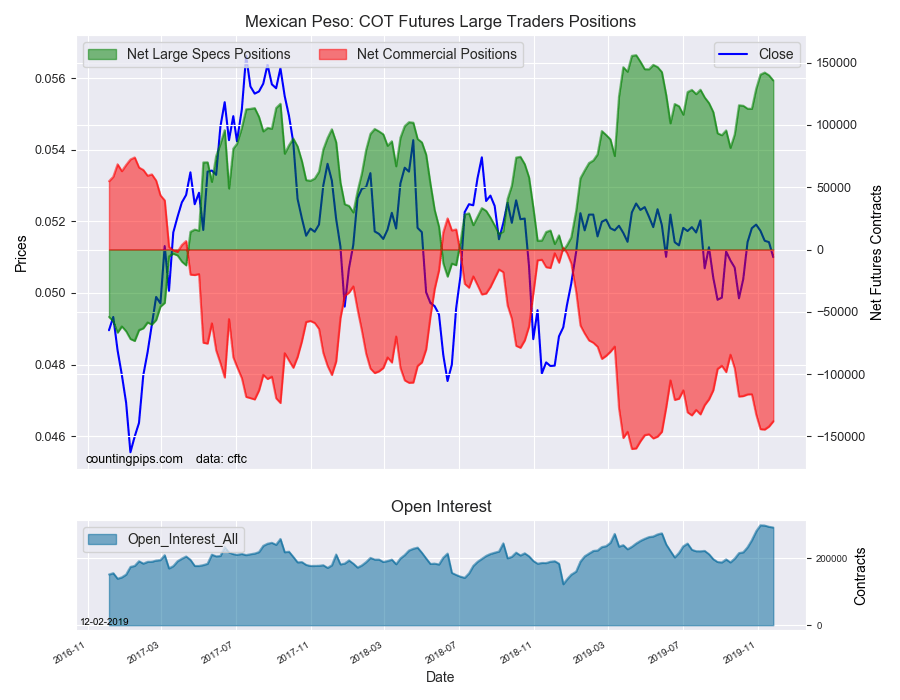

The currencies whose speculative bets declined last week were the US dollar index (-487 weekly change in contracts), British pound sterling (-4,673 contracts), Japanese yen (-4,560 contracts), Swiss franc (-4,783 contracts), Canadian dollar (-8,521 contracts), New Zealand dollar (-727 contracts) and the Mexican peso (-4,172 contracts).

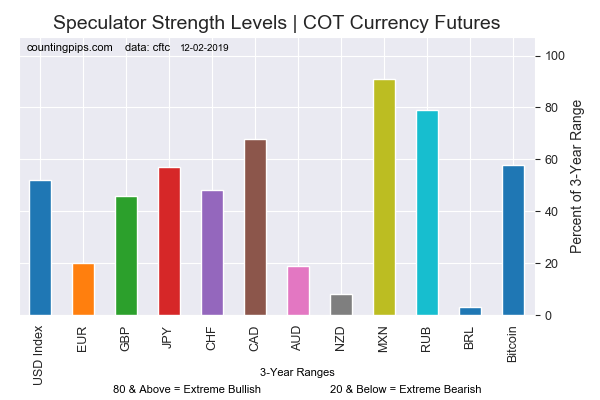

Chart: Current Strength of Each Currency compared to their 3-Year Range

See the table and individual currency charts below.

Table of Large Speculator Levels & Weekly Changes:

| Currency | Net Speculator Position | Specs Weekly Change |

| USD Index | 24,138 | -487 |

| EuroFx | -61,416 | 1,087 |

| GBP | -36,576 | -4,673 |

| JPY | -39,591 | -4,560 |

| CHF | -20,975 | -4,783 |

| CAD | 20,344 | -8,521 |

| AUD | -45,355 | 1,885 |

| NZD | -35,826 | -727 |

| MXN | 135,649 | -4,172 |

This latest COT data is through Tuesday and shows a quick view of how large speculators or non-commercials (for-profit traders) were positioned in the futures markets. All currency positions are in direct relation to the US dollar where, for example, a bet for the euro is a bet that the euro will rise versus the dollar while a bet against the euro will be a bet that the dollar will gain versus the euro.

Weekly Charts: Large Trader Weekly Positions vs Price

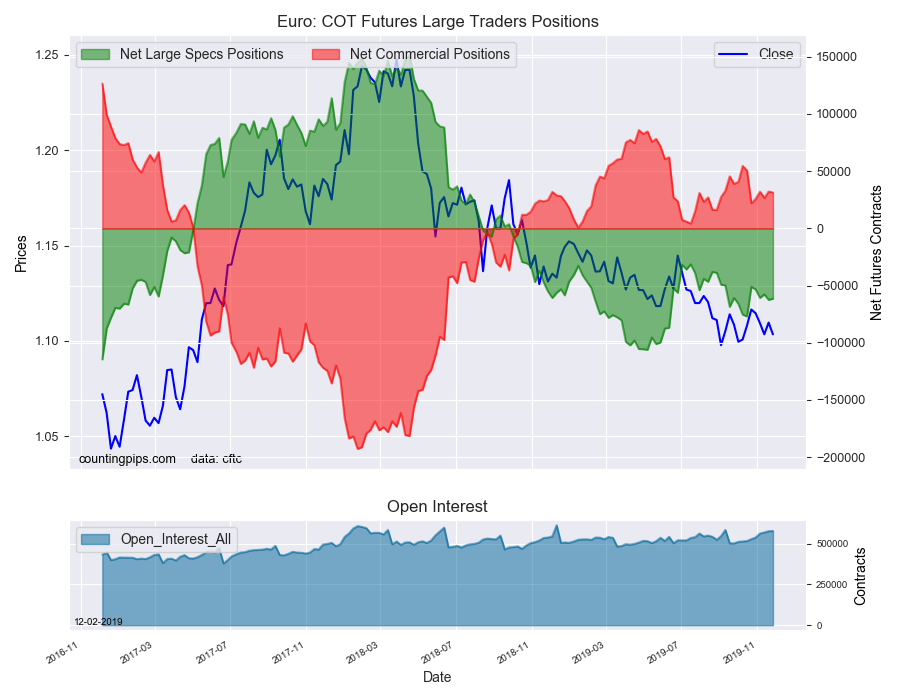

EuroFX:

The Euro large speculator standing this week totaled a net position of -61,416 contracts in the data reported through Tuesday. This was a weekly increase of 1,087 contracts from the previous week which had a total of -62,503 net contracts.

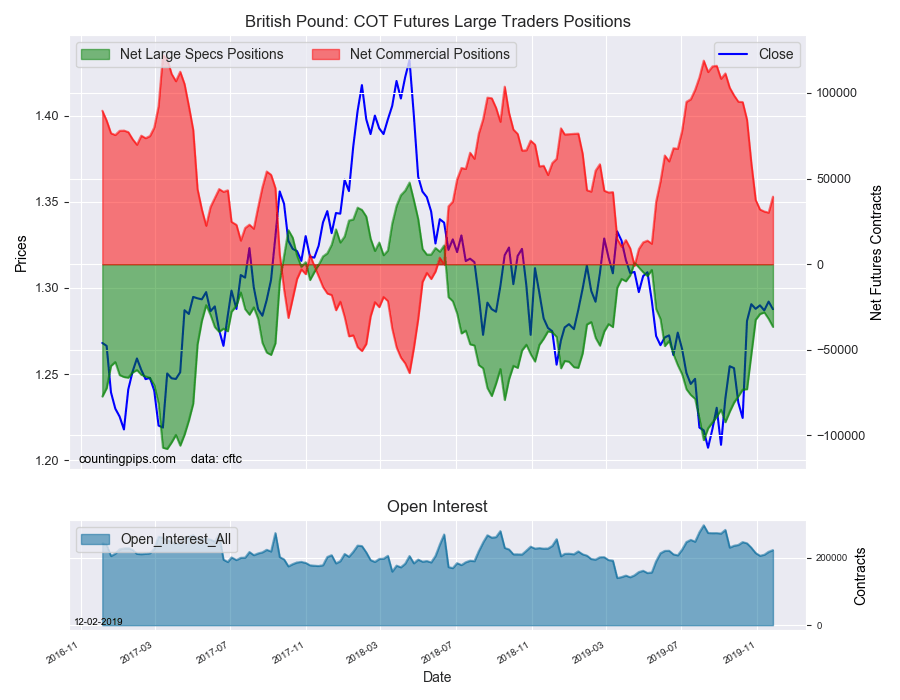

British Pound Sterling:

The large British pound sterling speculator level totaled a net position of -36,576 contracts in the data reported this week. This was a weekly decrease of -4,673 contracts from the previous week which had a total of -31,903 net contracts.

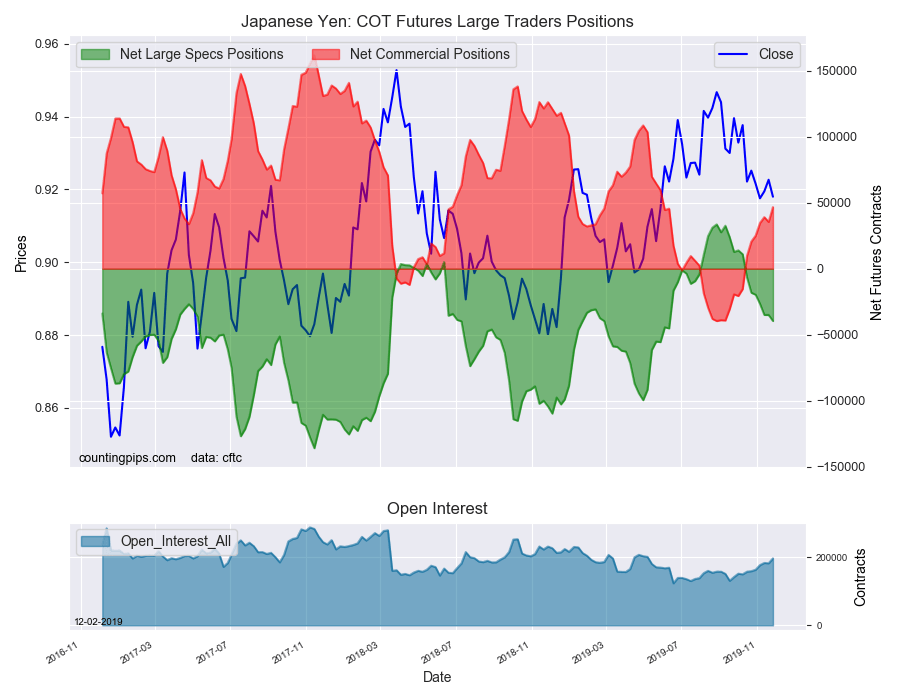

Japanese Yen:

Large Japanese yen speculators totaled a net position of -39,591 contracts in this week’s data. This was a weekly lowering of -4,560 contracts from the previous week which had a total of -35,031 net contracts.

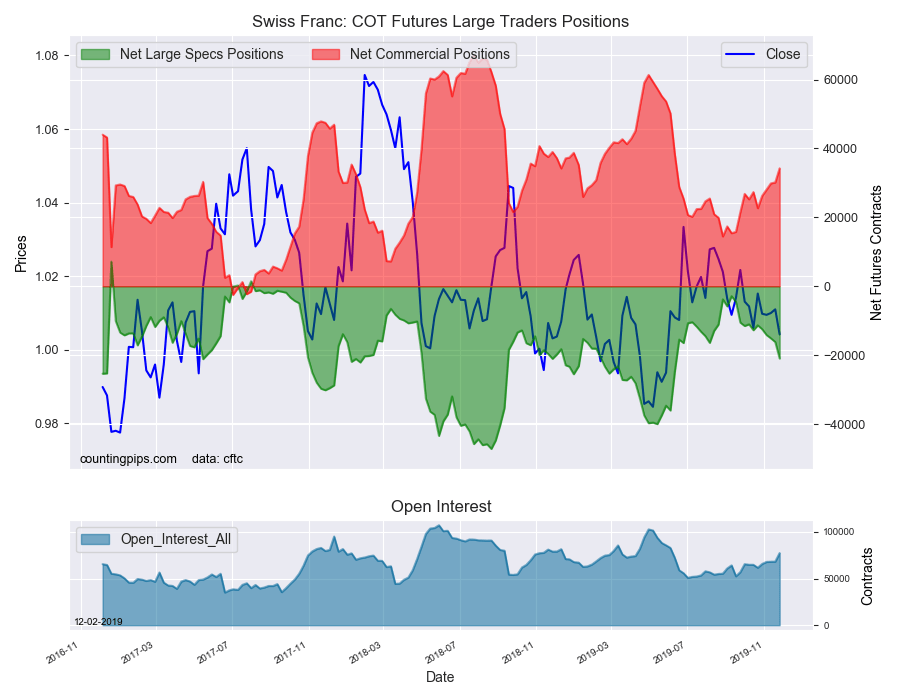

Swiss Franc:

The Swiss franc speculator standing this week reached a net position of -20,975 contracts in the data through Tuesday. This was a weekly fall of -4,783 contracts from the previous week which had a total of -16,192 net contracts.

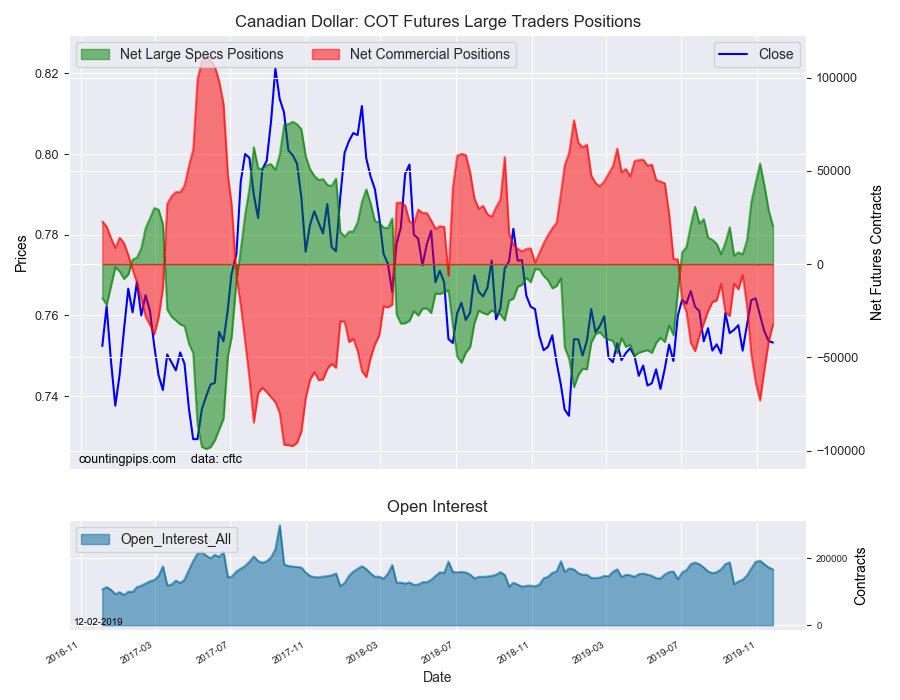

Canadian Dollar:

Canadian dollar speculators reached a net position of 20,344 contracts this week. This was a decrease of -8,521 contracts from the previous week which had a total of 28,865 net contracts.

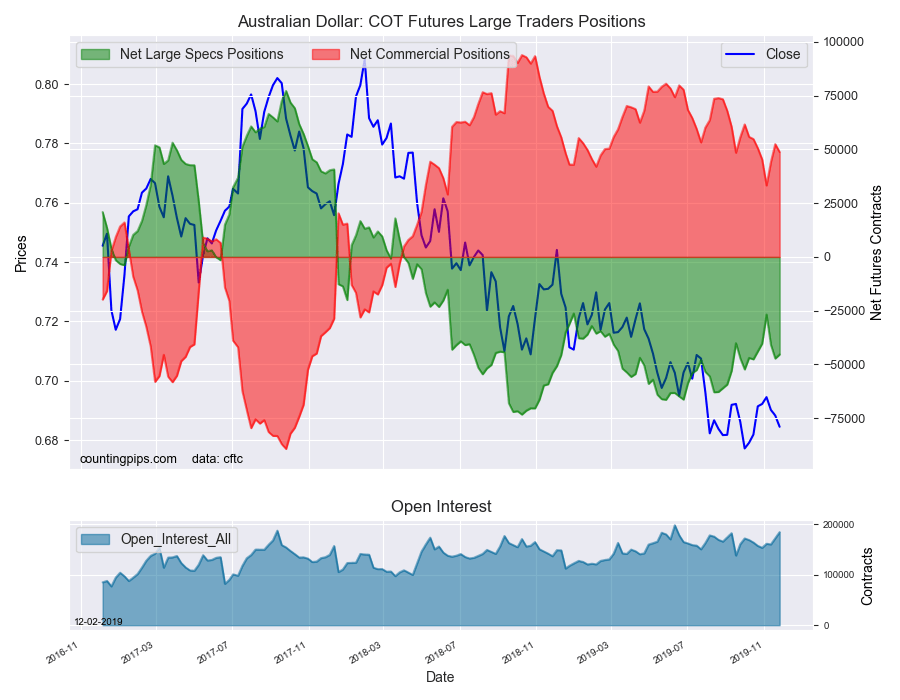

Australian Dollar:

The large speculator positions in Australian dollar futures reached a net position of -45,355 contracts this week in the data ending Tuesday. This was a weekly increase of 1,885 contracts from the previous week which had a total of -47,240 net contracts.

New Zealand Dollar:

The New Zealand dollar speculative standing equaled a net position of -35,826 contracts this week in the latest COT data. This was a weekly lowering of -727 contracts from the previous week which had a total of -35,099 net contracts.

Mexican Peso:

Mexican peso speculators totaled a net position of 135,649 contracts this week. This was a weekly reduction of -4,172 contracts from the previous week which had a total of 139,821 net contracts.

Article By CountingPips.com – Receive our weekly COT Reports by Email

*COT Report: The COT data, released weekly to the public each Friday, is updated through the most recent Tuesday (data is 3 days old) and shows a quick view of how large speculators or non-commercials (for-profit traders) were positioned in the futures markets.

The CFTC categorizes trader positions according to commercial hedgers (traders who use futures contracts for hedging as part of the business), non-commercials (large traders who speculate to realize trading profits) and nonreportable traders (usually small traders/speculators).

Find CFTC criteria here: (http://www.cftc.gov/MarketReports/CommitmentsofTraders/ExplanatoryNotes/index.htm).