By Orbex

On Thursday, UK voters return to the polls for their third general election in just four years.

The number of elections in this period (which is typically limited to one election every four years) highlights the difficulties Brexit has created within the domestic political landscape.

Battle For Brexit

With Brexit currently postponed until January 31st, 2020, this election is being viewed as a “single-issue” election over how Brexit will be handled. The Conservative party, under PM Johnson, has said that if it wins, it will work towards delivering Johnson’s Brexit deal and leave the EU by the new deadline, as planned.

However, the Labour party has said that if it wins, it will look to secure new terms with the EU. It will then give the UK public the chance to vote on whether to leave the EU with a new deal or remain in the EU, canceling Brexit.

YouGov Predicting Tory Party Majority

Recent polling has consistently shown the Conservative party to be in the lead with an average gain of around 10% on the Labour party.

Free Reports:

Get Our Free Metatrader 4 Indicators - Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get Our Free Metatrader 4 Indicators - Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

One poll, in particular, is worth paying attention to. The YouGov MRP model (the only poll to correctly predict Theresa May losing her majority in 2017) is currently forecasting that the Conservative party will win an outright majority of 359 seats versus 211 for Labour.

If the Conservative party does win a majority, this will give Johnson much greater power as he will no longer need to rely on the DUP to get his deal through.

Johnson has said that he wants to move quickly with Brexit and we are likely to see a parliamentary vote on his deal ahead of Christmas.

Tory Win To Support GBP

A Conservative win would likely be positive for GBP. It would give traders some much-needed clarity over Brexit.

Agreeing on a Brexit deal would see the UK moving into the transitional phase with the EU, with the two sides work on the details of a future trade agreement. In this scenario, the UK would avoid the economic cliff edge of a no-deal Brexit.

It would also finally put an end to the uncertainty which has stifled GBP over much of the year.

“Boosterism”

Looking beyond Brexit, Johnson’s economic policy proposals could also help support GBP. Johnson has highlighted plans to increase government spending.

While the details of his plan are still vague, Johnson said that his approach to the economy would be “boosterism”, saying that he wants to “turbocharge” the UK economy. If Johnson is successful in implementing growth-positive economic policies, this would attract a lot of capital inflow into the UK, driving GBP higher.

Impact on BOE

Finally, GBP would also derive some support from the BOE, which likely would refrain from cutting rates in the event of a Conservative party win.

While the BOE has said that there are clear two-way risks around Brexit, the prospect of the UK leaving with a deal would be the most manageable outcome for the bank. It would increase the likelihood that the BOE would not need to cut rates.

Technical Perspective

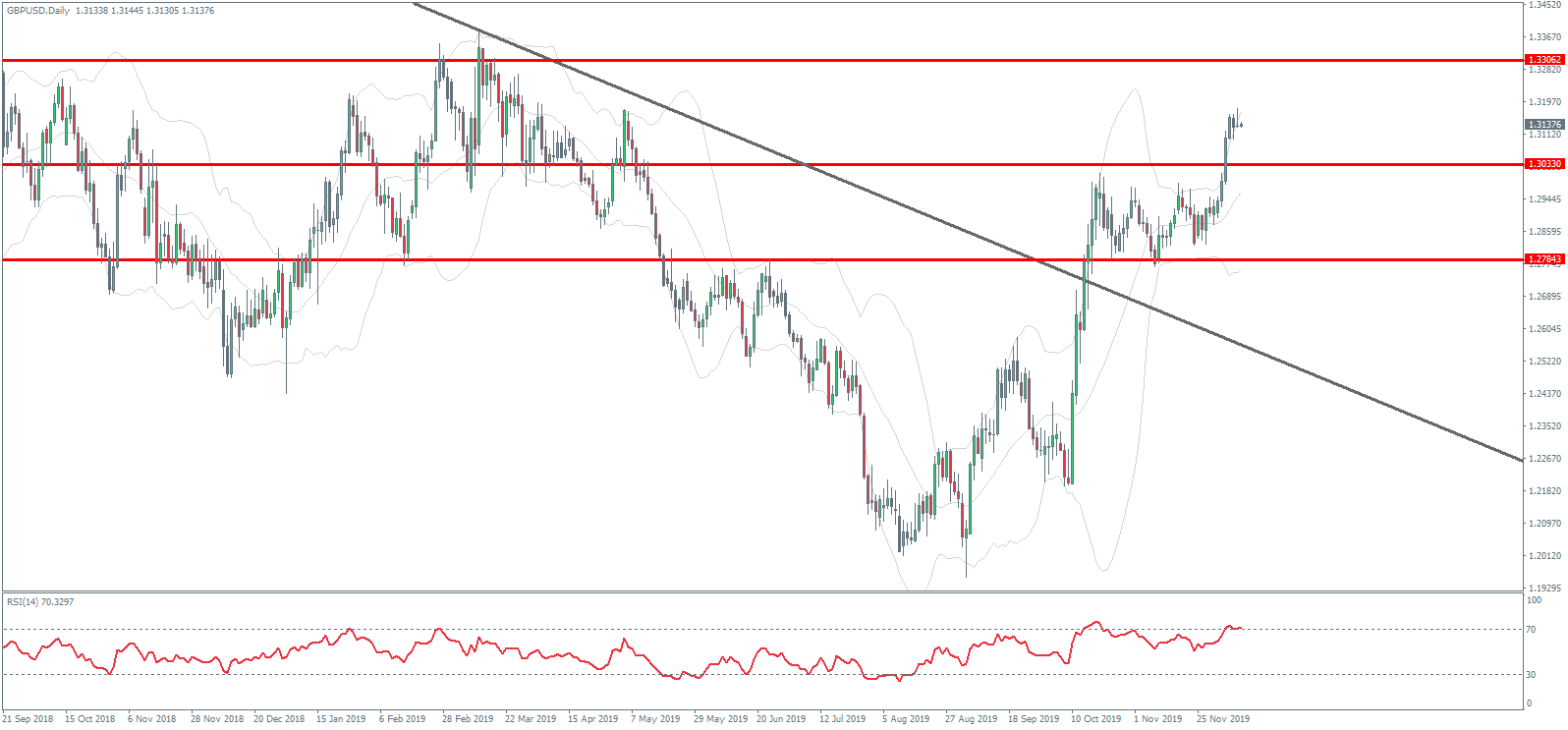

The rally in GBPUSD over the last week has seen price breaking out above the 1.3033 level and extending gains beyond the broken bearish trend line from 2018 highs. While above 1.3033, focus is on a further push higher with the 1.3306 level the next key resistance to watch.

By Orbex