By Orbex

FX traders are always on the search to find a tool or a method that could give them an edge in the markets. This is true, not just for the forex markets but also just about any market where one could speculate.

Therefore, the number of various technical trading indicators that one can choose from is tremendous. Among the many technical indicators, a few stand out.

Among these, is the ADX indicator. Known as the Average Directional Index, the ADX is a trend strength indicator. The main purpose of the ADX is to measure the strength of a trend.

When trading, it can be difficult to say whether the trend will continue or not. Under such circumstances, the ADX is a wonderful indicator that can visually give you some input. This, in turn, can be used either in developing a technical trading strategy or just to fine-tune an existing trading system.

Some FX traders also consider the ADX to be the ultimate trend indicator. The trend, as you might already know, is often said to be a forex trader’s best friend. Thus, an indicator that can measure the trend strength, no doubt, is widely accepted.

Free Reports:

Get Our Free Metatrader 4 Indicators - Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get Our Free Metatrader 4 Indicators - Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

In this article, we will not get into the details of how the ADX works. But rather, we will see whether the forex indicator can stand out from other custom indicators in its group.

Are there any Alternatives to the ADX Indicator?

The answer to this first depends on how the ADX indicator works. Firstly, the average directional index indicator highly depends on inputs from the moving average. The moving average, as you know is merely a moving average of the price of the security.

The general consensus is that when prices are rising, it tends to pull up the average price as well. This leads to an upward-sloping moving average. Conversely, when prices are falling, they tend to push the moving average price lower as well.

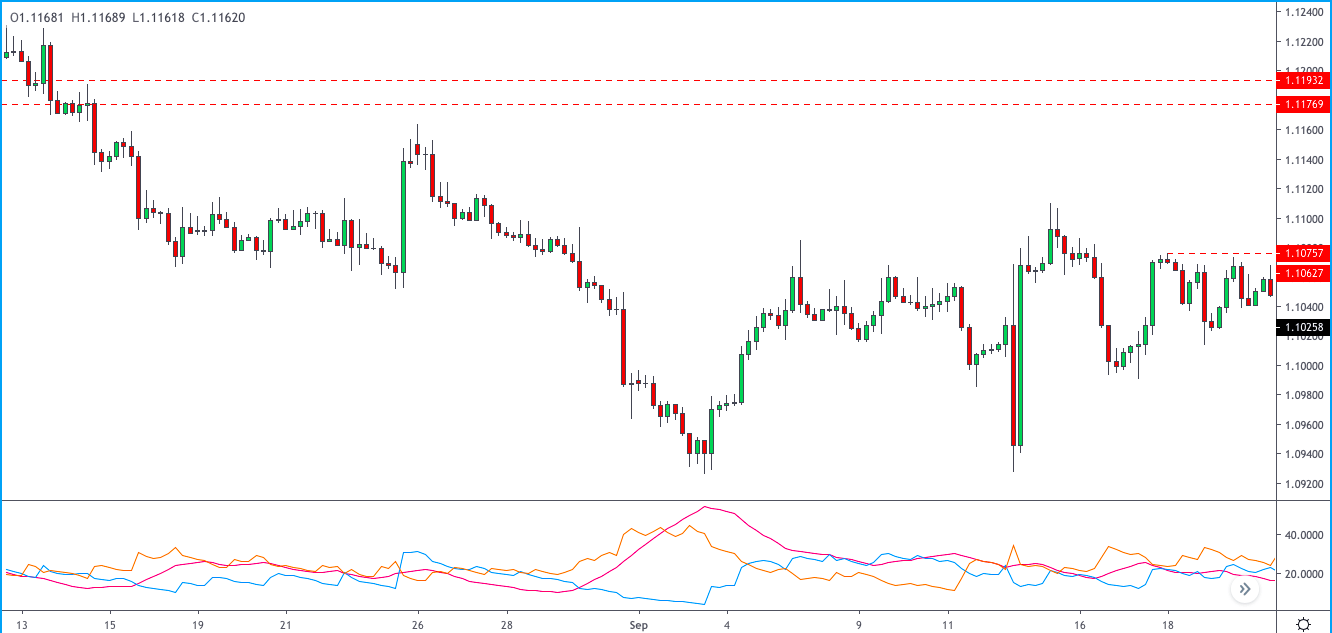

The ADX indicator uses this information to plot three lines. The DI+ line and the DI- line measures the highs and the lows in the price. Based on the trend, you will find the DI+ line crossing above the DI- line and vice versa.

The ADX moves between fixed values of 0 to 100.

In addition to this, there is also the ADX line. The ADX measures the momentum. Thus, when momentum is high and the DI+ is above DI-, it can mean that the strength of the trend is strong.

The same can be said when the DI- is above the DI+ line and the DMI line is rising. It signals that the downtrend is strong.

As you can see already, the ADX indicator requires quite a bit of reading to understand the trend strength. When there are three variables in the indicator it can lead to various scenarios.

In the larger scope of things, it can make things a bit difficult for forex traders.

Therefore, it is not uncommon to see some FX traders use only the DMI line while using other indicators to measure the trend.

Alternatives to the ADX Indicator

One of the other most commonly used forex indicators aside from the ADX is the Aroon oscillator. The Aroon oscillator works on similar concepts with two lines indicating whether the uptrend or the downtrend is higher.

The deeper you dig, the more you are bound to find more custom forex indicators.

But this begs the question as to whether the ADX is a good indicator or if one should merely use some of the other modified versions for it.

The bottom line is that forex traders tend to search for the Holy Grail indicator. And the hunt to find something better than the ADX might sound appealing. At the end of the day, forex trading is not just about using the best indicators but requires a mix of risk management and understanding of the FX markets.

If you are stuck on whether the ADX is a good indicator to use, then you should possibly introspect more into understanding the need for finding the next best indicator.

By Orbex