By IFCMarkets

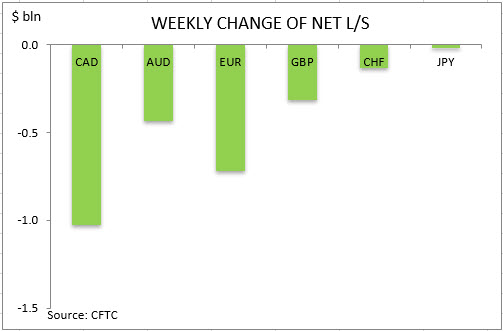

US dollar bullish bets rise continued to $18.36 billion from $16.18 billion against the major currencies during the one week period, according to the report of the Commodity Futures Trading Commission (CFTC) covering data up to November 19 and released on Friday November 22. The increase in bullish dollar bets was intact as retail sales growth rebounded in October to 0.3% after a 0.3% decline in September, despite US federal budget deficit’s 34% rise in October from a year ago, and St Louis Fed president Bullard said the “key risk” facing the US economy is a sharper-than-expected slowdown despite the Fed’s recent interest rate cuts.

CFTC Sentiment vs Exchange Rate

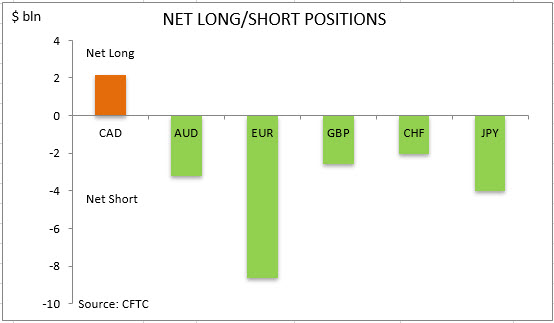

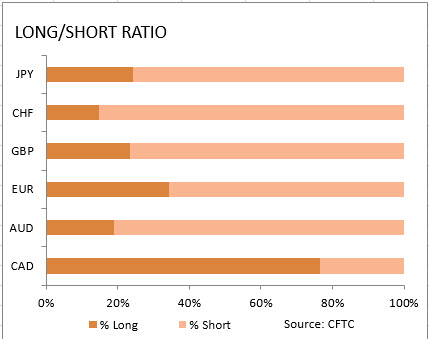

| November 19 2019 | Bias | Ex RateTrend | Position $ mln | Weekly Change |

| CAD | bullish | negative | 2177 | -1025 |

| AUD | bearish | negative | -3224 | -433 |

| EUR | bearish | negative | -8655 | -718 |

| GBP | bearish | negative | -2577 | -318 |

| CHF | bearish | negative | -2043 | -135 |

| JPY | bearish | negative | -4034 | -20 |

| Total | -18356 |

Market Analysis provided by IFCMarkets

Note:

This overview has an informative and tutorial character and is published for free. All the data, included in the overview, are received from public sources, recognized as more or less reliable. Moreover, there is no guarantee that the indicated information is full and precise. Overviews are not updated. The whole information in each overview, including opinion, indicators, charts and anything else, is provided only for familiarization purposes and is not financial advice or а recommendation. The whole text and its any part, as well as the charts cannot be considered as an offer to make a deal with any asset. IFC Markets and its employees under any circumstances are not liable for any action taken by someone else during or after reading the overview.