By IFCMarkets

Slower Honduras harvest bullish for coffee price

Coffee harvesting in Honduras has slowed due to dry weather. Will the coffee prices continue rising?

International Coffee Organization forecast last month that world coffee production in 2019-20 marketing year will decline by 0.9%, to about 10 million metric tons. A 2.7% decline in arabica production was stated as the main reason. Arabica output is estimated to hit the lowest level since 2015-16, according to ICO. And recently coffee prices are on the rise due to a slowdown in coffee harvesting in Honduras, the third-largest producer of arabica coffee in the world. The extremely dry conditions in Honduras are to blame for slow harvest. On the other hand, ICO estimates coffee demand is expected to rise globally, led by 3% consumption increase in Asia and the Pacific region. Strong demand and tighter supply estimates are bullish for coffee prices.

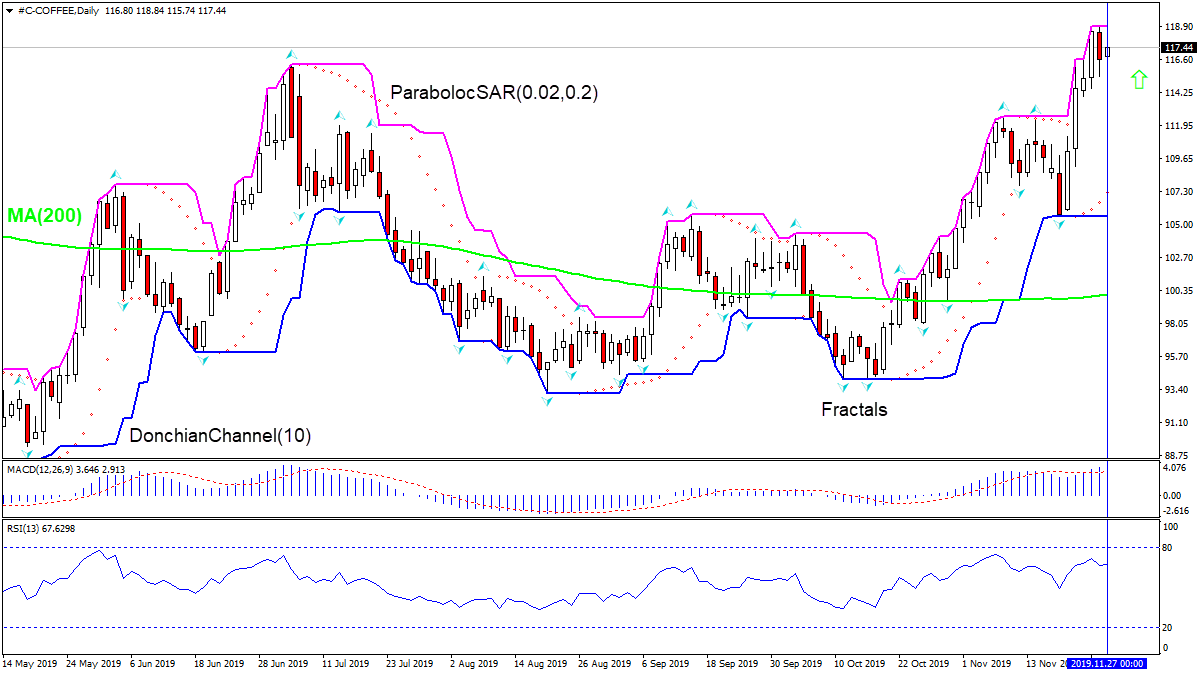

On the daily timeframe the COFFEE: D1 is above the 200-day moving average MA(200) which is level .

- The Parabolic indicator gives a buy signal.

- The Donchian channel indicates no trend: it is flat.

- The MACD indicator gives a bullish signal: it is above the signal line and the gap is widening.

- The RSI oscillator is rising but has not reached the overbought zone.

We believe the bullish momentum will continue as the price breaches above the upper Donchian boundary at 118.95. A pending order to buy can be placed above that level. The stop loss can be placed below the last fractal high at 112.36. After placing the order, the stop loss is to be moved every day to the next fractal low, following Parabolic signals. Thus, we are changing the expected profit/loss ratio to the breakeven point. If the price meets the stop loss level 112.36) without reaching the order (118.95), we recommend cancelling the order: the market has undergone internal changes which were not taken into account.

Free Reports:

Get Our Free Metatrader 4 Indicators - Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get Our Free Metatrader 4 Indicators - Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Technical Analysis Summary

| Order | Buy |

| Buy stop | Above 118.95 |

| Stop loss | Below 112.36 |

Market Analysis provided by IFCMarkets