By CountingPips.com – Receive our weekly COT Reports by Email

Here are this week’s links to the latest Commitment of Traders data changes that were released on Friday.

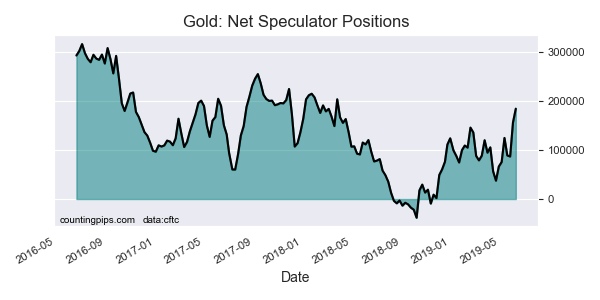

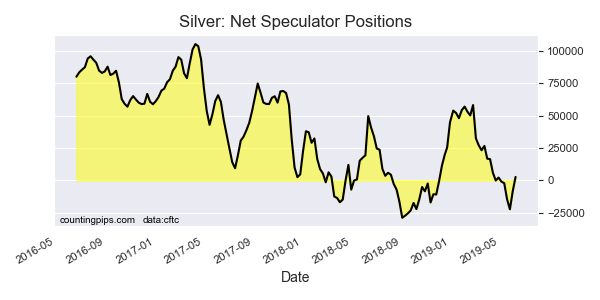

This week in the COT data, precious metals speculators once again sharply added to their Gold bullish positions after last week’s record gain. Silver bets improved for a second week and have settled into a small bullish level.

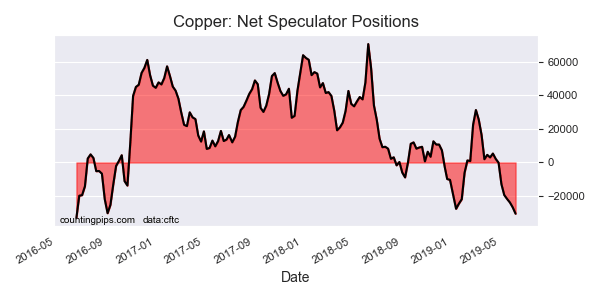

Copper speculators continued to push their bets more bearish for an 8th straight week and to the most bearish standing in 155 weeks.

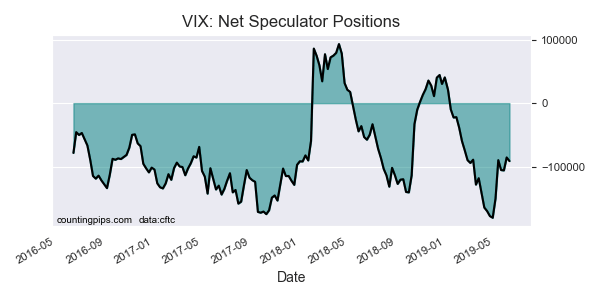

The VIX net speculative bearish position rose modestly this week and speculators have now added to bearish bets in three out of the past four weeks. Speculator bets saw huge pull backs in bearish positions on May 7th and 14th after reaching the all-time record high bearish level of -180,359 contracts on April 30th.

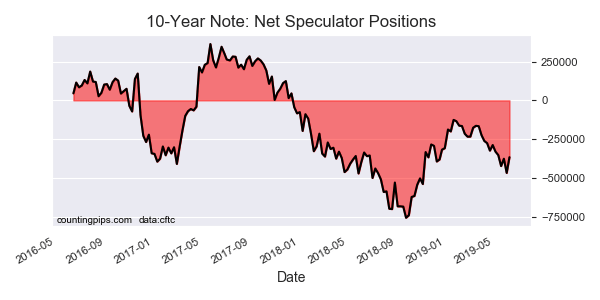

The 10-Year Bond speculators sharply cut their net short positions this week after having added to bearish bets for four out of the previous five weeks. The speculators have found themselves caught wrong-footed by the sharp rally in 10-Year bond prices in recent months and this week might be a start of trying to get on the right side of the trend.

Free Reports:

Get Our Free Metatrader 4 Indicators - Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get Our Free Metatrader 4 Indicators - Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

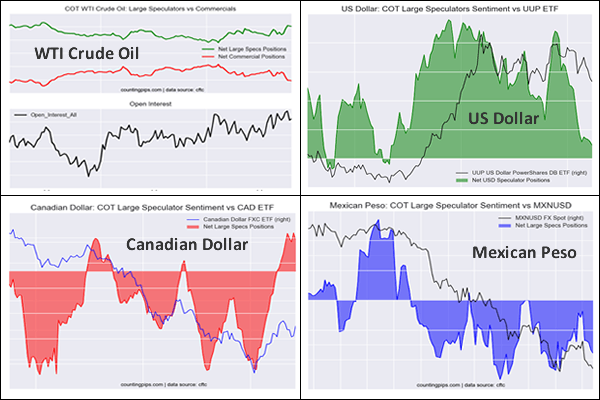

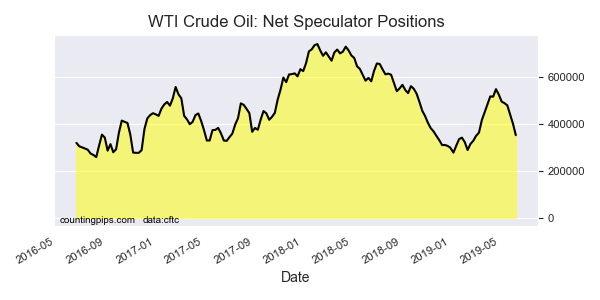

WTI Crude oil speculators once again pared their bullish bets for a 7th straight week and have now decreased positions by a whopping total of -195,704 contracts over this period. This week’s drop of -48,513 contracts was the largest one-week shortfall since August 29th of 2017.

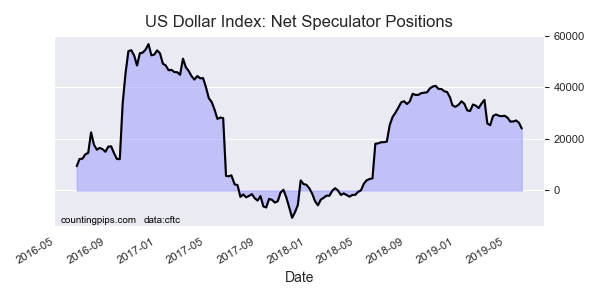

In Currencies, the USD Index Speculators continued their recent steady downtrend in positions as the USD Index fell for a 2nd week and to the lowest level since July 2018. Mexican peso positions furthered their recent declines (for a 4th week in a row) after reaching a record high bullish level on April 16th.

Finally, Swiss franc speculators strongly reduced their bearish bets this week by +11,277 contracts. The franc, like the Japanese yen, is a safe haven currency and has started to see improving trends despite remaining in an overall short position.

US Dollar Index Speculators dropped bets for 2nd week. Mexican Peso bets decline

Large currency speculators cut back on their net positions in the US Dollar Index futures markets this week, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday. See full article.

WTI Crude Oil Speculators further decreased their bullish bets for 7th week

The large speculator contracts of WTI crude futures totaled a net position of 351,655 contracts, according to the latest data this week. This was a change of -48,513 contracts from the previous weekly total. See full article.

10-Year Note Speculators strongly cut back on their bearish bets

Large speculator contracts of the 10-Year Bond futures totaled a net position of -365,988 contracts, according to the latest data this week. This was a change of 101,714 contracts from the previous weekly total. See full article.

Gold Speculators sharply boosted their bullish bets for 2nd week

Large precious metals speculator contracts of the Gold futures totaled a net position of 184,238 contracts, according to the latest data this week. This was a change of 28,123 contracts from the previous weekly total. See full article.

VIX Speculators added to their bearish bets this week

Large stock market volatility speculator contracts of the VIX futures totaled a net position of -91,182 contracts, according to the latest data this week. This was a change of -5,672 contracts from the previous weekly total. See full article.

Silver Speculators boosted their bets this week into a small bullish level

Large precious metals speculator contracts of the silver futures totaled a net position of 2,660 contracts, according to the latest data this week. This was a change of 11,103 contracts from the previous weekly total. See full article.

Copper Speculators continued to raise their bearish bets for 8th week

Metals speculator contracts of the copper futures totaled a net position of -30,521 contracts, according to the latest data this week. This was a change of -3,775 contracts from the previous weekly total. See full article.

Article By CountingPips.com – Receive our weekly COT Reports by Email

*COT Report: The COT data, released weekly to the public each Friday, is updated through the most recent Tuesday (data is 3 days old) and shows a quick view of how large speculators or non-commercials (for-profit traders) were positioned in the futures markets.

The CFTC categorizes trader positions according to commercial hedgers (traders who use futures contracts for hedging as part of the business), non-commercials (large traders who speculate to realize trading profits) and nonreportable traders (usually small traders/speculators).

Find CFTC criteria here: (http://www.cftc.gov/MarketReports/CommitmentsofTraders/ExplanatoryNotes/index.htm).