Article By RoboForex.com

BTCUSD, “Bitcoin vs US Dollar”

As we can see in the H4 chart, BTCUSD is forming a new ascending correction inside the mid-term downtrend; it has tested the retracement of 23.6% at 3990.00 once again. After breaking this level, the instrument may BTCUSD may continue growing towards the retracement of 38.2% at 4525.00. The key support is the low at 3121.90.

In the H1 chart, the divergence mad the pair reverse and start a new pullback. The correctional targets are the retracements of 38.2, 50.0%, and 61.8% at 3813.00, 37609.00, and 3705.00 respectively.

ETHUSD, “Ethereum vs. US Dollar”

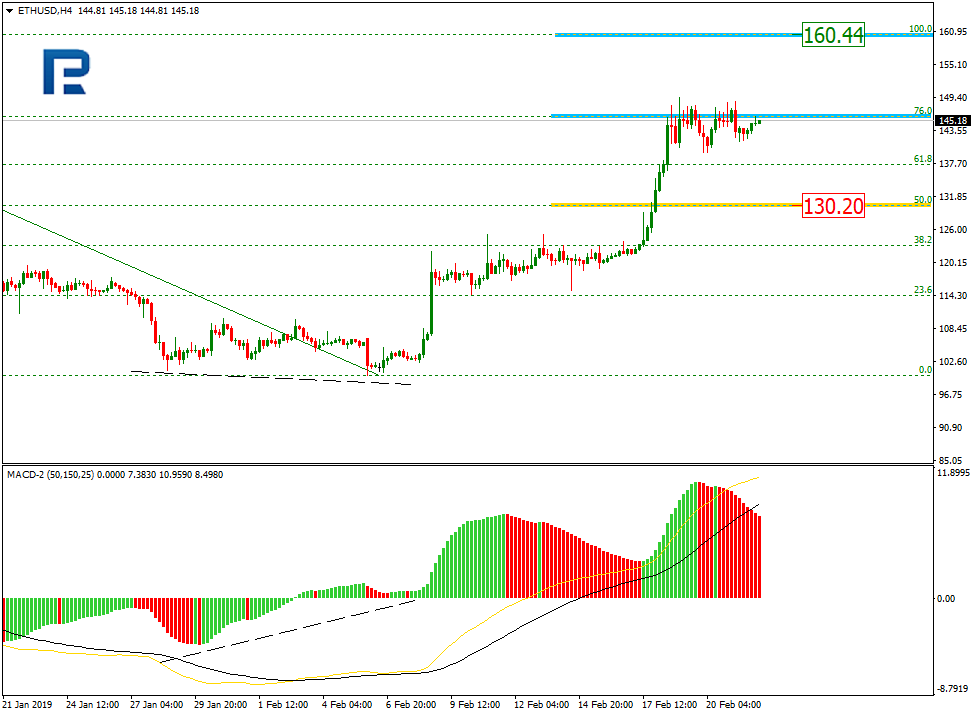

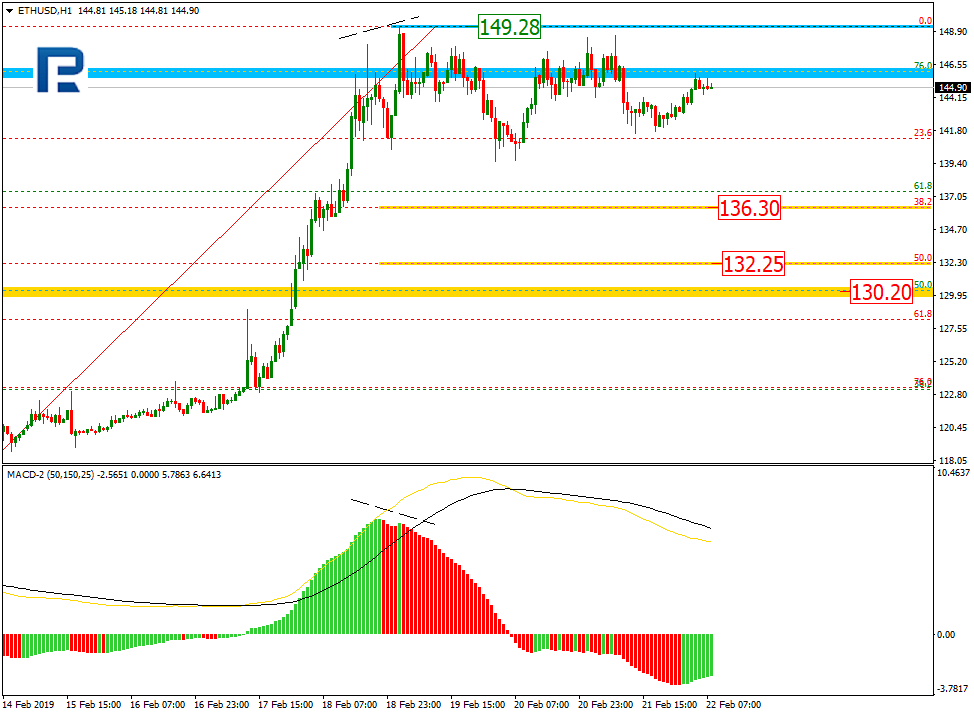

As we can see in the H4 chart, the uptrend slowed down at the retracement of 76.0%. After completing the correction, ETHUSD may start a new rising impulse to reach the high at 160.44. The support level is the retracement of 50.0% at 130.20.

Free Reports:

Get Our Free Metatrader 4 Indicators - Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get Our Free Metatrader 4 Indicators - Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

The H1 chart shows more detailed structure of the current correction. The targets of the correction are the retracements of 38.2% and 50.0% at 136.30 and 132.25 respectively.

Article By RoboForex.com

Attention!

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex LP bears no responsibility for trading results based on trading recommendations described in these analytical reviews.