By IFCMarkets

Dollar rebounds on surprise Manufacturing PMI beat

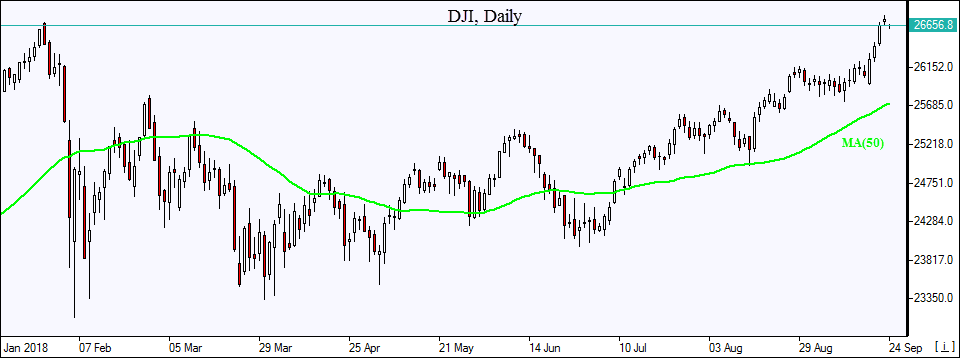

US stock market ended marginally lower on Friday despite second consecutive record close of Dow Jones industrial average. S&P 500 slipped 0.04% to 2929.48, closing 0.9% higher for the week. Dow Jones industrial average rose 0.3% to record high 26732. The Nasdaq lost 0.5% to 7986.96. The dollar strengthening resumed as Markit’s manufacturing PMI rose to 55.6 in September from the previous reading of 54.7 when a reading of 55.1 was forecast: the live dollar index data show the ICE US Dollar index, a measure of the dollar’s strength against a basket of six rival currencies, gained 0.3% to 94.178 and is higher currently. Futures on stock indices point to lower openings today.

FTSE 100 opens lower than other European markets

European stocks ended high on Friday led by financial and energy shares. Both the GBP/USD and EUR/USD turned lower after European Union leaders rejected Prime Minister Theresa May’s post-Brexit proposal on Thursday but both pairs are higher currently. The Stoxx Europe 600 Index added 0.4%, booking 1.7% gain for the week. The DAX 30 rose 0.9% to 12430.88. France’s CAC 40 added 0.8% and UK’s FTSE 100 jumped 1.7% to 7490.23. Indices opened 0.2% – 0.3% lower today

Asian indices retreat

Asian stock indices are mostly lower today with several markets, including those in Japan and China, closed for a holiday. Stock market in Hong Kong is falling with the Hang Seng Index 1.7% lower. Australia’s All Ordinaries Index slipped 0.1% despite the Australian dollar turn lower against the greenback.

Brent up

Brent futures prices are solidly higher today after OPEC’s leader Saudi Arabia and Russia indicated no immediate, additional increase in crude output on Sunday despite President Donald Trump’s calls for action to expand the output ahad of Iran sanctions. Prices rose Friday: Brent for November settlement added 0.1% to close at $78.80 a barrel Friday, rising 0.9% for the week.

Market Analysis provided by IFCMarkets

Free Reports:

Get Our Free Metatrader 4 Indicators - Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get Our Free Metatrader 4 Indicators - Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Note:

This overview has an informative and tutorial character and is published for free. All the data, included in the overview, are received from public sources, recognized as more or less reliable. Moreover, there is no guarantee that the indicated information is full and precise. Overviews are not updated. The whole information in each overview, including opinion, indicators, charts and anything else, is provided only for familiarization purposes and is not financial advice or а recommendation. The whole text and its any part, as well as the charts cannot be considered as an offer to make a deal with any asset. IFC Markets and its employees under any circumstances are not liable for any action taken by someone else during or after reading the overview.