By CountingPips.com – Receive our weekly COT Reports by Email

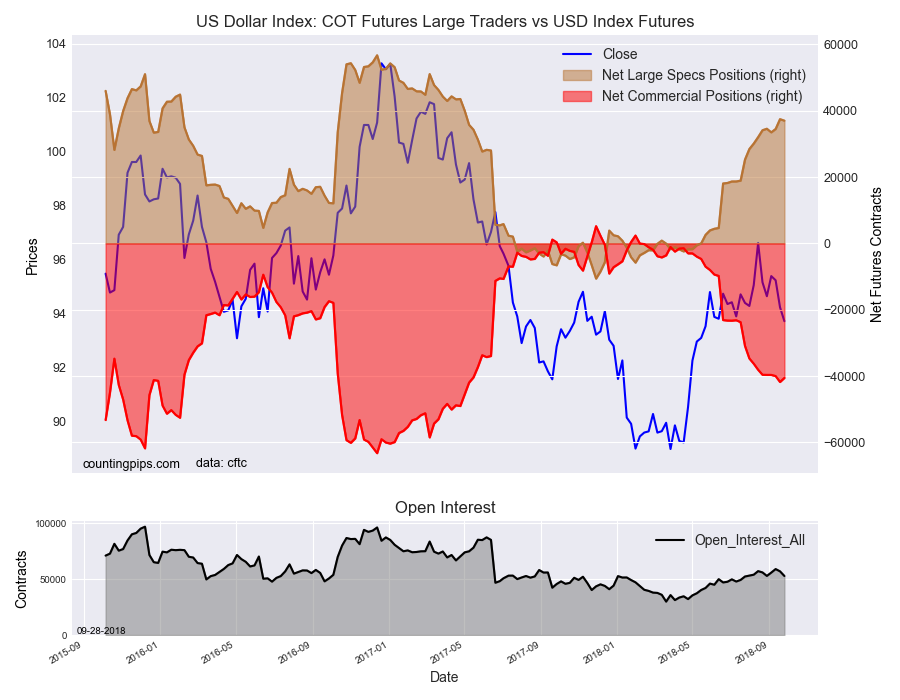

US Dollar Index Non-Commercial Speculator Positions:

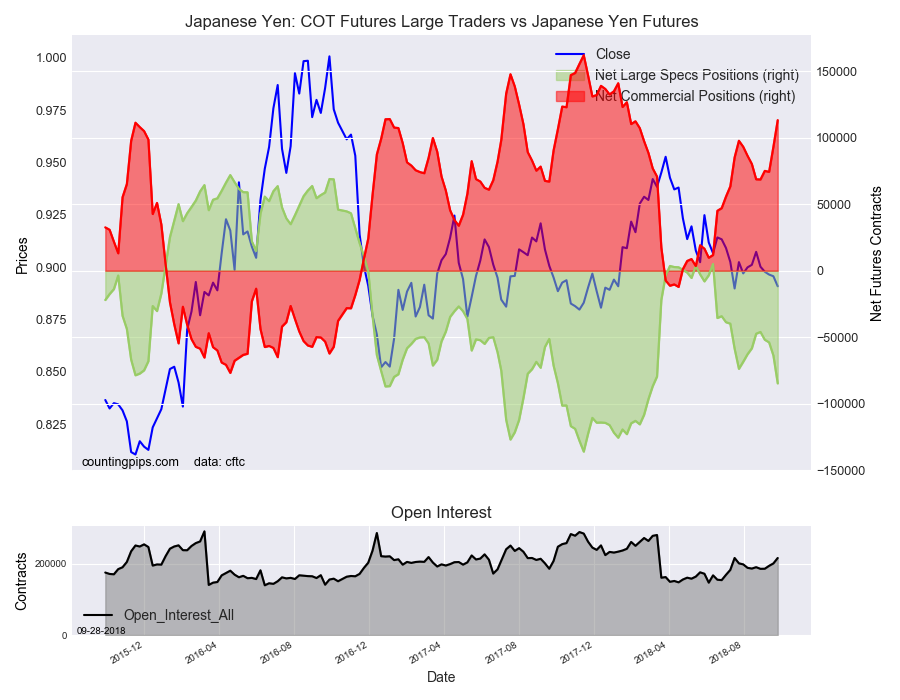

The latest data for the weekly Commitment of Traders (COT) report, released by the Commodity Futures Trading Commission (CFTC) on Friday, showed that large traders and speculators slightly trimmed their bullish bets for the US Dollar Index while sharply boosting their bearish bets for the Japanese yen.

The non-commercial futures contracts of US Dollar Index futures, traded by large speculators and hedge funds, totaled a net position of 37,009 contracts in the data reported through Tuesday September 25th. This was a weekly decrease of -447 contracts from the previous week which had a total of 37,456 net contracts.

The speculative position in the USD Index fell for just the second time in the past twenty-three weeks as the spec sentiment has gone from slightly bearish to strongly bullish in that time-span. The current standing for the USD Index now remains above the +30,000 net contract level for the eighth consecutive week.

Individual Currencies Data this week:

In the individual currency contracts data, we saw four substantial changes (+ or – 10,000 contracts) in the speculators category.

Free Reports:

Get Our Free Metatrader 4 Indicators - Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get Our Free Metatrader 4 Indicators - Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

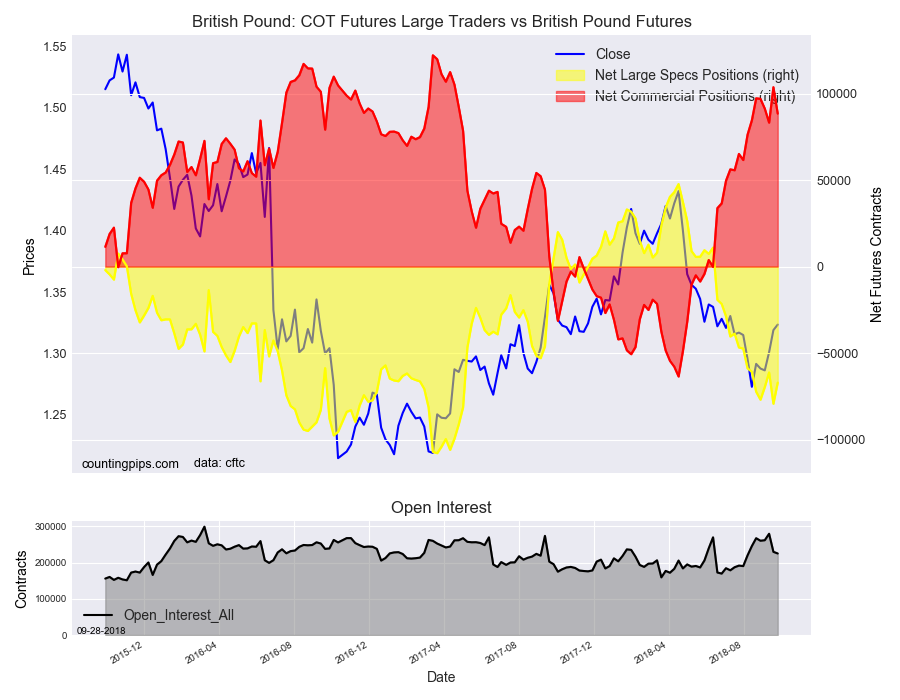

British pound sterling bets rebounded this week with a gain by over +12,000 contracts after falling by over -18,000 last week. The current net position remains highly bearish with the Pound’s level over the -60,000 contract level for a seventh straight week

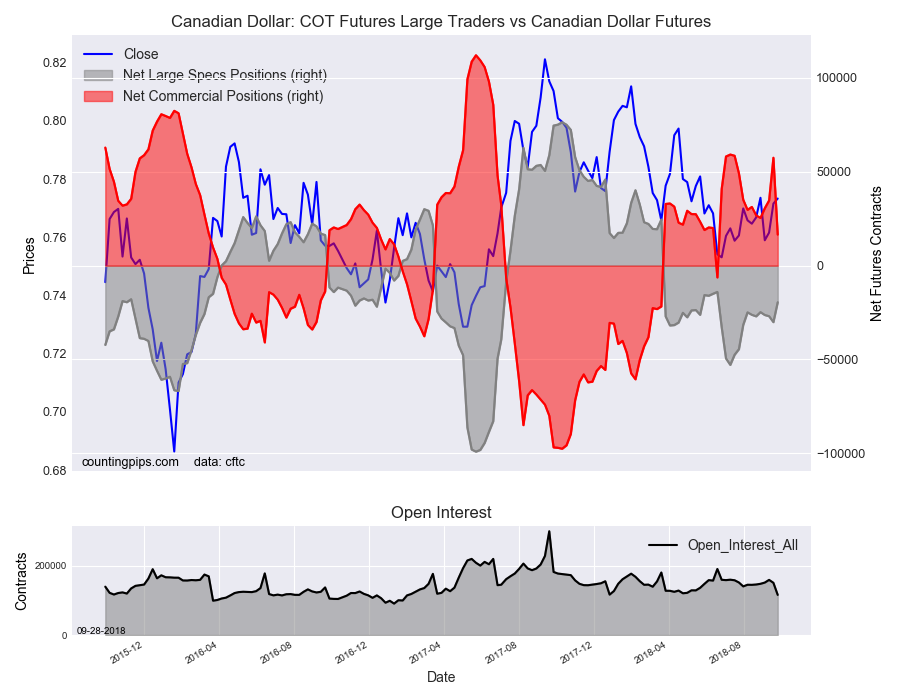

Canadian dollar bets advanced by over +10,000 contracts this week after falling in the previous three weeks. This week marked the first time in thirteen weeks that the CAD bearish position has fallen to less than at least -20,000 contracts

Japanese yen speculators raised their bearish bets for the fourth straight week and by over -20,000 bets this week alone. The current standing for the yen is now at the most bearish level since March 6th of this year when the net position totaled -86,845 contracts

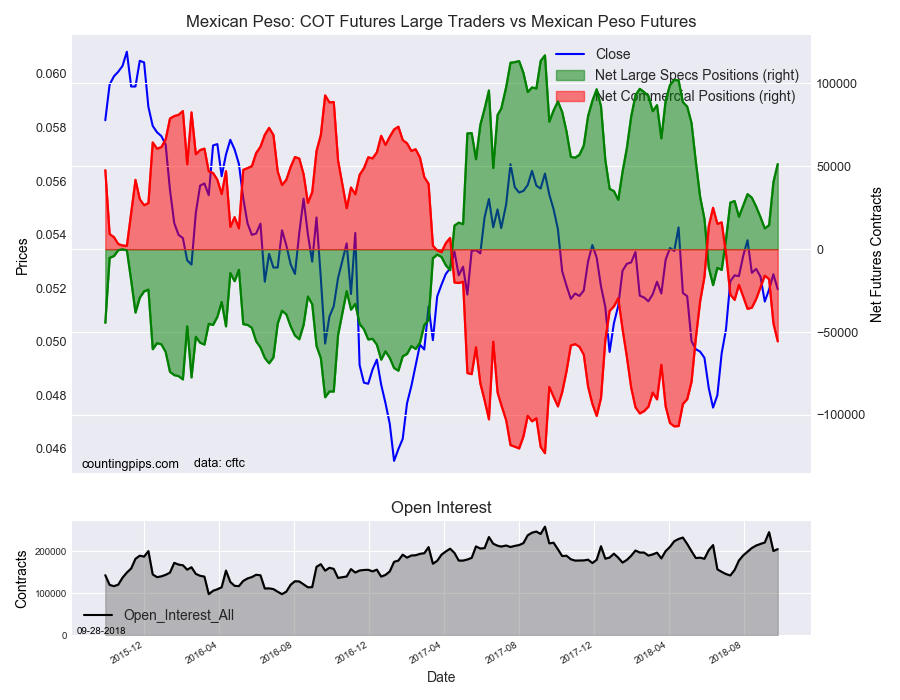

Mexican peso bullish bets rose by over +10,000 contracts this week following last week’s gain by over +25,000 contracts. The current net position standing has risen for three straight weeks and is at the highest bullish level since May 15th

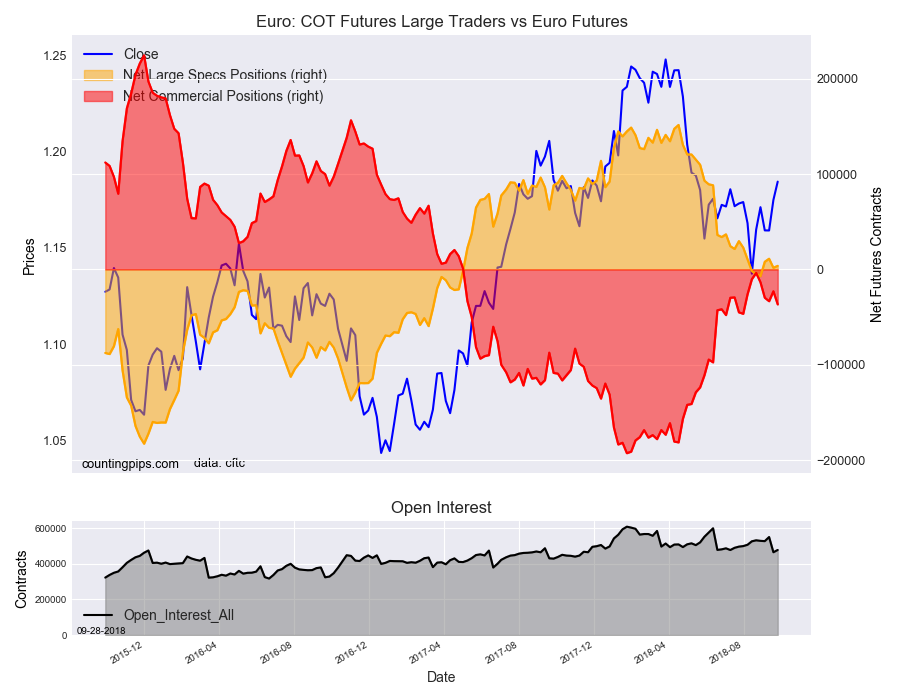

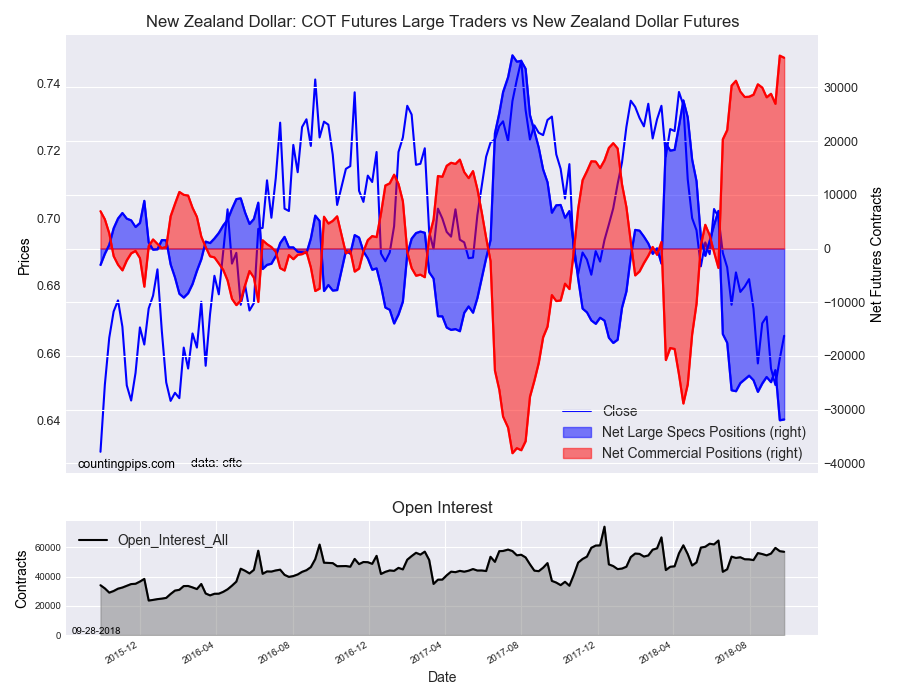

Overall, the major currencies that improved this week were the euro (2,030 weekly change in contracts), British pound sterling (12,180 contracts), Swiss franc (2,355 contracts), Canadian dollar (10,579 contracts), New Zealand dollar (154 contracts) and the Mexican peso (10,885 contracts).

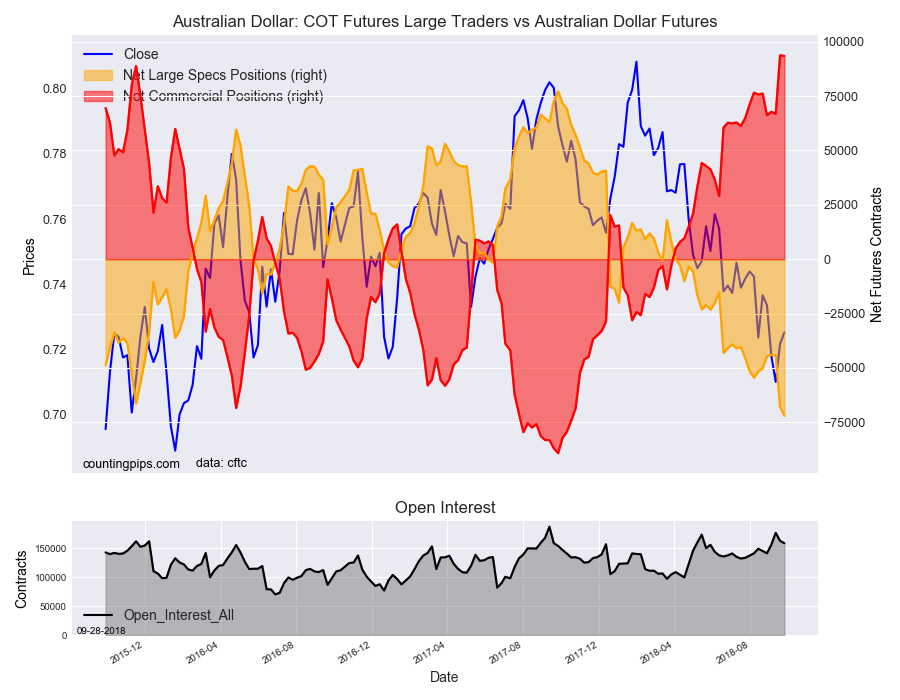

The currencies whose speculative bets declined this week were the US Dollar Index (-447 weekly change in contracts), the Japanese yen (-20,964 contracts) and the Australian dollar (-4,058 contracts).

See the table and individual currency charts below.

Table of Weekly Commercial Traders and Speculators Levels & Changes:

| Currency | Net Commercials | Comms Weekly Chg | Net Speculators | Specs Weekly Chg |

| EuroFx | -36,730 | -13,742 | 3,696 | 2,030 |

| GBP | 88,427 | -15,260 | -67,078 | 12,180 |

| JPY | 113,157 | 19,983 | -84,719 | -20,964 |

| CHF | 21,523 | -2,601 | -16,083 | 2,355 |

| CAD | 16,531 | -40,953 | -19,532 | 10,579 |

| AUD | 93,511 | -274 | -72,061 | -4,058 |

| NZD | 35,526 | -399 | -31,835 | 154 |

| MXN | -55,636 | -10,857 | 51,398 | 10,885 |

This latest COT data is through Tuesday and shows a quick view of how large speculators or non-commercials (for-profit traders) as well as the commercial traders (hedgers & traders for business purposes) were positioned in the futures markets. All currency positions are in direct relation to the US dollar where, for example, a bet for the euro is a bet that the euro will rise versus the dollar while a bet against the euro will be a bet that the dollar will gain versus the euro.

Weekly Charts: Large Trader Weekly Positions vs Price

*COT Report: The weekly commitment of traders report summarizes the total trader positions for open contracts in the futures trading markets. The CFTC categorizes trader positions according to commercial hedgers (traders who use futures contracts for hedging as part of the business), non-commercials (large traders who speculate to realize trading profits) and nonreportable traders (usually small traders/speculators). Find CFTC criteria here: (http://www.cftc.gov/MarketReports/CommitmentsofTraders/ExplanatoryNotes/index.htm).

The Commitment of Traders report is published every Friday by the Commodity Futures Trading Commission (CFTC) and shows futures positions data that was reported as of the previous Tuesday (3 days behind).

Each currency contract is a quote for that currency directly against the U.S. dollar, a net short amount of contracts means that more speculators are betting that currency to fall against the dollar and a net long position expect that currency to rise versus the dollar.

(The charts overlay the forex closing price of each Tuesday when COT trader positions are reported for each corresponding spot currency pair.) See more information and explanation on the weekly COT report from the CFTC website.

Article By CountingPips.com – Receive our weekly COT Reports by Email