By CountingPips.com

Here is a short summary and this week’s links (below) to the latest Commitment of Traders changes.

This week’s COT results showed that speculators dropped their bets for the US dollar last week (as of Tuesday) for the 7th out of the past 8 weeks and to about a 4 month low.

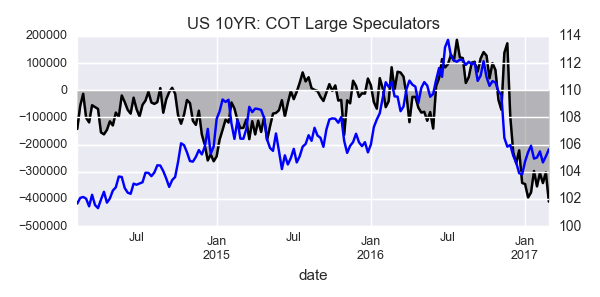

In the other major markets, the 10-year note speculators sharply boosted their net bearish positions to a new record high short position of over -400,000 contracts.

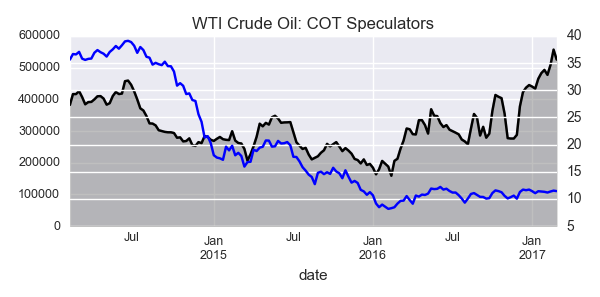

WTI Crude speculator reduced their bullish bets after setting a record high bullish position the week before.

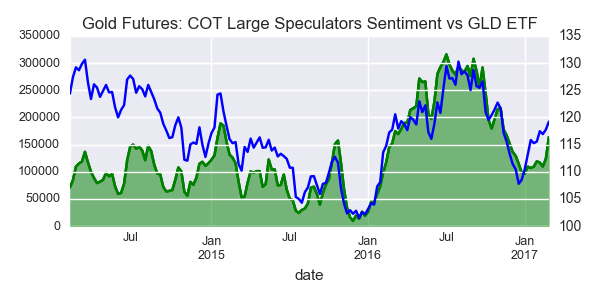

In metals, gold speculators sharply raised (+40,035 contracts) their bullish bets for a second straight week while silver specs continued to raise bullish bets for an 9th week and copper bets fell for the fourth straight week.

Free Reports:

Get Our Free Metatrader 4 Indicators - Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get Our Free Metatrader 4 Indicators - Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

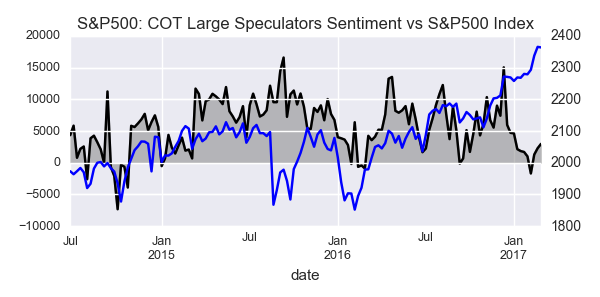

Finally, S&P500 speculators slightly added to their bullish bets in S&P500 futures for a third straight week.

FX Speculators reduced US Dollar bullish positions for 7th out of last 8 weeks

US Dollar net speculator positions leveled at $13.01 billion last week

The latest data for the weekly Commitment of Traders (COT) report, released by the Commodity Futures Trading Commission (CFTC) on Friday, showed that large traders and forex (FX) speculators reduced their bullish bets for the US dollar last week for the seventh time out of the past eight weeks.

WTI Crude Oil Speculators reduced net bullish positions from record high

The non-commercial contracts of WTI crude futures totaled a net position of 525,254 contracts, according to data from last week. This was a decline of -31,353 contracts from the previous weekly total.

Gold Speculators sharply boosted their bullish net positions last week

The large speculator contracts of gold futures advanced to a total net position of 163,798 contracts. This was a weekly jump of 40,035 contracts from the previous week.

10 Year Treasury Note Speculators pushed bearish net positions to record high

The large speculator contracts of 10-year treasury note futures totaled a net bearish position of -409,659 contracts. This was a weekly change of -107,360 contracts from the previous week.

S&P500 Speculators slightly raised bullish net positions for 3rd week

The large speculator contracts of S&P 500 futures totaled a net position of 2,972 contracts. This was a rise of 687 contracts from the reported data of the previous week.

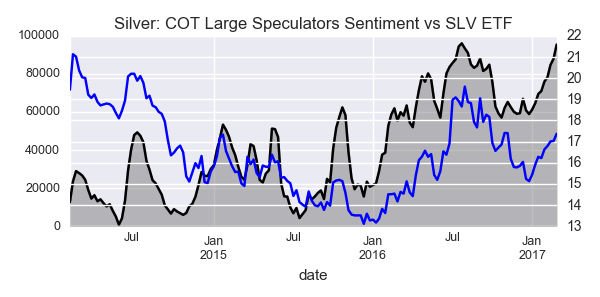

Silver Speculators increased net bullish positions for 9th week

The non-commercial contracts of silver futures totaled a net position of 95,423 contracts, according to data from last week. This was a weekly gain of 7,406 contracts from the previous totals.

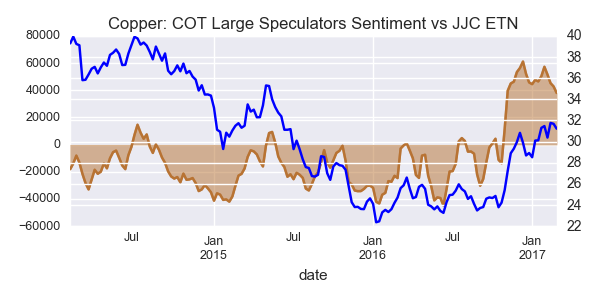

Copper Speculators trimmed their bullish net positions for 4th week

The large speculator contracts of copper futures fell to a net position of 37,998 contracts. This was a weekly change of -4,796 contracts from the data of the previous week.

Article by CountingPips.com

The Commitment of Traders report data is published in raw form every Friday by the Commodity Futures Trading Commission (CFTC) and shows the futures positions of market participants as of the previous Tuesday (data is reported 3 days behind).

To learn more about this data please visit the CFTC website at http://www.cftc.gov/MarketReports/CommitmentsofTraders/index.htm