By IFCMarkets

Sell AUD or not? Waiting for trade balance

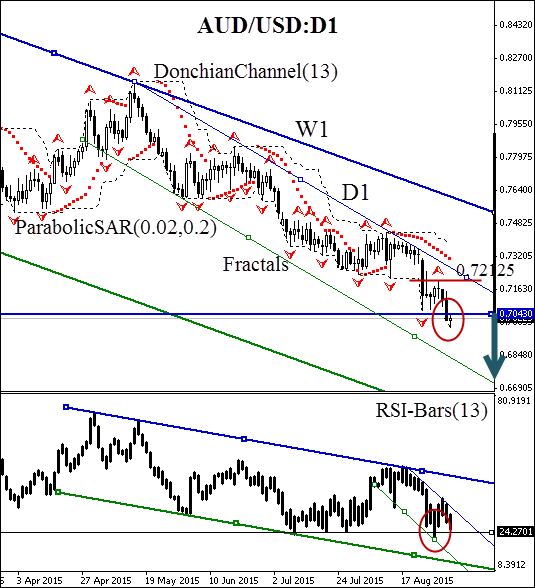

The Australian Dollar continues falling despite the temporary growth of the gold. Partly it happens due to the strengthening of the US currency and the economic uncertainty. Today the Australian trade balance of the previous month is to be published. The tentative outlook is negative. If the analysts prove to be right, the market will show the growth of the short positions which serves the perfect opportunity of joining the trend. .

At this moment we see the persisting bearish trend on the weekly and monthly timeframes. The slumped US indices made Dollar strengthen against the other currencies. The matter is whether this temporary trend is strong enough to support the bears. In our opinion, the Australian Dollar will help make money from the short positions in case of the trade balance growth. At this moment, the price has broken through the weekly support of 0.70430. The RSI-Bars oscillator which surpassed the 24% support level and the Parabolic Indicator reversal confirm the signal. The Donchian channel adds to the bearish sentiment as well.

We suggest opening the market sell order after RSI breaks through the 24% level for the second time. The risks are to be limited at the level of the Bill Williams’s fractal last high of 0.72125. This level served the support line of the Bollinger channel till the strengthening of the bearish trend. We recommend moving the stop every day to the next maximum following the Parabolic signal. By doing this, we alter the profit/loss ratio into our favour. Despite the high probability of the above scenario, the Aussie may lose the downside momentum. The risks are due to the forthcoming Jobless Claims in the US. Nevertheless we assume the oscillator signal works only subject to the long-term fundamental trend.

| Position | Sell |

| Sell | at market |

| Stop loss | above 0.72125 |

Market Analysis provided by IFCMarkets

Free Reports:

Get Our Free Metatrader 4 Indicators - Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get Our Free Metatrader 4 Indicators - Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.