Weekend Update by thepracticalinvestor.com

January 31, 2014

— VIX tested mid-Cycle support/resistance and closed higher for the week. This confirms the change in trend. It is now due to break through the Triangle trendline near 20.50 and challenge the weekly Cycle Top resistance at 22.05. Its ultimate target may be above its massive 4-year Ending Diagonal at 27.50.

SPX may threaten the lower Diagonal Trendline next week.

SPX closed solidly beneath its weekly Intermediate-term support/resistance band at 1792.58. The next support level is the trifecta of supports, consisting of the 14-year Top trendline, weekly Long-term support and the lower Diagonal trendline, all near 1705.00 to 1715.00. The bear market truly begins beneath that level.

(ZeroHedge) Another volatile day ended with the Dow is down around 5% in January – the worst start to a year since 2009 (and 2nd worst since 1990) and the worst month since May 2012 (a 3-sigma miss of the average +1.5% per month gain since 2009’s lows).

Trader’s Almanac – every down January on the S&P 500 since 1938, without exception, has preceded a new or extended bear market, a 10% correction, or a flat year. As we also noted here, The JAJO Effect

NDX careens between support and resistance.

This week NDX declined to weekly Long-term support at 3463.23, then bounced back toward weekly Short-term resistance at 3531.21, but closing beneath it. The next decline may be much more substantial once it falls beneath the support lines.

(ZeroHedge) Despite the best efforts of CNBC to have every bull on Amazon explain how great it really is and how they could enable to magical profit machine any minute if they so choose, the hedge fund hotel stock du jour is now down 10% and Bloomberg headlines blare:

Last night’s algo-ramp to VWAP (on rising Prime prices?) is a long-distant memory now…

(ZeroHedge) Following December’s biggest-surge-in-4-years for UMich consumer confidence (though a miss), UMich data has fallen back to 80.4 – missing expectations by the biggest margin in 8 years.

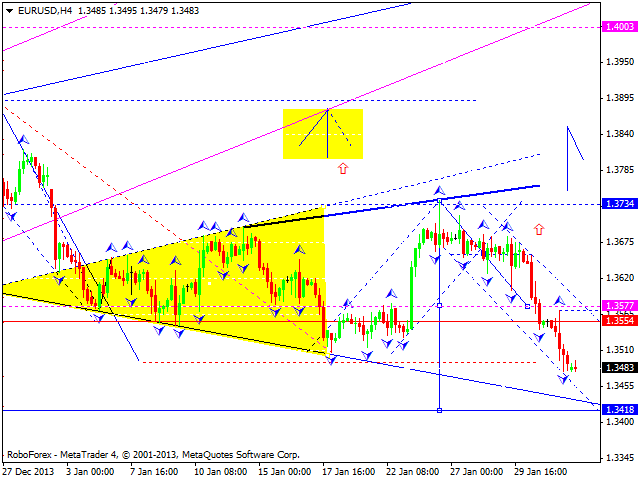

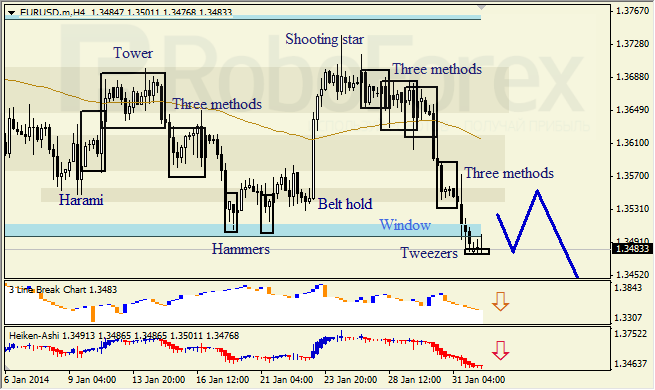

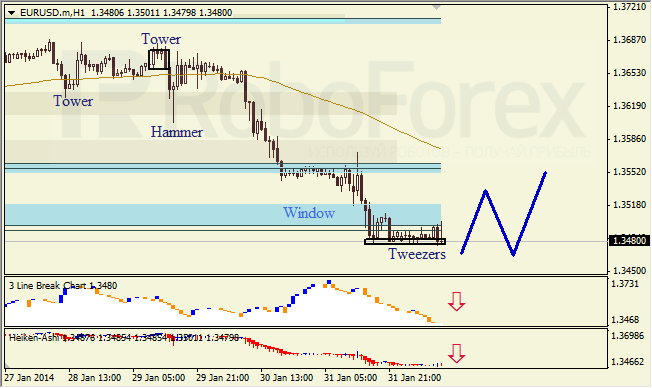

The Euro is losing its grip.

The Euro has broken down beneath its prior weekly lows of the past month, also closing beneath both weekly Short-term and Intermediate-term supports. The weekly Long-term support at 133.51 remains unbroken, but may be due for a challenge.

(Bloomberg) Euro-area inflation remained below half of the European Central Bank’s target in January, driven by falling energy prices, adding to the case for policy makers to cut interest rates next week.

Consumer prices rose an annual 0.7 percent after a 0.8 percent gain in December, the European Union’s statistics office in Luxembourg said today. The median estimate in a Bloomberg News survey of 41 economists was for an increase to 0.9 percent. That’s the fourth consecutive reading of less than 1 percent. The Frankfurt-based central bank aims to keep inflation at just under 2 percent.

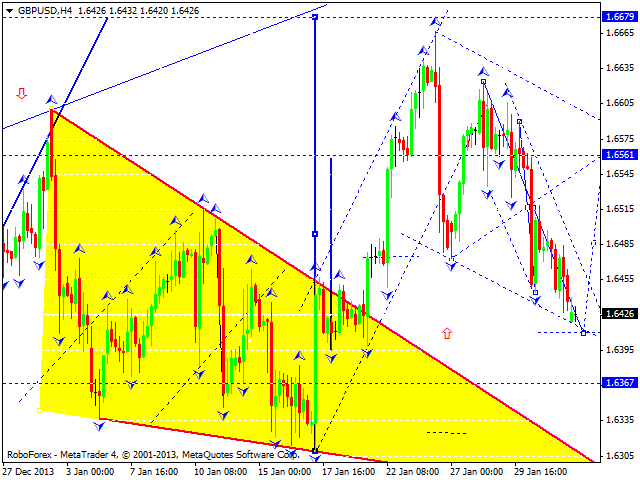

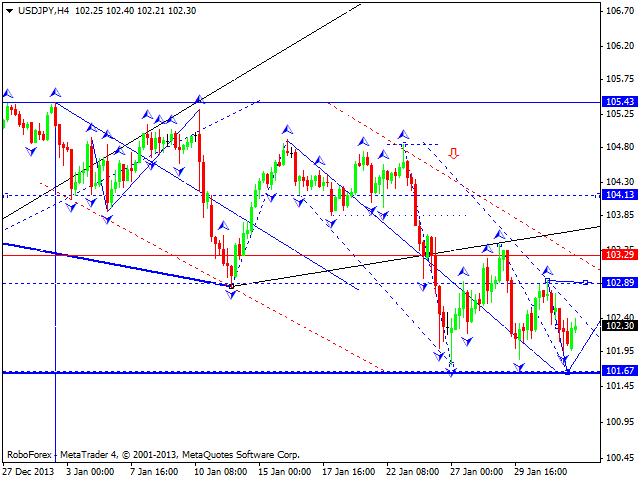

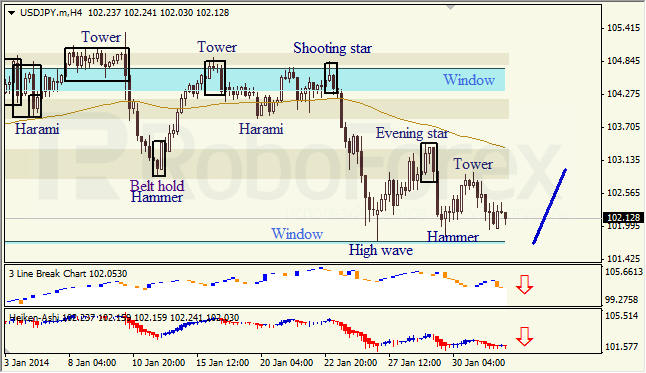

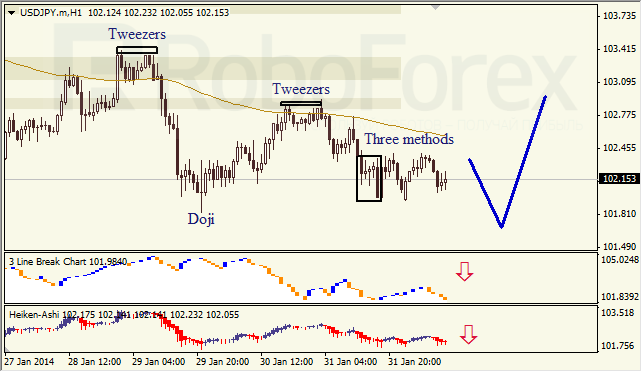

The Yen may have completed its retracement.

The Yen may have completed its retracement bounce just under weekly Intermediate-term resistance at 98.43. The Cycles Model suggests a reversal may occur next week. The next break of the Head & Shoulders neckline may bring it beneath its 2008 lows.

(Bloomberg) The yen extended monthly gains against emerging-market currencies as growing volatility amid a selloff spurs investors to reverse carry trades while seeking haven assets.

The yen strengthened 0.7 percent to 102.04 per dollar at 5 p.m. in New York for a 3.1 percent monthly advance that was the biggest since April 2012. The dollar rose 0.5 percent to $1.3486 per euro, pushing monthly gains to 1.9 percent, the most since February. Japan’s currency appreciated 1.2 percent to 137.63 per euro, having strengthened 5.2 percent since Dec. 31.

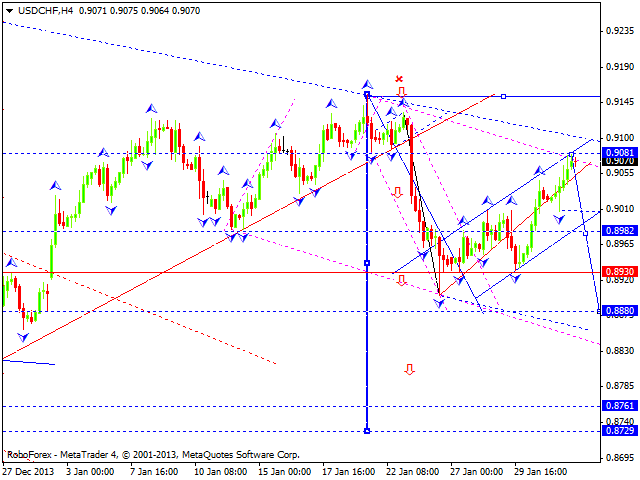

U.S. Dollar is building a base to move higher.

The dollar has been building a base from which it may surge higher. It made an important Cycle low on January 24, tagging the Triangle trendline. The reversal from the trendline took the dollar back to challenge Long-term resistance at 81.59. We may see a smaller consolidation occur back to the weekly mid-Cycle support at 81.03 before a strong breakout that has the potential to challenge the Cycle Top at 83.82.

(Reuters) – The euro fell on Friday as soft euro zone inflation data rekindled concerns the European Central Bank may have to act to combat deflation, while the dollar strengthened on mildly encouraging data to close out its best month since May.

The dollar index .DXY, which measures the dollar against six major currencies, rose 0.26 percent to 81.25, still helped by the prior day’s solid reading on U.S. fourth-quarter gross domestic product, which revived hopes that the global economy could, on the whole, take troubles from emerging markets in stride.

The dollar index rose 1.3 percent in January, its biggest monthly gain since May.

Treasuries continue to climb, but not for long.

Treasuries continued their “safe haven” status as the long bond advanced toward weekly Long-term resistance and a potential Trading Channel trendline at 134.66. It is probable that this rally may continue for a week or more as hot money looks for sanctuary from declining equities. Unfortunately, this is only a retracement rally within a bear market in bonds.

(ZeroHedge) You didn’t think the US could at first slowly, and then all of a sudden, expropriate retirement accounts and invest them in the “no risk, guaranteed return” MyRA Ponzi scheme introduced by Obama during the State of the Union address without lots of behavior-modifying indoctrination in the “friendly press” first now did you? Sure enough, here is the first major propaganda salvo, coming from none other than the US Treasury Secretary, Jack Lew, which will be published tomorrow across the McClatchy media empire.

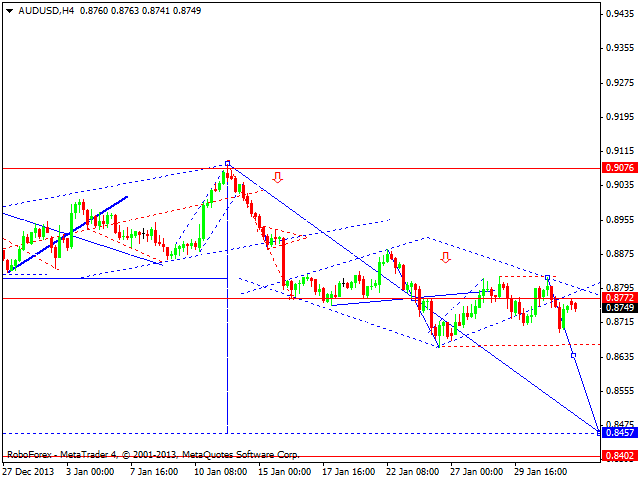

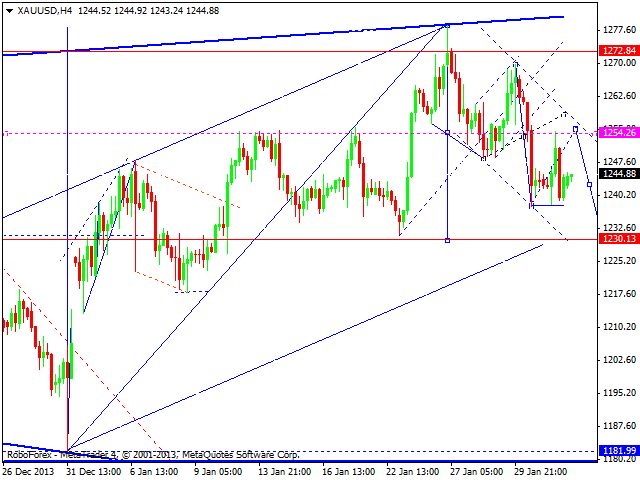

Gold retreats from its retracement high.

Gold retreated from its retracement high after challenging its Trading Channel trendline and weekly Intermediate-term support at 1262.69. The Cycles Model calls for a month-long decline that may break through the lower trendline, or Lip of a Cup with Handle formation. The potential consequences appear to be severe.

(FoxBusiness) Gold edged higher on Friday but was still on course for the first weekly fall in six due to strong U.S. economic growth, concerns over the U.S. Federal Reserve’s withdrawal of monetary stimulus and a slump in Chinese demand.

Bullion had gained for most of January until this week, underpinned by weakness in global equities on concerns over emerging economies.

But upbeat U.S. growth data reassured investors worried about capital outflows from emerging markets and also validated the Fed’s decision this week to reduce its monthly bond purchases to $65 billion from $75 billion, as expected.

Crude could not overcome Long-term resistance.

Crude made a substantial retracement of its decline into January 9, but could not overcome Long-Term resistance. When rallies fail to overcome prior highs in less than 30 days, they are doomed to a more substantial reversal. There is a Head & Shoulders formation at the base of this rally, which, if pierced, may lead to a much deeper decline.

(Reuters) – U.S. crude oil rose nearly $1 on Thursday on spread trading and higher demand as blistering cold sapped distillate supplies and government data showed solid economic growth in the fourth quarter last year.

The price difference between the European benchmark Brent and U.S. crude oil settled at its narrowest point in more than 2-1/2 months, after news that U.S. gross domestic product grew by a 3.2 percent annual rate, according to the U.S. Commerce Department.

China stock bounce weakens beneath resistance.

The bounce from the January 20 low has weakened, allowing a pullback. However, the bounce may extend at least to its Short-term resistance at 2089.79 in the next week or so. Once accomplished, the secular decline resumes with the next significant low in mid-March.

(ZeroHedge) The topic of China’s real estate bubble, its ghost cities, and its emerging middle class – who now have enough money to invest and have piled into houses not stocks – and have been dubbed “fang nu” or housing slaves (a reference to the lifetime of work needed to pay off their debts); is not a new one here but, as Bloomberg reports, the latest report from economist Gan Li shows China’s households are massively exposed to an oversupplied property market.

The Chinese have piled their savings into real estate…

The India Nifty begins its plunge…

The CNX Nifty gapped beneath both Short-term and Intermediate-term support and closed beneath them last week. The loss of near-term support is ominous and the potential loss of Long-term support at 5964.46 could be deadly for India stocks.

(ZeroHedge) India’s recently crowned central bank head (and predecessor of the IMF’s Nostradamal Olivier Blanchard), Raghuram Rajan, has not had it easy since taking over India’s printer: with inflation through the roof, and only so much scapegoating of gold as the root of all of India’s evils, Rajan announced an unexpected 50 bps interest rate hike two days ago in an attempt to preempt the massive EM capital flight that has roundhoused Turkey, South Africa, Hungary, Argentina and most other current account deficit emerging markets. Whether he succeeds in keeping India away from the EM maelstrom will be unveiled in the coming days, although if last summer is any indication, the INR has a long way to fall.

The Banking Index closed at its Trading Channel trendline.

BKX declined this week to its lower Trading Channel trendline and Intermediate-term support at 67.29. A break beneath these supports would do serious damage to the uptrend. The Cycles Model suggests a new low may be seen in a little less than three weeks.

(ZeroHedge) It would appear the fears of a global bank run are spreading. From HSBC’s limiting large cash withdrawals (for your own good) to Lloyds ATMs going down, Bloomberg reports that ‘My Bank’ – one of Russia’s top 200 lenders by assets – has introduced a complete ban on cash withdrawals until next week. While the Ruble has been losing ground rapidly recently, we suspect few have been expecting bank runs in Russia. Russia sovereign CDS had recently weakned to 4-month wides at 192bps.

(ZeroHedge) The biggest problem facing European banks – one we highlighted most recently yesterday when we showed the latest 20% surge in Spanish Banco Popular Non-Performing Loans to a fresh record – and one we have been covering since 2010, which as of 2012 amounted to some $4.5 trillion that needs to be “remedied” – is the staggering amount of bad debt on the books of Europe’s numerous banks, the bulk of which especially in the periphery are cojoined with their sovereign host in an unbreakable bond which despite Europe’s theatrical attempts to sever, only keeps getting stronger.

(ZeroHedge) A classical economist… and Harvard professor… preaching to the world that one’s money is not safe in the US banking system due to Ben Bernanke’s actions? And putting his withdrawal slip where his mouth is and pulling $1 million out of Bank America? Say it isn’t so…

From Terry Burnham, former Harvard economics professor, author of“Mean Genes” and “Mean Markets and Lizard Brains,” provocative poster on this page and long-time critic of the Federal Reserve, argues that the Fed’s efforts to strengthen America’s banks have perversely weakened them. First posted in PBS.

Is your money safe at the bank? An economist says ‘no’ and withdraws his

“Last week I had over $1,000,000 in a checking account at Bank of America. Next week, I will have $10,000.”

(CNNMoney) When is default a good thing?

That’s the question being asked in China, where the murky rescue of a high-yield fund appears to have prevented a default that would have cost investors millions and undermined faith in the country’s financial system.

But the 11th hour bailout by a mysterious third party has raised questions about China’s readiness to let investors pay the price for failed investments and mounting risk in the country’s shadow banking system.

Have a great week!

Tony Cherniawski

Disclaimer: Nothing in this email should be construed as a personal recommendation to buy, hold or sell short any security. The Practical Investor, LLC (TPI) may provide a status report of certain indexes or their proxies using a proprietary model. At no time shall a reader be justified in inferring that personal investment advice is intended. Investing carries certain risks of losses and leveraged products and futures may be especially volatile. Information provided by TPI is expressed in good faith, but is not guaranteed. A perfect market service does not exist. Long-term success in the market demands recognition that error and uncertainty are a part of any effort to assess the probable outcome of any given investment. Please consult your financial advisor to explain all risks before making any investment decision. It is not possible to invest in any index.

The use of web-linked articles is meant to be informational in nature. It is not intended as an endorsement of their content and does not necessarily reflect the opinion of Anthony M. Cherniawski or The Practical Investor, LLC.

P.O. Box 129  Holt, MI 48842

Holt, MI 48842 (517) 699-1554

(517) 699-1554  Fax: (517) 699-1558

Fax: (517) 699-1558

Email: [email protected]