By CentralBankNews.info

Malaysia’s central bank held its benchmark Overnight Policy Rate (OPR) steady at 3.0 percent, as expected, and said the momentum in economic growth was expected to continue this year while inflation was expected to be higher than last year.

Bank Negara Malaysia (BNM), which has maintained rates at this level since May 2011, also said global growth would be supported by emerging economies and the recovery in advanced economies but that “global economic and financial conditions remain vulnerable to shifts in sentiments and heightened volatility in the international financial markets.”

Like many other emerging market currencies, Malaysia’s ringgit has weakened in the last year, though much less than for example India’s rupee and Turkey’s lira. In 2013 the ringgit lost around 7 percent against the U.S. dollar as the U.S. Federal Reserve signaled it was preparing to wind up asset purchases. Since the start of this year, the ringgit has depreciated a further 1.8 percent, trading at 3.34 to the dollar today.

Malaysia’s inflation rate rose to 3.2 percent in December, a high for the year and continuing the acceleration seen since December 2012 when inflation was 1.2 percent.

In 2013 Malaysia’s inflation averaged 2.1 percent with prices rising due to disruptions in supply following adverse weather and higher domestic costs due to the government’s cut in fuel subsidies in September that raised the price of certain gasolines and diesel fuel.

“Going forward, inflation is expected to average higher largely due to domestic cost factors,” the central bank said, adding that moderate domestic demand and subdued external prices should help contain the impact on underlying inflation.

Malaysia’s central bank has often said it expects inflation to rise this year and may even exceed the long-term average of 3.2 percent, partly due to the earlier cut in subsidies and coming changes to taxes in April. Economists are expecting the central bank to raise rates later this year to contain the growing inflationary pressures.

“The MPC remains focused on ensuring medium-term price stability that would contribute to sustainable economic growth,” the central bank said.

Malaysia’s Gross Domestic Product rose by 1.7 percent in the third quarter from the second quarter for annual growth of 5 percent, up from 4.4 percent in the previous quarter, and the central bank said it expects sustained performance in the fourth quarter as better exports and supported growth while domestic demand has remained firm.

“Going forward, the growth momentum is expected to continue in 2014, amid better performance in the external sector,” the central bank said, adding that investment activity is projected to remain robust while domestic demand is expected to moderated due to the continuing fiscal consolidation and slower growth in private consumption.

Aussie Climbs For a Third Day; Fed Decision in Spotlight

The Aussie extended gains against the US dollar for a third day on Wednesday, as investors continue to speculate that the US Federal Reserve (Fed) will continue to cut its monthly bond purchases further which will strengthen the greenback.

The currency pair climbed 0.37% to $0.8807 at the time of writing, after reaching $0.8825 earlier in the session. The Australian dollar touched 86.60 on Jan 24, the lowest since July 2010. Australia’s ten-year government bond yield added nine basis points to 4.12%, after dropping to a low 4.02%; the lowest since Oct 31.

Federal Reserve Meeting

Members of the Federal Open Market Committee (FOMC) are meeting up later today to continue the two-day policy meeting.

Market analysts are predicting members of the Federal Open Market Committee will continue to reduce its monthly bond purchases by $10 billion at every meeting to end the stimulus program by this year, despite the recent disappointing non-farm payrolls data for the previous month.

In the last fed-meeting, the central bank decided to reduce its monthly bond purchases by $10 billion to $75 billion a month. Minutes for the Federal Open Market Committee (FOMC) meeting will be released on Wednesday.

Australian Data

Reports released revealed the National Australia Bank Business Confidence Index stood at 6 in December, after the previous month’s reading was up from 5 to 6.

The same report revealed the Australian business conditions rose by seven points to 4; the highest since March 2011, from -3 recorded in November.

“Business conditions recorded a surprising jump to a more than a 2.5-year high in December – cementing the upward trend seen over recent months – supported by the low interest rate environment, higher asset prices and less elevated Australian dollar,” the NAB commented.

Visit www.hymarkets.com to find out more about our products and start trading today with only $50 using the latest trading technology today.

The post Aussie Climbs For a Third Day; Fed Decision in Spotlight appeared first on | HY Markets Official blog.

Article provided by HY Markets Forex Blog

Crude Oil Mixed While Market Awaits Fed Decision

Crude Futures were seen trading mixed on Wednesday, as market participants awaits news from the Federal Reserve (Fed) meeting later in the day with predictions of a further reduction to the central bank’s monthly bond purchases.

The North American West Texas Intermediate (WTI) for March delivery came in 0.10% lower, trading at $97.32 per barrel on the New York Mercantile Exchange at the time of writing. On Tuesday, the contract rose $1.69 to $97.41, the highest since Dec 31.

At the same time, Brent crude for March settlement climbed 0.08%, at $107.50 per barrel on the London-based ICE Futures Europe exchange. The European benchmark was at a premium of $10.36 to WTI.

Crude – US Fuel Supplies

On Tuesday, the American Petroleum Institute (API) reports showed a rise in oil inventories by 4.7 million barrels in the week ending January 24, beating analysts forecast of 2.3 barrels.

The reports from API also revealed US distillate supplies; including heating oil and diesel, dropped by 1.79 million barrels in the previous week, while gasoline inventories added 363,000 barrels.

As the market awaits reports from the US Energy Information Administration (EIA) later in the day, investors are expecting to see a rise in supplies by 2.25 million.

Crude – Federal Reserve Meeting

Members of the Federal Open Market Committee (FOMC) are meeting up later today to continue the two-day policy meeting.

Market analysts are predicting members of the Federal Open Market Committee will continue to reduce its monthly bond purchases by $10 billion at every meeting to end the stimulus program by this year, despite the recent disappointing non-farm payrolls data for the previous month.

In the last fed-meeting, the central bank decided to reduce its monthly bond purchases by $10 billion to $75 billion a month. Minutes for the Federal Open Market Committee (FOMC) meeting will be released on Wednesday.

Visit www.hymarkets.com to find out more about our products and start trading today with only $50 using the latest trading technology today.

The post Crude Oil Mixed While Market Awaits Fed Decision appeared first on | HY Markets Official blog.

Article provided by HY Markets Forex Blog

EURUSD: Hesitates Above Its Key Support

EURUSD: Although EUR may be struggling above its rising trendline, its broader upside bias remains intact in the medium term. However, it will have to retake the 1.3739 level, its Jan 24 2014 high to trigger further upside pressure towards the 1.3818 level, its Dec 30 2013 high. A turn above the 1.3818 level will set the stage for a move higher towards the 1.3897 level, its Dec 27 2013 high. Further out, the 1.3950 level comes in as the next upside. Its daily RSI is bullish and pointing higher supporting this view. On the other hand, any pullback will meet support standing at the 1.3628 level, its Jan 28’2014 low. That level is expected to provide support when tested. However, if this level is violated, further decline could follow towards the 1.3550 level and the 1.3489 level where a violation will aim at the 1.3400 level, its psycho level. All in all, EUR remains biased to the upside medium term.

Article by www.fxtechstrategy.com

Wave Analysis 29.01.2014 (EUR/USD, GBP/USD, USD/CHF, USD/JPY)

Article By RoboForex.com

Analysis for January 29th, 2014

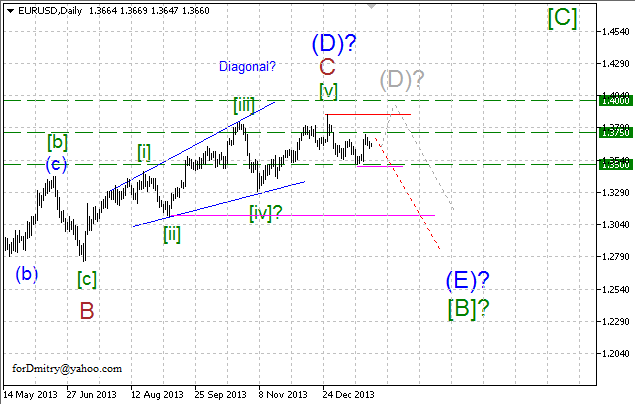

EUR/USD

One of possible scenarios implies that Euro completed ascending zigzag (D) of [B] and started forming final descending zigzag (E) of [B]. However, this assumption hasn’t been confirmed and price may yet change structure of wave (D).

Possibly, price is forming the first “leg” A of (E) of descending zigzag (E). Probably, pair finished (or is finishing right now) ascending correction [ii] of A of (E), which may be followed by descending wave [iii] of A of (E).

Probably, pair completed (or is completing) ascending correction [ii]. In this case, later price is expected to start descending impulse [iii].

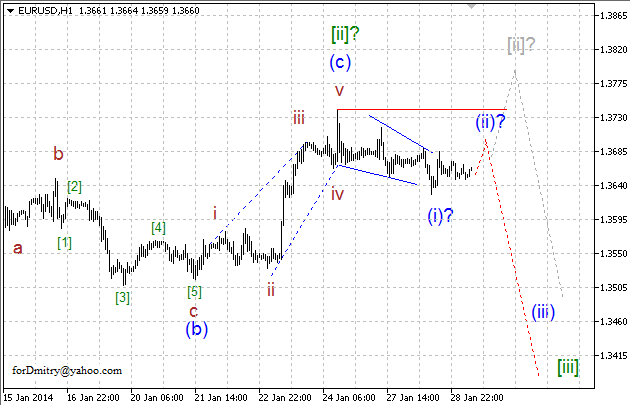

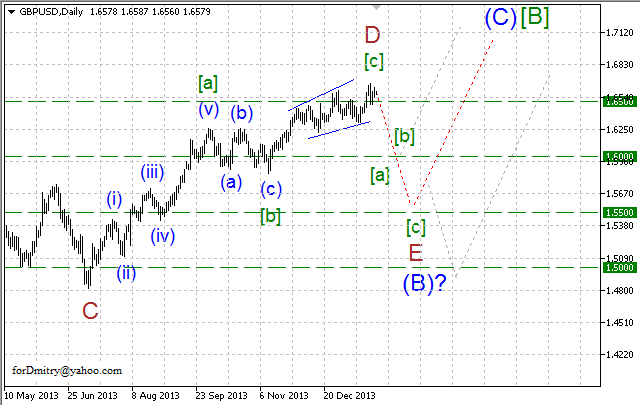

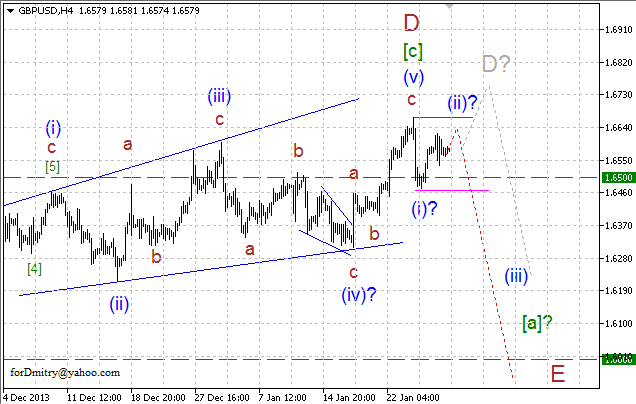

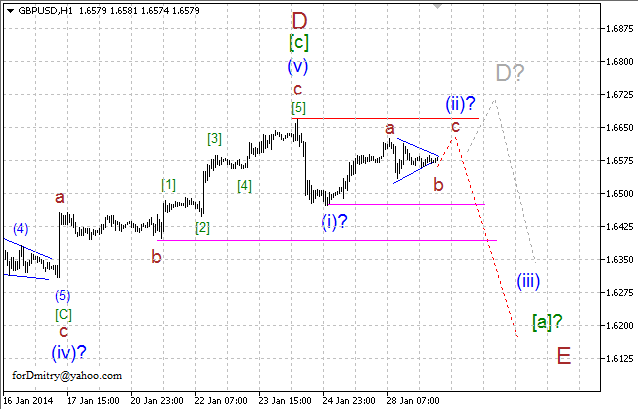

GBP/USD

Current chart structure implies that Pound finished ascending zigzag D of (B). In this case, then later pair is expected to form final descending zigzag E of (B). However, this assumption hasn’t been confirmed and price may yet change structure of wave D of (B).

Probably, price completed ascending diagonal triangle [c] of D and started final descending zigzag E. However, we should remember that it’s not the only possible scenario of price movement.

Possibly, pair is forming descending wave E in the form of zigzag. Right now, Pound is finishing local ascending correction (ii) of [a] of E. In this case, price may continue falling down inside impulse (iii) of [a] of E without breaking closest critical level.

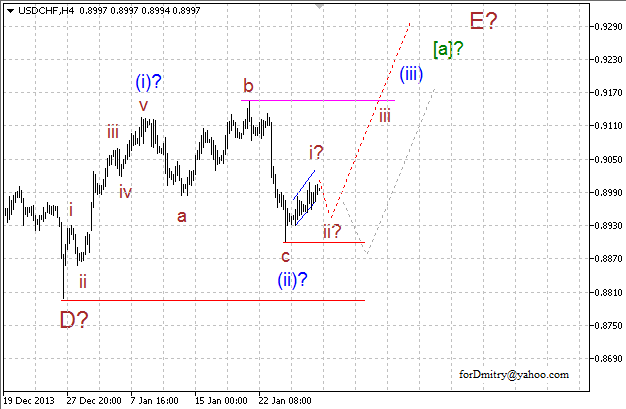

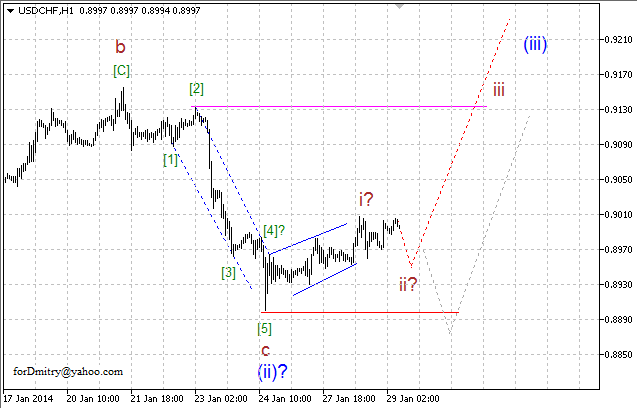

USD/CHF

Current chart structure implies that Franc completed descending zigzag D of (4) and started forming final ascending zigzag E of (4) of [C].

Probably, price formed impulse (i) of [a] of E of ascending zigzag E. Possibly, pair finished (or is finishing right now) local descending correction (ii) of [a] of E, which may be followed by ascending impulse (iii) of [a] of E.

Possibly, pair completed (or is completing) descending correction (ii) and started forming ascending impulse (iii).

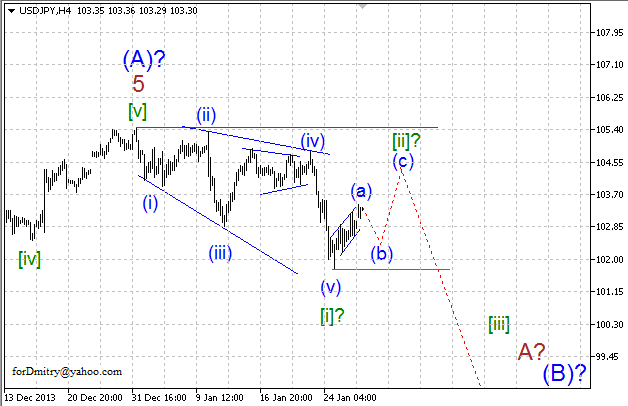

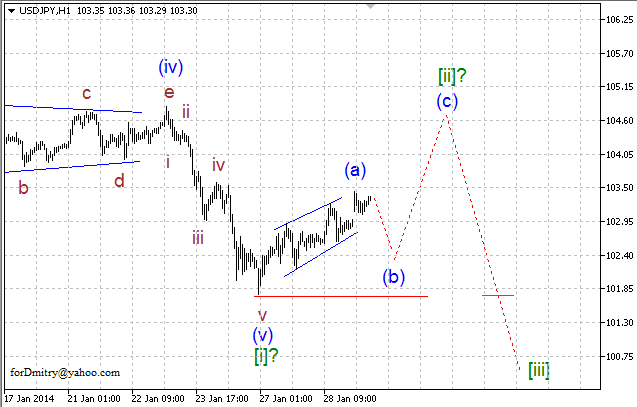

USD/JPY

Current chart structure implies that Yen finished ascending impulse (A). In this case, later price is expected to start large descending correction (B), may be in the form of zigzag.

Probably, pair has already finished wedge [i] of A of (B) of horizontal correction (B). In this case, then after completing local ascending correction [ii] of A, price is expected to form descending impulse [iii] of A.

Possibly, price completed descending wedge [i] and started forming local ascending correction [ii], which may take the form of zigzag.

RoboForex Analytical Department

Article By RoboForex.com

Attention!

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex LP bears no responsibility for trading results based on trading recommendations described in these analytical reviews.

Apple Forced to Pay a $40-Billion Ransom

After the bell on Monday, tech icon, Apple (AAPL), reported results.

On the one hand, the company delivered record profits of $14.50 per share, when analysts were expecting $14.05.

But when it came to iPhone sales during the all-important holiday quarter, Apple whiffed hard enough that the fans in the bleacher seats could feel it.

The company only sold 51 million iPhones – a full four million shy of analysts’ estimates. At an average selling price of $637, that works out to $2.5 billion in missed sales. Like I said, big whiff!

As a result, the market has taken Apple hostage.

Following the report, shares fell as much as 9%, vaporizing roughly $40 billion in market value.

Now, by no means is Apple in danger of going out of business. Not with over $13 billion in quarterly profit and a cash stockpile closing in on $160 billion.

However, an ominous trend is developing, pointing to an imminent day of reckoning between CEO Tim Cook and shareholders.

Or as Forbes’ Robert Hof put it, “Investors are getting even more restless.”

Indeed! Here’s why it’s absolutely justified – and, most importantly, how you can safely leverage the situation for your ultimate profit…

How Do You Like Them (Rotten) Apples?

Apple’s unfathomable smartphone shortfall comes at a time when the rest of the industry is firing on all cylinders.

In the last 24 hours, in fact, technology research group, IDC, confirmed that global smartphone sales zoomed 38% last year. They topped one billion units for the first time ever.

Analysts are calling for similarly heady growth of 26% in 2014.

Now, you’d think that trend would be Apple’s friend. Think again!

The bulk of the expected smartphone sales will be “low-quality growth,” according to BNP Paribas analyst, Peter Yu.

Translation: Cheap smartphones, selling for less than $150, will account for the majority of smartphone sales this year.

Pardon the Captain Obvious statement here, but that’s a price point Apple can’t touch.

Consumers’ preference for lower-priced smartphones, and Apple’s inability to compete, is already materializing in the data, too.

Over the last three quarters, Apple’s iPhone sales growth rate plummeted from around 20% to less than 7%, on a year-over-year basis.

Meanwhile, market share data reflects a similarly ominous trend. Whereas Apple sold nearly 20 million more iPhones in 2013 than 2012, its market share fell four percentage points to 15%.

Innovate or Die

Ever since the late Steve Jobs unveiled the company’s first iPhone in 2007, it’s been the main driver of Apple’s revenue. (In the last quarter, it accounted for 56% of sales.)

Based on the latest numbers, I’m afraid Apple’s eye-popping iPhone run is drawing to a close. That means it’s time to innovate (again) or die.

Of course, that’s always been the story with Apple. It needs to introduce new product categories – and instantly dominate the market. Otherwise, its stock is destined to fail.

When Steve Jobs was at the helm, no one ever questioned the company’s ability to do just that. With Tim Cook in charge, though, it’s not such a sure thing.

He’s just not the same type of visionary as Steve Jobs. Frankly, I don’t think anyone will ever be.

And the fact that shares are selling off after the quarterly report – even though Cook continues to promise Apple will launch new products this year (iWatch anyone?) – shows that the lack of confidence is widespread.

Now, Cook might not be able to match Jobs’ innovative abilities. But he’s no dummy. After all, you don’t become the successor at Apple for your lack of business acumen.

He made one comment during yesterday’s conference call that leads me to believe he’s about to make his mark on the world.

When pressed about mobile payments, he said, “We are seeing that people love being able to buy content, whether it’s music or movies or books, from their iPhone using Touch ID. It’s incredibly simple and easy and elegant – and it’s clear [that] there’s a lot of opportunity there.”

When asked about the same thing on the previous conference call, he curtly responded that mobile payment technology is “in its infancy.”

Apparently, it’s grown up (fast) in the span of several months. And therein lies his opportunity…

Get Ready for the Mobile Payment Boom

For years, I’ve contested that mobile payments would never take off until the security issues were resolved. Apple took care of that by incorporating biometric authentication into its latest iPhone.

So in order to take over the world, all Tim Cook needs to do now is start letting people use Touch ID to buy anything they want.

Think about it. Apple lays claim to one of the most valuable assets in the world – over 600 million user accounts, most of which are already linked to a credit card.

That’s more than Amazon.com (AMZN) and PayPal combined, based on BI Intelligence’s estimates from late 2013.

So by letting users pay for goods and services from their iPhone with their Apple ID, verified by Touch ID, Apple would instantly dominate the mobile payment market.

While it wouldn’t be as simple as flipping a switch, it’d be pretty darn close.

And it would definitely be much easier for Cook than trying to come up with a completely new, must-own consumer electronic device.

Now, you know I’ve always advocated investing in Apple’s stock smartly, instead of simply buying the stock at any price. I have to admit, though, my colleague, Karim Rahemtulla, has come up with the most ingenious way yet to bet on the company’s next big innovation.

It’s an opportunity to put as much as $26,000 in your pocket, instantly.

Go here for all the details

Ahead of the tape,

Louis Basenese

The post Apple Forced to Pay a $40-Billion Ransom appeared first on Wall Street Daily.

Article By WallStreetDaily.com

Original Article: Apple Forced to Pay a $40-Billion Ransom

Japanese Candlesticks Analysis 29.01.2014 (EUR/USD, USD/JPY)

Article By RoboForex.com

Analysis for January 29th, 2014

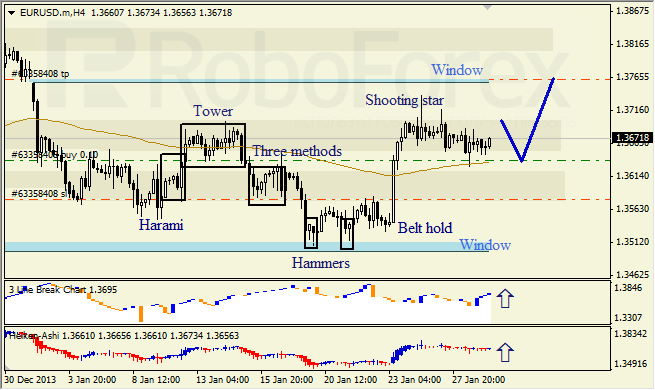

EUR/USD

H4 chart of EUR/USD shows sideways correction, which is indicated by Shooting Star pattern. Upper Window is resistance level. Three Line Break chart and Heiken Ashi candlesticks confirm ascending movement.

H1 chart of EUR/USD also shows sideways correction. Closest Window is resistance level. Tower pattern, Three Line Break chart, and Heiken Ashi candlesticks confirm ascending movement.

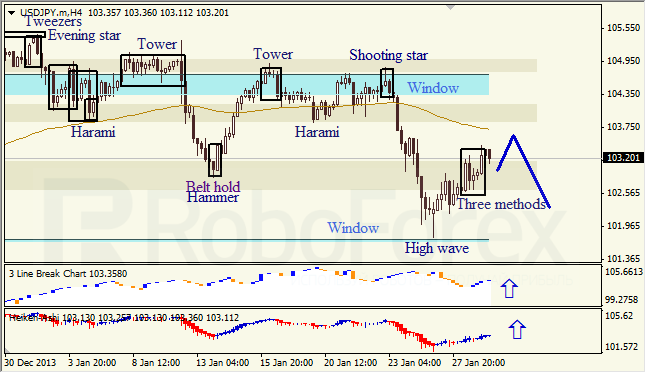

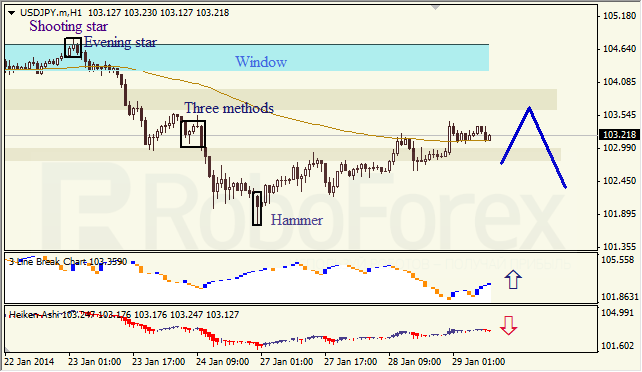

USD/JPY

H4 chart of USD/JPY shows correction within descending trend. Lower Window is support level. Bullish Three Methods pattern, Three Line Break chart, and Heiken Ashi candlesticks confirm that ascending correction continues.

H1 chart of USD/JPY shows bullish tendency, which started after Hammer pattern. Three Line Break chart confirms ascending movement; Heiken Ashi candlesticks indicate bearish pullback.

RoboForex Analytical Department

Article By RoboForex.com

Attention!

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex LP bears no responsibility for trading results based on trading recommendations described in these analytical reviews.

Oil Could Push Higher if Bullish Economic Growth Forecasts Ring True

Crude oil trading could result in the price of the commodity experiencing substantial gains if the predictions of widespread economic growth provided by market participants end up having some accuracy.

The forecasts that have been made about how well global business conditions will fare in 2014 and after could play a key role in the performance of crude oil, as the expectations that investors have for the worldwide economy are a crucial contributor to the price of the commodity.

The global economy should expand more rapidly this year than it did in 2013, at least according to the most recent estimates released by the International Monetary Fund in the latest update to its World Economic Outlook.

IMF bolsters 2014 global growth estimate

The organization forecast that in 2014, gross domestic product will grow at a rate of 3.7 percent. This figure was 0.1 percent higher than the estimate that it provided in the prior update to the WEO, which was made in October. In addition, this pace will hasten slightly in 2015, reaching an annual rate of 3.9 percent.

While the financial institution increased its forecast for global growth, a recent poll conducted by Bloomberg revealed that the majority of participants believe that the global economic outlook is getting better. The survey, which involved close to 500 traders, investors and analysts who subscribe to the media outlet, revealed that 59 percent of participants had this optimistic view.

“Developed countries are playing by far the most important part of the recovery in confidence, in markets and in the economy,” Wilhelm Schroeder, who works in Munich as managing director of Schroeder Equities GmbH and contributed to the poll, told the news source. “Without doubt, confidence is the single most important determinant for growth.”

Growth forecasts increased for several nations

The IMF also increased its growth predictions for the economies of several nations, including that of the U.S., Reuters reported. The organization forecast that in 2014, the GDP of the world’s largest economy would grow at a rate of 2.8 percent.

Such growth would certainly represent an improvement, as the nation’s economy expanded at a 1.9 percent pace in 2013, according to figures provided in the IMF report. The document released by the organization noted that declining headwinds from fiscal policy, and the subsequent impact that this should have on domestic demand, will help speed up the U.S. recovery.

Conference Board provides encouraging data for U.S.

This prediction that the American economy will grow more quickly in 2014 is supported by a December measure of leading indicators for the North American nation, Bloomberg reported. Data provided by the Conference Board revealed that during the month, the organization’s outlook for the coming three-to-six month period was 0.1 percent higher than the most recent rendition.

“It’s still consistent with a stronger economy in 2014,” Scott Anderson, who works in San Francisco at Bank of the West as chief economist, stated before the report was released, according to the news source. “We expect a healthier consumer, better business spending and somewhat faster job growth.”

The perception that economic conditions are improving was also supported by the most recent jobless claims report, which was released on Jan. 23, and revealed that during the prior week, the number of people who filed initial applications for these benefits lingered close to its lowest in six weeks, according to the news source.

The labor market is seen by many as being a key indicator of the strength of the economy. The improvement in this crucial measure was noted by Jim Diffley, a senior director at IHS and also the lead author of a report on U.S. metropolitan areas that was recently released, according to USA Today. The document, which was generated by IHS Global Insight, forecast that in 2014, 356 of the 363 metropolitan areas will expand.

“We’re finally on an upward trajectory with good job growth,” Diffley told the media outlet. “The recovery has started to affect substantially everywhere.” He added that many regions will need to recover substantially to get back to the level they were at before the financial crisis. “Two thirds of metros have still not gotten back to 2007 or 2008 peak levels of employment, and half of those won’t get there for another three years,” Diffley told the news source. “Financial crises do not produce normal recessions in the U.S.”

Additional data provided by the Conference Board pointed to the U.S. economy being strong at the present time, according to Bloomberg. The December index of coincident indicators released by The Conference Board was 0.2 percent higher than during the month before.

“This latest report suggests steady growth this spring, but some uncertainties remain,” Ken Goldstein, who works for the Conference Board as an economist, said in a statement today, the media outlet reported. “Business caution and concern about unresolved federal budget battles persist, but the better-than-expected holiday season might point to

The post Oil Could Push Higher if Bullish Economic Growth Forecasts Ring True appeared first on | HY Markets Official blog.

Article provided by HY Markets Forex Blog

Gold Decline Shows Key Role of Fed Speculation

Those who trade gold caused the price of the precious metal to decline on Jan. 27, and many market experts attributed this depreciation to speculation that the Federal Reserve would announce additional tapering of stimulus at the conclusion of its upcoming policy meeting scheduled for later in the week.

In addition, the resilient nature of the stock market was cited as helping to push the precious metal lower, Reuters reported. Equities have faced substantial headwinds so far this year, and their lack of performance has motivated many market participants to flock to gold. This situation of investors seeking the precious metal amid the poor results of stocks did not happen on Jan. 27.

Gold drops as equities rise

Spot gold rose to as much as $1,278.01 per ounce, according to the news source. This represented the highest value for the contract in two months. However, spot gold reversed direction after the S&P 500 Index managed to enjoy some gains, which represented a contrast to the sharp losses that the benchmark group of stocks suffered during the prior week.

This recovery was credited with drawing investors away from the precious metal, the media outlet reported. As a result of the strong performance of the index, spot gold erased the gains it had made earlier in the session, and was 1.2 percent lower at $1,253.69 an ounce by 3:35 p.m. EST (20:35 GMT).

April futures for the precious metal also declined, falling to as little as $1,257.20 per ounce on the Comex division of the New York Mercantile Exchange, according to Investing.com. The contract managed to recover from some of these losses, but was still down 0.1 percent at $1,263.20 per ounce.

Tapering speculation impacts metal

These contracts moved lower as those who trade gold speculated that when the Federal Open Market Committee concludes its meeting later in the week, the current pace of bond purchases will be reduced further, the media outlet reported.

The Fed purchased $85 billion worth of these debt-based securities every month starting in 2012. Then, at the conclusion of the central bank’s policy meeting in December, it was announced that starting in January, the financial institution would purchase $75 billion of these bonds per month.

The precious metal has been doing well so far this year, having reached a six-month low on Dec. 31, but there are concerns that it has become overvalued as a result of the appreciation that it has enjoyed in 2014, according to Bloomberg. If the Fed continues to gradually taper its bond purchases, this development could result in those who trade gold causing the precious metal to suffer further losses.

It is likely that the central bank will lower the monthly amount of debt-based securities that it buys by $10 billion at every one of the upcoming meetings of the FOMC, according to the median forecast of economists who took part in a Bloomberg poll. Regardless of what happens at the policy meeting, one analyst told the news source that he expects significant volatility from the precious metal in the near future.

“Those who worry about emerging markets want gold, and those who are optimistic about developed markets don’t want gold,” Xue Na, who works for Nanhua Futures Co. as an analyst at Nanhua Futures Co., told the media outlet. “We continue to expect price swings going into the FOMC meeting this week.”

Economic data and tapering

Whether the FOMC meeting results in further tapering of bond purchases relies largely on the strength of economic data, as the speculation that the Fed will soon opt to reduce QE further is based substantially on the robust nature of the reports that have been released, according to Investing.com.

However, some of the data that has been issued lately has drawn the strength of economic conditions into question, the media outlet reported. For example, a report released by the Census Bureau revealed lackluster home-buying activity in December. The activity fell short of the expectations of market experts. The data provided by the organization indicated that during the month, single-family home sales were made at a seasonally-adjusted annual rate of 414,000.

While this was well above the rate of 396,000 that happened in December 2012, it was far below the market prediction of homes being sold at an annual rate of 475,000 in the final month of 2013, according to the news source.

Another factor that could help to undermine confidence in the current U.S. recovery is the January jobs report, which will be released on Feb. 7, Brien Lundin, editor of Gold Newsletter, told MarketWatch.

The strength of the labor market is one key economic indicator that was noted by Ben Bernanke, chairman of the Fed, as having a crucial impact on the timeline that the central bank uses to taper stimulus. If the coming jobs report is lackluster, it could make the FOMC reluctant to further lower its bond purchases. Such a situation could motivate those who trade gold to push the precious metal higher.

The post Gold Decline Shows Key Role of Fed Speculation appeared first on | HY Markets Official blog.

Article provided by HY Markets Forex Blog

Forex Trading Causes AUD/USD to Recover From 3.5-Year Low

Forex trading resulted in the AUD/USD recovering on Jan. 27, after it recently dropped to its lowest point in three-and-one-half years.

The currency pair managed to appreciate during the day, as the downward pressure on the Aussie – that was created by concerns about emerging markets – started to dissipate, according to Investing.com. The AUD/USD was valued at 0.8730. This represented a 0.55 percent gain for the day, and happened after the exchange rate for the pair fell to as little as 0.8659 on Friday, Dec. 24. This was the lowest value for the currency pair since July 2010.

AUD/USD encounters challenges

The Aussie managed to encounter some serious challenges late in the prior week, after data revealed that in January, Chinese manufacturing contracted by more than expected, the media outlet reported. This report was important to the value of the AUD/USD since China is the largest trading partner of Australia, and emerging market economies could face headwinds as a result of Chinese business conditions deteriorating.

The AUD/USD did well earlier last week, rising to 0.8850 on Jan. 22 as global market participants speculated that another interest rate cut from the Reserve Bank of Australia would be less likely to happen as a result of a sharp rise in inflation, according to Reuters.

In addition, since the state of the Aussie is expected to be largely dependent on the actions taken by the RBA, some believe that the emerging-market currency will continue to decline in value this year, the media outlet reported.

Fed tapering key to emerging-market currencies

The currencies of these fledgling nations could encounter additional headwinds based on how quickly the Federal Reserve opts to reduce its bond purchases. They have already been pushed lower in value as a result of the Federal Open Market Committee announcing in December that it would cut its stimulus, according to Investing.com. The pace of tapering that is used by the central bank to lower these transactions could have a significant impact on the value of the U.S. dollar.

The more bonds the Fed buys every month to stimulate the economy, the more rapidly the U.S. money supply will grow. This expansion of the amount of money in circulation could easily put downward pressure on the greenback. If the central bank moves to lower these purchases more quickly, it could help provide tailwinds to the U.S. dollar. This, in turn, could result in those who engage in forex trading pushing the AUD/USD higher.

The post Forex Trading Causes AUD/USD to Recover From 3.5-Year Low appeared first on | HY Markets Official blog.

Article provided by HY Markets Forex Blog