By www.CentralBankNews.info Poland’s central bank held its reference interest rate steady at 2.50 percent, as widely expected, and its governor, Marek Belka, will explain its decision at a news conference later today.

Member’s of the National Bank of Poland’s (NBP) monetary policy council have often said in recent weeks that rates are likely to remain unchanged into 2014 and last month Belka was quoted as saying that interest rates would remain steady until the end of this year with no signs of inflationary pressures in the economy.

Last month the NBP, which has cut rates by 150 basis points this year, said it would maintain rates at least until the end of 2013, which would help inflation return to the bank’s 2.5 percent target.

Poland’s inflation rate was steady at 1.1 percent in August while Gross Domestic Product rose by 0.4 percent in the second quarter from the first for annual growth of 0.8 percent, up from 0.5 percent.

Iceland holds rate, ties rate changes to wage agreements

By www.CentralBankNews.info Iceland’s central bank kept its benchmark seven-day collateralised lending rate steady at 6.0 percent and tied future changes in its policy stance directly to the size of wage rises in upcoming settlements.

The Central Bank of Iceland, which has held rates steady this year after raising them by 125 basis points in 2012, also repeated that it’s accommodative policy stance had supported the economy but it was “still the case that as spare capacity disappears from the economy, it is necessary that slack in monetary policy should disappear as well” and the degree of this normalization depends on inflation, which in turn depends on wages and exchange rate movements.

Iceland’s inflation rate eased to 3.9 percent in August from 4.3 percent in July. The central bank forecast in August that inflation would rise slightly in the second half of this year and then decline toward the bank’s 2.5 percent target in early 2014.

Over the last month, the Icelandic krona has been largely steady against the U.S. dollar but since the beginning of the year it has appreciated by 5.4 percent, trading at 121.17 to the U.S. dollar today.

“The Bank’s intervention in the foreign exchange market has contributed to reduced exchange rate volatility,” the bank said, adding that inflation expectations have not change, possibly due to uncertainty about foreign debt deleveraging, settlement of failed banks’ estates, capital account liberalization and uncertainty over future wage settlements.

The central bank also said its policy had to take into account fiscal policy and noted that the latest budget proposal assumes that the primary surplus will rise and debt decline, underlining that it was important that an overall surplus be achieved as soon as possible to help foster economic stability and inflation that is close to target.

Iceland’s economy expanded by an annual 4.2 percent in the second quarter for first half growth just over 2.0 percent, slightly stronger than assumed by the bank in its August forecast. The bank forecast economic growth of 1.9 percent this year and 2014 growth of 2.8 percent.

The unemployment rate eased to 4.9 percent in August from 5.0 percent and the bank said it had assumed that wage increases in the upcoming round would be larger than consistent with its inflation target.

“If wage increases are in line with the forecast, it will probably be necessary to raise the bank’s nominal interest rates, other things being equal, particularly if the margin of spare capacity in the economic continues to narrow” the bank said, adding:

“If wages rise in excess of the forecast, it is even more likely that the bank will raise interest rates. If wage increases are consistent with the inflation target, however, inflation will fall more quickly than is currently predicted and interest rates will be lower than would otherwise be necessary, other things being equal.”

ECB holds refi rate steady at 0.5% as expected

By www.CentralBankNews.info The European Central Bank (ECB) held its refinancing rate steady at 0.50 percent, as expected, along with its other main rates.

ECB President Mario Draghi will comment on the governing council’s decision later today at a news conference in Paris where the ECB council met today. Twice a year the ECB meets in cities outside its Frankfurt headquarters.

Last month Draghi acknowledged that the council discussed cutting the refi rate, which has been steady since a cut in May, and repeated that it expects its policy stance to remain accommodative “for as long as necessary” and it expects to keep its rates at the current or lower level for “an extended period of time.”

Inflation in the euro area eased to 1.1 percent in September from 1.3 percent in August, below the ECB’s target of inflation below but close to 2.0 percent.

The economy exited recession in the second quarter with Gross Domestic Product rising by 0.3 percent quarter-on-quarter, following six consecutive quarters of contraction. On an annual basis, GDP shrank by 0.5 percent.

The euro area’s unemployment rate remained steady at 12.0 percent in August from July.

WTI Oil Declines Ninth Time On US Shutdown

Prices for the WTI Oil dropped for the ninth time in the past ten days as investors’ worries over the US first government shutdown in 17 years will slowdown the growth rate of the economy and the demand for crude.

Futures for WTI Oil dropped 0.6% lower in New York and was on the edge of its lowest close in three months. The US began its shutdown on Tuesday after lawmakers failed to agree the federal budget by the deadline on Monday midnight. While crude stockpiles rose by 4.55 million barrels last week, the American Petroleum Institute confirmed. Data expected from the Energy Information Administration is predicted to show a rise in supplies by 2.5 million, according to Bloomberg News survey.

“The picture for oil is not good, it remains bearish,” said Jonathan Barratt, the chief executive officer of Barratt’s Bulletin in Sydney. “Fiscal issues in the U.S. continue to be a headline, while inventory levels are increasing. Oil remains under pressure.”

WTI November delivery dropped 61 cents lower to $101.43 a barrel on the New York Mercantile Exchange. The volume of futures traded was approximately 62% below the 100-level.

While Brent November delivery declined 50 cents to $107.44 a barrel, on the London ICE Futures Europe exchange. The European benchmark crude Brent was at $5.99 to WTI.

WTI Oil – US Government Shutdown

The US Congress failed to finalize an agreement over the country’s budget for the fiscal year which began yesterday, causing its first government shutdown in 17 years and could affect almost 800,000 federal employees.

The US announced its final extraordinary measures to avoid exceeding the borrowing limit and its ability to borrow will end on October 17, Jacob J. Lew, Treasury Secretary announced.

American Petroleum Institute confirmed that the US gasoline supplies boosted by 3.26 million barrels last week. While the EIA report is expected to show a fall in inventories by 700,000 barrels, according to the Bloomberg survey.

Meanwhile distillate stockpiles (including heating oil and diesel), dropped by 1.57 million barrels, the API said.

Visit www.hymarkets.com today and find out more on how you can how you can trade Energy products with only $50.

The post WTI Oil Declines Ninth Time On US Shutdown appeared first on | HY Markets Official blog.

Article provided by HY Markets Forex Blog

European Stock Futures Falls Ahead Of ECB

European stock futures declined during the pre-market trading on Wednesday, as investors focus on the European Central Bank (ECB) rate announcement and the press conference from ECB President Mario Draghi.

The pan-European Euro Stoxx 50 futures lost 0.24% to 2,911.56 at the time of writing, while futures of the French CAC 40 fell 0.27% at 4,180.87. At the same time the German DAX edged 0.36% lower at 8,670.64, while the UK FTSE 100 declined 0.24%, standing at 6,408.68 at the time of writing.

The European Central Bank (ECB) is expected to announce its rate decision at 11:45am GMT, while ECB President Mario Draghi will be holding a press conference at 12:30pm.

The Spanish employment ministry will report the unemployment change in September at 7:00am GMT.

Meanwhile in Italy, the country’s Prime Minister Enrico Letta is expected to face a confidence vote on Wednesday, after leading ministers in the People of Liberty party (PDL) defied Silvio Berlusconi and said they would support the prime minister.

Silvio Berlusconi’s deputy and the secretary of the PDL party said, “I am firmly convinced that our party as a whole should vote confidence in Letta.”

In Germany, the German Bundes Bank is expected to hold an auction of 10-year government bonds.

European Stock Futures – US Shutdown

On Monday, the US faced their first government shutdown in 17 years after the government failed to agree on the federal budget by Monday midnight. The government shutdown could affect as many as 800,000 federal employees.

The Treasury announced procedures to avoid exceeding the borrowing limit, which will end on October 17. The US won’t have enough money to pay most of its bills between October 22 and October 31 without any action by Congress, according to reports from the Congressional Budget Office.

The current state of affairs is expected to cost an estimated $300 million a day, IHS confirmed.

The government is expected to continue discussing the country’s funding measure later in the day. A string of macroeconomic data’s are expected to be delayed if the shutdown continues.

Interested in trading In the European Market?

Visit www.hymarkets.com and find out how you can start trading today with only $50.

The post European Stock Futures Falls Ahead Of ECB appeared first on | HY Markets Official blog.

Article provided by HY Markets Forex Blog

Rick Mills: Greenland Is the Final Frontier for Lower-Cost Mining

Source: Kevin Michael Grace of The Metals Report (10/1/13)

http://www.theaureport.com/pub/na/rick-mills-greenland-is-the-final-frontier-for-lower-cost-mining

Industrial minerals like copper and nickel are essential to global economic expansion. But everywhere you look, grades are getting lower, and costs are getting much, much higher. Is there a way out? Rick Mills says mining companies need to look to Greenland. In this interview with The Metals Report, the owner and host of Ahead of the Herd.com lauds the world’s largest island for its vast resources, its one-stop regulatory system and its year-round access to ocean transportation.

The Metals Report: You never really believed that there was anything resembling an economic recovery in the United States, correct?

Rick Mills: I don’t believe you can have an economic recovery with the type of jobs that have been created in the last few years. Wages have stagnated. The velocity of money, how many times it turns over in the economy, how many times it’s spent, is at a record low,

TMR: So the decision by the Federal Reserve to hold off on tapering quantitative easing didn’t surprise you?

RM: I’ve gone on record saying there would be no tapering this time around, but that doesn’t mean it isn’t coming—it certainly is. But it will likely be very gradual, and the Fed will start only when they feel the economic data support such a move. I firmly believe, however, that the Fed’s zero interest rate policy is here to stay, and this is very important for gold investors.

TMR: Why?

RM: Because it will result in permanent gold backwardation. That’s when the spot or cash price—gold sold for immediate delivery—is trading above the near active futures contract. Backwardation indicates a physical shortage, it’s very rare for any commodity to go into backwardation, but especially gold. Backwardation tells us that gold is being valued higher right now than fiat currencies. It tells us that people are losing confidence in paper money and they’d prefer to hold gold rather then fiat currency.

With real interest rates (your rate of return minus the rate of inflation) in negative territory, the Fed has unintentionally created a lot of support for gold. Gold doesn’t do well in a high interest rate environment because it’s got no yield. If you could get 6% on your money, why would you buy gold, right? Historically, 2% interest has been the tipping point for gold.

TMR: Some people believe there’s been a divorce between physical gold and exchange traded funds (ETFs). What do you think?

RM: I have never been an ETF fan; if you’re buying gold for insurance against calamity, why would you want it held in Toronto or New York or somewhere else? I want my gold a lot closer than that. We see in the news that investors cannot get their gold back when they try to redeem some of their ETF holdings.

TMR: You’ve warned that with regard to nickel and copper the world is running out of low-hanging fruit. Will this lead to shortages, higher prices or both?

RM: Both. One billion people will enter the global consuming class by 2025. That’s 83 million (83M) people per year. Demand is not going to go down. China will have to increase its average urban per-capita copper stock by seven or eight times just to achieve the same level of services we in the West enjoy.

While this is happening, copper mining has become an especially capital-intensive industry. In 2000, the average cost was between $4,000 and $5,000 to build the capacity to produce a tonne of copper. Today, this figure is north of $10,000 per tonne on average and has been reported as high as $18,000 for one particular project.

TMR: Why are costs escalating so rapidly?

RM: Two reasons. First, declining copper-ore grades mean much larger scales are required for mining and milling operations. Second, a growing proportion of mining projects are in remote areas of developing economies where there’s little to no existing infrastructure.

TMR: You’ve predicted significantly higher copper production from Chile is not likely. Why not?

RM: Chile has a shortage of electrical power, a problem exacerbated by “green” groups delaying or stopping new power projects. Chile also has a serious shortage of fresh water needed for mining. Many companies are starting to pipe it in from the ocean and desalinate it.

TMR: Do we see the same higher demand/higher costs scenario with nickel?

RM: Yes, it’s the exact same trend except a few degrees worse. Capital intensity for new nickel mininghas gone through the roof. And the discrepancy between the initial per-pound capital cost of nickel projects and the ultimate construction costs is over 50%. And larger-scale projects have not demonstrated lower per-unit capital costs. Sometimes large projects have even higher capital intensity.

In the future, global nickel supply will come increasingly from laterite nickel deposits, which require high-pressure acid leach (H-Pal) plants. We are now looking at north of $35 per pound ($35/lb) capital intensity as we move into these multibillion-dollar ferronickel and H-Pal projects.

TMR: Your search for cost-effective new sources for industrial metals has led you to Greenland, the world’s largest island. What advantages does this Danish colony have over northern Canada?

RM: Approximately 80% of Greenland is covered by ice with the exposed area forming a fringe around the edge. Geologically, these ice-free coasts are an extension of the Canadian Shield. Both Canada and Greenland are stable politically. The balance starts to tip in Greenland’s favor when we talk about regulation. All permitting in Greenland is done through one agency, the Bureau of Minerals and Petroleum. This is pretty much one-stop shopping—very efficient compared to the regulatory duplication common in Canada.

TMR: How about infrastructure?

RM: Greenland’s easy access to seaborne freight gives it a tremendous cost advantage over northern Canada. If you are in the interior of the Canadian north, you need to truck your product, usually across vast distances, to get it to a railhead or port, sometimes utilizing both a railway and ocean freighter to get it to a smelter. In Greenland, transport distances from project site to open water are usually only tens of kilometers, versus hundreds of kilometers in Canada’s north.

Access to the sea puts the world’s smelters, end users, middlemen, etc., at your fingertips. It lowers your upfront development costs and capital expenditures/operating expenditures (capex/opex) when it comes time to build and run your mine. The southwest coastal region of Greenland has a relatively mild climate with deep-sea shipping possible year round. And climate change leading to the disappearance of sea ice seems to be making the <href=”#dashboard/follows/” target=”_blank”>Northwest Passage a viable route.

TMR: Canada’s native peoples are often highly suspicious of—and sometimes outright hostile to—mining activity. This is not the case in Greenland?

RM: No, they seem to welcome the increased capital. Mining brings an awful lot of money into the local and national economies. It provides jobs and taxes. Greenland is dependent on Denmark for much of its funding but wants to become self sufficient. Greenlanders are very protective of their environment. They’ve got rules in place, but they’re not onerous. You can get your work done.

TMR: What specific Greenland nickel-copper play do you like?

RM: North American Nickel Inc. (NAN:TSX.V). The company has the Maniitsoq nickel, copper, cobalt and PGM project in southwest Greenland. This project contains the 70-km Greenland Norite Belt (GNB).

TMR: This is not a laterite deposit, right?

RM: Correct. It is a nickel-sulphide deposit. Something to understand about nickel sulphides is that although they can occur as individual bodies, groups of deposits may occur in belts up to hundreds of kilometers long. Such deposits are known as districts. Two giant nickel-copper districts stand out above all the rest in the world: Sudbury, Ontario and Noril’sk-Talnakh, Russia.

What I want to get across to our readers is that Maniitsoq is thought to be a meteor-impact event like Sudbury. Unlike Sudbury, however, Maniitsoq’s outcrop exposures of nickel-copper sulphide mineralization and its massive sulphide drill intercepts are at surface or very close to surface. Sudbury had glacial movement, whereas this isn’t so in Greenland. I ask myself, what would Sudbury look like if you scraped away the top few hundred meters. It might look like Maniitsoq.

TMR: What is the exploration situation at Maniitsoq?

RM: The company has, so far, over 100 targets. In 2012, 1,550 meters (1,550m) were drilled in nine holes targeting geophysical anomalies. In November 2012, the company announced significant assay results for nickel, copper and cobalt in near solid to solid sulphide mineralization within the GNB from its Imiak Hill target. In December 2012, it announced the discovery of a second zone of significant nickel, copper, platinum, palladium and gold mineralization from drilling at Spotty Hill, which is 1.5 kilometers (1.5km) from Imiak.

In September of this year, North American Nickel announced a second discovery and a third zone of mineralization. Drill hole MQ-13-026 intersected 18.6m of sulphide mineralization averaging an amazing 40–45% total sulphides, with numerous sections containing 65–85%. This third discovery, at Imiak North, is in close proximity to Imiak Hill and Spotty Hill. The company is starting to get some significant intersections and is building tonnage. And the mineralized zones discovered to date are all open at depth.

But with only 27 holes in the ground and over 5,106 square kilometers of area to cover, I think it’s safe to say that North American Nickel is just getting started.

TMR: Could you comment on its cash position and management?

RM: The management is very, very good. It’s the same group as VMS Ventures Inc. (VMS:TSX.V). They are fully backed by the Sentient Group, a very large resource fund, and they raised $7.5M earlier this year, so the company is fully funded. VMS owns 27% of North American Nickel.

TMR: You’re quite excited about anorthosite. What is this, and why does it excite you?

RM: It’s calcium feldspar, which is basically sand containing aluminum, calcium and low levels of soda and iron. Anorthosite could serve as an alternative material in many industrial applications. For example, it could be a new source of filler material. Fillers are a significant component of the plastic, paints and paper industry. It could also replace kaolin, which is a major component of glass fiber manufacturing. And we’re not talking about the pink fiberglass that insulates your house; we’re talking about the fiberglass that piping and a lot of the new materials are being made of.

TMR: What’s the anorthosite situation in Greenland?

RM: Hudson Resources Inc. (HUD:TSX.V) is a fascinating opportunity for investors to get in early and watch the company grow into production. Hudson has the White Mountain anorthosite project in the<href=”#dashboard/follows/” target=”_blank”>southwest coastal region of Greenland. Hudson has already proved it can reduce its anorthosite’s iron content by running it through an onsite magnetic separator. So now both the soda and iron are below the levels needed to create a ready replacement for kaolin. It’s a fairly easy thing, and we’re talking about an immense deposit.

In addition, Hudson has produced alumina, which is aluminum oxide, from initial bench-scale testing on its anorthosite. James Tuer, the company’s president, believes Hudson is well on its way to producing a marketable smelter-grade alumina. Interestingly enough, Alcoa Inc. (AA:NYSE) is building an aluminum smelter in Maniitsoq, just 80km away from the White Mountain project

TMR: What other Greenland asset does Hudson hold?

RM: It has one of the world’s largest carbonatite complexes, Sarfartoq, which is also in southwest Greenland. What is important about it is neodymium, which is the key to making rare earth permanent magnets. These are the superior, high-strength permanent magnets used for many energy-related applications. For instance, the most efficient wind turbines require 1,000 kilograms of neodymium for each megawatt of electricity.

These magnets are also used in hybrid automobiles, the result of the shift away from electromagnetic systems toward permanent magnetic-based direct drive systems.

Sarfartoq has one of the industry’s highest ratios of neodymium to total rare earth oxide. Right now, Hudson’s working on a flow sheet for the metallurgy, and I expect some news on that fairly soon.

TMR: Tell us about VMS Ventures’ Manitoba joint venture (JV) with HudBay Minerals Inc. (HBM:TSX; HBM:NYSE).

RM: That’s the Reed Copper project in Manitoba. VMS signed a JV agreement with HudBay in 2010. HudBay holds 70%, and VMS holds 30%. VMS is carried through production, so its portion of the mine construction costs will be financed by HudBay, and its 30% share of capital expenditures will be paid back out of the proceeds of production.

TMR: When does production begin?

RM: It’s expected to begin later this year, with full production reached in Q2/2014. The current life of mine (LOM) is estimated to be approximately six years, although deposits in this camp have a habit of growing. Once you get underground, you start drilling to explore for additional mineralization. In the meantime, VMS and HudBay are exploring the prospective areas around the Reed project for new deposits.

TMR: How lucrative is this deal for VMS?

RM: When full production is reached, approximately 1,300 tonnes per day from a probable reserve of 2.16 million tons (Mt), and after recoveries are factored in, the rock is going to be worth $270/tonne. That’s at spot prices of $3.25/lb copper, $1,363 per ounce ($1,363/oz) gold, and $23.60/oz silver.

That’s $354,000 worth of production per day over the current LOM of six years. So, remembering that VMS is carried by HudBay at 30% of production, that’s $118,000 gross per day coming VMS’s way after the payback of production costs. That is an extraordinary amount of money for a junior resource company to have coming in every day. It’s an extraordinary accomplishment.

TMR: You’re bullish on uranium. Why so?

RM: First off, let’s remember one of the golden rules of investing—buy something when it’s out of favor, buy what the herd shuns and hold it ’till they want it. The United States produces 5 million pounds (5 Mlb) of U308 per year, yet they use over 50 Mlb. The Russian enrichment program with the U.S. is coming to an end at the end of this year. That’s going to reduce American supply significantly.

TMR: Is there a near-term U.S. uranium play you like?

RM: Uranerz Energy Corp. (URZ:TSX; URZ:NYSE.MKT) is in Wyoming and the company will be going into production soon. It’s a no brainer, as far as I’m concerned. You’ve got a well-run company that will be producing uranium in the States. Uranerz significant offtake agreements and Cameco Corp. (CCO:TSX; CCJ:NYSE) are going to be processing the resin for the company.

TMR: You’ve written about Barrick Gold Corp.’s (ABX:TSX; ABX:NYSE) considerable investments in Nevada in general and in the Spring Valley in particular. Which juniors stand to benefit from joint venture and net smelter royalty agreements there?

RM: Midway Gold Corp. (MDW:TSX.V; MDW:NYSE.MKT) is Barrick’s joint-venture partner. The company has carried to production by Barrick. Two years ago, the published resource was 4.1 million ounces (4.1 Moz), but since then the JV has drilled some of the best holes to ever come out of the deposit. We should get a new resource fairly soon, and I expect it to grow significantly. Midway is a cashed-up junior with other irons in the fire.

Another company that would stand to benefit from Barrick putting Spring Valley into production is Terraco Gold Corp. (TEN:TSX.V), which has a royalty on the Spring Valley deposit. Once the project goes into production, the cash flow to Terraco will be tremendous, and Terraco can also use pieces of the royalty as an ATM, as it were, if they want to do a non-dilutive financing.

TMR: What about Terraco’s other assets?

RM: It has a project called Moonlight, which is attached to the north end of the Spring Valley project. It certainly looks like the Spring Valley mineralization heads north to Moonlight. Also, most people don’t know that there could be a very good opportunity for silver there. That’s why it’s called Moonlight. The old-timers used to talk about seeing the moonlight glint off the silver at night.

The other thing Terraco has got going for it is almost 1 Moz gold in its Almaden project in Idaho. With heap leach, it looks like it would be very cheap to put into production. All told, Terraco is an interesting play.

TMR: What other silver miners do you like?

RM: I’ve been following Great Panther Silver Ltd. (GPR:TSX; GPL:NYSE.MKT) for many years. I’ve watched it grow to be a significant producer. I like it for its exposure to rising silver and gold prices as a producer.

TMR: Do you think we’re going to see prices rise?

RM: Absolutely. You’re looking at a zero interest rate policy in the U.S., that’s negative real rates forever and permanent gold backwardation. You’re looking at a currency war where each country has to keep its currency lower than its export competitors in order to get other countries’ citizens to buy its products rather than everyone else’s. Countries keep their currency weak by printing. The money that has been created so far hasn’t gotten out into the general economy. The monetary base has exploded, but the actual money supply hasn’t gone up appreciably. The banks have been hoarding the money. They haven’t been lending, but bank stocks are rising in anticipation of a lending restart. It’s happening with commercial and real estate loans and some consumer loans, and banks are going to do very well with the interest rate differential. It’s all pointing toward a perfect storm.

TMR: Would you expect major upward movements in the prices of gold and silver before the end of the year?

RM: No. I think all of this is going to take time to work out. The banks have to start lending again; the velocity of money has to increase; and we have to get over this wage stagnation. But it will come. Gold and silver need to find a base for a while, and then we’ll start to see a climb in prices.

TMR: Rick, thank you for your time and your insights.

Rick Mills is the owner and host of www.Aheadoftheherd.com and invests in the junior resource sector. His articles have been published on over 400 websites.

Want to read more Metals Report interviews like this? Sign up for our free e-newsletter, and you’ll learn when new articles have been published. To see a list of recent interviews with industry analysts and commentators, visit our Metals Report <href=”#interviews” target=”_blank”>homepage.

DISCLOSURE:

1) Kevin Michael Grace conducted this interview for The Metals Report and provides services to The Metals Report as an independent contractor. He or his family own shares of the following companies mentioned in this interview: None.

2) The following companies mentioned in the interview are sponsors of The Metals Report: Uranerz Energy Corp., Great Panther Silver Ltd. and Terraco Gold Corp. Streetwise Reports does not accept stock in exchange for its services or as sponsorship payment.

3) Rick Mills: I or my family own shares of the following companies mentioned in this interview: None. I personally am or my family is paid by the following companies mentioned in this interview: Hudson Resources Inc., North American Nickel Inc., VMS Ventures Inc. and Great Panther Silver Ltd. I was not paid by Streetwise Reports for participating in this interview. Comments and opinions expressed are my own comments and opinions. I had the opportunity to review the interview for accuracy as of the date of the interview and am responsible for the content of the interview.

4) Interviews are edited for clarity. Streetwise Reports does not make editorial comments or change experts’ statements without their consent.

5) The interview does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer.

6) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned and may make purchases and/or sales of those securities in the open market or otherwise.

Streetwise – The Gold Report is Copyright © 2013 by Streetwise Reports LLC. All rights are reserved. Streetwise Reports LLC hereby grants an unrestricted license to use or disseminate this copyrighted material (i) only in whole (and always including this disclaimer), but (ii) never in part.

Streetwise Reports LLC does not guarantee the accuracy or thoroughness of the information reported.

Streetwise Reports LLC receives a fee from companies that are listed on the home page in the In This Issue section. Their sponsor pages may be considered advertising for the purposes of 18 U.S.C. 1734.

Participating companies provide the logos used in The Gold Report. These logos are trademarks and are the property of the individual companies.

101 Second St., Suite 110

Petaluma, CA 94952

Tel.: (707) 981-8999

Fax: (707) 981-8998

Email: [email protected]

The Reserve Bank of Australia Wants Stock Charts to Look Like This…

All in all the threat of a US government shutdown turned out to be a fizzer for the Australian market. Australian stocks closed yesterday down just 12 points.

And as we read news from around the markets yesterday afternoon, even the US markets gave the shutdown a big yawn.

As reported by Bloomberg News:

‘Standard & Poor’s 500 Index futures added 0.3 percent as the shutdown became official.‘

By the close in New York this morning, US stocks were up 0.8% on the S&P 500.

So much for the great panic many had feared leading up to the shutdown. As we noted on our Google+ page yesterday, the biggest fear of a shutdown is from the politicians and bureaucrats who worry the public will realise that things carry on just fine when the government isn’t meddling.

Of course, in our view the US debt ceiling and government shutdown talk is just a sideshow. The real story is low interest rates. But we must admit we forgot all about the Reserve Bank of Australia’s (RBA) interest rate meeting yesterday.

Turns out we didn’t miss much, it’s business as usual…

The key paragraph in the RBA’s statement was this one:

‘The easing in monetary policy since late 2011 has supported interest-sensitive spending and asset values. The full effects of these decisions are still coming through, and will be for a while yet. The pace of borrowing has remained relatively subdued to date, though recently there have been signs of increased demand for finance by households. There is also continuing evidence of a shift in savers’ behaviour in response to declining returns on low-risk assets.‘

Be in no doubt that the Reserve Bank of Australia seeks to manipulate the stock market and asset prices just as much as any other central bank.

That single paragraph from the RBA statement is proof of that.

It helps to confirm our view that despite the recent run-up in stock prices, it’s still a great time to buy stocks…

Blowing Bubbles Until They Blow Up in Your Face

But it’s not just stock prices getting a boost.

The property bulls have begun shaking off the cobwebs. They insist once again that Aussie housing isn’t in a price bubble…and if we read between the lines they suggest it never will be in a price bubble. (Cue the usual excuses about a housing shortage.)

The reality is different. Of course housing is in a price bubble. In the same way that stock prices are forming a price bubble too.

However, just because prices are in bubble territory doesn’t mean the bubble can’t grow bigger. If you’ve ever blown up a balloon you’ll know it’ll always expand that little bit more than you expect…

…And then it blows up in your face.

That’s what’s happening with asset prices right now, and it’s all with the blessing of the RBA.

To be honest, everything is playing out pretty much as we expected. Central banks continue to manipulate the markets and push them gradually higher.

The ultimate aim for the central bankers is to control asset prices in much the same way they control inflation. The central banks believe they’ve got inflation manipulation down to an art form – managing a gradual increase at around 2-4% per year.

Take the following chart. It’s the US Personal Consumption Expenditures index, one of the US Federal Reserve’s inflation measures:

Central bankers would like asset price charts to look just like this.

Whether it’s house prices or stock prices, if they can engineer a gradual and relatively non-volatile price rise it will have obvious knock-on consequences for the economy.

The biggest benefit would be for the banks, who could forever increase their loan book. They’d never again have to worry about falling asset prices and loan defaults.

Now, perhaps you’re thinking, ‘What’s wrong with that?’

They Have the Power and They Will Use it

Well, the biggest problem is that it takes all risk and reward out of the market.

It’s merely an extension of the illusion of wealth caused by continuous inflation. At first glance people think they’re wealthier because wages are higher, but much of the wages growth is purely down to inflation rather than genuine growth.

If central banks manage to achieve the same goal with investment markets you’d get the same illusion of growth without any actual growth.

Currently, it’s still possible to beat the market and also beat inflation. You just have to buy low and sell high when the opportunities arise.

The problem comes if the central banks achieve their goal of making asset prices grow in the same way they’ve allowed inflation to grow. Under that scenario you’re always buying high and selling high – in nominal terms anyway. Or put another way, it would turn stock prices into nothing more than a cash-equivalent investment…and that won’t make anyone rich.

Quite when the central bankers will crack the code and find the secret to manipulating the markets is anyone’s guess. Hopefully they’ll never do it. But whatever happens, you can expect them to push interest rates as low as possible.

The Reserve Bank of Australia kept rates on hold yesterday, but don’t expect that to be the end of the interest rate cutting cycle. The RBA knows it still has plenty of room up its sleeve to cut rates and push stocks (and house prices) higher.

Be under no illusion: the RBA has this power and it’s guaranteed to use it. We’re still on track for ASX target 7,000 by 2015.

Cheers,

Kris+

Special Report: UNAVOIDABLE: Australia’s First Recession in 22 Years

US Government Shutdowns, a Brief History.

I was curious about the history of government shutdowns in America. Below, I’ve pieced together a quick ‘n’ dirty history of how this political varietal came to be. (I found AP writer Connie Cass’ Closed for Business? Government Shutdown History to be most helpful.) And near the end, we’ll look over how they impact the stock market – and what you should do (or not).

As you know, the U.S. Congress has the power of the purse. The Framers did this as a way to check the power of the presidency. It didn’t work that way in practice because the federal government would buy on credit and then come back to Congress to get a bill passed to pay the debt.

This obvious end-around the rules closed with the passage of the Anti-Deficiency Act in 1884. Over time, there have been a number of amendments. The purpose of the law is the same as it ever was: to expose federal employees who spent money not approved by Congress to penalties, including jail time.

But that didn’t really work either. Congress was slow to approve bills on time. Some agencies went a full year without an approved budget. Nobody went to jail, and eventually, Congress got around to funding the gaps retroactively. It was a system of willfully ignoring (and not enforcing) the Anti-Deficiency Act.

That ended with President Jimmy Carter’s attorney general Benjamin Civiletti in 1980. He issued an opinion (actually, two opinions) defending the Anti-Deficiency Act, and he threatened to prosecute those who ignored it.

Either government had the authority to spend the money or it did not. And if it did not, then it would have to start shutting down, sending people home to save money, etc.

The first casualty was the Federal Trade Commission. Shortly after Civiletti’s opinion, funding for the FTC expired. The FTC sent nearly 2,000 workers home, cancelled cases, etc. It was the first agency to shut down because of a budget dispute. It didn’t last long, and lawmakers quickly fixed it. The FTC started up again the next day.

A Bigger Fight Was Brewing

The showdown came a year later with Reagan vetoed Congress’s budget in 1981. This resulted in the first government shutdown – workers sent home, agencies closing – but it lasted only hours. Congress approved another emerging budget that Reagan signed off on, and government opened on time the next day.

(To be clear, many sources cite the 10-day shutdown in 1976 as the first shutdown. But this was not a shutdown as we would recognise it now. There were funding gaps, but government agencies did not stop work.)

There were more shutdowns in Reagan’s time in office, but these were mere mayflies, lasting only a day or two.

The big shutdowns came when Clinton was president and Gingrich ran the House. Two shutdowns – one was for six days and the other was for 21 days, the longest shutdown ever.

The 1996 shutdown of the federal government was the last one up to now.

The key question is what the stock market does during times like this. Mostly, the market falls. If you look at all 17 funding gaps/shutdowns since 1976, the S&P fell just 2.5% if the shutdown lasted more than 10 days and just 1.4% if they lasted less than that. In the big Clinton-Gingrich 21-day show, the market fell almost 4%.

The US debt ceiling fight is a bigger concern, I think. Last time we went through one of those – in the summer of 2011 – the stock market fell nearly 14% from July 13 (when Moody’s put the US credit rating on ‘watch’ ahead of a downgrade on Aug. 5) to the low of Aug. 10.

In any case, the shutdown is a temporary thing. I don’t plan to do anything differently because of a shutdown.

If anything, I’m rooting for a good, long government shutdown.

First, because I am amused by the circus of it all — the blowhard politicians, the idiotic talking heads, the absurdity and the delicious irony involved.

On this last point, The Washington Post had an article last weekend exposing the ‘use it or lose it’ spending habits of government agencies. The Department of Veterans Affairs bought $562,000 worth of artwork in the past week, the Coast Guard spent $178,000 on cubicles and the USDA bought $144,000 worth of toner cartridges.

The list goes on and on. One agency bought three years’ worth of staples. Most federal agencies wind up spending nearly 10% of their annual budget in the last part of the fiscal year. And all of this while the government is out of money, deficits mount and debt piles up.

Second, I hope the market gets knocked down good and hard. I would love the opportunity such a sell-off would present. Any long-term investor ought to be rooting for a good correction.

Otherwise, it’s just another day. Maybe there will be less traffic on the roads for the commuters. Maybe people will realise just how nonessential the nonessential government employees who will be sent home are.

One thing for sure: People’s faith in US government should take another deserved lick.

Chris Mayer

Contributing Editor, Money Morning

Publisher’s Note: US Government Shutdowns, A Brief History originally appeared in The Daily Reckoning USA.

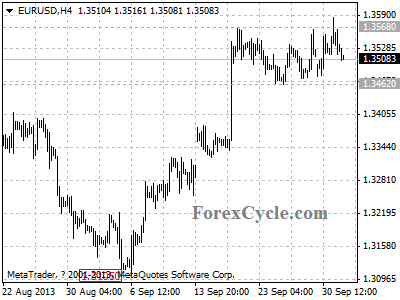

EURUSD pulls back from 1.3587

After breaking above 1.3568 resistance, EURUSD pulls back from 1.3587, suggesting that lengthier consolidation of the uptrend from 1.3105 is underway. Range trading between 1.3462 and 1.3587 would likely be seen in a couple of days. Support is at 1.3462, as long as this level holds, the uptrend could be expected to resume, and one more rise towards 1.3700 is still possible. On the downside, a breakdown below 1.3462 will indicate that the uptrend had completed at 1.3587 already, then the following downward movement could bring price back to 1.3350 zone.

Provided by ForexCycle.com

Bob Moriarty: On the Road to Armageddon, Take Shelter in Resources

Source: JT Long of The Energy Report (10/1/13)

An economic recovery that isn’t one. A civil war that isn’t one. Cheap oil that is no more. According to Bob Moriarty, resources remain one of the few absolutes in the world. In this The Energy Report interview, Bob explains why he’s sticking to resources when many investors are turning to the mainstream markets, and shares long-term opportunities for shale oil in New Zealand and coal bed methane in Indonesia.

The Energy Report: The last time we chatted, you were adamant that the U.S. is not in recovery. Does the Fed’s decision to continue tapering prove you right?

Bob Moriarty: Of course. Tapering spends money without improving things. The Dow and the S&P are at record highs. That’s a good thing, but only 12% of Americans own any shares at all, including in a retirement fund. At the very best, tapering is helping only that 12%.

The reality is that you’re helping the 1%. The 1% is doing very well, but 99% are getting further behind. Plus, we’re increasing the debt. One of these days it will blow sky high. I don’t know whether the Fed will blow up or if the 10-year Treasury yield will, but this is a very dangerous time.

TER: When we talked to James Dines, he said bonds would take a big hit. Are you worried about that?

BM: Of course. The 10-year Treasury is very important because home mortgage prices are set using that as a base. A little over a year ago, the 10-year Treasury was 1.45%; a couple of weeks ago, it hit 3%.

The theory behind not having a taper was that the yield curve would go down. When Bernanke announced there would be no taper, the yield curve was 2.86%. Now, it’s 2.75%. There has been almost no impact. If the 10-year Treasury goes through 3 or 3.25%, we’re going to see Armageddon.

TER: Are China and Europe doing any better?

BM: No. China is slowing down. Europe’s in the same situation we are. People need to understand that you cannot spend your way to prosperity. You can only save your way to prosperity.

Spending the way to prosperity didn’t work for the U.S. and it won’t work for the European Union. The E.U. countries need to get government spending in line with how much money the governments collect. It needs to stop cradle-to-grave subsidies for everything and return to economic reality. After 20 years of crazy growth, China is slowing down, which should be very healthy for its economy.

TER: Angela Merkel was just reelected in Germany, but with a less powerful coalition. Does that restrict her ability to impose austerity on countries like Greece and Portugal?

BM: Austerity is one of those emotionally laden words that is absolutely meaningless. Austerity means living within your means. There is no alternative to austerity. Merkel is in a true dilemma, given that the other twopolitical parties in Germany have said they will not form a coalition with her. She won, but she didn’t win.

TER: Given all that, is the $100+ per barrel ($100+/bbl) price for oil based on conflict fear rather than economic demand?

BM: We passed peak oil in 2005; $100/bbl is the new normal. In a depression, it might go as low as $80/bbl. If there was a real conflict, you could see oil at $300/bbl or $500/bbl. Peak oil has everybody confused. People think it means there is no more oil. There’s still plenty of oil, like shale oil and tar sands oil, but it costs a lot to extract it. The price needs to stay at least $100/bbl for it to be economic. No more cheap oil.

TER: Could a deal with Syria or Iran result in lower gas prices by lessening that conflict fear?

BM: No. I don’t think it’s a supply-based fear. I think it’s an Armageddon fear. The oil price is high because everybody’s afraid we’re going to start World War III, which could well happen.

TER: With all of that going on, are you still investing in energy companies? Are there any safe places left in the world?

BM: The one area I’ve written about in detail lately is the North Island of New Zealand. Two companies down there are doing extraordinarily well.

The first is TAG Oil Ltd. (TAO:TSX.V). On the conventional drilling side, TAG is doing very well. In addition, in the East Coast Basin of the North Island, the company drilled a 4,500-foot hole into shale. To give you an idea, this shale is 300–600 meters (300–600m) thick. By comparison, the Bakken shale is 10–20m thick; in Texas, 30–40m.

That is an absolute home run that the company is being very quiet about. There will be an auction in October and TAG will try to add to its land position then. New Zealand will be a big oil story in five years.

TER: What is the second New Zealand company?

BM: The other is Marauder Resources East Coast Inc. (MES:TSX.V). It has a $7 million ($7M) market cap, but hasn’t done any drilling.

Marauder is riding on TAG’s coattails, which is smart. If TAG hits a home run in the East Coast Basin, it will be a home run for Marauder too. The shale formations tend to go on for hundreds of kilometers. I expect TAG and Marauder to be very aggressive at the auctions in October.

TER: Would Marauder also reach its true potential in the next five years?

BM: I hope so; I own a lot of shares.

TER: You’ve also talked about CBM Asia Development Corp. (TCF:TSX.V) and its coal methane beds. Are you still excited about that?

BM: Yes and no. Coal bed methane and Indonesia are both very exciting, but CBM Asia is just about the worst communicator I’ve seen. Four years ago, the company made a giant mistake by trying to grab as much land as possible. As a result, its costs have gone through the roof and the company isn’t doing anything visible to shareholders. In 2009, the stock was $0.60; today it’s $0.10. The company announced a $15M raise in March and never completed it. Management never told people what was going on.

Going by how much gas it has, CBM Asia should be a $300M or $400M company. Instead, it’s a $16M company that has raised $40M. Management has torn dollar bills in half and thrown them away. CBM Asia could be a home run if you had a change in management first. They should fire the president; he has destroyed a very valuable asset through his lack of communication.

TER: Do any small or midsize producers appeal to you?

BM: I follow the Canadian firm Aroway Energy Inc. (ARW:TSX.V; ARWJF:OTCQX) very closely.

TER: Aroway Energy just increased its reserve estimate by 246%, but there was no correlated increase in its stock price.

BM: Exactly. The company is producing more and it has good management, yet the stock price has been cut in half. It has nothing to do with the merits of the company. It has everything to do with irrational behavior on the part of investors. I’m not concerned over the long term.

TER: Do you like any of the big producers?

BM: I don’t, because they’re like 50,000-pound elephants. When they start moving, they move a lot, but it takes a lot to get them moving.

TER: What about energy services? Does that sector excite you?

BM: Absolutely. For example, Synodon Inc. (SYD:TSX.V) is a home run. It has an extremely effective airborne process for detecting leaks from natural gas or oil. The company has finally gotten traction and is starting to sign more deals. I think it will be very successful over the long term.

TER: Are services a safer play compared to natural gas?

BM: Yes, because natural gas is so cheap. In Indonesia, natural gas is selling at ~$12 per thousand cubic feet ($12/Mcf). But here in North America, it’s ~$3/Mcf. There is a lot of opportunity in energy, regardless of what happens to the economy. It will always be needed in transportation and agriculture.

TER: Given all the scary headlines, what reassurance can you give energy investors?

BM: Here’s what investors need to know: Everybody is aware that gold and silver stocks have gone down, but they don’t realize that many energy stocks have gone down just as much. There has been a giant rush from resources into the mainstream stock market. When that rush changes and people realize that resources are the only safe place to be, things will get interesting.

The worst place to be right now is bonds. The second worst place is the Dow and the S&P. The safest place to be is resources.

TER: Bob, thanks for your time and your insights.

Bob and Barb Moriarty brought 321gold.com to the Internet almost 10 years ago. They later added 321energy.com to cover oil, natural gas, gasoline, coal, solar, wind and nuclear energy. Both sites feature articles, editorial opinions, pricing figures and updates on current events affecting both sectors. Previously, Bob was a Marine F-4B and O-1 pilot with more than 820 missions in Vietnam. He holds 14 international aviation records.

Want to read more Energy Report interviews like this? Sign up for our free e-newsletter, and you’ll learn when new articles have been published. To see a list of recent interviews with industry analysts and commentators, visit our Streetwise Interviews page.

DISCLOSURE:

1) JT Long conducted this interview for The Energy Report and provides services to The Energy Reportas an employee. She or her family own shares of the following companies mentioned in this interview: None.

2) The following companies mentioned in the interview are sponsors of The Energy Report: Aroway Energy Inc. and CBM Asia Development Corp. Streetwise Reports does not accept stock in exchange for its services or as sponsorship payment.

3) Bob Moriarty: I or my family own shares of the following companies mentioned in this interview: CBM Asia Corp., Synodon Inc., Aroway Energy Inc. and Marauder Resources East Coast Inc. I personally am or my family is paid by the following companies mentioned in this interview: None. My company has a financial relationship with the following companies mentioned in this interview: CBM Asia Corp., Synodon Inc., Aroway Energy Inc. and Marauder Resources East Coast Inc. I was not paid by Streetwise Reports for participating in this interview. Comments and opinions expressed are my own comments and opinions. I had the opportunity to review the interview for accuracy as of the date of the interview and am responsible for the content of the interview.

4) Interviews are edited for clarity. Streetwise Reports does not make editorial comments or change experts’ statements without their consent.

5) The interview does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclosure.

6) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned and may make purchases and/or sales of those securities in the open market or otherwise.

Streetwise – The Energy Report is Copyright © 2013 by Streetwise Reports LLC. All rights are reserved. Streetwise Reports LLC hereby grants an unrestricted license to use or disseminate this copyrighted material (i) only in whole (and always including this disclaimer), but (ii) never in part.

Streetwise Reports LLC does not guarantee the accuracy or thoroughness of the information reported.

Streetwise Reports LLC receives a fee from companies that are listed on the home page in the In This Issue section. Their sponsor pages may be considered advertising for the purposes of 18 U.S.C. 1734.

Participating companies provide the logos used in The Energy Report. These logos are trademarks and are the property of the individual companies.

101 Second St., Suite 110

Petaluma, CA 94952

Tel.: (707) 981-8204

Fax: (707) 981-8998

Email: [email protected]