London Gold Market Report

from Adrian Ash

BullionVault

Monday, 1 July 08:05 EST

The PRICE of gold rose hard in Asian trade Monday morning, extending Friday’s strong rally, but slipped back in London to start the third quarter of 2013 with an AM Fix of $1243.50 per ounce.

That was 26% below New Year for US Dollar investors, 21% down in Sterling, and 25% lower in Euros.

Silver also spiked before pulling back, dropping below Friday’s finish at $19.69 per ounce.

Commodity prices rose, major government bonds slipped again, and European stock markets reversed an early fall.

“Friday’s [rally] strikes us as being technical in nature,” says one analyst in a note today, repeating his view that gold bullion fell too hard, too fast and was due a sharp bounce.

“For gold to regain the trust of investors,” Reuters quotes a Hong Kong trader, “it needs at the very least to consolidate for a few days.”

Swiss investment and London bullion bank Credit Suisse last week called the drop in gold prices “shattering” for long-time investors.

Clients of hedge-fund manager David Einhorn’s Greenlight Capital lost nearly 12% in June, according to Reuters, thanks to the fund’s large position in physical gold.

Sales of American Eagle gold bullion coins meantime sank to a 10-month low in June, down more than 80% from the sudden 3-year record set in April, data from the US Mint show.

Gold trust funds traded on stock markets in the developed West last week shrank for the 20th week running, taking the net outflow of bullion for 2013 to nearly 600 tonnes – over one fifth of their holdings at the start of the year.

“There is still room for liquidation should sentiment remain averse,” writes Marc Ground at Standard Bank. But in the futures and options market, “shorting the metal is becoming a crowded trade,” he adds.

Speculative bets against the gold price increased again last week, data from US regulator the CFTC showed late Friday, hitting fresh record highs.

Accounting for bullish and bearish bets amongst those ‘Large Speculators’ using Comex gold futures and options, the so-called “net long” position shrank to a new multi-year low equal to just 102 tonnes by value – down by 79% from New Year and almost 90% below the peak of summer 2011.

“So extreme has the price move been,” says a note on gold bullion from Australia’s Macquarie Bank, “we’re tempering our bearishness.

“Financial markets, and in particular the gold market, appear to have got ahead of themselves on QE tapering and the potential for higher interest rates.”

Friday this week will bring the latest US non-farm payrolls employment report, typically a key data point for analysts and traders.

Before that, both the Bank of England (under new chief Mark Carney) and European Central Bank will vote on their monetary policy Thursday.

“We believe that an interim low is now in place,” says Germany’s Commerzbank in a chart analysis of gold bullion prices today.

“A corrective move higher towards the $1321.50 April low is now underway.”

“We could see gold move back toward $1100 an ounce in the short term,” counters Mark Pervan at ANZ Banking Group, speaking to Bloomberg TV.

“[But] I don’t think it’s sustainable at that level. Lower prices will induce strong demand in Asia.”

New data from China – set to overtake India in 2013 as the world’s #1 gold consumer according to some analysts – today showed manufacturing activity shrinking at the fastest pace since September on the unofficial Purchasing Managers’ Index compiled by HSBC and Markit Economics.

Turkey meantime imported 44 tonnes of gold bullion in June, widening the country’s trade deficit and further extending the rise in gold demand in the world’s fourth largest consumer.

Over in India, and putting aside the recent duty hikes and import restrictions, households could buy 10% more gold at current world prices, The Hindunewspaper reports, if it weren’t for the Indian Rupee’s sharp drop to record lows on the currency markets.

Vietnamese capital Hanoi yesterday saw customers “flood gold stores to purchase gold bullion”, official daily newspaper the Saigon Giai Phong reports, thanks to the continued fall in prices.

“In Tran Nhan Tong Street where dozen gold stores locate, many local gold buyers gathered causing traffic congestion.”

Adrian Ash

BullionVault

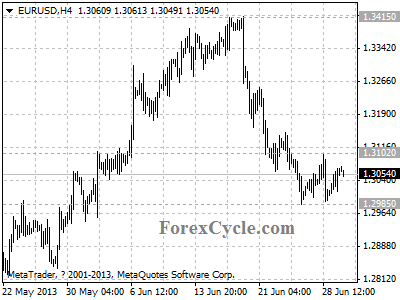

Gold price chart, no delay | Buy gold online

Adrian Ash is head of research at BullionVault, the secure, low-cost gold and silver market for private investors online, where you can buy gold and silver in Zurich, Switzerland for just 0.5% commission.

(c) BullionVault 2013

Please Note: This article is to inform your thinking, not lead it. Only you can decide the best place for your money, and any decision you make will put your money at risk. Information or data included here may have already been overtaken by events – and must be verified elsewhere – should you choose to act on it.