Article by Investment U

| View the Investment U Video Archive |

In focus this week: Can MSFT take on AAPL, the first sign of the coming blood bath in bond funds, and of course, the SITFA.

First Up, MSFT

A recent Journal article described MSFT as gearing up to take on AAPL. According to a former employee, MSFT may be making the Xbox, a game console, the new primary focus of the company.

The Xbox, you head me correctly. A gaming console folks play games on.

It seems many Xbox users are already using the device to stream Netflix on their TVs now, and this little giant seems to have all kinds of possibilities in the media area.

Remember, media is where AAPL is headed next with AAPL TV. So maybe this isn’t as far-fetched as it seems.

If MSFT can market the new Xbox 720 as a media center PC, not just a game console, we may have something here. The Journal article says they could have the market to themselves.

MSFT moved their operating system genius David Cutler to the Xbox division in January. Cutler is the person responsible for Windows 2000 and everything at MSFT since has stemmed from the Windows 2000 program.

If MSFT can produce a branded computer like AAPL’s Mac, the box industry could get very interesting, very quickly.

This one definitely deserves to be followed very closely. Put it on your bogey boards.

The First Crack in Bond Funds

If you follow me here or in the IU Daily articles, you know I’ve been warning folks for some time to get out of any bond fund with leverage or with maturities over five years; both, in fact. Well, the first indication of what you can expect hit the markets in the past few weeks.

The 10-year bond yield jumped a meager 0.25%. It was no big deal; it went from 1.97 to about 2.23, peanuts in the big scheme of things. But it was a real shocker to bond funds.

The iShares 20-year Treasury fund plunged 4.1%. That’s like the Dow crashing 500 points. That was from a minor blip in the 10-year. What do you think will happen when rates run up a point or two? And it is going happen…

A 500-point equivalent drop on just a 0.25% increase on just the 10-year Treasury. The Fed hasn’t budged!

One reader who wrote into the Journal said he lost the equivalent of two years of income on this dip… two years of income. And this isn’t limited to treasuries.

The Nuveen Municipal Fund, one of the oldest and most respected in the business, its share price fell 6.3% in four days when the yield spiked on the 10-year.

The reasons for the losses now and in the future haven’t changed; long maturities to help boost the yield of funds to attract investors and leveraging to boost the yield even further to, of course, attract rate pigs, which most people are.

You can hold bonds, but you cannot hold leveraged bond funds or long maturities, they’re the kiss of death. You must buy individual bonds so you can control the maturities and not have any leveraging in your portfolio. I write about this type of investment all the time at IU.

If you think a 6% drop is big, you haven’t been around long enough. Look for the shares of very heavily leverage funds to drop 50% and 60% when things really get rolling. Most of it will never be recovered.

In 1994, I watched billions disappear, forever, and we’re in a much more threatening environment now than then. We are at 0% rates; I have never seen 0% rates in the 30 years I’ve been in the markets.

This rate environment guarantees one thing; rates will move up. The only issue is when and how quickly.

Make the move now. If you’ve been in bond funds for a while, you should have a very hefty profit. Take it now or forever hold your peace.

This will be a silent blood bath because there’s almost no coverage of the bond market and most people don’t even understand what drives it up and down. Silent but deadly!

Get out now!

Here’s a quick follow up to a story I did a few months ago on IGT, International Game Technology.

At that time they had just paid a bundle for an online gaming company in a bid to capture the at-home gambler who wants to play poker and black jack online.

Well, the numbers since then have been really good. Casinos are opening all over the U.S. and IGT has a 50% market share of the most profitable part of the whole gambling world, slot machines.

Ohio alone is opening four casinos this year. Morgan Stanley estimates casinos will add 20,000 new slots this year alone.

IGT has 50% of the almost one million slot machines in the U.S. and expects 40% to 50% of the new orders this year. Overseas they have a 10% to 20% share.

Slots produce 70% to 80% of casino revenue and IGT leases their machines to the casinos for a percentage of the revenue.

But the stock is well below its historic multiples. The PE has historically run around 20 and sits at about 14 now, well below its expected 20% earnings growth for next year.

MS has a $20 price target on it this year and cites increasing unit sales, increasing market share in Asia and a stock buy back, $100 million this year, as reasons to own it.

IGT, this one isn’t a one-arm bandit!

And yes, the reason you folks really watch this video, the SITFA.

I wanted to thank all the folks at the IU Conference in San Diego last week for all the nice comments about the SITFA. I’m glad you all enjoy it so much.

This week’s cheek smacker is delivered by a Princeton physicist to President Obama and all the other folks who have been running around screaming about global warming.

According to Dr. William Happer, all of the computer models that have been predicting global doom from rapidly rising temperatures are just wrong, again.

Happer say most of the warming of the atmosphere that followed the little ice age at the beginning of the nineteenth century occurred in the early part of the nineteenth century before we started pouring CO2 into the atmosphere.

In fact, in the past 10 years, there has been no increase in temperature at all. Not just that, but this past February when many parts of the U.S. saw higher than average temps, an event we also saw in 1942, according to Happer, the satellites that record the earth’s temperature actually recorded a slight decrease in temp of about 0.12 degrees Celsius.

How can so many people in Washington be so wrong, so often, about so much, not just our weather? Sometime these folks seem really dumb. It’s scary.

Article by Investment U

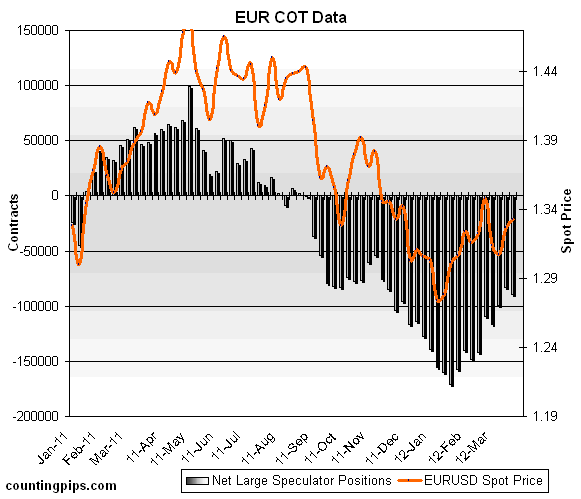

Tradervox (Dublin) – Euro opened up by 20 pips but soon closed up the gap during the Asian session. The Euro recovered during the late European session to print a fresh high of the day at 1.3380. But during the European session, the pair started losing the levels and has printed a fresh low for the day at 1.3323.

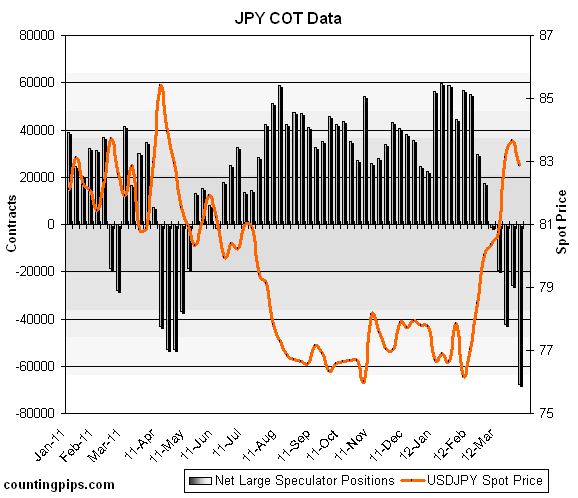

Tradervox (Dublin) – Euro opened up by 20 pips but soon closed up the gap during the Asian session. The Euro recovered during the late European session to print a fresh high of the day at 1.3380. But during the European session, the pair started losing the levels and has printed a fresh low for the day at 1.3323. Tradervox (Dublin) – The yen closed its first quarter at its lowest since 1995 against major currencies. This resulted from the Bank of Japan’s decision to continue with its plan of asset purchases. This has been a much talked about operation with the Bank of Japan governor indicating that this was always an option for the country. The BOJ deflation efforts have worked so far with the currency falling by 10.4 percent in the first quarter of the year.

Tradervox (Dublin) – The yen closed its first quarter at its lowest since 1995 against major currencies. This resulted from the Bank of Japan’s decision to continue with its plan of asset purchases. This has been a much talked about operation with the Bank of Japan governor indicating that this was always an option for the country. The BOJ deflation efforts have worked so far with the currency falling by 10.4 percent in the first quarter of the year.