Source: Streetwise Reports (2/26/24)

Artificial intelligence (AI) and digital wallet provider firm Fobi AI Inc. announced it is one of ten companies picked from 1,500 applicants for the Comcast NBCUniversal SportsTech Accelerator program. Find out why one technical analyst says this company’s stock is about to break out into a bull market.

Artificial intelligence (AI) and digital wallet provider firm Fobi AI Inc. (FOBI:TSX) announced it is one of ten companies picked from 1,500 applicants for the Comcast NBCUniversal SportsTech Accelerator program.

The six-month program gives company officials opportunities to collaborate with leading sports brands like NBC Sports, NASCAR, the Premier League, the PGA Tour, Sky Sports, Comcast Spectator, and U.S. Olympic sports organizations, Fobi AI said.

Since it started in 2021, alumni of the SportsTech program have achieved 132 pilots, partnerships, and commercial deals with consortium partners.

“It’s an extraordinary opportunity for us to not only enhance our visibility but also establish direct connections within the partner network,” Fobi AI Chief Executive Officer Rob Anson said.

Fobi AI leverages AI, automation, and analytics to deliver data-driven, real-time applications to deliver speed, connectivity, and interoperability, according to its investor presentation. With recent acquisitions, the company is expanding its presence in the rapidly expanding digital wallet market dominated by companies like Apple and Google.

“But you certainly wouldn’t think so to look at its stock price and, like it or not, these wallets look set to be the future and to be introduced rapidly,” wrote Technical analyst Clive Maund on February 20.

“But you certainly wouldn’t think so to look at its stock price and, like it or not, these wallets look set to be the future and to be introduced rapidly,” wrote Technical analyst Clive Maund on February 20.

Over the past year, Fobi AI’s share price has decreased 83% from CA$0.51 on Feb. 24, 2023, to CA$0.085 on February 23, 2024.

However, Maund said that based on its one-year arithmetic chart, “factors have been in play for many weeks, suggesting that a breakout into a new bull market is incubating, and, furthermore, that it is likely to happen soon.”

Allowing Co.’s to Align Solutions With Potential Partners

In the SportsTech Accelerator program, the company will work with SportsTech advisors and learn market strategy, commercial business alignment, and adaptive business modeling.

“Every facet of our decision-making process aims to unlock startups that can become ‘scale-ups’ ready to impact the world of sports,” said Jenna Kurath, vice president of startup partnerships and head of Comcast NBCUniversal SportsTech. “The SportsTech program focuses not only on tackling complex business challenges for a vast cross-section of some of the world’s most recognized sports brands, but it additionally prepares founders to build sustainable businesses.”

The program is set to begin March 4 in Florida with behind-the-scenes looks at Universal Studios Florida, NASCAR’s Daytona International Speedway, and coverage of the PGA Tour and other sporting events.

This will allow the companies “to identify how to align their technology solutions to the business and operational needs of partners,” Comcast NBCUniversal noted in a release.

“The capstone of the program will take place at Rally Innovation in Indianapolis on August 27-28, 2024, where this year’s founders will showcase their tech innovations, putting a spotlight on their scale-up traction during the program to garner new business opportunities across the broader sports industry,” the release noted.

The Catalyst: Growth of Sectors Here to Stay

The AI and mobile wallet sectors are here to stay and are expected to be the focus of big growth. The company’s investor presentation said AI will generate US$15 trillion in revenue by 2030 and increase business efficiency by 40%. Four out of five companies say AI is a top priority in their business strategy.

By 2026, about 5.2 billion mobile wallet passes will be in use, it said. About 85% of wallet passes are never deleted (while 71% of apps are), and four out of five customers abandon transactions that require apps.

The continued emergence of digital credential digital wallet solutions is “at the forefront of everything that we hear about today,” Anson said in Fobi AI’s conference call with the media about its earnings in January.

Anson said the company operates in 150 countries and provides more than 100 million digital wallets.

“We’ve seen tremendous growth, not just in, of course, the scale of the product, but obviously now from international support with our acquisitions that we’ve made to date and the addition of some of our international tech resource team,” Anson said.

Last year, the company acquired the leading Spanish digital wallet agency Wallet-Com and the leading European digital wallet company Passwortks SA.

“This agreement with Wallet-Com not only marks Fobi’s fifth wallet pass acquisition but also the strategic acquisition of a leading digital wallet agency that will help reinforce Fobi’s strength and scale as a global wallet pass leader,” Anson said when the Wallet-Com transaction was announced. “This collaboration not only broadens our global footprint but also opens doors to exciting new prospects and innovative opportunities.”

Analyst: ‘Upside Breakout Soon’

The mobile wallet market was valued at about US$7.42 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 28.3% from 2023 to 2022, Grand View Research said in a report.

The COVID-19 pandemic had a positive effect on the market, researchers said.

“The pandemic pushed digital transactions and mobile payments across the world,” the report said. “It has accelerated the growth of the e-commerce industry toward new customers, firms, and types of products. For instance, according to the Census Bureau’s Annual Retail Trade Survey (ARTS), in the U.S., sales in the e-commerce sector surged by 43% or (US$)244.2 billion in 2020, the first year of the pandemic.”

Maund agreed that the AI and mobile wallet industries were huge growth markets. In the company’s one-year chart, the downtrend of Fobi AI’s stock has “morphed into a bullish Falling Wedge,” and downside momentum has eased during that period, he noted.

The third bullish factor is the buildup in upside volume since the end of 2023.

“This quite aggressive and persistent buying has been draining off the supply at these levels at quite a rapid rate, setting the stage for an upside breakout soon,” Maund wrote.

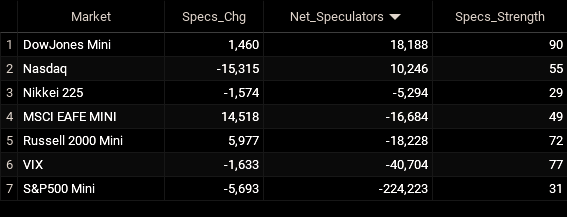

| Retail: 80% |

| Insiders & Management: 20% |

80%

20%

*Share Structure as of 2/26/2024

That tilt toward upside volume has also driven the Accumulation line higher, the analyst said.

“These factors together make a strong case for an upside breakout soon,” Maund wrote.

Ownership and Share Structure

According to the company, about 20% is held by insiders, including the CEO Anson, who has 4.35% personally and 15.45% through Fobisuite Technologies Inc. The rest is with retail.

Fobi AI’s market cap is CA$15.9 million, with 176.65 million shares outstanding, and 141.87 million free floating. It trades in a 52-week range of CA$0.58 and CA$0.07.

Important Disclosures:

- Fobi AI Inc. has a consulting relationship with an affiliate of Streetwise Reports, and pays a monthly consulting fee between US$8,000 and US$20,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Fobi AI Inc.

- Steve Sobek wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Contributor Disclosures:

- Author Certification and Compensation: [Clive Maund of clivemaund.com] is being compensated as an independent contractor by Street Smart, an affiliate of Streetwise Reports, for writing this article. Maund received his UK Technical Analysts’ Diploma in 1989. The recommendations and opinions expressed in this content accurately reflect the personal, independent, and objective views of the author regarding any and all of the designated securities discussed. No part of the compensation received by the author was, is, or will be directly or indirectly related to the specific recommendations or views expressed.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

Clivemaund.com Disclosures

The above represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maund’s opinions are his own, and are not a recommendation or an offer to buy or sell securities. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund’s opinions on the market and stocks can only be construed as a solicitation to buy and sell securities when they are subject to the prior approval and endorsement of a Registered Securities Advisor operating in accordance with the appropriate regulations in your area of jurisdiction.

Article by

Article by