By JustMarkets

US stock indices opened higher on Thursday on positivity from Wednesday, with Federal Reserve Chairman Jerome Powell reiterating his view that it would probably be appropriate to start cutting interest rates at some point this year. But by the end of the trading session, the stock market began a strong selloff amid hawkish comments from FOMC officials. Philadelphia Fed President Harker said inflation is still too high. Minneapolis Fed President Kashkari said a Fed rate cut may not be needed this year if progress on inflation stalls. At yesterday’s close, the Dow Jones (US30) index was down 1.35%, and the S&P 500 (US500) Index fell by 1.35%. The NASDAQ Technology Index (US100) closed negative 1.40%. The S&P 500 and Nasdaq 100 indexes fell to two-week lows, while the Dow Jones Industrials fell to a 2-week low.

The US trade deficit, a key indicator of the country’s economic health, widened to $68.9 billion in February 2024, the highest in ten months. This was up from an upwardly revised $67.6 billion in January, surpassing forecasts of a $67.3 billion deficit. The data reflected a $0.3 billion decline in the goods deficit to $91.4 billion and a $1.6 billion surplus in services to $22.5 billion. Notably, exports rose by 2.3% to a record high of $263 billion, while imports rose 2.2% to $331.9 billion. This data has implications for the dollar index, suggesting a positive trend.

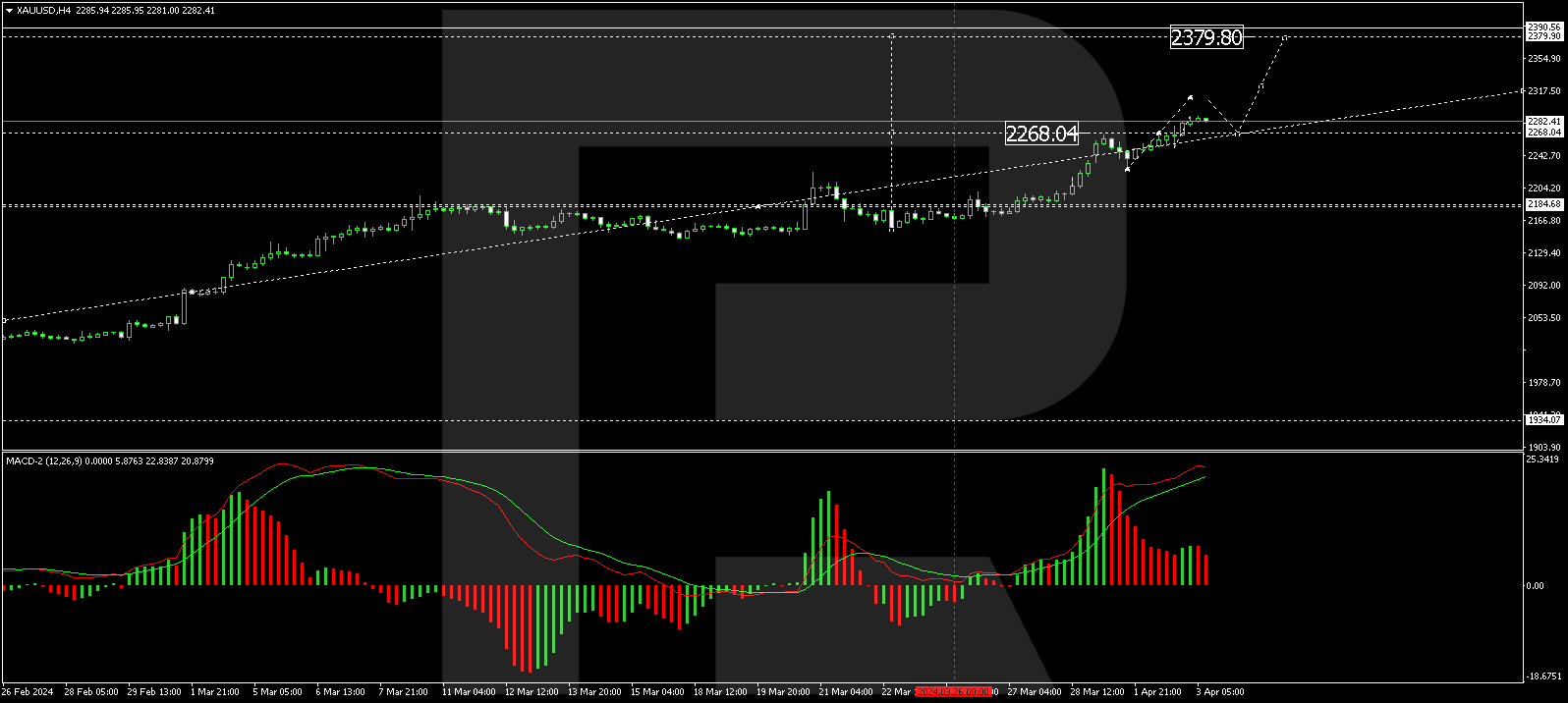

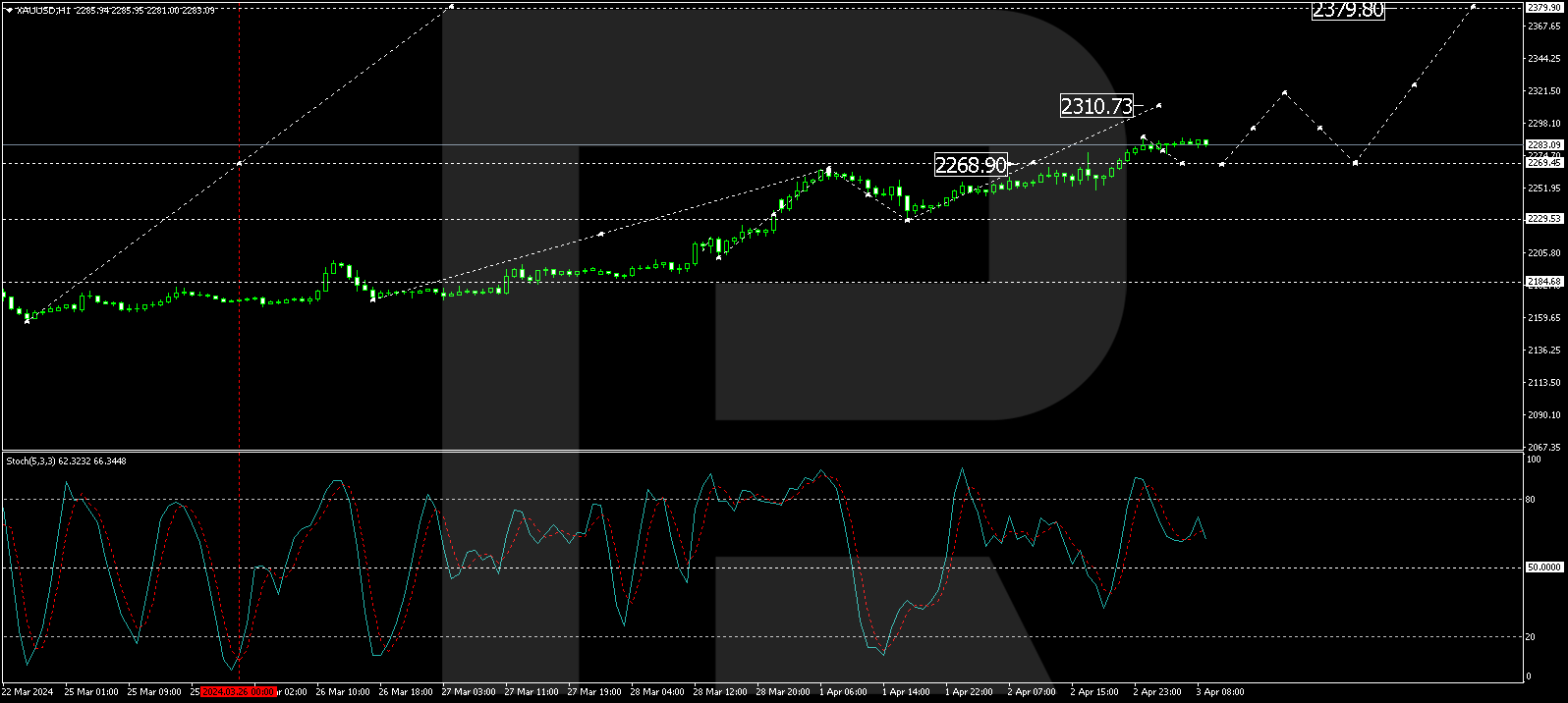

The monthly Nonfarm payrolls labor market report, a crucial economic indicator, is set to be released in the US today. The US economy is expected to have added 205k new jobs in March, maintaining the unemployment rate at 3.9%. However, average hourly earnings are expected to have declined from 4.3% to 4.1% year-over-year. This report will be the focus of investor attention, with many anticipating a soft landing for the economy. If the data set is worse than expected, particularly in terms of wages, it could put pressure on the US dollar, benefiting risk assets and indices. Conversely, if the data set is generally positive, especially if NFP turns out to be hotter than expected, it could delay the likelihood of a rate cut, providing support for the dollar. In such a scenario, indices and gold would come under pressure.

Canada reported a trade surplus of CAD 1.4 billion in February 2024, up from a revised surplus of CAD 0.6 billion in January and well above market forecasts of a CAD 0.8 billion surplus. Exports rose by 5.8% for the month to CAD 66.6 billion.

Equity markets in Europe were mostly up on Thursday. Germany’s DAX (DE40) rose by 0.19%, France’s CAC 40 (FR40) closed yesterday up 0.02%, Spain’s IBEX 35 (ES35) added 0.53%, and the UK’s FTSE 100 (UK100) closed positive 0.48%.

The minutes of the latest ECB meeting showed that policymakers are increasingly confident that inflation will return to the 2% target and that the case for lower interest rates is strengthening. However, they emphasized that they must wait for further data on wages and service prices before taking any steps.

Escalating geopolitical tensions in oil-producing regions, OPEC+ efforts to curb supply and strong energy demand forecasts are provoking further oil price rises.

Asian markets were predominantly down yesterday. Japan’s Nikkei 225 (JP225) was up 0.81%, China’s FTSE China A50 (CHA50) and Hong Kong’s Hang Seng (HK50) were not trading yesterday, while Australia’s ASX 200 (AU200) was positive 0.45%.

The Reserve Bank of India (RBI) held the benchmark repo rate at 6.5% for the seventh consecutive meeting amid continued price pressures. The latest move came after annual inflation stood at 5.09% in February 2024, almost unchanged from January, after hitting a four-month high of 5.69% in December 2023, remaining within the RBI’s target range of 2-6% in the medium term. The RBI governor reiterated its commitment to bring inflation down to 4% on time and sustainably. The central bank also maintained its economic growth forecast for FY 2025 at 7%, with projections of 7.1% in Q1, 6.9% in Q2, and Q3 and Q4 at 7% each.

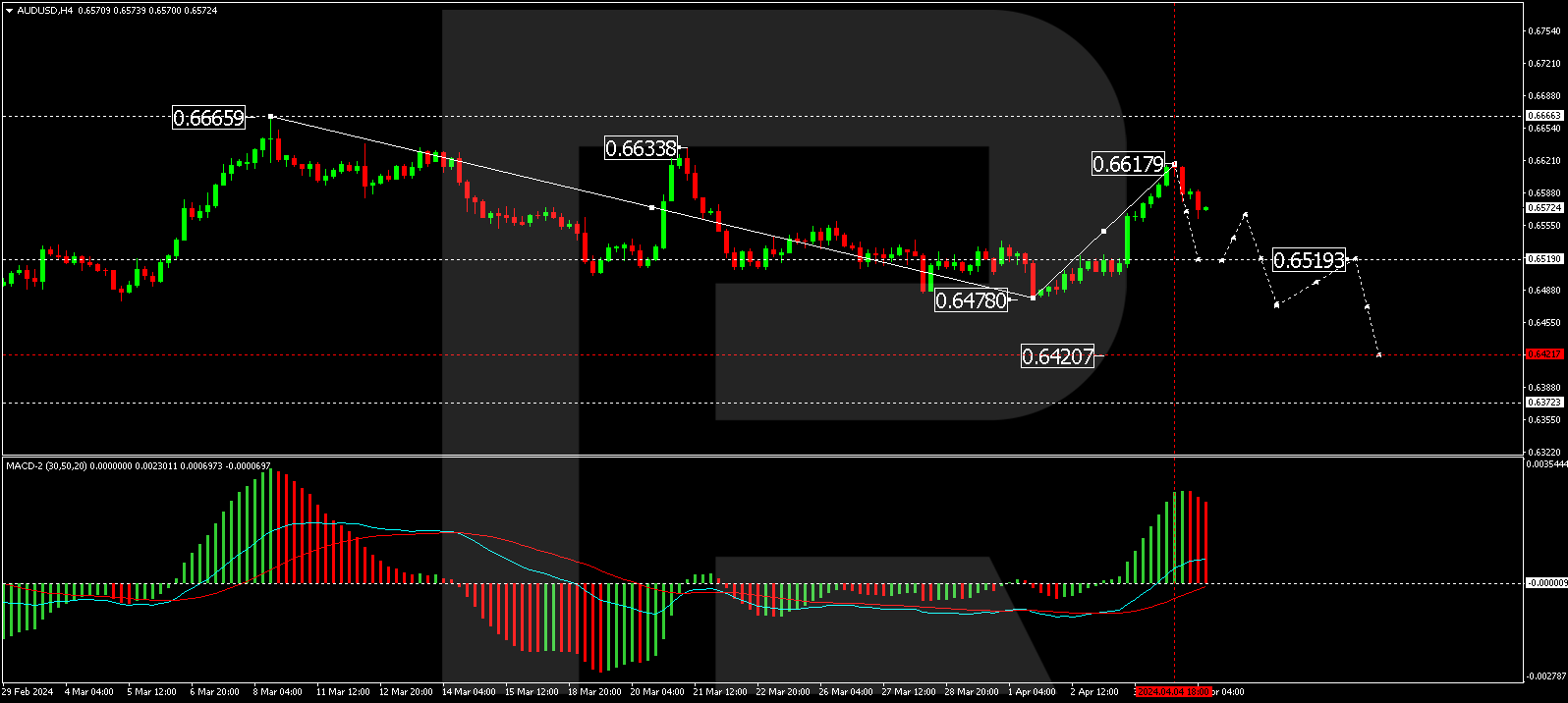

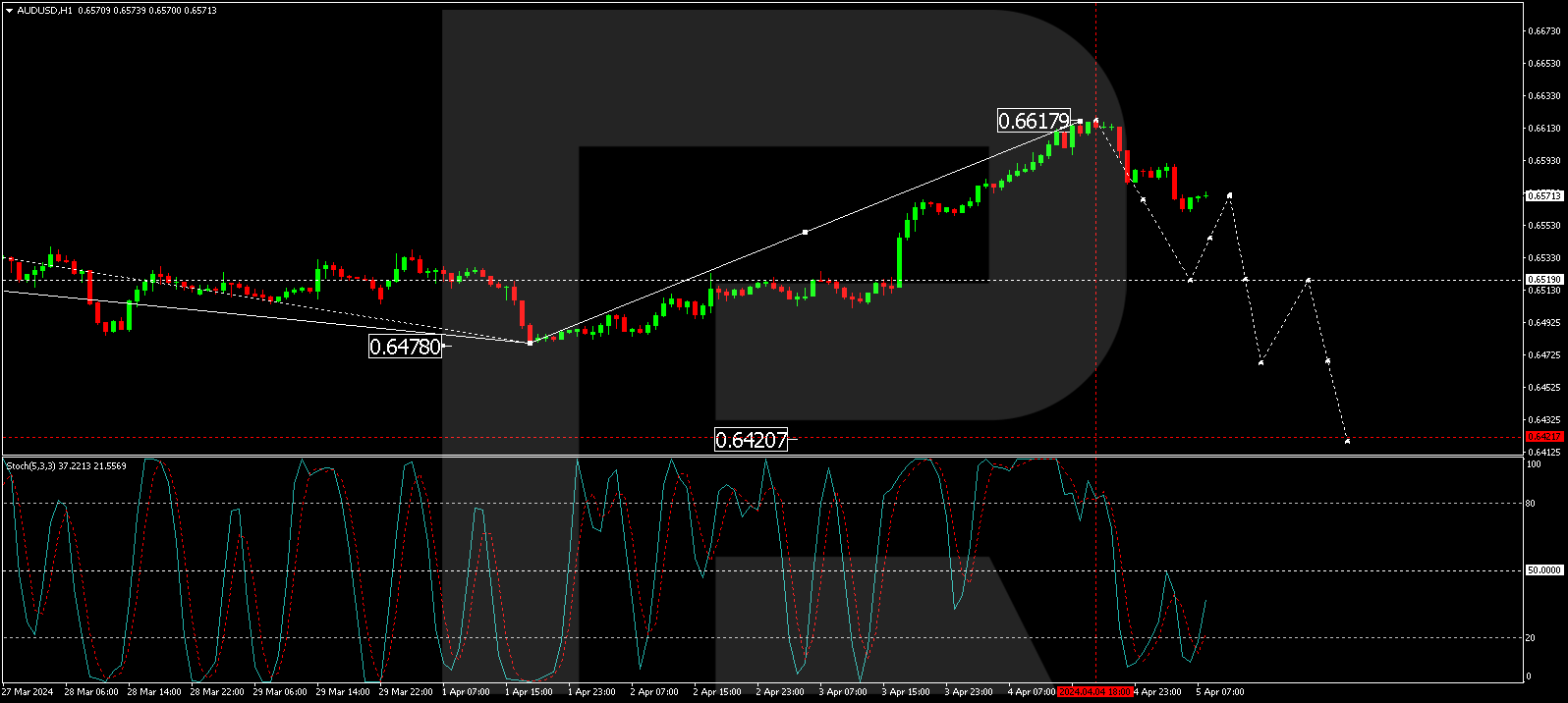

Australia’s trade surplus in goods for February 2024 fell to A$7.28 billion from a downwardly revised A$10.06 billion in the previous month, below market forecasts of A$10.4 billion. It was the smallest trade surplus since September last year as exports fell and imports rose.

S&P 500 (US500) 5,147.21 −64.28 (−1.23%)

Dow Jones (US30) 38,596.98 −530.16 (−1.35%)

DAX (DE40) 18,403.13 +35.41 (+0.19%)

FTSE 100 (UK100) 7,975.89 +38.45 (+0.48%)

USD Index 104.26 −0.55 (−0.53%)

- – Australia Trade Balance (m/m) at 03:30 (GMT+3);

- – UK Construction PMI (m/m) at 11:30 (GMT+3);

- – Eurozone Retail Sales (m/m) at 12:00 (GMT+3);

- – US Nonfarm Payrolls (m/m) at 15:30 (GMT+3);

- – US Unemployment Rate (m/m) at 15:30 (GMT+3).

- – Canada Unemployment Rate (m/m) at 15:30 (GMT+3);

- – Canada Ivey PMI (m/m) at 17:00 (GMT+3).

By JustMarkets

This article reflects a personal opinion and should not be interpreted as an investment advice, and/or offer, and/or a persistent request for carrying out financial transactions, and/or a guarantee, and/or a forecast of future events.

Article by

Article by