By Lukman Otunuga Research Analyst, ForexTime

Jerome Powell soothed market nerves in his semi-annual testimony to Congress yesterday by staying on message about the transitory nature of inflation. He said that the US economy is a “ways off” the Fed’s benchmark of “substantial further progress” towards reaching its employment goal. And with that, markets breathed a large sigh of relief!

The dollar and US Treasury yields fell as markets become increasingly baffled by the Fed sticking to its guns, even as the producer price index from June showed higher than expected inflation, which followed the biggest increase in the consumer price index (CPI) since 2008 that was released on Tuesday. The greenback is softer again this morning with Powell increasingly focused on the labour market which still remains well below pre-pandemic levels. Indeed, he predicted that even after new labour supply comes to meet demand, the US will still be short of maximum employment.

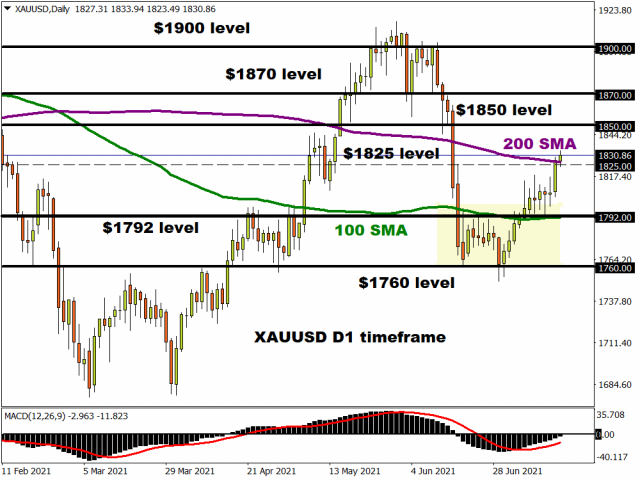

Gold likes the fall in real yields

After breaking out of recent consolidation around $1800, the yellow metal is now trading just above its 200-day moving average as gold bugs looks to push on to $1850. This level would mark a complete retrace of the entire downside in the wake of the June FOMC meeting.

The fresh assurances from Chair Powell helped while US real yields have come under strong pressure this week on the back of the hot June inflation report. A strong weekly close will certainly attract more buyers and help bugs push north towards $1900. The 100-day moving average offers support at the lower end of the recent range at $1792.

Free Reports:

Download Our Metatrader 4 Indicators – Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Download Our Metatrader 4 Indicators – Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Bank of Canada tapers, but RBNZ delivers the big surprise

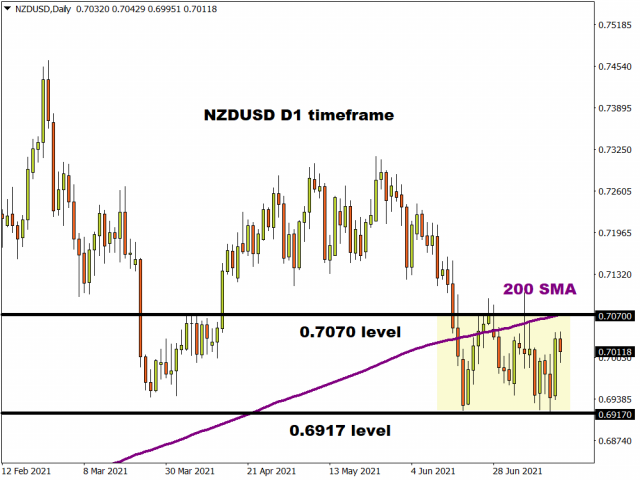

The tapering announcement by the BoC yesterday was expected by markets and the bank maintained its forecast for no rate hikes until at least the second half of the year. But the RBNZ did deliver a surprisingly hawkish message, announcing the end of its current QE programme next week and pointing to a rate hike that may come at the end of this year. All the RBNZ meetings are now “live” with the markets pricing in more a 50% chance of a move at its next meeting in August. Key to this will be tomorrow’s inflation data and then the jobs report early next month.

NZD/USD made new seven-month lows at 0.6917 before the meeting on the back of dollar strength. The pair has moved back into the recent range with bulls aiming to move above the 200-day moving average at 0.7070.

Disclaimer: The content in this article comprises personal opinions and should not be construed as containing personal and/or other investment advice and/or an offer of and/or solicitation for any transactions in financial instruments and/or a guarantee and/or prediction of future performance. ForexTime (FXTM), its affiliates, agents, directors, officers or employees do not guarantee the accuracy, validity, timeliness or completeness, of any information or data made available and assume no liability as to any loss arising from any investment based on the same.

Article by ForexTime

Article by ForexTime

ForexTime Ltd (FXTM) is an award winning international online forex broker regulated by CySEC 185/12 www.forextime.com

- 3 Signs of Developing U.S. Economic Slowdown Apr 19, 2024

- Israel has retaliated against Iran. Investors run to safe assets Apr 19, 2024

- Gold hits record high amid growing geopolitical tensions Apr 19, 2024

- The US natural gas prices fell to a 2-month low. A drop in the technology sector on Wednesday had a negative impact on the broad market Apr 18, 2024

- Target Thursdays: Cocoa, Bitcoin and USDCHF hit targets! Apr 18, 2024

- British Pound shows signs of recovery amid favourable inflation data Apr 18, 2024

- Indices decline amid hawkish comments from the Fed. Investors are waiting for Israel’s answer Apr 17, 2024

- EURGBP: Slams into support on hot UK inflation Apr 17, 2024

- Brent crude prices dip amid concerns over global demand Apr 17, 2024

- Stock indices sell-off amid rising geopolitical tensions in the Middle East. China’s GDP grew the most in a year Apr 16, 2024