By Han Tan Market Analyst, ForexTime

On 1 July, OPEC+ is due to decide on its August production levels. Markets are expecting this coalition of 23 oil-producing nations to raise its collective output by another 500,000 barrels per day (bpd).

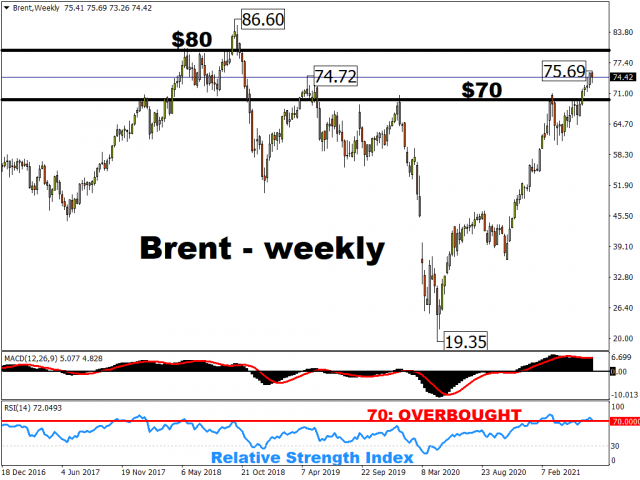

A decision this Thursday that deviates greatly from that 500k figure could rock Brent oil, which is currently trading around its highest levels since October 2018.

‘Markets Extra’ Podcast: OPEC+ Preview – Could a cautious cartel pave the way for $100 Brent?

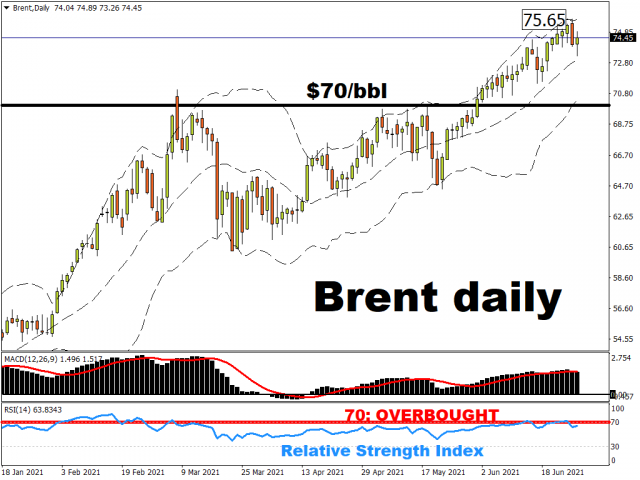

From a technical perspective, traders appear to have done oil bulls a favour by clearing some of the froth in prices and easing away from overbought conditions. This is evidenced by Brent’s pulling away from its upper Bollinger band and moderating closer to its 20-day simple moving average (SMA), while its 14-day relative strength index has dipped into sub-70 domain for the time being. There are also repositionings in the futures markets, with a key contract set to expire tomorrow (30 June) that’s prompting some easing of oil prices.

Free Reports:

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

Still, it’s definitely worth a moment to take stock of Brent futures’ stellar performance in numbers:

- So far in June: +8.4%

- So far in 2021: +46.3%

- Past 12 months: +70.7%

- Notched 5 consecutive weekly gains

- Set to wrap up a 5th consecutive quarterly advance

Why are oil prices climbing?

Oil prices are riding on the back of a rosier global demand outlook. With more people embarking on their summer vacations across the US and Europe while factories round the world continue ramping up production, such economic activity has led to more consumption of oil.

So much so that global demand is now said to be nearing pre-pandemic levels of around 100 million bpd (to be sure, according to the International Energy Agency, that demand level might only be achieved at the end of next year).

Over on the supply side, OPEC+, which controls about half of the total oil production worldwide, hasn’t drastically loosened the oil taps to be surging global demand. Instead, they’ve been adopting a cautious approach, meeting every month to raise output in measured amounts.

To put that into figures, OPEC+ has only so far restored about 40% of the near-10 million bpd they’ve withheld amid the throes of the global pandemic.

In other words, they’ve got plenty of production capacity left idling, as the coalition bides their time before unleashing it back into the markets, depending on whether global economic conditions are robust enough to absorb the incoming barrels.

And to the credit of OPEC+, that strategy has paid off!

So much so that the negative oil prices (WTI crude futures) that flabbergasted the world back in April 2020 now seems like a distant memory with prices having skyrocketed by over 280% since that trough.

The cautious cartel

Despite the vastly improving global demand levels, that doesn’t mean that OPEC+ is raring to flood the world with oil. There are still notable risks that are being taken into account:

- US-Iran nuclear talks

The US and Iran are engaged in long, drawn-out talks about lifting economic sanctions on the latter should both agree to a nuclear deal. From OPEC+’s perspective, the concern is that the lifting of those sanctions could see Iran shipping out an estimated 2 million bpd to customers around the world. That could dent the supply plans by OPEC+, in that if the coalition were to ramp up production at the same time that more Iranian oil is coming back online, that could drag oil lower.

- Developments pertaining to the delta variant

The delta (and delta-plus) variant of the coronavirus is making its way across major economies. It has warranted enough concern to delay the UK economy’s full reopening, trigger fresh lockdowns across half of Australia, and is fast becoming the dominant strain in the likes of France and Germany. Should its spread curtail the ability of major economies to throw off the shackles of Covid-19, then that could dampen economic activity and suppress global demand.

Could we see $80 oil in July?

Overall, the idea that global oil markets are set to remain in deficit is a notion that’s supportive for oil prices. According to OPEC+ estimates in May, the supply-demand gap would stand at around 1.9 million bpd in August. And even if this alliance of 23 nations would pump out another 500k bpd in August, that would still leave global oil markets in a deficit (not enough supply to meet rising demand).

Hence, when adopting such an outlook, oil’s downside appears limited, with bulls potentially hoping for a positive surprise.

A smaller-than-expected output hike this week should send oil prices closer to the psychologically-important $80/bbl mark.

Disclaimer: The content in this article comprises personal opinions and should not be construed as containing personal and/or other investment advice and/or an offer of and/or solicitation for any transactions in financial instruments and/or a guarantee and/or prediction of future performance. ForexTime (FXTM), its affiliates, agents, directors, officers or employees do not guarantee the accuracy, validity, timeliness or completeness, of any information or data made available and assume no liability as to any loss arising from any investment based on the same.

Article by ForexTime

Article by ForexTime

ForexTime Ltd (FXTM) is an award winning international online forex broker regulated by CySEC 185/12 www.forextime.com

- The US natural gas prices fell to a 2-month low. A drop in the technology sector on Wednesday had a negative impact on the broad market Apr 18, 2024

- Target Thursdays: Cocoa, Bitcoin and USDCHF hit targets! Apr 18, 2024

- British Pound shows signs of recovery amid favourable inflation data Apr 18, 2024

- Indices decline amid hawkish comments from the Fed. Investors are waiting for Israel’s answer Apr 17, 2024

- EURGBP: Slams into support on hot UK inflation Apr 17, 2024

- Brent crude prices dip amid concerns over global demand Apr 17, 2024

- Stock indices sell-off amid rising geopolitical tensions in the Middle East. China’s GDP grew the most in a year Apr 16, 2024

- New FXTM commodity hits all-time high! Apr 16, 2024

- NZD hits five-month low against strong US dollar Apr 16, 2024

- Escalating conflict in the Middle East is forcing investors to shift funds to safe assets Apr 15, 2024