By Han Tan Market Analyst, ForexTime

The $1900 mark has been pushed further out from gold’s reach ahead of the keenly-awaited, two-day Fed meeting which begins today.

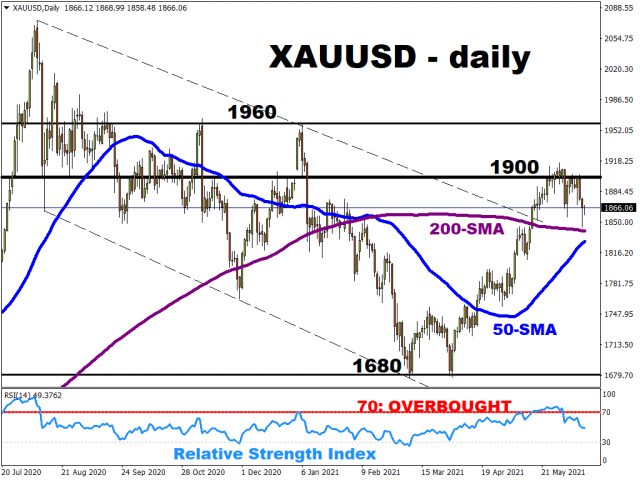

Since breaching the psychologically-important level in May, the precious metal has declined about 2.5% so far this month, posting a lower high and a lower low on the daily charts.

To be fair, after posting the double-bottom on 30 March, spot gold has advanced by more than 10% even after taking into account June’s declines. However, what’s of particular note is the fact that it has since struggled to punch significantly past $1900.

‘Markets Extra’ Podcast: Gold prices and the two “magic” T-words

Free Reports:

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Why are gold prices struggling to climb higher?

Gold bulls’ June frustrations so far stem from a US dollar that’s refusing to buckle under the weight of a dovish Fed, and the relative resilience of real yields on US Treasuries; both have moved higher coming into this week.

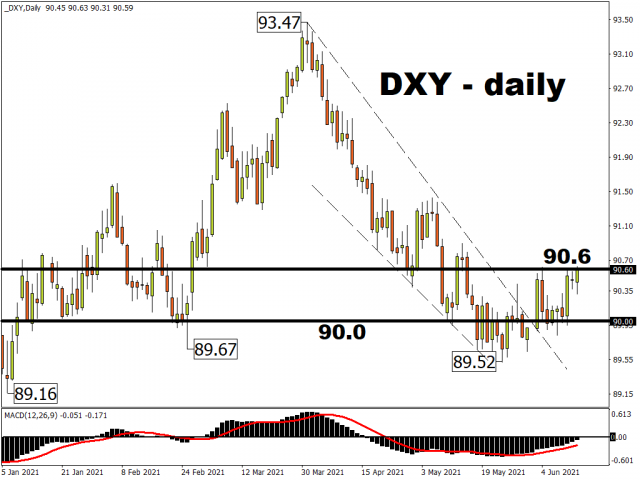

Despite a 3-month low for nominal yields on 10-year Treasuries, which the greenback tracks rather closely, the dollar index (DXY) has been able to keep its head above the psychological 90 level.

Similarly, the real yields on 10-year Treasuries have refused to fall deeper into negative territory, hovering around the minus 0.9 percent mark at the time of writing. Note the inverse relationship between gold prices and real Treasury yields (when real yields rise, gold falls, and vice versa).

It looks like both the DXY and 10-year real yields have to climb a leg lower (think sub-90 DXY and 10-year real yields that are closer to negative one percent) before the precious metal can enjoy another gust of tailwinds.

The crucial immediate question is, will the Fed produce those bullish cues for gold this week?

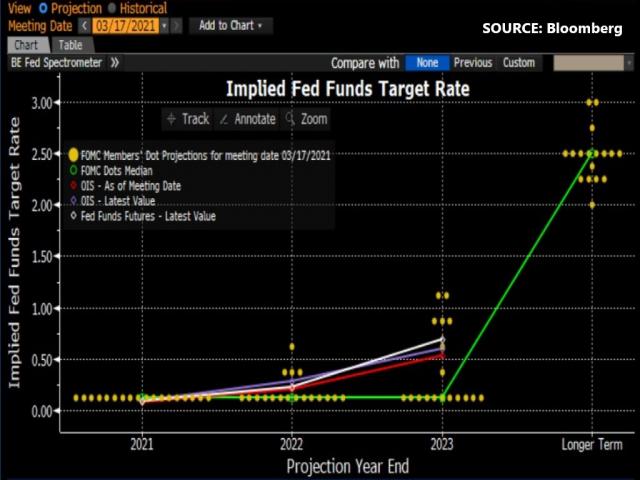

First things first, the Fed is widely expected to leave its policy settings untouched at the June meeting. That means interest rates remain near-zero, and the Fed presses on with its $120 billion in monthly asset purchases that’s supported financial markets since the pandemic broke out.

Also, the Fed has often repeated its stance that inflationary pressures in play at the moment are expected to be transitory. So instead of looking at inflation overshoots, policymakers want to see a more equitable and “broad-based” recovery in the US labour market before easing up on their support.

It’s highly unlikely that the Fed would want to rock global financial markets. I’m sure policymakers would want to avoid a repeat of the infamous ‘taper tantrum’ from 2013.

The key here is for the Fed to convey its policy intentions clearly, allowing market participants plenty of time to digest the central bank’s messaging.

And what is this message that markets are so eager to hear?

It’s when, or under what economic conditions, would the Fed start to taper its $120 billion in monthly asset purchases.

And those cues could arrive from any of these channels on Wednesday:

- The language used in the FOMC statement

- The updated economic projections

- The words employed by Fed Chair Jerome Powell during his post-meeting press conference

- The FOMC dot plot (which denotes each FOMC member’s outlook for US interest rates)

Should any of these channels offer cues that the Fed’s tapering is coming sooner than expected, such hawkish tones could see spot gold testing its 200-day simple moving average as a key support level. However, if the Fed coos signals that are more dovish-than-expected, that could spell a return to $1900 for the precious metal while potentially sealing a ‘golden cross’ for spot gold whereby its 50-day simple moving average can cross above its 200-day counterpart.

READ MORE: 6 reasons behind gold’s recent climb

Disclaimer: The content in this article comprises personal opinions and should not be construed as containing personal and/or other investment advice and/or an offer of and/or solicitation for any transactions in financial instruments and/or a guarantee and/or prediction of future performance. ForexTime (FXTM), its affiliates, agents, directors, officers or employees do not guarantee the accuracy, validity, timeliness or completeness, of any information or data made available and assume no liability as to any loss arising from any investment based on the same.

Article by ForexTime

Article by ForexTime

ForexTime Ltd (FXTM) is an award winning international online forex broker regulated by CySEC 185/12 www.forextime.com

- Israel has retaliated against Iran. Investors run to safe assets Apr 19, 2024

- Gold hits record high amid growing geopolitical tensions Apr 19, 2024

- The US natural gas prices fell to a 2-month low. A drop in the technology sector on Wednesday had a negative impact on the broad market Apr 18, 2024

- Target Thursdays: Cocoa, Bitcoin and USDCHF hit targets! Apr 18, 2024

- British Pound shows signs of recovery amid favourable inflation data Apr 18, 2024

- Indices decline amid hawkish comments from the Fed. Investors are waiting for Israel’s answer Apr 17, 2024

- EURGBP: Slams into support on hot UK inflation Apr 17, 2024

- Brent crude prices dip amid concerns over global demand Apr 17, 2024

- Stock indices sell-off amid rising geopolitical tensions in the Middle East. China’s GDP grew the most in a year Apr 16, 2024

- New FXTM commodity hits all-time high! Apr 16, 2024