By Lukman Otunuga Research Analyst, ForexTime

Never bet against all the doubters who say the mighty dollar is down and out? (Or even many esteemed Wall Street analysts who forecast the greenback would sink all year due to structural issues and deficits). The world’s reserve currency is heading for its best week in nearly nine months after the surprise change in tone from the Federal Reserve on Wednesday continues to rattle markets and fundamental positioning.

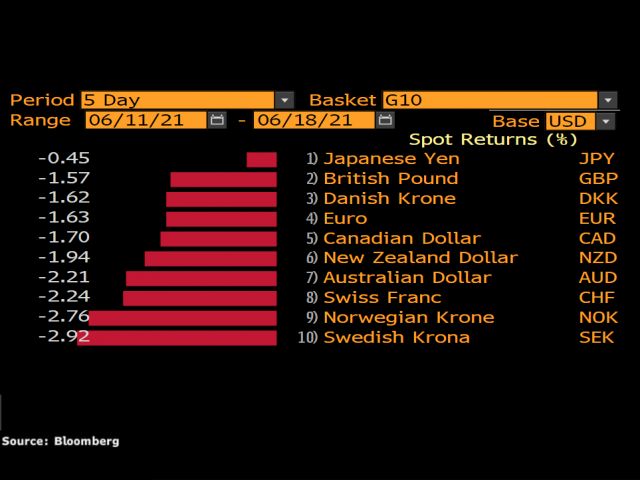

A market accustomed to liquidity on tap from a “patient” Fed has had to face the reality that a tightening is coming far sooner than it previously thought. Short positions in the dollar are being furiously unwound with broad measures of the trade-weighted dollar rallying around 1.5% this week, rising over 1.6% versus the euro and a bigger than 2% versus AUD. There is now an end point to zero rates, tapering discussions have commenced and position adjustment is now taking place in full effect!

EUR/USD dips below 1.19

The world’s most traded currency pair has tanked another big figure from 1.21 to 1.20 to below 1.19 this morning. Support zones have been smashed with the trade-weighted dollar kissing 92 in its widely-watched index.

Free Reports:

Download Our Metatrader 4 Indicators – Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Download Our Metatrader 4 Indicators – Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Given that it is heavily weighted towards the European low yielding currencies, the short-term bull trend may have more legs to it. With a quiet calendar for today, current sentiment and momentum to wrap up this tumultuous week will be instrumental in where we close.

The ECB will be happy to distance itself from the Fed with its currency falling and so keeping financing conditions loose through the summer. With a Fib level around 1.1950 (38.2% of this year’s high to low move) taken out yesterday, the next support level comes in around the psychological 1.19 mark before 1.1835.

GBP suffering today

Just released UK retail sales figures for May disappointed with a reading of -1.4% versus the expected +1.5%. However, the decline marks only a modest correction after the surge in the previous month when shops reopened their doors. Analysts predict that rising confidence and pent-up savings should help retailers over the summer, especially if overseas holiday trips are curtailed.

GBP has been a relative outperformer this week, at least compared to the commodity currencies, but ongoing Brexit issues may cast a shadow over sterling going forward with the risk of protocols being triggered and possibly even tariffs being threatened as the war of words between London and Brussels intensifies. Cable has dropped through the long-term trendline and is also now trading below the 100-day SMA. Loss of support in the low 1.39 area is targeting a move down to 1.3800/10.

Disclaimer: The content in this article comprises personal opinions and should not be construed as containing personal and/or other investment advice and/or an offer of and/or solicitation for any transactions in financial instruments and/or a guarantee and/or prediction of future performance. ForexTime (FXTM), its affiliates, agents, directors, officers or employees do not guarantee the accuracy, validity, timeliness or completeness, of any information or data made available and assume no liability as to any loss arising from any investment based on the same.

Article by ForexTime

Article by ForexTime

ForexTime Ltd (FXTM) is an award winning international online forex broker regulated by CySEC 185/12 www.forextime.com

- Indices decline amid hawkish comments from the Fed. Investors are waiting for Israel’s answer Apr 17, 2024

- EURGBP: Slams into support on hot UK inflation Apr 17, 2024

- Brent crude prices dip amid concerns over global demand Apr 17, 2024

- Stock indices sell-off amid rising geopolitical tensions in the Middle East. China’s GDP grew the most in a year Apr 16, 2024

- New FXTM commodity hits all-time high! Apr 16, 2024

- NZD hits five-month low against strong US dollar Apr 16, 2024

- Escalating conflict in the Middle East is forcing investors to shift funds to safe assets Apr 15, 2024

- US dollar exhibits remarkable strength amid global tensions Apr 15, 2024

- COT Metals Charts: Speculator bets led higher by Copper & Platinum Apr 13, 2024

- COT Bonds Charts: Speculator Bets led by 10-Year & 5-Year Bonds Apr 13, 2024