Article By RoboForex.com

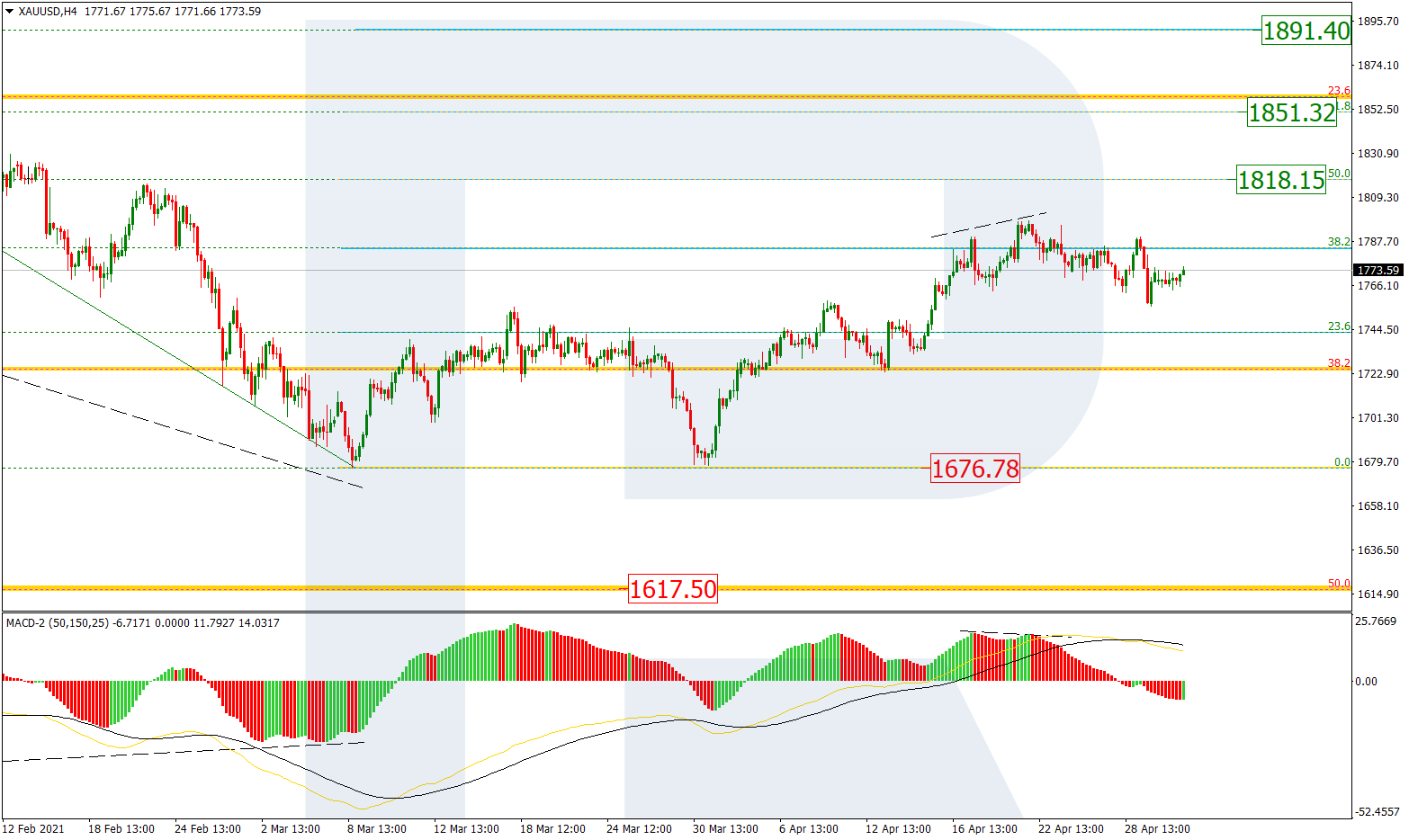

XAUUSD, “Gold vs US Dollar”

As we can see in the H4 chart, a local divergence on MACD made XAUUSD complete the ascending wave at 38.2% fibo and start a new pullback to the downside. After the pullback is over, the rising dynamics may resume towards 50.0%, 61.8%, and 76.0% fibo at 1818.15, 1851.32, and 1891.40 respectively. The scenario that implies a further downtrend towards the low at 1676.78 is very unlikely.

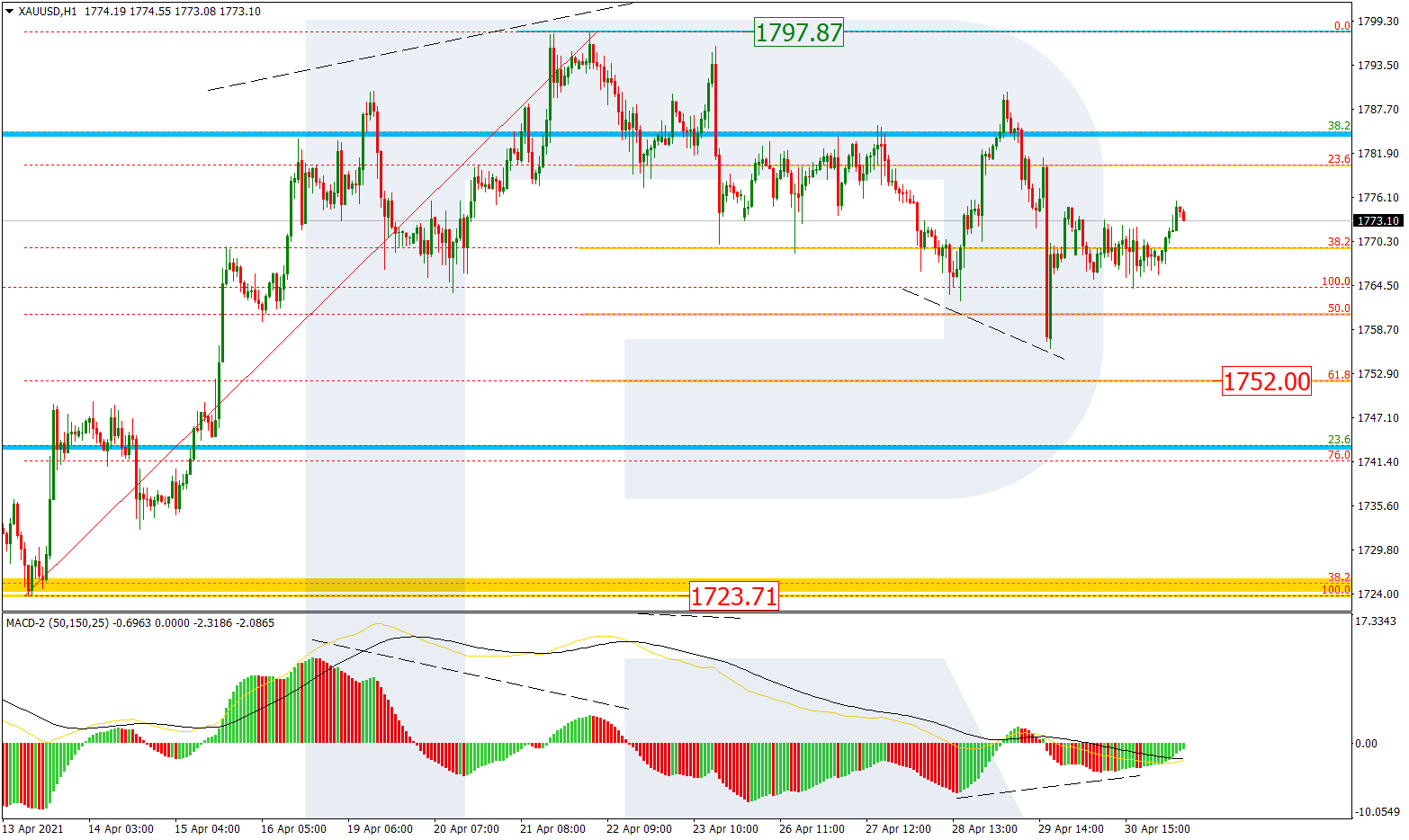

In the H1 chart, a convergence on MACD made the pair stop the correctional downtrend at 50.0% fibo and start a new growth. There is a possibility of another descending impulse towards 61.8% fibo at 1752.00 but the key scenario implies a further uptrend to reach the current high at 1797.87.

Free Reports:

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Download Our Metatrader 4 Indicators – Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Download Our Metatrader 4 Indicators – Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

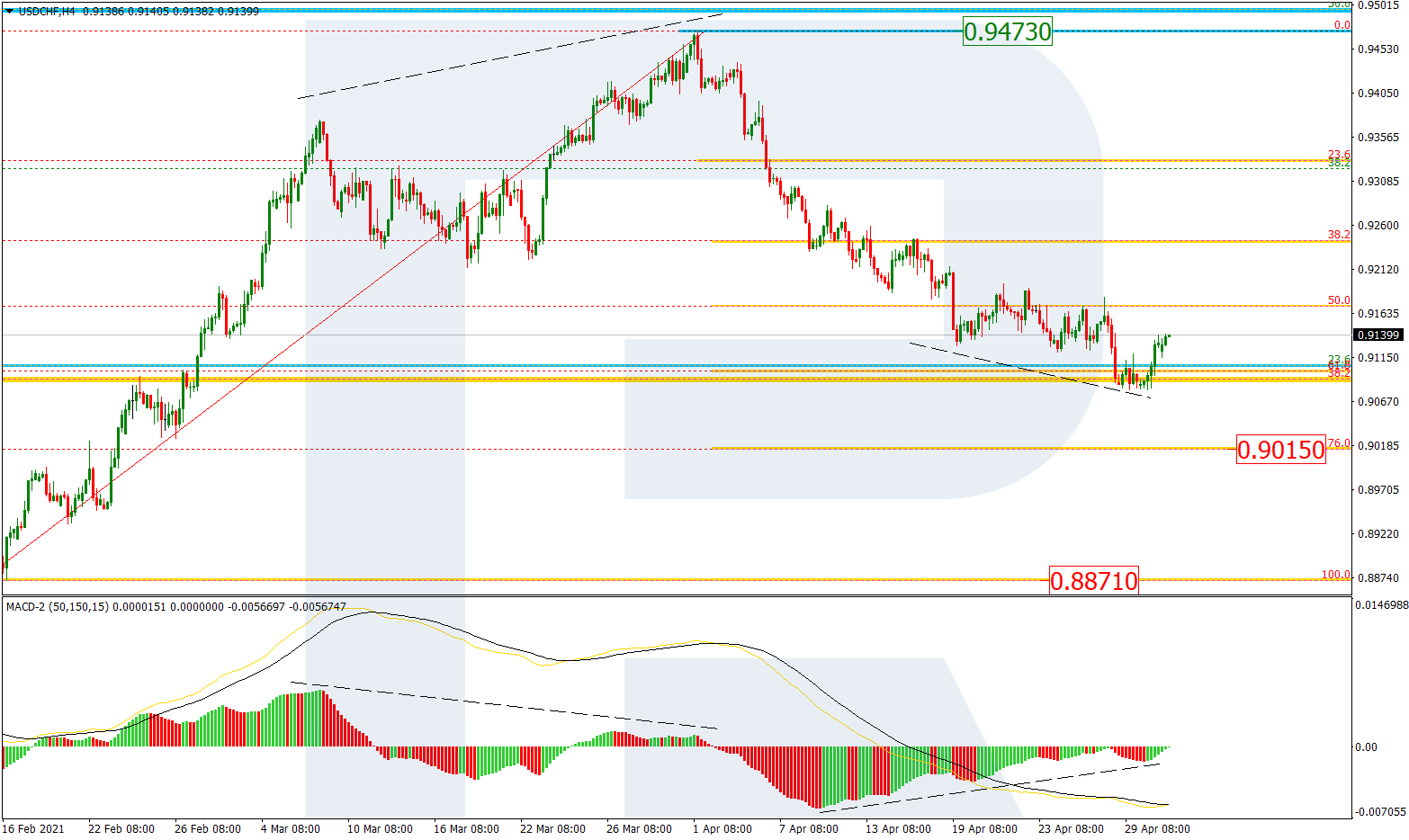

USDCHF, “US Dollar vs Swiss Franc”

In the H4 chart, a convergence on MACD made the pair stop at 61.8% fibo and start a new ascending wave towards the high at 0.9473. Another scenario suggests one more decline to reach 76.0% fibo at 0.9015 but it is very unlikely.

The H1 chart shows potential short-term upside targets after a convergence on MACD – 23.6%, 38.2%, and 50.0% fibo at 0.9173, 0.9230, and 0.9277 respectively. The local support is the low at 0.9080.

Article By RoboForex.com

Attention!

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex LP bears no responsibility for trading results based on trading recommendations described in these analytical reviews.

- Target Thursdays: NAS100, Robusta Coffee, USDCHF Apr 25, 2024

- QCOM wants to create competition in the AI chip market. Hong Kong index hits five-month high Apr 25, 2024

- Japanese yen hits all-time low as BoJ meeting commences Apr 25, 2024

- TSLA shares rose on a weak report. Inflationary pressures are easing in Australia Apr 24, 2024

- USDJPY: On intervention watch Apr 24, 2024

- Euro gains against the dollar amid mixed economic signals Apr 24, 2024

- PMI data is the focus of investors’ attention today. Turkey, Iraq, Qatar, and UAE signed a transportation agreement Apr 23, 2024

- Australian dollar rises on strong economic indicators Apr 23, 2024

- Geopolitical risks in the Middle East are declining. China kept interest rates at lows Apr 22, 2024

- Brent crude dips to four-week low amid easing geopolitical tensions Apr 22, 2024