By Lukman Otunuga Research Analyst, ForexTime

We’ve had a plethora of Fed members on the wires already this week and although they have been known doves, it is clearly evident that the Fed is very much in “patient” mode. Of course, they are “talking about talking about tapering” as San Francisco Fed President Daly said yesterday, but inflation is still described as “transitory” and it’s not about doing anything now or in the short term. Much will depend on the data flow and the next few job reports with this Friday’s new inflation data no doubt grabbing some headlines, with forecasters expecting personal consumption prices to rise to the highest reading since June 1993.

US stock futures are pointing to a better day after a mixed close overnight. Growth stocks continue to outperform value as we once again edge towards the all-time highs in the S&P500. European stocks are pretty much on that mark now and will look to push higher with the risk mood stays bright amid easing inflation concerns.

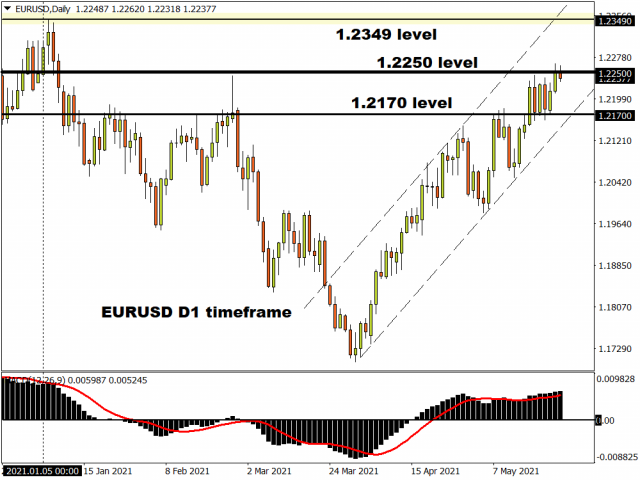

Dollar downtrend firmly intact

With this backdrop, the dollar is struggling to find many buyers as low yields and signs of a more synchronised global recovery begin to offer better alternatives to the greenback. The downtrend channel from the April highs in the dollar index is ongoing and bears are now targeting the year-to-date lows. EUR/USD moved above the 1.2250 zone yesterday and this opens up a push to the cycle high at 1.2349 from early January as long as we hold above the breakout level.

Free Reports:

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

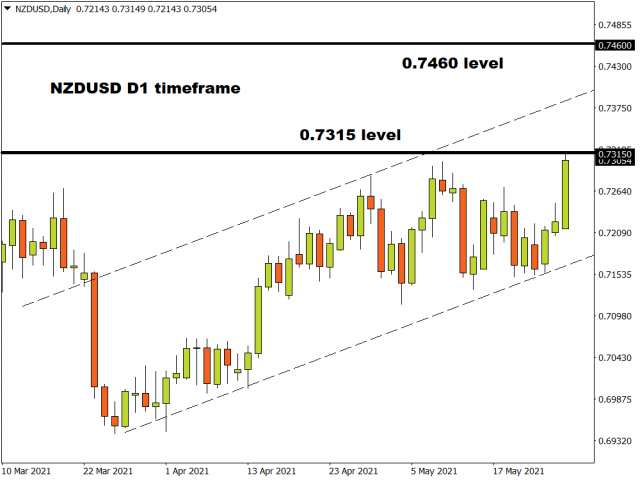

RBNZ joins the hawkish central bank club

Although it left its policy settings unchanged, the RBNZ took a step towards normalisation at its meeting overnight when it signalled a rate hike in the second half of next year in its latest projections, amid a notable improvement in the economic situation. This hawkish surprise has propelled NZD/USD higher over 1.1% towards the top of its recent range. The early January high at 0.7315 is close by before the year-to date highs around 0.7460. The kiwi finds itself in a similar situation to the loonie (CAD) with a standout hawkish central bank and this should provide strong support to its currency going forward.

Disclaimer: The content in this article comprises personal opinions and should not be construed as containing personal and/or other investment advice and/or an offer of and/or solicitation for any transactions in financial instruments and/or a guarantee and/or prediction of future performance. ForexTime (FXTM), its affiliates, agents, directors, officers or employees do not guarantee the accuracy, validity, timeliness or completeness, of any information or data made available and assume no liability as to any loss arising from any investment based on the same.

Article by ForexTime

Article by ForexTime

ForexTime Ltd (FXTM) is an award winning international online forex broker regulated by CySEC 185/12 www.forextime.com

- The US natural gas prices fell to a 2-month low. A drop in the technology sector on Wednesday had a negative impact on the broad market Apr 18, 2024

- Target Thursdays: Cocoa, Bitcoin and USDCHF hit targets! Apr 18, 2024

- British Pound shows signs of recovery amid favourable inflation data Apr 18, 2024

- Indices decline amid hawkish comments from the Fed. Investors are waiting for Israel’s answer Apr 17, 2024

- EURGBP: Slams into support on hot UK inflation Apr 17, 2024

- Brent crude prices dip amid concerns over global demand Apr 17, 2024

- Stock indices sell-off amid rising geopolitical tensions in the Middle East. China’s GDP grew the most in a year Apr 16, 2024

- New FXTM commodity hits all-time high! Apr 16, 2024

- NZD hits five-month low against strong US dollar Apr 16, 2024

- Escalating conflict in the Middle East is forcing investors to shift funds to safe assets Apr 15, 2024