By Lukman Otunuga Research Analyst, ForexTime

It’s been another rip-roaring three months for traders, with economic recovery, vaccine rollouts and surging bond yields all grabbing the headlines in what has been a highly eventful start to the year. Where do the weeks go? is a question we often ask ourselves on the trading desk, as we approach April and the next stage of the US Government’s multitrillion dollar stimulus plan.

President Biden’s next $2 trillion proposal aims to rebuild the country’s infrastructure, confront climate change and curb wealth inequality. The key question is how this will be paid for and the already announced increase in corporation taxes to 28% from 21% (nb. Still below the 35% when Trump came to office) is likely to be bolstered by income tax rises at some point.

Big moves in bonds and the greenback

Of course, this quarter has seen the sharpest upward move in bond yields for decades. Take the US 10-year Treasury which has risen from 0.9180% to around 1.73% today, as investors anticipate both a jump in government borrowing due to stimulus spending and higher inflation.

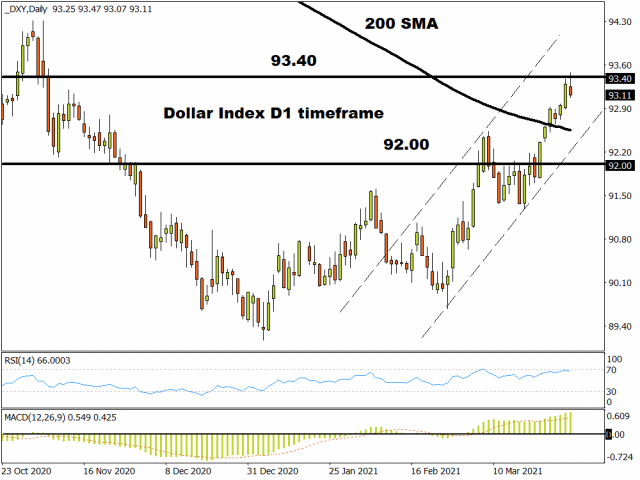

King dollar has also moved significantly in the first three months of the year, though it is tough to say it has reasserted its throne just yet! Confounding many analysts calling for declines are up to 20% for the year, the buck still looks good for more upside if the bulls can close above 93.40 on the DXY. The 55-week moving average resides around there so a weekly close above this key resistance level would greatly increase the odds for more USD strength. 94.30 should offer the next level of resistance while 92.00 is first support.

Free Reports:

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Europe all mixed up

Overnight data in the Eurozone was a mixed bag with German unemployment beating estimates but the bloc’s headline inflation missed expectations, increasing from 0.9% to 1.3% in March (1.4% consensus). The coming months should see further rising prices on the back of surging commodity prices and disrupted supply chains. However, most of these factors are due to be very much temporary with many economists expecting CPI to fall back over the medium-term. This will be extremely challenging for the ECB and is something to look out for later on in the year.

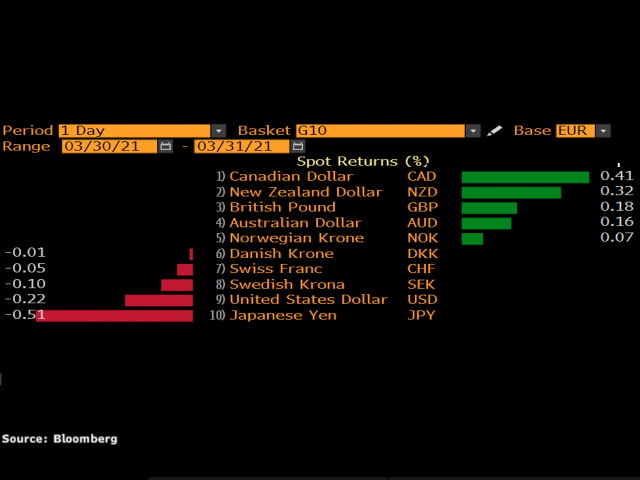

In the near-term, ECB President Lagarde today said the markets “can test us as much they want” with regard to rising yields and the bond buying program, which reminds us of her “we’re not here to close spreads” phrase which didn’t go down well with bond traders. EUR is struggling again this afternoon and we would expect it to remain weak as the ECB prevents rising bond yields and further expands the currency’s yield disadvantage of US Treasurys over the region’s benchmark German equivalent.

Disclaimer: The content in this article comprises personal opinions and should not be construed as containing personal and/or other investment advice and/or an offer of and/or solicitation for any transactions in financial instruments and/or a guarantee and/or prediction of future performance. ForexTime (FXTM), its affiliates, agents, directors, officers or employees do not guarantee the accuracy, validity, timeliness or completeness, of any information or data made available and assume no liability as to any loss arising from any investment based on the same.

Article by ForexTime

Article by ForexTime

ForexTime Ltd (FXTM) is an award winning international online forex broker regulated by CySEC 185/12 www.forextime.com

- Target Thursdays: NAS100, Robusta Coffee, USDCHF Apr 25, 2024

- QCOM wants to create competition in the AI chip market. Hong Kong index hits five-month high Apr 25, 2024

- Japanese yen hits all-time low as BoJ meeting commences Apr 25, 2024

- TSLA shares rose on a weak report. Inflationary pressures are easing in Australia Apr 24, 2024

- USDJPY: On intervention watch Apr 24, 2024

- Euro gains against the dollar amid mixed economic signals Apr 24, 2024

- PMI data is the focus of investors’ attention today. Turkey, Iraq, Qatar, and UAE signed a transportation agreement Apr 23, 2024

- Australian dollar rises on strong economic indicators Apr 23, 2024

- Geopolitical risks in the Middle East are declining. China kept interest rates at lows Apr 22, 2024

- Brent crude dips to four-week low amid easing geopolitical tensions Apr 22, 2024