Article By RoboForex.com

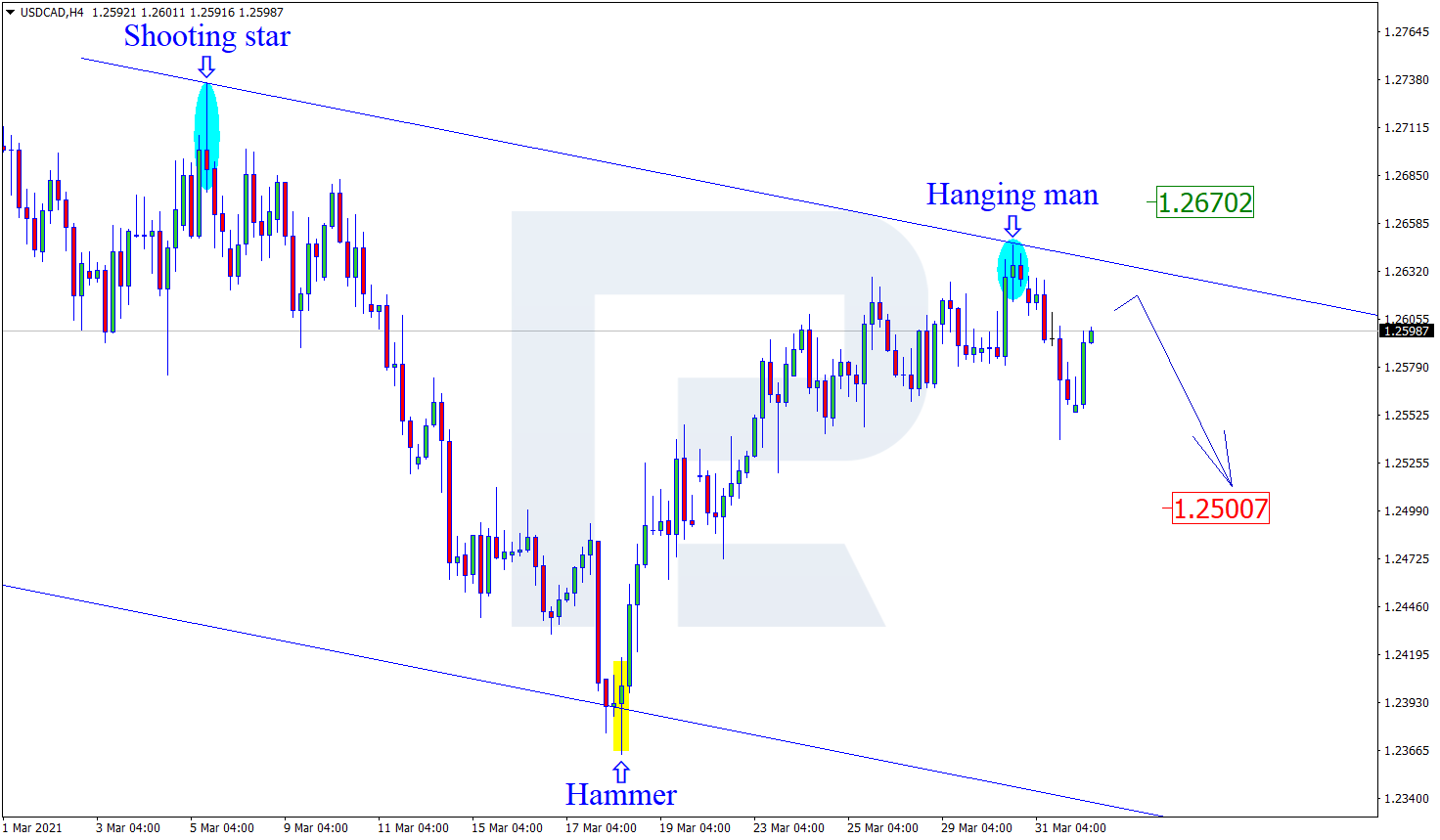

USDCAD, “US Dollar vs Canadian Dollar”

As we can see in the H4 chart, after forming several reversal patterns, including Hanging Man, not far from the resistance level, USDCAD may reverse and fall towards the support area at 1.2500. After testing the support area, the price may continue its descending tendency. However, an alternative scenario implies a further uptrend to return to the resistance level at 1.2670 before resuming its decline.

AUDUSD, “Australian Dollar vs US Dollar”

As we can see in the H4 chart, during the pullback, AUDUSD has formed several reversal patterns, such as Harami, not far from the resistance area. At the moment, the asset is still reversing. In this case, the downside target is the support area at 0.7490. At the same time, an opposite scenario implies that the price may correct towards the resistance level at 0.7600 before resuming its descending tendency.

Free Reports:

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

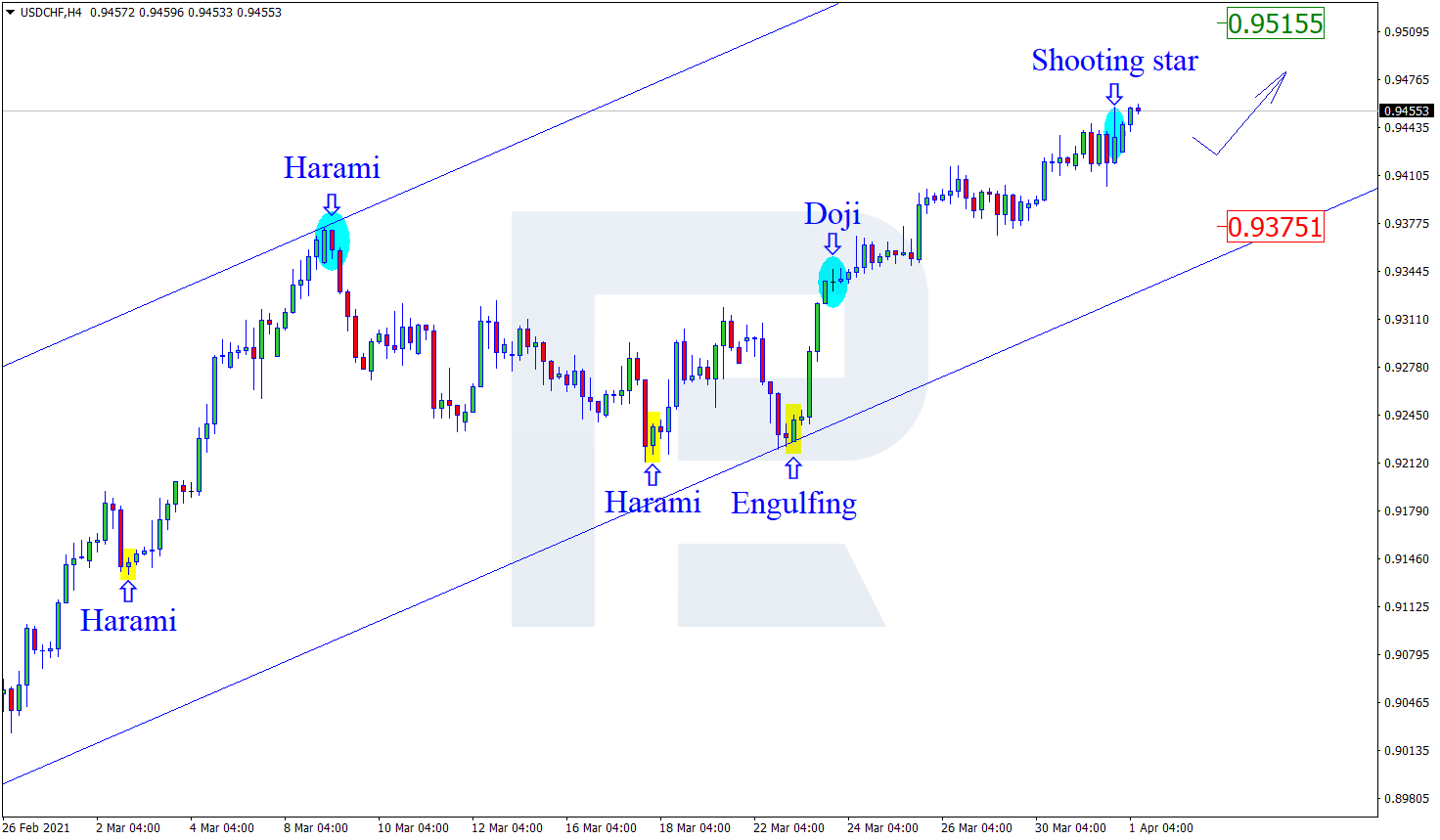

USDCHF, “US Dollar vs Swiss Franc”

As we can see in the H4 chart, the uptrend continues. At the moment, after forming several reversal patterns, such as Shooting Star, not far from the resistance area, USDCHF may reverse and correct downwards. In this case, the correctional target is the support level at 0.9375. Still, there might be an alternative scenario, according to which the asset may continue growing to reach 0.9515 without reversing and correcting.

Article By RoboForex.com

Attention!

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex LP bears no responsibility for trading results based on trading recommendations described in these analytical reviews.

- The US natural gas prices fell to a 2-month low. A drop in the technology sector on Wednesday had a negative impact on the broad market Apr 18, 2024

- Target Thursdays: Cocoa, Bitcoin and USDCHF hit targets! Apr 18, 2024

- British Pound shows signs of recovery amid favourable inflation data Apr 18, 2024

- Indices decline amid hawkish comments from the Fed. Investors are waiting for Israel’s answer Apr 17, 2024

- EURGBP: Slams into support on hot UK inflation Apr 17, 2024

- Brent crude prices dip amid concerns over global demand Apr 17, 2024

- Stock indices sell-off amid rising geopolitical tensions in the Middle East. China’s GDP grew the most in a year Apr 16, 2024

- New FXTM commodity hits all-time high! Apr 16, 2024

- NZD hits five-month low against strong US dollar Apr 16, 2024

- Escalating conflict in the Middle East is forcing investors to shift funds to safe assets Apr 15, 2024