By Dmitriy Gurkovskiy, Chief Analyst at RoboForex

In the second week of April, oil quotations remain quite high though on April 5th, Brent is declining to 64.24 USD.

Earlier OPEC+ members have agreed on smooth increasing oil production May through July by 2.15 million barrels a day. From the contract, one can conclude that the preferences of increasing production are evenly spread between OPEC+ members, including Saudi Arabia. Previously, this country made the most effort to control supply in the global market.

May through July, Saudi Arabia will send back to the market some 1 million barrels of oil a day.

OPEC+ seems to be quite sure that the demand for energy carriers will soon restore, including thanks to air traffic recuperating, otherwise, it would think better than pouring so much oil into the market while currently, demand remains limited.

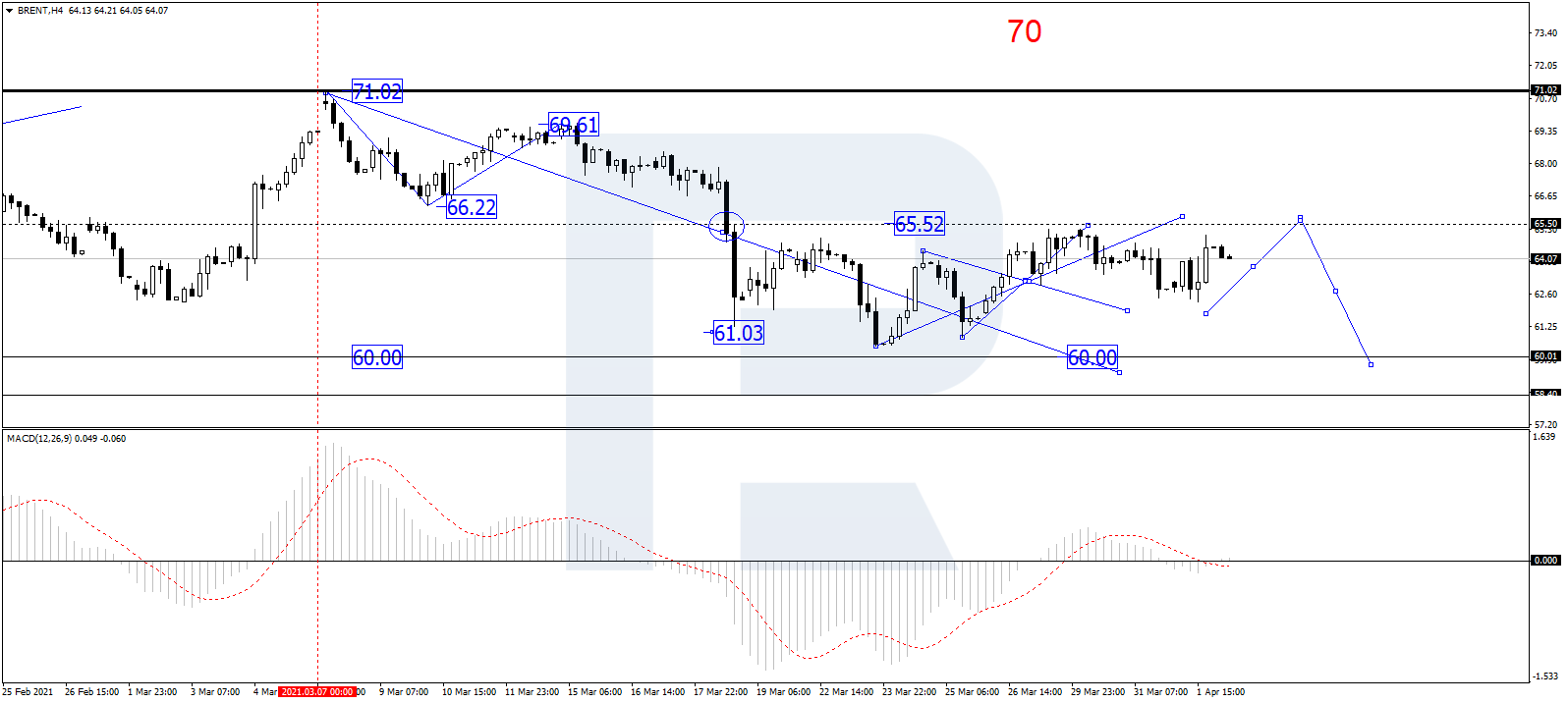

On H4, BRENT is correcting to 65.52. When it is over, we expect the trend to continue to 60. After this level is reached, we expect a link of growth to 65.30. Technically, the scenario is confirmed by the MACD oscillator. Its signal line escaped the histogram area and declined to zero. We expect the signal line to grow again.

Free Reports:

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

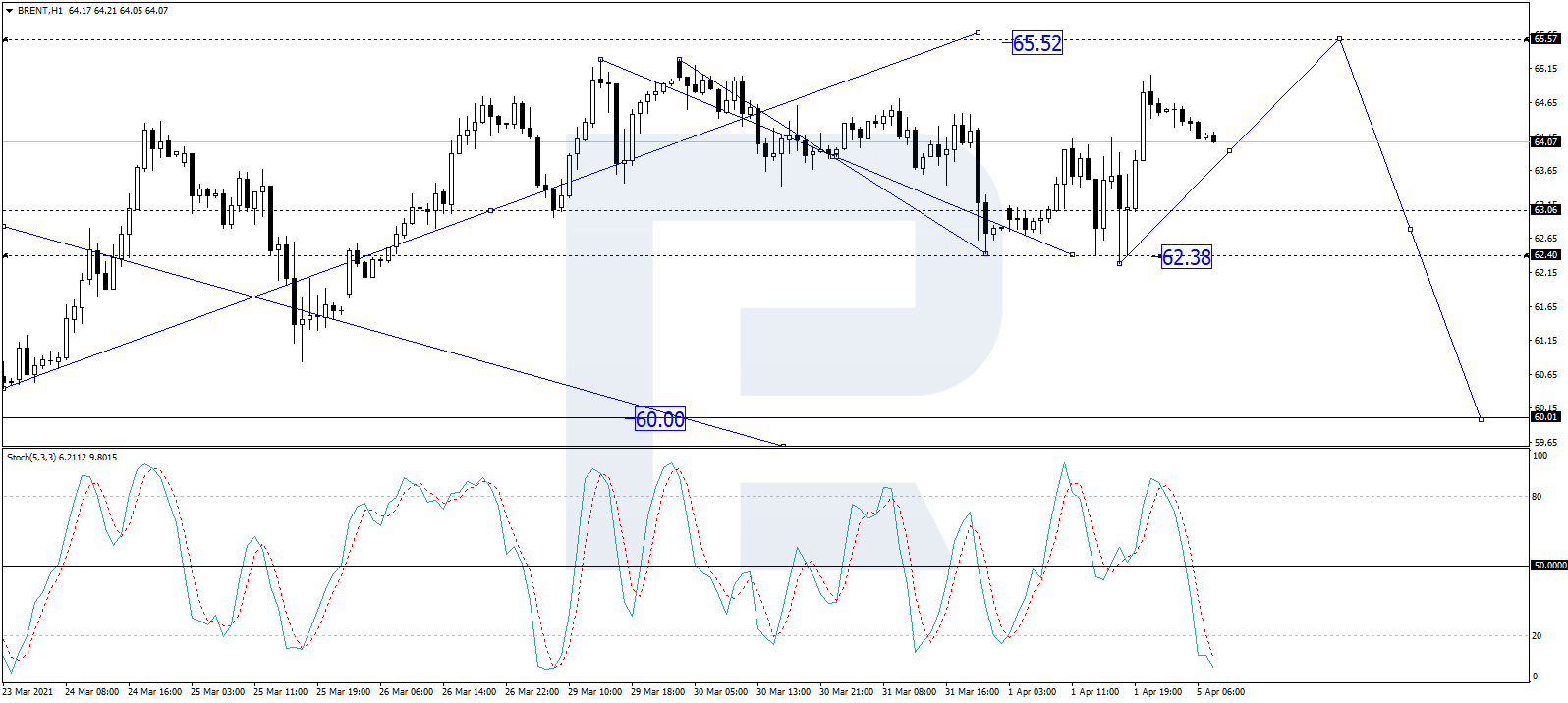

On H1, the market completed a wave of decline to 62.38. At the moment, the market is trading in the fifth wave of growth to 65.52, where we expect the wave of growth to end. Then we expect another wave of declining to 60. Technically, the scenario is supported by the Stochastic oscillator. Its signal line is trading under 20 today, which suggests the beginning of growth to 50. After this level is broken, growth might continue to 80.

Disclaimer

Any forecasts contained herein are based on the author’s particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for trading results based on trading recommendations and reviews contained herein.

- TSLA shares rose on a weak report. Inflationary pressures are easing in Australia Apr 24, 2024

- USDJPY: On intervention watch Apr 24, 2024

- Euro gains against the dollar amid mixed economic signals Apr 24, 2024

- PMI data is the focus of investors’ attention today. Turkey, Iraq, Qatar, and UAE signed a transportation agreement Apr 23, 2024

- Australian dollar rises on strong economic indicators Apr 23, 2024

- Geopolitical risks in the Middle East are declining. China kept interest rates at lows Apr 22, 2024

- Brent crude dips to four-week low amid easing geopolitical tensions Apr 22, 2024

- COT Metals Charts: Speculator bets led by Copper & Silver Apr 20, 2024

- COT Bonds Charts: Speculator bets led by 10-Year Bonds & Fed Funds Apr 20, 2024

- COT Stock Market Charts: Speculator bets led by S&P500-Mini Apr 20, 2024