By Lukman Otunuga Research Analyst, ForexTime

US stock futures are set to give back some gains today as bond yields hit levels last seen before the wretched global pandemic came into our lives. But stock markets are well known for looking through the near-term noise and focusing on the landscape six months out and more. That means European stocks have risen nearly 8% this year after a 10.5% gain in the last quarter of 2020, while the S&P500 is up nearly 6% on the year.

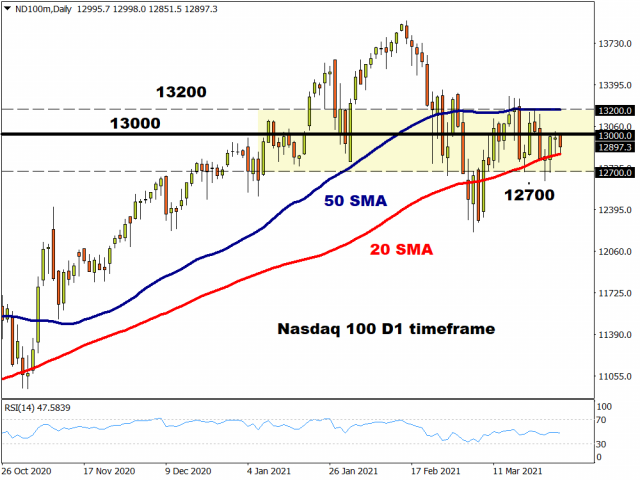

The broader US index has clearly outperformed the tech-heavy Nasdaq, which is just popping its nose above water with a 1.3% rise this year, in a clear sign of cyclical rotation.

Look past the shambolic vaccination rollout and increasing infections in Europe stock investors are saying and own a piece of the banking, industrial or services sectors. These are all set to benefit when restrictions ease and so have risen by at least 9% this year. Laden with financials and resource-commodity companies, the FTSE 100 is also in on this action rising over 4% after a 10% gain in the prior three months.

Free Reports:

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Download Our Metatrader 4 Indicators – Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Download Our Metatrader 4 Indicators – Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Bond market in focus

With President Biden hoping to dish out a few more trillion dollars in the form of his infrastructure plan, a fresh bout of bond selling has hit the markets this morning as investors weighed another plan to boost fiscal stimulus and continued optimism over the US vaccine distribution. Unprecedented amounts of government spending could pump up inflation even though the Fed will allow the economy to run hot. How hot is the key but in the meantime, the US 10-year Treasury yield has hit its highest level since the early days of the pandemic, close to 1.77%.

Dollar up, gold down

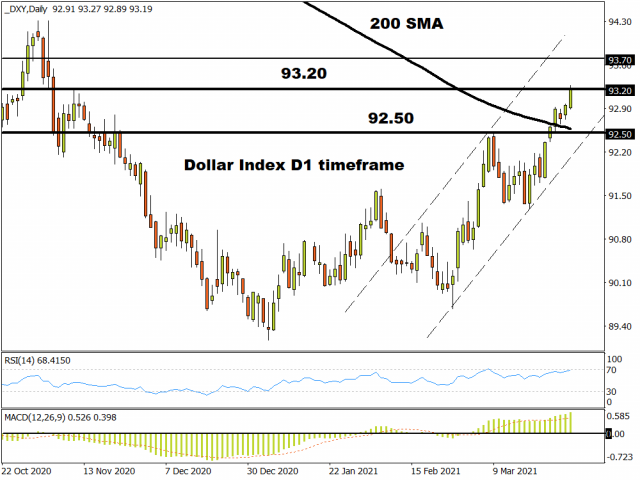

With elevated bond yields, so investors are keen to grab a piece of the dollar pie.

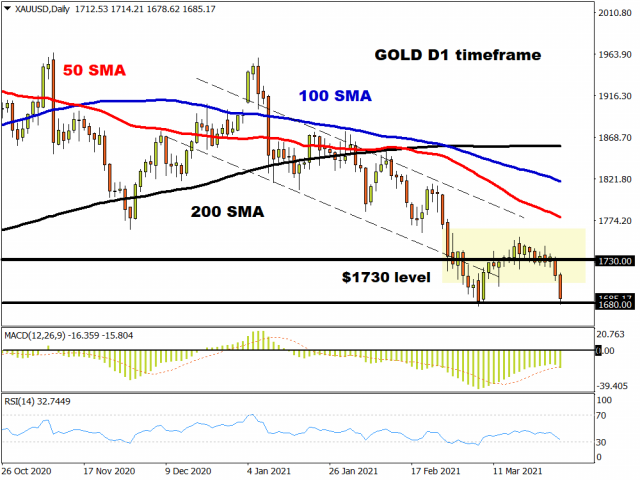

But this is not good news for gold bugs who are suffering today after a bad start to the week on Monday. $1,700 offered little support and all eyes are now on the cycle low below at $1,680. If bond yields keep going higher, then expect to see new lows with the mid-$1,500s the next line in the sand.

USD/JPY overextended

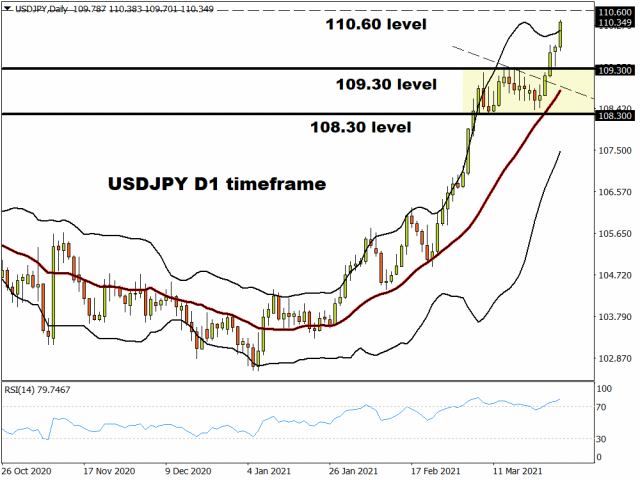

We delved into the technical set up in USD/JPY this morning and this is always a key currency pair to look at when bond yields are moving north. Tomorrow is the end of the Japanese financial year and our target of 110.60 in USD/JPY is getting very close already. If the pair can hold and close up here, then the next level is a few big figures away. However, 110 is the approximate top of the broad descending channel going back to the end of 2016 and momentum indicators are heavily overbought on the daily charts so this pair could be due a pullback soon.

Disclaimer: The content in this article comprises personal opinions and should not be construed as containing personal and/or other investment advice and/or an offer of and/or solicitation for any transactions in financial instruments and/or a guarantee and/or prediction of future performance. ForexTime (FXTM), its affiliates, agents, directors, officers or employees do not guarantee the accuracy, validity, timeliness or completeness, of any information or data made available and assume no liability as to any loss arising from any investment based on the same.

Article by ForexTime

Article by ForexTime

ForexTime Ltd (FXTM) is an award winning international online forex broker regulated by CySEC 185/12 www.forextime.com

- 3 Signs of Developing U.S. Economic Slowdown Apr 19, 2024

- Israel has retaliated against Iran. Investors run to safe assets Apr 19, 2024

- Gold hits record high amid growing geopolitical tensions Apr 19, 2024

- The US natural gas prices fell to a 2-month low. A drop in the technology sector on Wednesday had a negative impact on the broad market Apr 18, 2024

- Target Thursdays: Cocoa, Bitcoin and USDCHF hit targets! Apr 18, 2024

- British Pound shows signs of recovery amid favourable inflation data Apr 18, 2024

- Indices decline amid hawkish comments from the Fed. Investors are waiting for Israel’s answer Apr 17, 2024

- EURGBP: Slams into support on hot UK inflation Apr 17, 2024

- Brent crude prices dip amid concerns over global demand Apr 17, 2024

- Stock indices sell-off amid rising geopolitical tensions in the Middle East. China’s GDP grew the most in a year Apr 16, 2024