Article By RoboForex.com

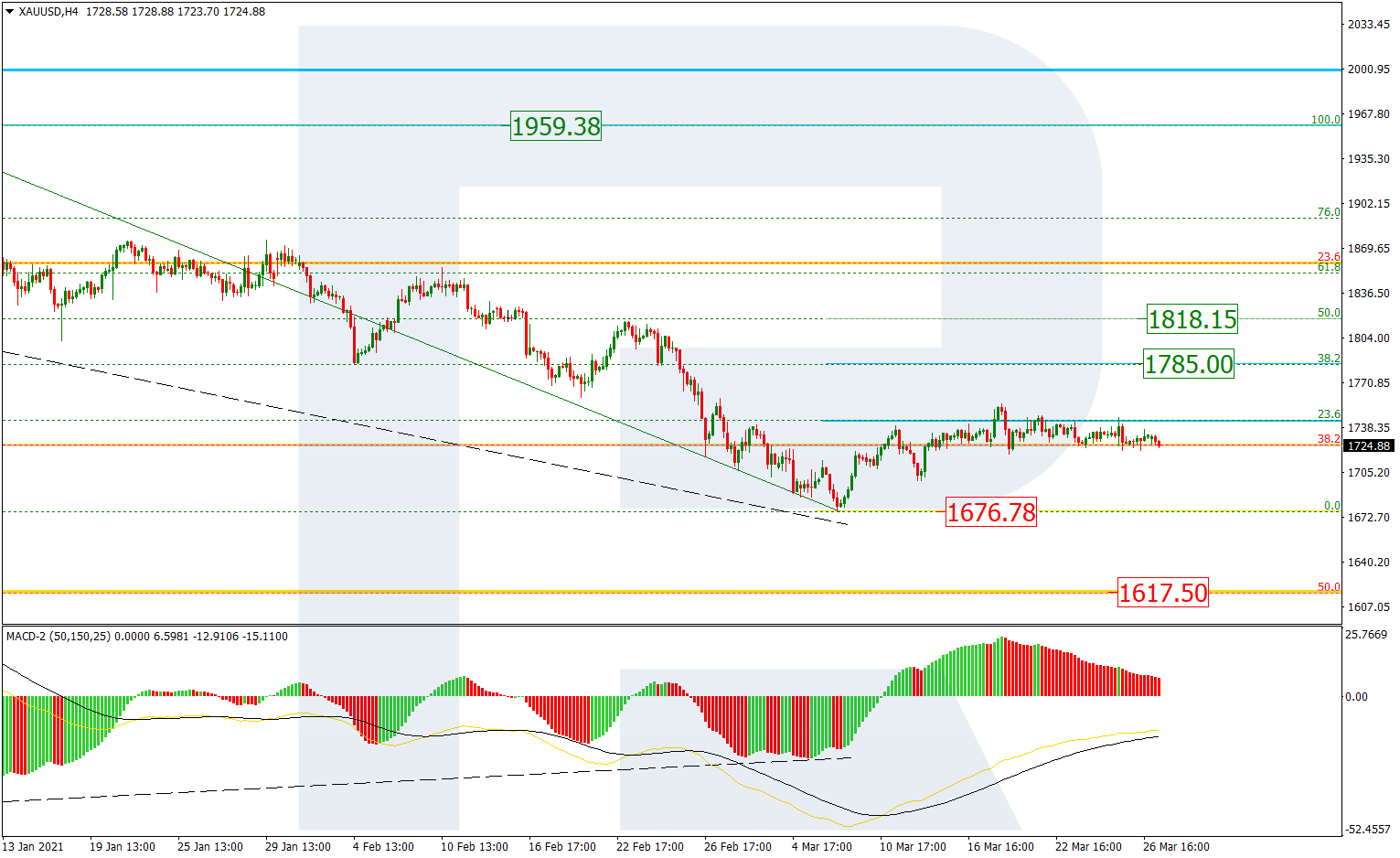

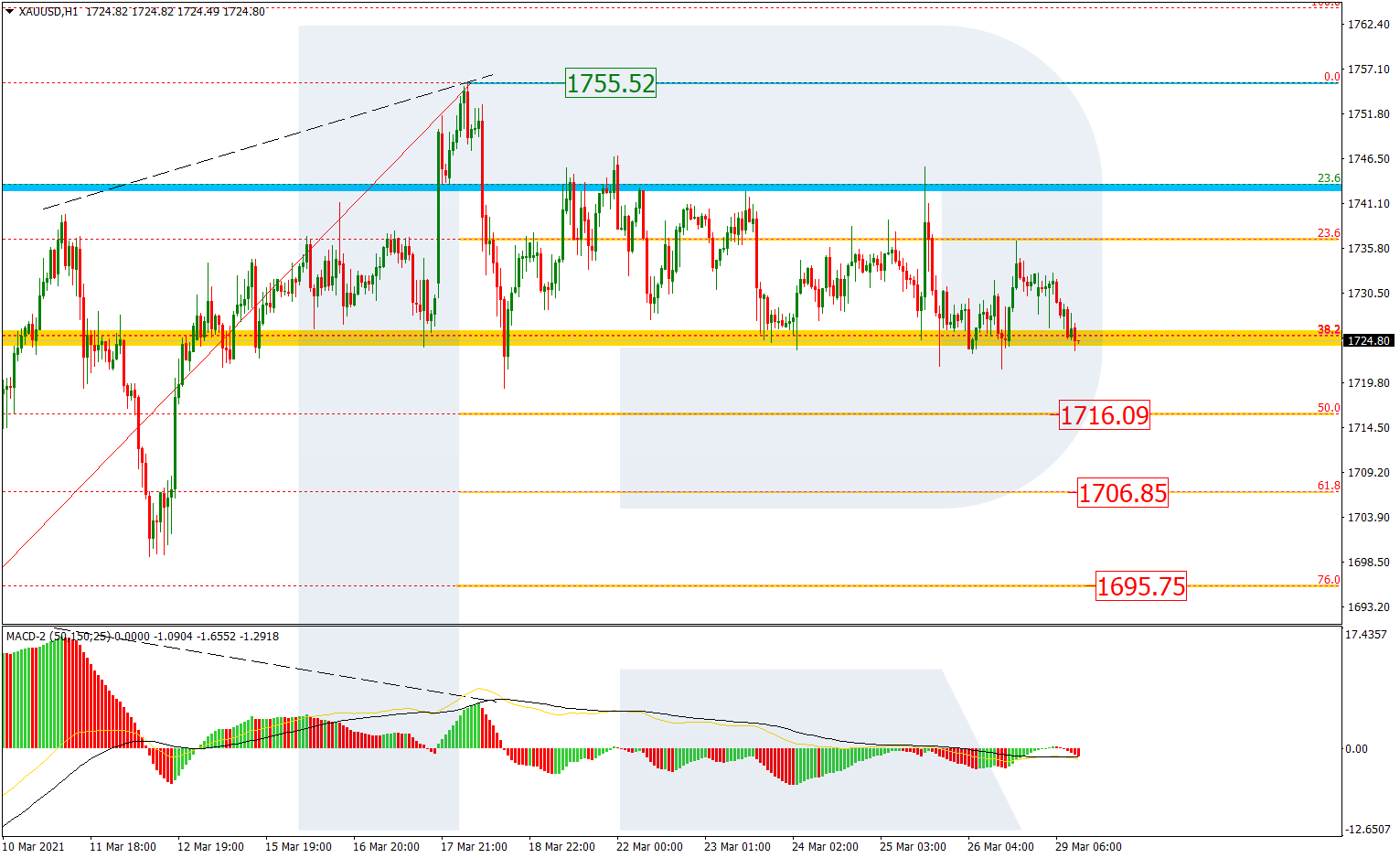

XAUUSD, “Gold vs US Dollar”

As we can see in the H4 chart, the situation hasn’t changed much since last Monday. After reaching 23.6% fibo, XAUUSD is still moving there and forming the consolidation range. In this case, both upward and downwards scenarios are possible. The first one implies a further ascending correction towards 38.2% and 50.0% fibo at 1785.00 and 1818.15 respectively. The second scenario suggests a new descending impulse and a breakout of the low at 1676.78. Later, the market may continue falling to reach its mid-term target, which is 50.0% fibo at 1617.50.

The H1 chart shows a more detailed structure of the current short-term correction after a divergence. At the moment, the asset is trading between 23.6% and 38.2% fibo and may soon resume falling towards 50.0%, 61.8%, and 76.0% fibo at 1716.09, 1706.85, and 1695.75 respectively. The resistance is the local high at 1755.52.

Free Reports:

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

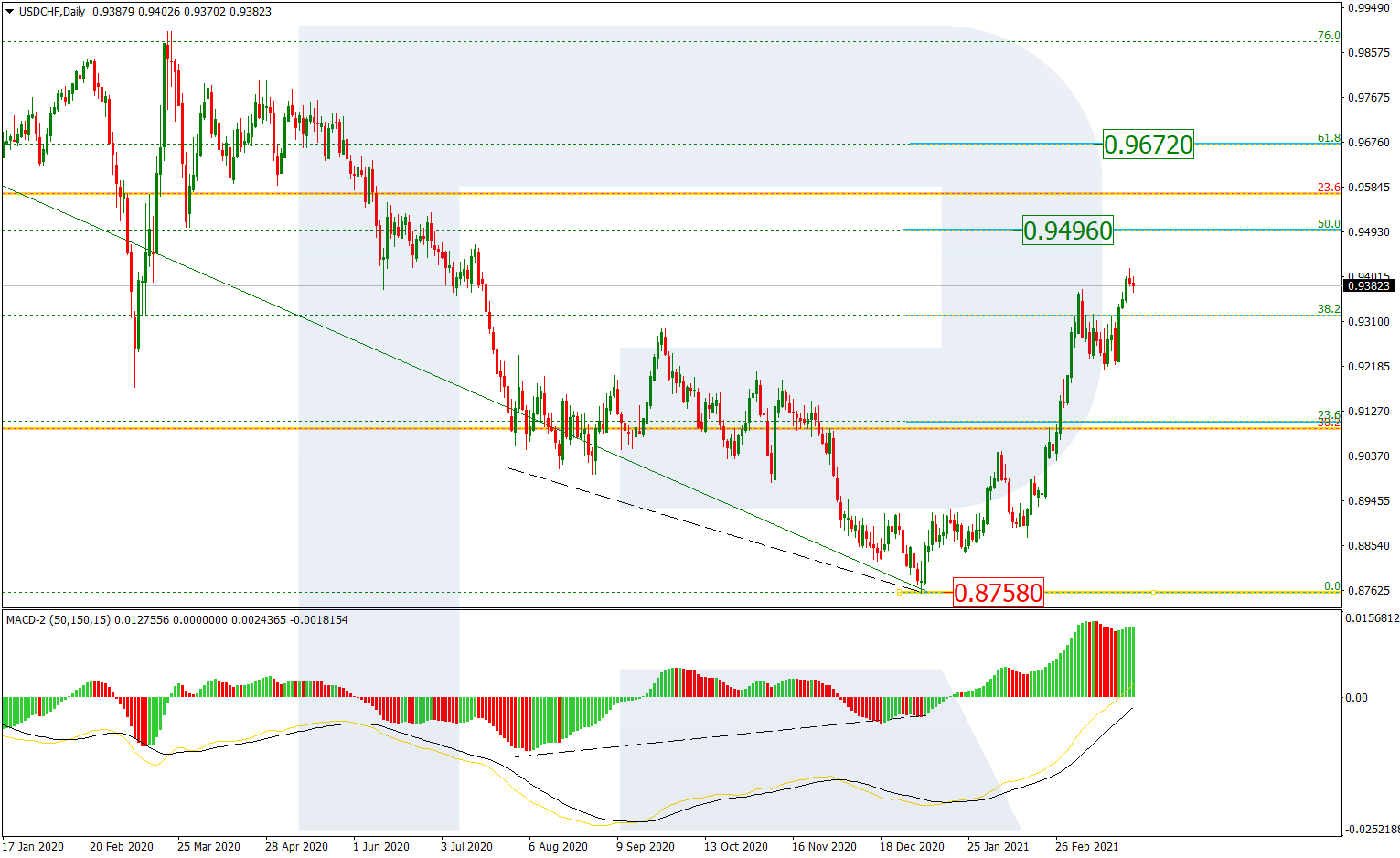

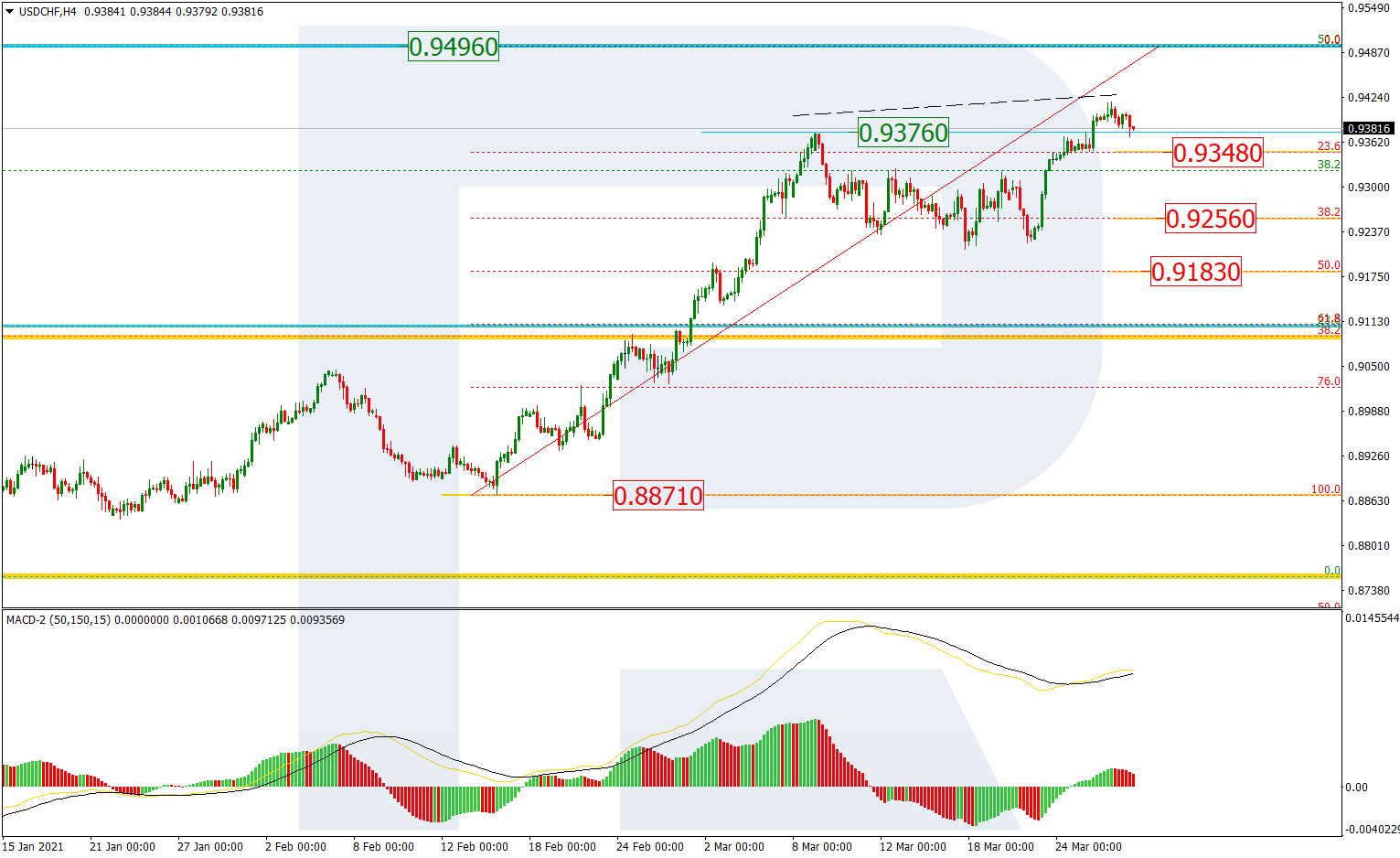

USDCHF, “US Dollar vs Swiss Franc”

The daily chart shows that USDCHF continues the ascending tendency after completing a short-term pullback. After breaking 38.2% fibo, the asset is heading towards 50.0% and 61.8% fibo at 0.9496 and 0.9672 respectively. The key support is the low at 0.8758.

As we can see in the H4 chart, after breaking the previous local high at 0.9376, the pair is heading towards 50.0% fibo at 0.9496. At the same time, there is a divergence on MACD, which may indicate a new pullback after the price reaches its target. The correctional targets may be 23.6%, 38.2%, and 50.0% fibo at 0.9348, 0.9256, and 0.9183 respectively.

Article By RoboForex.com

Attention!

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex LP bears no responsibility for trading results based on trading recommendations described in these analytical reviews.

- Target Thursdays: NAS100, Robusta Coffee, USDCHF Apr 25, 2024

- QCOM wants to create competition in the AI chip market. Hong Kong index hits five-month high Apr 25, 2024

- Japanese yen hits all-time low as BoJ meeting commences Apr 25, 2024

- TSLA shares rose on a weak report. Inflationary pressures are easing in Australia Apr 24, 2024

- USDJPY: On intervention watch Apr 24, 2024

- Euro gains against the dollar amid mixed economic signals Apr 24, 2024

- PMI data is the focus of investors’ attention today. Turkey, Iraq, Qatar, and UAE signed a transportation agreement Apr 23, 2024

- Australian dollar rises on strong economic indicators Apr 23, 2024

- Geopolitical risks in the Middle East are declining. China kept interest rates at lows Apr 22, 2024

- Brent crude dips to four-week low amid easing geopolitical tensions Apr 22, 2024