By Han Tan Market Analyst, ForexTime

Next up on this week’s list of major market events is the European Central Bank which has a policy decision due today.

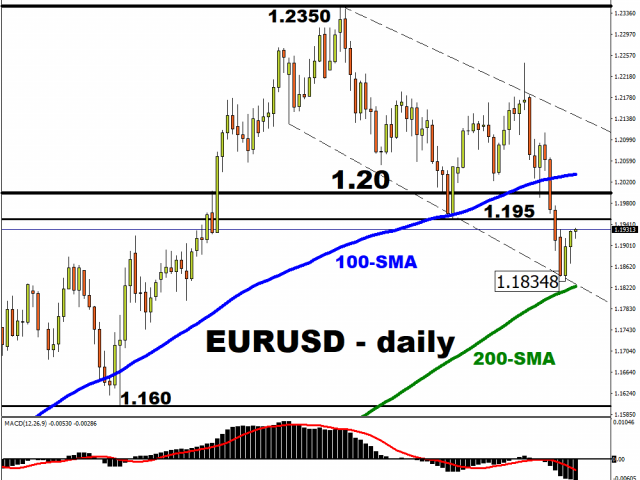

In the leadup to today’s ECB meeting, the euro has only managed to eke out a 0.1 percent advance against the US dollar so far this week, making it the smallest gainer on a week-to-date basis among G10 currencies versus the greenback. On a year-to-date basis, EURUSD has declined by more than 2%, nearly testing its 200-day simple moving average (SMA) as a support level on Monday before pulling back up.

Traders will be closely monitoring whether the world’s most-traded currency pair can breach 1.195, if it gets there, which was the support region for the currency pair in early February. Failure to breach could then see the currency pair come face to face with its 200-day SMA.

Free Reports:

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

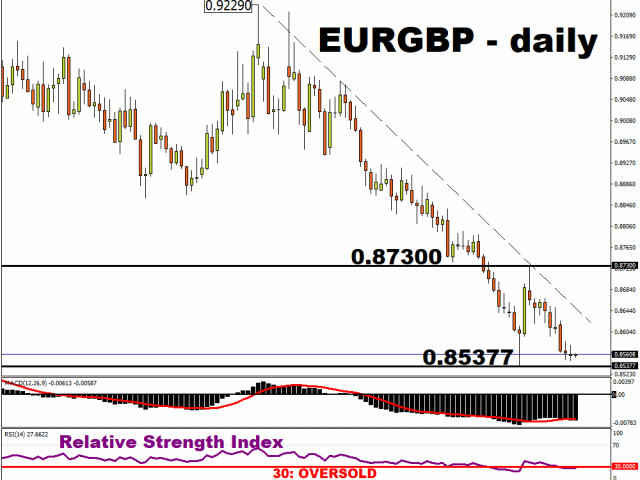

Meanwhile, EURGBP has weakened by more than 4% so far in 2021. However, this currency pair may be due for a pullback in the not-too-distant future, given that its 14-day relative strength index has already broken below the 30 line and is now in oversold territory.

What are markets expecting out of the ECB today?

Today, the European Central Bank is highly unlikely to adjust interest rates or its asset purchases programme. The ECB is also set to unveil its latest economic forecasts, which is expected to show policymakers’ belief that any inflation spike won’t stick around for long.

However, it’ll be the central bank’s characterization of the surging bond yields that harbours the biggest potential to jolt markets today.

Note that rising bond yields can be a double-edged sword. On one hand, it can be interpreted as a sign of economic optimism. On the other hand, it presents higher borrowing costs which impedes the government’s ability to raise funds for the economic recovery.

Hence, the ECB’s interpretation of the unsettling climb in bond yields, which has roiled global markets in recent weeks, could be crucial in determining how European assets perform in the immediate aftermath.

Watch out for these two words in particular: “unwarranted tightening”.

If ECB President Christine Lagarde uses those two words to describe how bond yields have been behaving of late, that could signal to the markets that the ECB is ready to step in to quell the bond rout.

And if markets believe that the central bank wants to and can push yields lower, that could heap even more downward pressure on the euro (note that the bloc’s currency holds a year-to-date decline against most of its G10 peers, except for the Swedish Krona, Japanese Yen, and the Swiss Franc).

Could EURUSD break below its 200-day SMA support?

And if European bond yields are suppressed while Treasury yields keep climbing, especially if today’s auction of $24 billion in 30-year Treasuries is met with lackluster demand, then the widening gap between European and US bond yields could even drag EURUSD below its 200-day SMA.

For now, it remains a battle of wits between the markets and the ECB in ascertaining how high yields can go. And Lagarde’s words may play an outsized role in determining the trajectory for European bond yields, and for the euro.

Disclaimer: The content in this article comprises personal opinions and should not be construed as containing personal and/or other investment advice and/or an offer of and/or solicitation for any transactions in financial instruments and/or a guarantee and/or prediction of future performance. ForexTime (FXTM), its affiliates, agents, directors, officers or employees do not guarantee the accuracy, validity, timeliness or completeness, of any information or data made available and assume no liability as to any loss arising from any investment based on the same.

Article by ForexTime

Article by ForexTime

ForexTime Ltd (FXTM) is an award winning international online forex broker regulated by CySEC 185/12 www.forextime.com

- 3 Signs of Developing U.S. Economic Slowdown Apr 19, 2024

- Israel has retaliated against Iran. Investors run to safe assets Apr 19, 2024

- Gold hits record high amid growing geopolitical tensions Apr 19, 2024

- The US natural gas prices fell to a 2-month low. A drop in the technology sector on Wednesday had a negative impact on the broad market Apr 18, 2024

- Target Thursdays: Cocoa, Bitcoin and USDCHF hit targets! Apr 18, 2024

- British Pound shows signs of recovery amid favourable inflation data Apr 18, 2024

- Indices decline amid hawkish comments from the Fed. Investors are waiting for Israel’s answer Apr 17, 2024

- EURGBP: Slams into support on hot UK inflation Apr 17, 2024

- Brent crude prices dip amid concerns over global demand Apr 17, 2024

- Stock indices sell-off amid rising geopolitical tensions in the Middle East. China’s GDP grew the most in a year Apr 16, 2024