By Han Tan Market Analyst, ForexTime

Federal Reserve Chair Jerome Powell hammered home the message that the US central bank will not be rushed into raising US interest rates, despite green shoots of an economic recovery. It’s been a point that Powell had reiterated on multiple occasions already. This time, markets began to pay more heed.

The Fed’s dovish message prompted risk assets to move higher:

- S&P 500: + 0.29%

- Dow Jones index: +0.58%

- Nasdaq 100: +0.38%

The S&P 500 and the Dow posted new record highs respectively, with the latter closing above the psychologically-important 33,000 level for the first time ever. Meanwhile, the tech-heavy Nasdaq 100 notched 3 consecutive days of gains to remain close to its 50-day simple moving average.

At the time of writing, the futures contracts for all 3 major benchmark indices are in the green, suggesting more gains are in store if this sentiment until the Thursday US cash session open, and beyond.

Free Reports:

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

Risk appetite should also stay buoyed, thanks to the Fed’s positive revisions to its economic forecasts:

- 2021 GDP growth is expected to come in at 6.5%, compared to the prior forecast of 4.2%.

- Unemployment is set to drop from last month’s 6.2% to 4.5% by end-2021 and 3.5% in 2023.

What’s changed with the Fed’s policy?

In the past, policymakers would try and pre-empt surging inflation by raising interest rates to prevent consumer prices from roaring higher. Then, after a policy review, the Fed announced in August last year that the central bank is now willing to tolerate an inflation overshoot.

Yet, up until recently, markets were of the opinion that the trillions of dollars spent supporting the US economy would result in more inflationary pressures that would force the Fed to act sooner than expected. Judging by the market action in the latest US session, investors and traders are now getting a better handle on the Fed’s messaging which insists that policymakers would not act until there are more concrete signs that a full economic recovery is in sight.

Two doesn’t a tantrum make

There was however a notable change in the number of Fed officials who now see a liftoff in US interest rates sometime in 2023.

During the December FOMC meeting, five of 17 officials held that opinion.

Yesterday, that figure went up to seven of 18.

The majority of Fed officials still believe that interest rates should remain near-zero at least through 2023.

That shift in those two FOMC members wasn’t enough to roil risk appetite, with market participants now interpreting this as a clearer runway for risk assets to climb higher, potentially through all of 2022.

Powell remains untroubled by bond yields surge

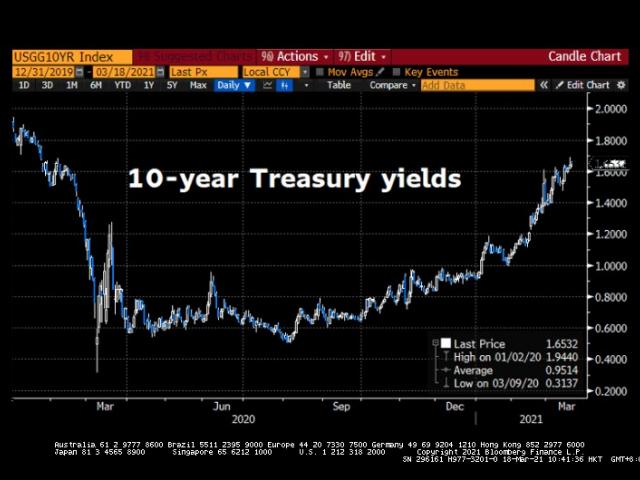

The yields on 10-year Treasuries had surged to its highest levels since January 2020, even breaching the 1.68% mark temporarily before the Fed’s announcement only to have eased off slightly since.

Despite the wild movements in yields in recent months, Powell took the opportunity to stress that the Fed’s current asset-purchasing programme, which stands at US$120 billion per month since the pandemic took hold, is at the “right place”.

Note that those rising yields on the back of heightened inflation expectations had prompted a selloff from more expensive tech stocks, even pushing the Nasdaq into a brief correction (10% drop from recent high). That also pushed investors into rotating funds into other sectors that are catching up since the pandemic, such as energy and financial stocks, the top two performing sectors on the S&P 500 so far this year.

To be clear, further upticks in Treasury yields are only to be expected moving forward, as yields continue recovering from historic lows.

But as long as Treasuries act in a calm and orderly manner, and market participants don’t see an obvious need to challenge the Fed’s commitment towards maintaining its ultra-loose policy settings, that would contribute greatly towards a conducive environment for more stock gains.

Disclaimer: The content in this article comprises personal opinions and should not be construed as containing personal and/or other investment advice and/or an offer of and/or solicitation for any transactions in financial instruments and/or a guarantee and/or prediction of future performance. ForexTime (FXTM), its affiliates, agents, directors, officers or employees do not guarantee the accuracy, validity, timeliness or completeness, of any information or data made available and assume no liability as to any loss arising from any investment based on the same.

Article by ForexTime

Article by ForexTime

ForexTime Ltd (FXTM) is an award winning international online forex broker regulated by CySEC 185/12 www.forextime.com

- Target Thursdays: NAS100, Robusta Coffee, USDCHF Apr 25, 2024

- QCOM wants to create competition in the AI chip market. Hong Kong index hits five-month high Apr 25, 2024

- Japanese yen hits all-time low as BoJ meeting commences Apr 25, 2024

- TSLA shares rose on a weak report. Inflationary pressures are easing in Australia Apr 24, 2024

- USDJPY: On intervention watch Apr 24, 2024

- Euro gains against the dollar amid mixed economic signals Apr 24, 2024

- PMI data is the focus of investors’ attention today. Turkey, Iraq, Qatar, and UAE signed a transportation agreement Apr 23, 2024

- Australian dollar rises on strong economic indicators Apr 23, 2024

- Geopolitical risks in the Middle East are declining. China kept interest rates at lows Apr 22, 2024

- Brent crude dips to four-week low amid easing geopolitical tensions Apr 22, 2024